Global Petrochemicals Market

Market Size in USD Million

CAGR :

%

USD

484.77 Million

USD

823.62 Million

2024

2032

USD

484.77 Million

USD

823.62 Million

2024

2032

| 2025 –2032 | |

| USD 484.77 Million | |

| USD 823.62 Million | |

|

|

|

|

Petrochemicals Market Size

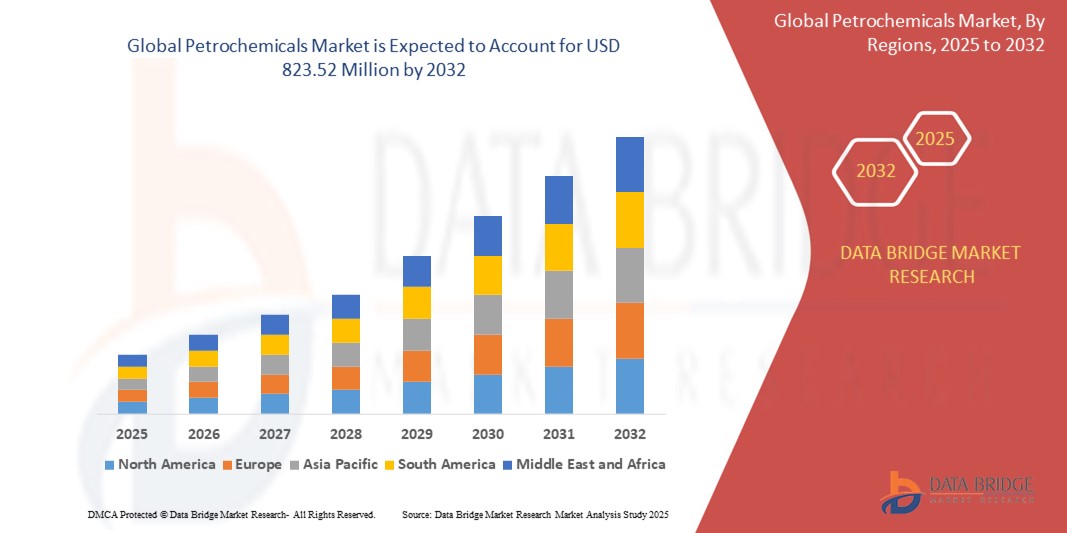

- The global petrochemicals market size was valued at USD 484.77 million in 2024 and is expected to reach USD 823.62 million by 2032, at a CAGR of 6.85% during the forecast period

- The market growth is driven by increasing demand for plastics, rising industrialization, and advancements in manufacturing processes, particularly in emerging economies

- The growing need for lightweight materials in automotive and packaging industries, coupled with the expansion of construction and electronics sectors, is fueling the adoption of petrochemical products globally

Petrochemicals Market Analysis

- Petrochemicals, derived from petroleum and natural gas, are essential building blocks for a wide range of products, including plastics, chemicals, and synthetic materials used across industries

- The rising demand for petrochemicals is primarily driven by the growing consumption of polymers in packaging, automotive, and construction applications, as well as the increasing use of specialty chemicals in healthcare and electronics

- North America dominated the petrochemicals market with the largest revenue share of 38.5% in 2024, driven by advanced manufacturing infrastructure, significant investments in shale gas, and a strong presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid urbanization, increasing industrial activities, and rising disposable incomes in countries such as China and India

- The ethylene segment dominated the largest market revenue share of 28% in 2024, driven by its extensive use in the production of polyethylene, which is widely utilized across packaging, textiles, and automotive industries

Report Scope and Petrochemicals Market Segmentation

|

Attributes |

Petrochemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Petrochemicals Market Trends

“Rising Demand for Sustainable and Bio-Based Petrochemical Alternatives”

- The global petrochemicals market is witnessing a growing trend toward the development and adoption of sustainable and bio-based feedstocks as alternatives to traditional fossil fuel-derived petrochemicals

- Increasing environmental concerns, stringent government regulations, and corporate sustainability goals are driving this shift

- Companies are investing in green technologies such as bio-refineries, carbon capture utilization, and circular economy models to reduce their carbon footprint

- For instance, several major chemical producers are launching commercial-scale bio-based ethylene and propylene production facilities using renewable feedstocks such as sugarcane, algae, and waste oils

- This trend is reshaping product portfolios across the industry and influencing manufacturing processes, applications, and end-use industries

- In addition, consumers and regulatory bodies are pushing for transparency and traceability in the sourcing and production of petrochemical products, further accelerating the integration of sustainable practice

Petrochemicals Market Dynamics

Driver

“Growth in End-Use Industries Driving Demand for Petrochemical Derivatives”

- Rapid expansion of key end-use industries such as packaging, automotive and transportation, construction, electrical and electronics, and healthcare is significantly boosting the demand for petrochemical products

- Polymers derived from ethylene and propylene are extensively used in packaging materials, automotive components, and consumer goods

- In the construction sector, petrochemical-based products such as polystyrene, solvents, and adhesives are critical for insulation, paints, and sealants

- The healthcare industry relies on petrochemical derivatives for medical device manufacturing, pharmaceutical packaging, and disposable equipment

- Asia-Pacific, particularly China and India, is experiencing robust growth due to urbanization, industrialization, and rising disposable incomes, making it the fastest-growing region in the market

- North America remains the dominant region, supported by advanced manufacturing infrastructure, shale gas availability, and strong R&D capabilities in petrochemical processing technologies

Restraint/Challenge

“Volatility in Crude Oil Prices and Regulatory Pressures”

- Fluctuations in crude oil prices directly impact the cost of raw materials for petrochemical production, leading to price instability and affecting profit margins across the supply chain

- Geopolitical tensions, supply chain disruptions, and trade restrictions further exacerbate market volatility

- Stringent environmental regulations and emission norms imposed by governments in Europe and North America are increasing compliance costs for manufacturers

- These regulations are limiting the expansion of conventional petrochemical plants and encouraging investment in cleaner but more expensive technologies

- In addition, public opposition to new petrochemical projects due to environmental and health concerns is delaying project approvals and increasing capital expenditures

- These challenges are prompting companies to explore alternative feedstocks and regional diversification strategies to mitigate risk

Petrochemicals market Scope

The market is segmented on the basis of product, manufacturing process, application, and end-use industry.

- By Product

On the basis of product, the global petrochemicals market is segmented into ethylene, propylene, butadiene, benzene, xylene, toluene, polystyrene, and methanol. The ethylene segment dominated the largest market revenue share of 28% in 2024, driven by its extensive use in the production of polyethylene, which is widely utilized across packaging, textiles, and automotive industries.

The methanol segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand in the chemical synthesis of formaldehyde, acetic acid, and as an alternative fuel in the transportation sector, particularly in Asia-Pacific.

- By Manufacturing Process

On the basis of manufacturing process, the global petrochemicals market is segmented into fluid catalytic cracking (FCC), steam cracking, and catalytic reforming. The steam cracking segment accounted for the largest market revenue share of 41% in 2024, due to its widespread use in producing light hydrocarbons such as ethylene and propylene, which are fundamental building blocks for plastics and synthetic materials.

The fluid catalytic cracking (FCC) segment is projected to grow at the fastest CAGR of 9.7% from 2025 to 2032, supported by rising investments in refining infrastructure in emerging economies and growing need for propylene as a key feedstock for polypropylene production.

- By Application

On the basis of application, the global petrochemicals market is segmented into polymers, paints and coatings, solvents, rubber, adhesives and sealants, surfactants, dyes, and others. The polymers segment dominated the market with a revenue share of 34% in 2024, attributed to the massive consumption of polyethylene and polypropylene in packaging, consumer goods, and automotive components.

The solvents segment is anticipated to register the highest growth rate during the forecast period, driven by expanding applications in pharmaceuticals, paints & coatings, and cleaning agents, especially in North America and Europe.

- By End-Use Industry

On the basis of end-use industry, the global petrochemicals market is segmented into packaging, automotive and transportation, construction, electrical and electronics, healthcare, and others. The packaging industry holds the largest revenue share of 29% in 2024, primarily due to high demand for plastic-based containers, films, and bottles across food & beverage, consumer goods, and e-commerce sectors.

The automotive and transportation segment is expected to grow at the fastest pace of 10.3% from 2025 to 2032, supported by lightweight material adoption, rising electric vehicle production, and increased use of composites and synthetic rubbers.

Petrochemicals Market Regional Analysis

- North America dominated the petrochemicals market with the largest revenue share of 38.5% in 2024, driven by advanced manufacturing infrastructure, significant investments in shale gas, and a strong presence of key industry players

- Growth in North America is supported by continuous technological advancements in manufacturing processes and a growing focus on sustainability. The integration of digitalization and automation in production facilities further enhances operational efficiency and competitiveness in the market

U.S. Petrochemicals Market Insight

The U.S. petrochemicals market captured the largest revenue share of 87.9% in 2024 within North America, fueled by strong domestic demand and a focus on advanced manufacturing. The country's ample shale gas resources provide a cost-effective feedstock, attracting significant investments in new production capacities, particularly for ethylene and propylene. The market is bolstered by the increasing use of petrochemicals in the packaging, automotive, and construction industries, along with a growing emphasis on high-performance polymers and specialty chemicals.

Europe Petrochemicals Market Insight

The Europe petrochemicals market is experiencing steady growth, driven by a strong regulatory emphasis on sustainability and a shift towards circular economy models. The region is a key consumer of high-value petrochemicals, with a focus on advanced materials for the automotive, construction, and electrical & electronics sectors. The market is characterized by a high degree of technological innovation, with a focus on improving production efficiency and developing bio-based or recycled feedstocks.

U.K. Petrochemicals Market Insight

The U.K. market for petrochemicals is driven by the demand for various applications, particularly in packaging and consumer goods. The market's growth is supported by a focus on sustainable solutions, with an increasing interest in bio-plastics and recycled polymers. The U.K.'s established manufacturing base and its role in the global supply chain for a wide range of products influence its consumption of key petrochemical building blocks.

Germany Petrochemicals Market Insight

Germany is a key player in the European petrochemicals market, attributed to its advanced automotive and manufacturing sectors. The country's strong focus on engineering and high-quality products drives the demand for specialized petrochemicals and polymers. German consumers and industries prioritize technologically advanced materials that contribute to energy efficiency and performance in end products, such as lightweight components for vehicles and durable materials for construction.

Asia-Pacific Petrochemicals Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate in the global petrochemicals market, driven by rapid urbanization, rising disposable incomes, and expanding industrial sectors in countries such as China, India, and Japan. The region's increasing automotive production, construction activities, and booming packaging industry are major drivers of demand for petrochemicals. Significant investments in new production capacities and a growing focus on meeting domestic demand are key factors contributing to the region's market expansion.

Japan Petrochemicals Market Insight

Japan's petrochemicals market is characterized by a strong consumer preference for high-quality and technologically advanced products. The country is a major hub for automotive and electronics manufacturing, driving the demand for specialty polymers and other petrochemical derivatives. The market benefits from the presence of major petrochemical manufacturers and a continuous focus on research and development to create innovative materials for various applications.

China Petrochemicals Market Insight

China holds the largest share of the Asia-Pacific petrochemicals market, propelled by its massive manufacturing industry, rapid urbanization, and rising vehicle ownership. The country's strong domestic manufacturing capabilities, competitive pricing, and growing middle class contribute to a robust demand for petrochemicals in various end-use industries, including packaging, construction, and textiles. Government initiatives promoting economic growth and industrial expansion further fuel the market.

Petrochemicals Market Share

The petrochemicals industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Lyondell Basell Industries Holdings B.V. (U.S.)

- INEOS (U.K.)

- Shell Plc. (U.K.)

- SABIC (Saudi Arabia)

- Reliance Industries Limited (India)

- Mitsubishi Chemical Holdings Corporation (Japan)

- Dow (U.S.)

- LG Chem (South Korea)

- Chevron Phillips Chemical Company LLC. (U.S.)

- China National Petroleum Corporation (China)

- Maruzen Petrochemical (Japan)

- SIBUR Holding PJSC (Russia)

- Unicorn Petroleum (India)

What are the Recent Developments in Global Petrochemicals Market?

- In May 2025, Gelest, a Mitsubishi Chemical Group company, completed the expansion of its specialty materials production facility at its global headquarters in Morrisville, Pennsylvania. The new 50,000-square-foot building significantly boosts Gelest’s manufacturing capacity, supporting applications across microelectronics, medical devices, thermal coatings, and mobility solutions. Designed with advanced equipment and a 3,000-square-foot ISO 7 cleanroom, the facility enhances operational efficiency and ensures chemical purity. This expansion reflects Gelest’s ongoing investment in cutting-edge material science and its commitment to meeting the growing global demand for high-performance specialty chemistries

- In May 2024, Honeywell introduced a groundbreaking Naphtha to Ethane and Propane (NEP) technology, aimed at transforming petrochemical production by enhancing energy efficiency and sustainability. This innovative process enables the conversion of naphtha and LPG feedstocks into ethane and propane, which are then directed to specialized cracking units to maximize ethylene and propylene yields. Compared to traditional mixed-feed steam crackers, the NEP approach reduces CO₂ emissions by up to 50% and increases net cash margins by 15–50%, while minimizing lower-value byproducts. The launch underscores Honeywell’s commitment to advancing low-carbon, high-efficiency solutions for the global petrochemical industry

- In November 2023, Braskem and Oxiteno announced a strategic partnership to advance the production of bio-attributed ethylene derived from renewable sources. Certified by the International Sustainability and Carbon Certification (ISCC), this ethylene is produced using a mass balance approach, blending traditional carbon sources with recycled or renewable feedstocks. Oxiteno will utilize this certified raw material to develop innovative, sustainable chemical solutions, maintaining the same quality as conventional products while significantly reducing fossil fuel dependency and greenhouse gas emissions. The collaboration reflects both companies’ shared commitment to decarbonization, eco-efficiency, and a circular economy in the petrochemical sector

- In November 2023, Dow announced an $8.9 billion investment to build a net-zero petrochemical complex in Alberta’s Industrial Heartland, near Fort Saskatchewan, Canada. Known as the Path2Zero project, this facility is set to become the world’s first integrated ethylene cracker and derivatives site with net-zero Scope 1 and 2 emissions. It will produce approximately 3 million tonnes of low- to zero-carbon ethylene and polyethylene derivatives annually. Backed by both federal and provincial funding, construction was scheduled to begin in 2024, with completion in phases through 2029, reinforcing Dow’s commitment to industrial decarbonization

- In July 2023, SABIC launched a new PCR-based NORYL™ portfolio, advancing its commitment to sustainability and circularity in the petrochemical industry. These innovative resins incorporate 25% or more post-consumer recycled (PCR) content, with some grades—such as NORYL NH5120RC3—achieving a 10% reduction in global warming potential compared to fossil-based counterparts. The portfolio also includes bio-based variants certified under ISCC+, offering drop-in replacements for traditional grades without compromising performance. With over 200 existing grades and the ability to customize new ones, SABIC’s initiative supports customers in reducing their carbon footprint while maintaining high material standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Petrochemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Petrochemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Petrochemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.