Global Pet Insurance Market

Market Size in USD Million

CAGR :

%

USD

47.32 Million

USD

9.49 Million

2024

2032

USD

47.32 Million

USD

9.49 Million

2024

2032

| 2025 –2032 | |

| USD 47.32 Million | |

| USD 9.49 Million | |

|

|

|

|

Pet Insurance Market Size

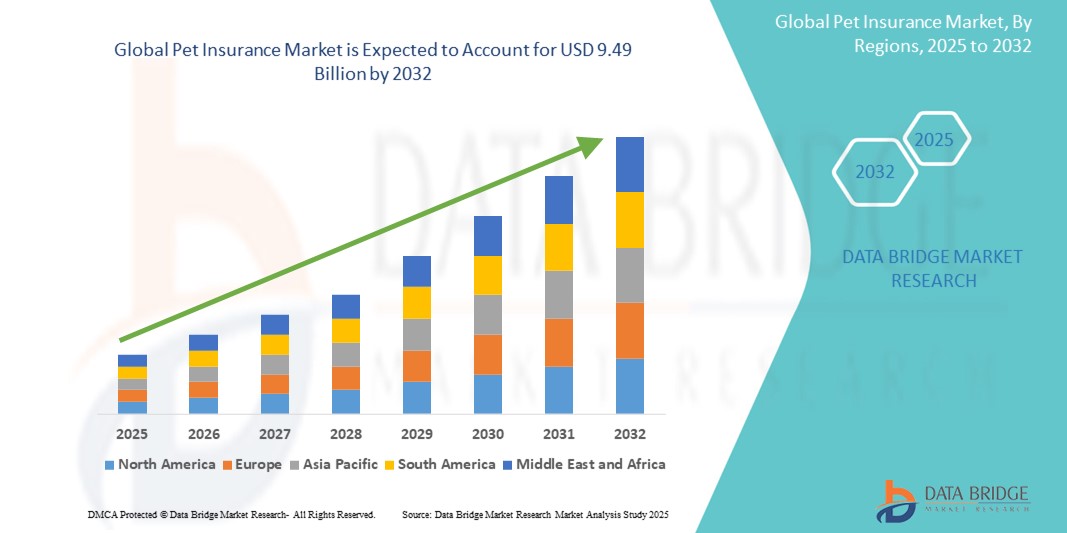

- The global pet insurance market size was valued at USD 47.32 Billion in 2024 and is expected to reach USD 9.49 Billion by 2032, at a CAGR of 94.00% during the forecast period

- The market growth is largely fueled by the increasing pet adoption rates and heightened awareness among pet owners regarding the rising costs of veterinary care, prompting a greater need for financial protection and comprehensive pet health coverage

- Furthermore, the growing demand for customized, user-friendly, and digitally accessible insurance plans is establishing pet insurance as a vital component of responsible pet ownership. These converging factors are accelerating the uptake of pet insurance solutions, thereby significantly boosting the industry's growth

Pet Insurance Market Analysis

- Pet insurance, providing financial protection against veterinary expenses, is an essential component of responsible pet ownership—gaining traction across developed and emerging markets due to rising pet adoption, steep veterinary care costs, and growing awareness of animal wellness

- The increasing demand for pet insurance is driven by the humanization of pets, higher incidence of chronic conditions and injuries, and the availability of flexible, digitally accessible insurance plans

- North America dominated the pet insurance market with a revenue share of 35.0% in 2024, propelled by high pet ownership, premium veterinary costs, strong digital platforms, and innovative product offerings. The U.S. market—surpassing $5.7 billion in premiums in 2024 with over 7 million pets insured—underscores this dominance

- Asia-Pacific is poised to be the fastest-growing region in the pet insurance market during the forecast period, with an estimated CAGR of 17.6%, supported by rising disposable incomes, urbanization, and increasing awareness of pet health, especially in China, India, Japan, and Australia

- The lifetime cover pet insurance segment dominated the market with a share of 61.5% in 2024, owing to its comprehensive nature that ensures continued coverage for chronic and recurring conditions throughout a pet’s life. This segment’s popularity is driven by growing awareness among pet owners about long-term health risks and the financial benefits of consistent insurance support

Report Scope and Pet Insurance Market Segmentation

|

Attributes |

Pet Insurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pet Insurance Market Trends

“Increased Personalization and Digital Innovation in Pet Insurance Offerings”

- A notable and accelerating trend in the global pet insurance market is the increasing shift toward personalized and tech-driven solutions that enhance policyholder engagement and streamline claims processing. This includes the adoption of digital platforms, wearable devices for pets, and mobile apps that track health metrics, manage policies, and offer instant vet support

- For instance, companies are offering mobile-based claim submissions and 24/7 virtual vet consultations, making it easier for pet owners to manage their insurance needs without paperwork or delays. Providers such as Trupanion and Figo Pet Insurance offer digital tools that help users monitor coverage, access emergency care, and renew policies automatically

- These innovations enable insurers to collect real-time health data, which can be used to tailor premiums and offer wellness-based incentives—enhancing both customer satisfaction and pet health outcomes. Some insurers are integrating GPS and fitness tracking features into their services, allowing pet owners to monitor their pets’ physical activity and health conditions, which in turn reduces insurance risks

- The growing use of advanced analytics and machine learning algorithms in backend systems is also enabling more accurate risk assessment, faster claim approvals, and detection of fraudulent claims—ultimately improving operational efficiency

- As pet parents increasingly seek transparency, ease-of-use, and proactive healthcare management for their animals, insurance providers are rapidly evolving to meet these demands. This growing emphasis on digital and personalized pet insurance services is reshaping customer expectations and redefining competitive dynamics in the global market

Pet Insurance Market Dynamics

Driver

“Growing Need Due to Rising Veterinary Costs and Pet Ownership”

- The increasing prevalence of chronic conditions in pets and rising veterinary treatment costs are significant drivers for the growing demand in the pet insurance market. As pet owners become more aware of the financial risks associated with pet healthcare, there is a growing shift towards securing insurance coverage to manage unforeseen medical expenses

- For instance, in April 2024, Trupanion announced an expansion of its direct payment veterinary network, aiming to reduce out-of-pocket costs for pet owners. Such strategic initiatives by leading companies are expected to boost the pet insurance industry over the forecast period

- With pets increasingly considered part of the family, owners are seeking high-quality, long-term healthcare solutions. Pet insurance offers coverage for surgeries, chronic illnesses, diagnostics, and preventive care—making it an essential tool for managing costs

- Furthermore, the growing adoption of pets, particularly in urban households, and the rising trend of multi-pet ownership are accelerating the need for customizable and multi-pet insurance plans

- The convenience of digital claims management, wellness coverage, and value-added services such as telehealth consultations are also playing a critical role in attracting modern pet owners. These developments, coupled with greater awareness through veterinary partnerships and digital marketing, are fostering market growth

Restraint/Challenge

“Low Penetration and Limited Awareness in Emerging Markets”

- Despite strong growth prospects, the pet insurance market faces challenges in regions with low insurance awareness and poor penetration rates. In many developing countries, pet insurance is still considered a discretionary expense, with limited availability of products and providers

- For instance, the lack of standardized healthcare pricing and fragmented veterinary services in emerging economies makes it difficult for insurers to assess risk accurately and build cost-effective plans. In addition, limited awareness among pet owners regarding the benefits of pet insurance results in lower adoption rates, even in markets where veterinary expenses are rising

- The lack of regulatory frameworks and data on pet health further hinders the development of tailored insurance offerings in several regions

- Overcoming these challenges will require significant efforts in education, partnerships with veterinary clinics, and the introduction of flexible, affordable insurance models suited to different income groups and pet types. Developing regional partnerships and offering tiered coverage options can aid in building trust and expanding coverage to untapped markets

Pet Insurance Market Scope

The market is segmented on the basis of product type, animal type, and end-user.

• By Product Type

On the basis of product type, the pet insurance market is segmented into non-lifetime cover pet insurance, lifetime cover pet insurance, and accident-only pet insurance. The lifetime cover pet insurance segment dominated the largest market revenue share of 61.5% in 2024, driven by increasing demand for comprehensive, long-term health coverage for pets. This type of policy covers recurring medical conditions throughout a pet’s life, making it the preferred choice among pet owners seeking maximum financial protection.

The accident-only pet insurance segment is anticipated to witness the fastest growth rate of 20.3% from 2025 to 2032, fueled by its affordability and growing adoption among first-time pet insurance buyers. This policy type is popular in price-sensitive markets and among pet owners who want essential coverage for emergencies without committing to higher premiums.

• By Animal Type

On the basis of animal type, the pet insurance market is segmented into dogs, cats, horses, and others. The dogs segment held the largest market revenue share in 2024, owing to the high rate of dog ownership globally and the relatively higher cost of veterinary care associated with canines. Dog owners often opt for comprehensive plans to cover chronic illnesses, surgeries, and preventive care.

The cats segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing popularity of cats as indoor pets, particularly in urban regions. As awareness of feline health issues grows, more owners are seeking insurance solutions tailored to their pets’ needs.

• By End-User

On the basis of end-user, the pet insurance market is segmented into agency, broker, bancassurance, and direct writing. The direct writing segment accounted for the largest market revenue share in 2024, supported by the rise of digital platforms and insurer websites that allow pet owners to compare and purchase policies directly. Direct writing offers insurers better control over customer relationships and pricing.

The broker segment is projected to witness the fastest CAGR from 2025 to 2032, as brokers provide personalized advice and access to a wide range of insurance products, helping pet owners make informed decisions. The growing complexity of insurance offerings is making intermediaries increasingly valuable in matching pet owners with appropriate coverage plans.

Pet Insurance Market Regional Analysis

- North America dominated the pet insurance market with the largest revenue share of 35.00% in 2024, driven by increasing pet ownership, rising veterinary care costs, and growing awareness regarding the financial benefits of pet insurance

- Consumers in the region are highly inclined toward comprehensive pet healthcare solutions, and insurers are offering diverse, customizable plans that cater to varying needs and budgets, including coverage for chronic conditions, preventive care, and hereditary diseases

- This widespread adoption is further supported by high disposable incomes, a strong presence of leading insurance providers, and the cultural perception of pets as family members, which is encouraging proactive spending on pet well-being and health protection

U.S. Pet Insurance Market Insight

The U.S. pet insurance market captured the largest revenue share of 78.3% in 2024 within North America, fueled by high per-pet healthcare spending and the increasing adoption of comprehensive coverage plans. Consumers are showing a strong preference for lifetime and wellness-inclusive policies, reflecting a growing humanization of pets. In addition, the presence of major insurance providers, advanced digital infrastructure, and easy online claim processing contribute to the market’s dominance in the region.

Europe Pet Insurance Market Insight

The Europe pet insurance market is projected to expand at a CAGR of 11.5% throughout the forecast period, primarily driven by rising veterinary costs, growing pet ownership, and heightened awareness of pet health benefits. Consumers across European countries are increasingly inclined toward lifetime policies that offer long-term protection and coverage for chronic conditions. New digital platforms and partnerships between insurers and veterinary clinics are enhancing policy accessibility and customer engagement.

U.K. Pet Insurance Market Insight

The U.K. pet insurance market is anticipated to grow at a CAGR of 12.2% during the forecast period, supported by high insurance penetration, increased pet adoption, and a strong culture of preventive healthcare for animals. Concerns over rising veterinary expenses, combined with a well-developed insurance framework and government support for animal welfare, are expected to further accelerate market expansion. Online policy management tools and flexible premium options are also boosting uptake.

Germany Pet Insurance Market Insight

The Germany pet insurance market is expected to expand at a CAGR of 10.8% during the forecast period, fueled by an increasing focus on pet well-being, digital transformation in insurance services, and growing disposable incomes. German pet owners are increasingly opting for plans that cover preventive and emergency care. The country’s reputation for innovation and environmental consciousness is also encouraging the development of eco-friendly and tech-integrated insurance models.

Asia-Pacific Pet Insurance Market Insight

The Asia-Pacific pet insurance market is poised to grow at the fastest CAGR of 17.6% from 2025 to 2032, driven by surging pet ownership, rising awareness of pet health, and rapid economic development in countries such as China, Japan, and India. The adoption of pet insurance is being fueled by the humanization of pets and growing middle-class demand for quality healthcare services. The emergence of local providers and digital policy platforms is further boosting market accessibility.

Japan Pet Insurance Market Insight

The Japan pet insurance market is gaining momentum and is expected to grow at a CAGR of 14.1%, supported by the country's aging population, compact urban living environments, and strong emphasis on safety and preventive care. The market is expanding as consumers prioritize wellness, chronic illness coverage, and ease of policy access. Integration with mobile apps and streamlined claim settlements are key factors enhancing customer satisfaction.

China Pet Insurance Market Insight

The China pet insurance market accounted for 42.7% of Asia-Pacific revenue in 2024, attributed to the expanding middle class, growing disposable income, and a surge in pet ownership. China remains a fast-evolving hub for pet healthcare and insurance, driven by tech-savvy consumers and robust domestic product offerings. The government's smart city initiatives, paired with a booming e-commerce sector, are fostering rapid digital adoption in pet insurance offerings.

Pet Insurance Market Share

The pet insurance industry is primarily led by well-established companies, including:

- Nationwide Building Society (U.S.)

- Trupanion (U.S.)

- Pethealth Inc. (U.S.)

- Embrace Pet Insurance Agency LLC (U.S.)

- United States Fire Insurance Company (U.S.)

- Petplan Ltd. (U.K.)

- Hartville Group, Inc. (U.S.)

- Petfirst Healthcare LLC (U.S.)

- Anicom Holdings Inc. (Japan)

- RSA (U.K.)

- ipet Insurance (Japan)

- The Oriental Insurance Company Ltd. (India)

- Figo Pet Insurance, LLC (U.S.)

- Direct Line (U.K.)

- Animal Friends Insurance Services Limited (U.K.)

Latest Developments in Global Pet Insurance Market

- In April 2023, Trupanion Inc., a prominent U.S.-based pet insurance provider, announced its expansion into South Africa, aimed at improving access to pet healthcare services and insurance coverage for a growing pet-owning population. This strategic move showcases the company's intent to leverage international market opportunities and strengthen its global footprint in the rapidly expanding pet insurance market

- In August 2024, Apollo Insurance, a leading Canadian digital insurer, launched a comprehensive pet insurance program offering customizable coverage for both illness and preventive care.

- In June 2024, Trupanion entered a strategic partnership with Boehringer Ingelheim, a global pharmaceutical giant, to integrate veterinary medical insights into its insurance plans. This collaboration aims to improve pet health outcomes through enhanced data utilization and preventive care offerings, reflecting a broader industry shift toward integrated pet health ecosystems

- In September 2024, Trupanion expanded into Germany and Switzerland, introducing its accident and illness coverage for dogs and cats. The move marks its entry into high-growth European markets where pet insurance penetration remains low but pet ownership is steadily increasing

- In December 2024, Trupanion achieved a milestone of over USD 3 billion in total veterinary claims paid, emphasizing the scale of its operations and consumer trust. This development reflects the growing reliance on pet insurance as a financial safety net for unforeseen veterinary costs and complex treatments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.