Global Pet Cancer Therapeutics Market

Market Size in USD Million

CAGR :

%

USD

309.69 Million

USD

621.62 Million

2024

2032

USD

309.69 Million

USD

621.62 Million

2024

2032

| 2025 –2032 | |

| USD 309.69 Million | |

| USD 621.62 Million | |

|

|

|

|

Pet Cancer Therapeutics Market Size

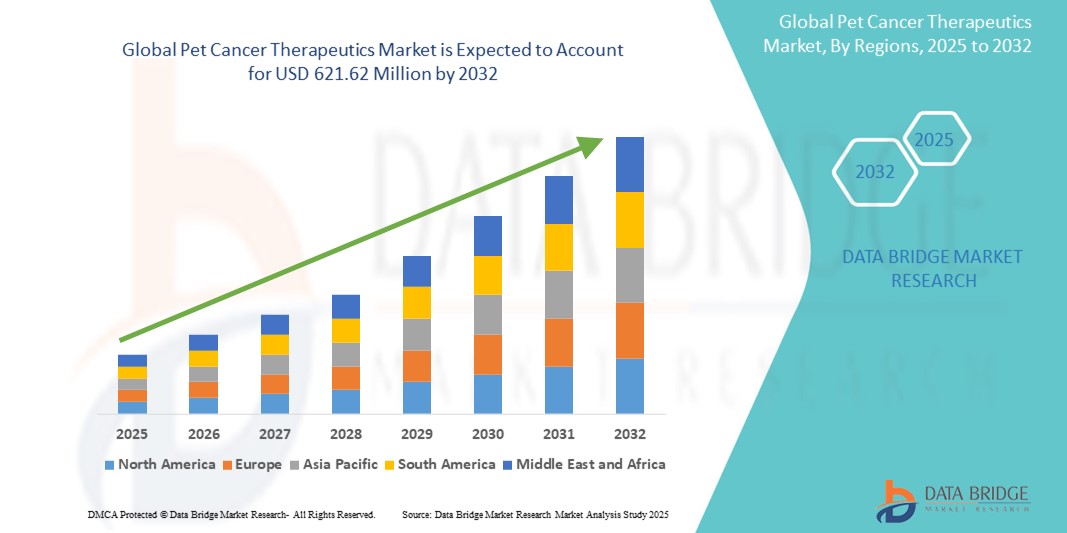

- The global pet cancer therapeutics market size was valued at USD 309.69 Million in 2024 and is expected to reach USD 621.62 Million by 2032, at a CAGR of 9.10% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress in veterinary oncology, leading to the development of more advanced, targeted therapies for treating cancer in pets. This includes innovations such as monoclonal antibodies, targeted small molecules, and immunotherapy, which are transforming the landscape of animal cancer care

- Furthermore, rising pet ownership, increasing awareness among pet owners about early cancer diagnosis, and a growing willingness to spend on specialized treatments are significantly boosting demand for effective and safe pet cancer therapeutics solutions. These converging factors are accelerating the uptake of veterinary oncology drugs and personalized treatments, thereby significantly boosting the industry's growth

Pet Cancer Therapeutics Market Analysis

- Pet cancer therapeutics, including chemotherapy, targeted therapy, immunotherapy, and others, are becoming essential in veterinary oncology due to the rising incidence of cancer in companion animals and growing awareness among pet owners regarding advanced treatment options

- The increasing demand for pet cancer therapeutics is largely driven by the growing pet population, rising healthcare spending on pets, and technological advancements in veterinary diagnostics and treatments

- North America dominated the pet cancer therapeutics market with the largest revenue share of 41.6% in 2024, fueled by early adoption of advanced veterinary care, high pet ownership rates, and robust healthcare infrastructure for companion animals. The U.S. contributes significantly to this growth through extensive investments in animal health research and the presence of major market players focused on oncology solutions

- Asia-Pacific is projected to be the fastest-growing region in the pet cancer therapeutics market during the forecast period, with a CAGR of 11.3% from 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, and growing awareness about veterinary oncology care in countries such as China, India, and Japan

- The chemotherapy segment dominated the pet cancer therapeutics market with the largest revenue share of 38.4% in 2024, owing to its widespread use in treating a variety of pet cancers

Report Scope and Pet Cancer Therapeutics Market Segmentation

|

Attributes |

Pet Cancer Therapeutics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pet Cancer Therapeutics Market Trends

“Advancing Veterinary Oncology Through Targeted and Personalized Therapies”

- A significant and accelerating trend in the global pet cancer therapeutics market is the rising focus on targeted therapies and personalized medicine for treating cancer in companion animals. This approach is reshaping veterinary oncology by offering more effective, less invasive treatment options tailored to specific cancer types and the genetic profiles of pets

- For instance, targeted therapies such as tyrosine kinase inhibitors (TKIs) are gaining traction in treating mast cell tumors in dogs, with products such as Palladia (toceranib phosphate) approved by the U.S. FDA for veterinary use. These therapies work by interfering with specific molecular targets involved in cancer progression, minimizing damage to healthy tissues and improving treatment outcomes

- The increasing availability of veterinary diagnostic tools, such as genetic testing and biomarker analysis, is enabling veterinarians to select more appropriate and effective treatment regimens for individual pets. This trend is contributing to the growth of companion diagnostics in the animal healthcare sector, supporting earlier detection and improved monitoring of cancer progression

- Moreover, immunotherapy is emerging as a promising area, particularly in canine melanoma and lymphoma treatment. Veterinary oncologists are now exploring the use of cancer vaccines and monoclonal antibodies that stimulate the pet’s immune system to recognize and destroy cancer cells

- With pet owners becoming more emotionally and financially invested in the health of their animals, there is increasing willingness to pursue advanced oncology care, including chemotherapy, radiation therapy, and surgery. This has led to the expansion of specialty veterinary cancer centers across major markets such as the U.S., Canada, and parts of Europe

- Leading pharmaceutical companies and biotech firms are investing significantly in R&D for novel veterinary oncology drugs, supported by favorable regulatory environments that facilitate accelerated approvals for animal health products

- This shift towards precision oncology and evidence-based treatment is expected to continue driving innovation and revenue growth in the pet cancer therapeutics market, ultimately improving survival rates and quality of life for pets undergoing cancer treatment

Pet Cancer Therapeutics Market Dynamics

Driver

“Growing Demand Driven by Increasing Pet Ownership and Rising Cancer Incidence”

- The increasing number of companion animals globally, along with heightened awareness among pet owners regarding animal health, is a significant driver for the growing demand for pet cancer therapeutics. As pets are increasingly considered family members, there is a stronger willingness among owners to pursue advanced treatments, including cancer therapies

- For instance, in May 2024, Zoetis Services LLC announced the expansion of its oncology pipeline with a focus on targeted biologics and immunotherapies for canine and feline cancers. Such initiatives by key companies are expected to significantly drive the growth of the Pet Cancer Therapeutics market in the coming years

- Moreover, the growing incidence of cancers such as lymphoma, mast cell tumors, and melanoma in cats and dogs is prompting a shift toward early diagnosis and intervention. With more veterinary practices adopting advanced imaging and biopsy techniques, the demand for effective cancer therapies is increasing rapidly

- The availability of specialized cancer treatments, including chemotherapy, immunotherapy, and targeted therapy, along with improved veterinary infrastructure, is helping increase adoption in both urban and semi-urban markets

- In addition, the emergence of telemedicine and online pet pharmacies is improving accessibility to cancer therapeutics, especially in remote regions. This trend, coupled with growing veterinary awareness and training, is expected to further boost the adoption of pet oncology solutions

Restraint/Challenge

“High Treatment Costs and Limited Availability of Approved Therapies”

- One of the primary challenges in the pet cancer therapeutics market is the high cost of treatment. Many advanced therapies, such as targeted drugs and radiation therapy, remain expensive and may not be financially viable for all pet owners, especially in developing regions

- Moreover, the limited number of approved oncology drugs for animals, compared to the human pharmaceutical industry, restricts treatment options. Regulatory challenges and lengthy approval timelines further slow down the introduction of novel drugs into the market

- For instance, while companies such as Elanco and AB Science have made strides in veterinary oncology, the process of bringing innovative therapies to market remains time-consuming and resource-intensive

- In addition, there is a lack of insurance coverage or reimbursement policies for pet treatments in many countries, making advanced cancer care unaffordable for a large section of pet owners

- Overcoming these challenges will require increased R&D investment, collaboration with veterinary institutions, and policy support to enhance access, reduce treatment costs, and drive sustainable growth in the Pet Cancer Therapeutics market

Pet Cancer Therapeutics Market Scope

The market is segmented on the basis of therapy, medicine type, route of administration, cancer type, species type, and end user.

• By Therapy

On the basis of therapy, the pet cancer therapeutics market is segmented into chemotherapy, radiation therapy, immunotherapy, targeted therapy, combination therapy, and others. The chemotherapy segment dominated the market with the largest revenue share of 38.4% in 2024, owing to its widespread use in treating a variety of pet cancers.

The immunotherapy segment is expected to register the fastest CAGR of 10.8% from 2025 to 2032, driven by increased focus on novel cancer vaccines and monoclonal antibodies.

• By Medicine Type

On the basis of medicine type, the pet cancer therapeutics market is segmented into chemotherapy drugs and vaccines. The chemotherapy drugs segment held the largest share of 66.1% in 2024, due to the extensive availability of conventional cytotoxic drugs.

The vaccines segment is anticipated to grow at a CAGR of 11.5% from 2025 to 2032, as demand rises for preventive therapies in pet oncology.

• By Route of Administration

On the basis of route of administration, the pet cancer therapeutics market is segmented into parenteral, oral, and others. The parenteral segment accounted for the largest revenue share of 57.9% in 2024, reflecting its dominance in veterinary clinics for rapid drug action.

The oral segment is projected to grow at the fastest CAGR of 9.7% from 2025 to 2032, supported by pet owners' preference for home-based care.

• By Cancer Type

On the basis of cancer type, the pet cancer therapeutics market is segmented into melanoma, mast cell cancer, lymphoma, mammary and squamous cell cancer, and others. The lymphoma segment led the market with a share of 29.6% in 2024, due to its high incidence and responsiveness to treatment.

The melanoma segment is projected to witness the fastest CAGR of 10.2% from 2025 to 2032, driven by advances in therapeutic vaccines and diagnostics.

• By Species Type

On the basis of species type, the pet cancer therapeutics market is segmented into cat, dog, and others. The dog segment held the largest share of 71.3% in 2024, owing to a higher cancer prevalence in dogs and availability of more treatment options.

The cat segment is expected to grow at a fastest CAGR of 8.6% from 2025 to 2032, with increasing access to specialized feline therapies.

• By End User

On the basis of end user, the pet cancer therapeutics market is segmented into veterinary hospitals and clinical pharmacies, retail pharmacies, online pharmacies, and others. The veterinary hospitals and clinical pharmacies segment dominated the market with a share of 54.8% in 2024, benefiting from comprehensive oncology services and patient care.

The online pharmacies segment is expected to grow at the fastest CAGR of 12.3% from 2025 to 2032, driven by rising digital pet care adoption and e-commerce expansion.

Pet Cancer Therapeutics Market Regional Analysis

- North America dominated the pet cancer therapeutics market with the largest revenue share of 41.6% in 2024, driven by the increasing prevalence of cancer in pets, high awareness among pet owners, and strong veterinary healthcare infrastructure

- There is a growing demand for advanced therapies, including chemotherapy, immunotherapy, and targeted drug delivery, supported by pet insurance coverage and increasing pet healthcare spending in the region

- The presence of major players and ongoing research and development in veterinary oncology further fuel market growth

U.S. Pet Cancer Therapeutics Market Insight

The U.S. pet cancer therapeutics market accounted for 85.1% of the North America market share in 2024, supported by a robust network of veterinary oncology centers, early access to newly approved therapies, and strong adoption of personalized cancer treatments for pets. Rising cases of lymphoma, mast cell tumors, and melanoma in dogs and cats are contributing to the demand for novel therapeutics. The U.S. also benefits from the presence of advanced diagnostics and favorable regulatory pathways from the FDA Center for Veterinary Medicine (CVM).

Europe Pet Cancer Therapeutics Market Insight

The Europe pet cancer therapeutics market is expected to witness a significant CAGR during the forecast period, due to increasing pet adoption rates and growing awareness of pet health. Stricter regulations around animal welfare and increased funding for veterinary research are supporting the expansion of treatment options. Several European countries, including Germany, France, and the U.K., are focusing on integrating oncology services into general veterinary practice.

U.K. Pet Cancer Therapeutics Market Insight

The U.K. pet cancer therapeutics market is projected to grow at a noteworthy CAGR during the forecast period, driven by a rising number of pet owners seeking advanced treatments and diagnostics. The country’s veterinary practices are increasingly adopting specialized cancer therapies, and the presence of universities and institutions conducting research on veterinary oncology is supporting growth.

Germany Pet Cancer Therapeutics Market Insight

The Germany pet cancer therapeutics market is expected to expand at a significant CAGR during the forecast period, with strong demand for advanced veterinary diagnostics and treatment protocols. The German market benefits from high pet ownership rates, growing expenditure on pet care, and an emphasis on improving the quality of life of companion animals with chronic conditions, including cancer.

Asia-Pacific Pet Cancer Therapeutics Market Insight

The Asia-Pacific pet cancer therapeutics market is projected to grow at the fastest CAGR of 11.3% from 2025 to 2032, attributed to growing awareness of pet health, increasing disposable incomes, and expanding veterinary services in countries such as China, Japan, and India. Urbanization and the humanization of pets are increasing the demand for specialty services, including cancer diagnostics and treatment. Supportive government policies and international collaborations are encouraging veterinary advancements in the region.

Japan Pet Cancer Therapeutics Market Insight

The Japan pet cancer therapeutics market is seeing rising demand for cancer treatment in pets, driven by its aging pet population and high standards of veterinary care. The market is benefitting from technological innovations in diagnostics and a cultural emphasis on preventive healthcare for animals, leading to early detection and treatment of various cancers.

China Pet Cancer Therapeutics Market Insight

The China pet cancer therapeutics market held the largest share of the Asia-Pacific market in 2024, supported by rapid urbanization, a growing middle class, and increasing spending on pet healthcare. The expanding pet insurance sector and strong presence of domestic veterinary pharmaceutical companies are supporting wider access to cancer therapies. China is also witnessing a growing number of veterinary specialty clinics that offer targeted cancer treatments such as chemotherapy and immunotherapy.

Pet Cancer Therapeutics Market Share

The pet cancer therapeutics industry is primarily led by well-established companies, including:

- AB Science (France)

- Elanco (U.S.)

- Candel Therapeutics (Canada)

- NIPPON ZENYAKU KOGYO CO., LTD. (Japan)

- Rhizen Pharmaceuticals AG (Switzerland)

- Virbac (France)

- Pfizer Inc. (U.S.)

- VetDC (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Karyopharm (U.S.)

- VETCO (U.S.)

- ELIAS Animal Health (U.S.)

- Vivesto AB (Sweden)

- Torigen Pharmaceuticals Inc. (U.S.)

- Zoetis Services LLC (U.S.)

Latest Developments in Global Pet Cancer Therapeutics Market

- In October 2024, Calviri (a biotech specialized in canine cancer vaccines) initiated a clinical trial for its immunotherapy vaccine targeting early-stage hemangiosarcoma in dogs. This SOCH study evaluates whether combining the vaccine with surgery and chemotherapy can significantly extend survival compared to standard care

- In March 2025, ELIAS Animal Health received full USDA approval for its ELIAS Cancer Immunotherapy (ECI)—the first licensed autologous cell therapy for treating canine osteosarcoma—opening access via apheresis treatment centers across the U.S.

- In August 2024, FidoCure (One Health Company) secured a U.S. patent for its AI-enhanced targeted therapy and biomarker platform for canine bladder cancer, representing a major step forward in personalized veterinary oncology

- In January 2025, Vetigenics, a biotech focused on canine monoclonal antibodies, closed a USD 6 million seed round. They achieved positive results from a clinical trial of an anti-CTLA4 therapy for canine oral melanoma and are nearing completion of an anti-PD1 study for urothelial carcinoma

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PET CANCER THERAPEUTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PET CANCER THERAPEUTICS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 PIPELINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 EPIDEMIOLOGY MODELLING

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PET CANCER THERAPEUTICS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 MERGERS AND ACQUISITIONS

10.8 FUTURE OUTLOOK

11 EPIDEMIOLOGY

11.1 INCIDENCE OF ALL BY GENDER

11.2 TREATMENT RATE

11.3 MORTALITY RATE

11.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

11.5 PATIENT TREATMENT SUCCESS RATES

12 REGULATORY COMPLIANCE

12.1 REGULATORY AUTHORITIES

12.2 REGULATORY CLASSIFICATIONS

12.2.1 CLASS I

12.2.2 CLASS II

12.2.3 CLASS III

12.3 REGULATORY SUBMISSIONS

12.4 INTERNATIONAL HARMONIZATION

12.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

12.6 REGULATORY CHALLENGES AND STRATEGIES

13 PIPELINE ANALYSIS

13.1 CLINICAL TRIALS AND PHASE ANALYSIS

13.2 DRUG THERAPY PIPELINE

13.3 PHASE III CANDIDATES

13.4 PHASE II CANDIDATES

13.5 PHASE I CANDIDATES

13.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR PET CANCER THERAPEUTICS MARKET

Company Name Product Name

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE FOR PET CANCER THERAPEUTICS MARKET

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved but Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE FOR PET CANCER THERAPEUTICS MARKET

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE FOR PET CANCER THERAPEUTICS MARKET

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR PET CANCER THERAPEUTICS MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

14 REIMBURSEMENT FRAMEWORK

15 OPPUTUNITY MAP ANALYSIS

16 VALUE CHAIN ANALYSIS

17 HEALTHCARE ECONOMY

17.1 HEALTHCARE EXPENDITURE

17.2 CAPITAL EXPENDITURE

17.3 CAPEX TRENDS

17.4 CAPEX ALLOCATION

17.5 FUNDING SOURCES

17.6 INDUSTRY BENCHMARKS

17.7 GDP RATION IN OVERALL GDP

17.8 HEALTHCARE SYSTEM STRUCTURE

17.9 GOVERNMENT POLICIES

17.1 ECONOMIC DEVELOPMENT

18 GLOBAL PET CANCER THERAPEUTICS MARKET, BY TYPE

18.1 OVERVIEW

18.2 CHEMOTHERAPY

18.3 IMMUNOTHERAPY

18.4 TARGETED THERAPY

18.5 COMBINATION THERAPY

18.6 RADIATION THERAPY

18.6.1 STEREOTACTIC RADIATION

18.6.2 CONVENTIONAL RADIATION THERAPY

18.7 RADIOACTIVE IODINE I-131 THERAPY

18.8 OTHERS

19 GLOBAL PET CANCER THERAPEUTICS MARKET, BY PRODUCT TYPE

19.1 OVERVIEW

19.2 MEDICINE/DRUGS

19.2.1 BY DRUGS

19.2.1.1. MARKETED

19.2.1.1.1. CISPLATIN

19.2.1.1.2. TOCERANIB

19.2.1.1.3. PREDNISONE

19.2.1.1.4. CYCLOPHOSPHAMIDE

19.2.1.1.5. CHLORAMBUCIL

19.2.1.1.6. LOMUSTINE

19.2.1.1.7. METHOTREXATE

19.2.1.1.8. OTHERS

19.2.1.2. EMERGING

19.2.1.2.1. AURANOFIN

19.2.1.2.2. DESMOPRESSIN

19.2.1.2.3. DOXYCYCLINE

19.2.1.2.4. LOSARTAN

19.2.1.2.5. OTHERS

19.2.2 BY FORM

19.2.2.1. TABLET

19.2.2.2. CAPSULES

19.2.2.3. OTHERS

19.2.3 BY DRUG TYPE

19.2.3.1. BRANDED

19.2.3.2. GENERICS

19.2.4 BY THERAPY TYPE

19.2.4.1. MONO THERAPY

19.2.4.2. COMBINATION THERAPY

19.2.5 OTHERS

19.3 INJECTABLE/VACCINES

19.3.1 BY TYPE

19.3.1.1. INJECTIONS

19.3.1.1.1. RABACFOSADINE

19.3.1.1.2. DACTINOMYCIN

19.3.1.1.3. MELPHALAN

19.3.1.1.4. L-ASPARAGINASE

19.3.1.1.5. OTHERS

19.3.1.2. INTRAVENOUS (IV) INFUSIONS

19.3.1.2.1. DOXORUBICIN

19.3.1.2.2. CARBOPLATIN

19.3.1.2.3. EPIRUBICIN

19.3.1.2.4. MITOXANTRONE

19.3.1.2.5. VINBLASTINE

19.3.1.2.6. VINCRISTINE

19.3.1.2.7. VINORELBINE

19.3.1.2.8. CYTOSINE ARABINOSIDE

19.3.1.2.9. OTHERS

19.3.2 BY DRUG TYPE

19.3.2.1. BRANDED

19.3.2.2. GENERICS

19.3.3 BY THERAPY

19.3.3.1. MONO THERAPY

19.3.3.2. COMBINATION THERAPY

19.3.4 OTHERS

20 GLOBAL PET CANCER THERAPEUTICS MARKET, BY DRUG TYPE

20.1 OVERVIEW

20.2 BRANDED

20.3 GENERICS

21 GLOBAL PET CANCER THERAPEUTICS MARKET, BY ANIMAL TYPE

21.1 OVERVIEW

21.2 CAT

21.3 DOG

21.4 OTHERS

22 GLOBAL PET CANCER THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION

22.1 OVERVIEW

22.2 ORAL

22.2.1 TABLET

22.2.2 CAPSULES

22.2.3 OTHERS

22.3 PARENTERAL

22.3.1 INTRAVENEOUS

22.3.2 SUBCUTANEOUS

22.3.3 OTHERS

22.4 OTHERS

23 GLOBAL PET CANCER THERAPEUTICS MARKET, BY APPLICATION

23.1 OVERVIEW

23.2 LYMPHOMA

23.3 MELANOMA

23.4 MAST CELL CANCER

23.5 MAMMARY AND SQUAMOUS CELL CANCER

23.6 OTHERS

24 GLOBAL PET CANCER THERAPEUTICS MARKET, BY END USER

24.1 OVERVIEW

24.2 VETERINARY HOSPITALS

24.2.1 PUBLIC

24.2.2 PRIVATE

24.3 HOME HEALTHCARE

24.4 VETERINARY CARE CENTRES

24.5 ANIMAL AND VETERINARY FARMS

24.6 VETERINARY RESEARCH CENTRES

24.7 OTHERS

25 GLOBAL PET CANCER THERAPEUTICS MARKET, BY DISTRIBUTION CHANNEL

25.1 OVERVIEW

25.2 DIRECT TENDER

25.3 RETAIL SALES

25.3.1 ONLINE SALES

25.3.2 OFFLINE SALES

25.4 OTHERS

26 GLOBAL PET CANCER THERAPEUTICS MARKET, BY GEOGRAPHY

GLOBAL PET CANCER THERAPEUTICS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

26.1 NORTH AMERICA

26.1.1 U.S.

26.1.2 CANADA

26.1.3 MEXICO

26.2 EUROPE

26.2.1 GERMANY

26.2.2 FRANCE

26.2.3 U.K.

26.2.4 HUNGARY

26.2.5 LITHUANIA

26.2.6 AUSTRIA

26.2.7 IRELAND

26.2.8 NORWAY

26.2.9 POLAND

26.2.10 ITALY

26.2.11 SPAIN

26.2.12 RUSSIA

26.2.13 TURKEY

26.2.14 BELGIUM

26.2.15 NETHERLANDS

26.2.16 SWITZERLAND

26.2.17 REST OF EUROPE

26.3 ASIA-PACIFIC

26.3.1 JAPAN

26.3.2 CHINA

26.3.3 SOUTH KOREA

26.3.4 INDIA

26.3.5 AUSTRALIA

26.3.6 SINGAPORE

26.3.7 THAILAND

26.3.8 MALAYSIA

26.3.9 INDONESIA

26.3.10 PHILIPPINES

26.3.11 VIETNAM

26.3.12 REST OF ASIA-PACIFIC

26.4 SOUTH AMERICA

26.4.1 BRAZIL

26.4.2 ARGENTINA

26.4.3 PERU

26.4.4 REST OF SOUTH AMERICA

26.5 MIDDLE EAST AND AFRICA

26.5.1 SOUTH AFRICA

26.5.2 SAUDI ARABIA

26.5.3 UAE

26.5.4 EGYPT

26.5.5 KUWAIT

26.5.6 ISRAEL

26.5.7 REST OF MIDDLE EAST AND AFRICA

27 GLOBAL PET CANCER THERAPEUTICS MARKET, COMPANY LANDSCAPE

27.1 COMPANY SHARE ANALYSIS: GLOBAL

27.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

27.3 COMPANY SHARE ANALYSIS: EUROPE

27.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

27.5 MERGERS & ACQUISITIONS

27.6 NEW PRODUCT DEVELOPMENT & APPROVALS

27.7 EXPANSIONS

27.8 REGULATORY CHANGES

27.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

28 GLOBAL PET CANCER THERAPEUTICS MARKET, SWOT AND DBMR ANALYSIS

29 GLOBAL PET CANCER THERAPEUTICS MARKET, COMPANY PROFILE

29.1 ELANCO OR ITS AFFILIATES.

29.1.1 COMPANY OVERVIEW

29.1.2 REVENUE ANALYSIS

29.1.3 GEOGRAPHIC PRESENCE

29.1.4 PRODUCT PORTFOLIO

29.1.5 RECENT DEVELOPMENTS

29.2 ZOETIS SERVICES LLC.

29.2.1 COMPANY OVERVIEW

29.2.2 REVENUE ANALYSIS

29.2.3 GEOGRAPHIC PRESENCE

29.2.4 PRODUCT PORTFOLIO

29.2.5 RECENT DEVELOPMENTS

29.3 AB SCIENCE

29.3.1 COMPANY OVERVIEW

29.3.2 REVENUE ANALYSIS

29.3.3 GEOGRAPHIC PRESENCE

29.3.4 PRODUCT PORTFOLIO

29.3.5 RECENT DEVELOPMENTS

29.4 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

29.4.1 COMPANY OVERVIEW

29.4.2 REVENUE ANALYSIS

29.4.3 GEOGRAPHIC PRESENCE

29.4.4 PRODUCT PORTFOLIO

29.4.5 RECENT DEVELOPMENTS

29.5 PFIZER INC.

29.5.1 COMPANY OVERVIEW

29.5.2 REVENUE ANALYSIS

29.5.3 GEOGRAPHIC PRESENCE

29.5.4 PRODUCT PORTFOLIO

29.5.5 RECENT DEVELOPMENTS

29.6 TORIGEN PHARMACEUTICALS INC.

29.6.1 COMPANY OVERVIEW

29.6.2 REVENUE ANALYSIS

29.6.3 GEOGRAPHIC PRESENCE

29.6.4 PRODUCT PORTFOLIO

29.6.5 RECENT DEVELOPMENTS

29.7 ELIAS ANIMAL HEALTH

29.7.1 COMPANY OVERVIEW

29.7.2 REVENUE ANALYSIS

29.7.3 GEOGRAPHIC PRESENCE

29.7.4 PRODUCT PORTFOLIO

29.7.5 RECENT DEVELOPMENTS

29.8 RHIZEN PHARMACEUTICALS AG

29.8.1 COMPANY OVERVIEW

29.8.2 REVENUE ANALYSIS

29.8.3 GEOGRAPHIC PRESENCE

29.8.4 PRODUCT PORTFOLIO

29.8.5 RECENT DEVELOPMENTS

29.9 VIRBAC

29.9.1 COMPANY OVERVIEW

29.9.2 REVENUE ANALYSIS

29.9.3 GEOGRAPHIC PRESENCE

29.9.4 PRODUCT PORTFOLIO

29.9.5 RECENT DEVELOPMENTS

29.1 KARYOPHARM

29.10.1 COMPANY OVERVIEW

29.10.2 REVENUE ANALYSIS

29.10.3 GEOGRAPHIC PRESENCE

29.10.4 PRODUCT PORTFOLIO

29.10.5 RECENT DEVELOPMENTS

29.11 VETCO PHARMACEUTICAL INC.

29.11.1 COMPANY OVERVIEW

29.11.2 REVENUE ANALYSIS

29.11.3 GEOGRAPHIC PRESENCE

29.11.4 PRODUCT PORTFOLIO

29.11.5 RECENT DEVELOPMENTS

29.12 VIVESTO AB

29.12.1 COMPANY OVERVIEW

29.12.2 REVENUE ANALYSIS

29.12.3 GEOGRAPHIC PRESENCE

29.12.4 PRODUCT PORTFOLIO

29.12.5 RECENT DEVELOPMENTS

29.13 CURELAB ONCOLOGY

29.13.1 COMPANY OVERVIEW

29.13.2 REVENUE ANALYSIS

29.13.3 GEOGRAPHIC PRESENCE

29.13.4 PRODUCT PORTFOLIO

29.13.5 RECENT DEVELOPMENTS

29.14 DECHRA

29.14.1 COMPANY OVERVIEW

29.14.2 REVENUE ANALYSIS

29.14.3 GEOGRAPHIC PRESENCE

29.14.4 PRODUCT PORTFOLIO

29.14.5 RECENT DEVELOPMENTS

29.15 QBIOTICS GROUP

29.15.1 COMPANY OVERVIEW

29.15.2 REVENUE ANALYSIS

29.15.3 GEOGRAPHIC PRESENCE

29.15.4 PRODUCT PORTFOLIO

29.15.5 RECENT DEVELOPMENTS

29.16 NOVAVIVE INC.

29.16.1 COMPANY OVERVIEW

29.16.2 REVENUE ANALYSIS

29.16.3 GEOGRAPHIC PRESENCE

29.16.4 PRODUCT PORTFOLIO

29.16.5 RECENT DEVELOPMENTS

29.17 NIPPON ZENYAKU KOGYO CO., LTD.

29.17.1 COMPANY OVERVIEW

29.17.2 REVENUE ANALYSIS

29.17.3 GEOGRAPHIC PRESENCE

29.17.4 PRODUCT PORTFOLIO

29.17.5 RECENT DEVELOPMENTS

29.18 VETDC

29.18.1 COMPANY OVERVIEW

29.18.2 REVENUE ANALYSIS

29.18.3 GEOGRAPHIC PRESENCE

29.18.4 PRODUCT PORTFOLIO

29.18.5 RECENT DEVELOPMENTS

29.19 ANIVIVE

29.19.1 COMPANY OVERVIEW

29.19.2 REVENUE ANALYSIS

29.19.3 GEOGRAPHIC PRESENCE

29.19.4 PRODUCT PORTFOLIO

29.19.5 RECENT DEVELOPMENTS

29.2 VETOQUINOL

29.20.1 COMPANY OVERVIEW

29.20.2 REVENUE ANALYSIS

29.20.3 GEOGRAPHIC PRESENCE

29.20.4 PRODUCT PORTFOLIO

29.20.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

30 RELATED REPORTS

31 CONCLUSION

32 QUESTIONNAIRE

33 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.