Global Pet Bottle Market

Market Size in USD Million

CAGR :

%

USD

95,400.00 Million

USD

132,583.69 Million

2022

2030

USD

95,400.00 Million

USD

132,583.69 Million

2022

2030

| 2023 –2030 | |

| USD 95,400.00 Million | |

| USD 132,583.69 Million | |

|

|

|

|

Polyethylene Terephthalate (PET) Bottle Market Analysis and Size

PET is made when ethylene glycol and terephthalic acid are polymerized, and it is widely regarded as a material that is 100% recyclable, non-toxic, safe, lightweight, strong, and flexible. It is utilized in many different applications, including automotive, construction, consumer goods, sheets and films, food packaging, and beverage packaging. One of the key factors propelling the expansion of the global market is the rise in demand for PET containers, particularly from the food and beverage industry, and the increase in demand for frozen and processed foods.

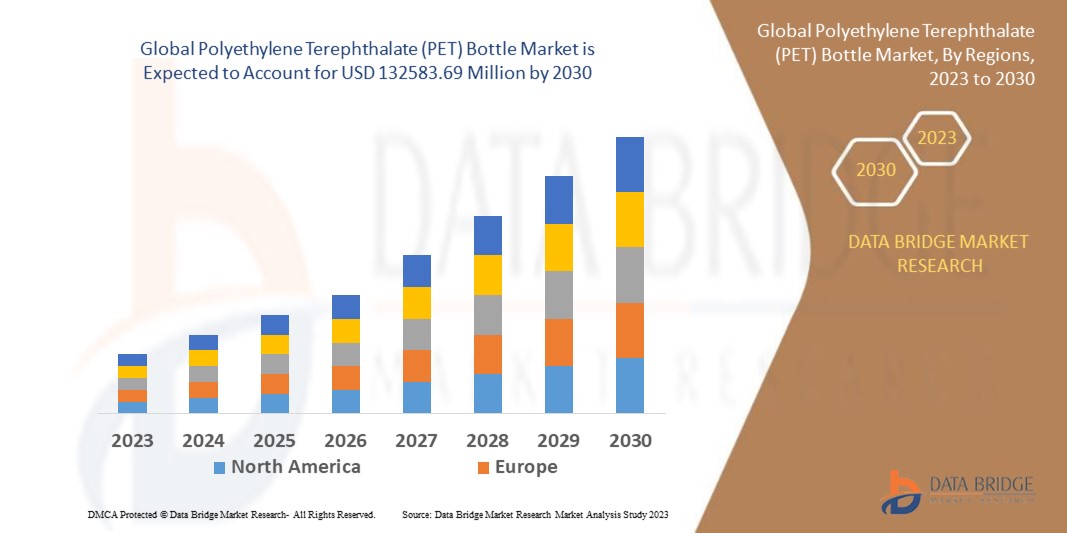

Data Bridge Market Research analyses that the polyethylene terephthalate (PET) bottle market, valued at USD 95,400 million in 2022, will reach USD 132583.69 million by 2030, growing at a CAGR of 4.20% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Polyethylene Terephthalate (PET) Bottle Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Virgin, Recycled), Capacity (High, Medium, Low), Distribution Channel (Business to Business, Retail), Color (Transparent, Colored), Technology (Stretch Blow Molding, Injection Molding, Extrusion Blow Molding, Thermoforming, Other), Product type(Carbonated food drink, Bottled water, Other drinks, Sheets and films Food Non-food), Volume (Up to 500 ml, 500 ml to 1000 ml, 1000 ml to 2000 m, More than 2000 ml), Neck Type (ROPP/BPV, PCO/BPF, ALASKA/BERICAP/OBRIST), Application (Food and beverages, Consumer Goods, Automotive, Textile, Photovoltaic Modules, Thermoplastic resin, Packaging, Film, Sheet and straps, Cosmetic Bottle, Household products, Electronics, Others), End- Users (foods and Beverages, Electrical and Electronics, Automotive industry, healthcare, consumer goods, construction, and other) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa |

|

Market Players Covered |

Amcor plc (Australia), DuPont (U.S.), Crown Paper Mill LLC (U.A.E.), Westrock Company. (U.S.), Berry Global Inc.(U.S.), ALPLA (Austria), Cospack America Corp (U.S.), BERICAP (Germany), Graham Packaging Company (U.S.), Ontario Plastic Container Producers Ltd. (Canada), Alpack Ltd (Mexico), PLASTIPAK HOLDINGS, INC (U.S.), RESILUX NV (Belgium), Silgan Plastics (U.S.), Retal Industries LTD. (Cyprus), Esterform Ltd (U.K.), GTX HANEX Plastic Sp. z o. o (Poland) |

|

Market Opportunities |

|

Market Definition

Polyethylene terephthalate, also known as PET, is a thermoplastic polymer resin that belongs to the polyester family and is frequently used to create plastic bottles. PET bottles outperform PP, HDPE, and PVC bottles in terms of durability, transparency, weight, non-reactivity, affordability, and thermal stability. They also reduce production costs because they are eco-friendly and have a high recycling rate. In addition to their primary use in packaging of drinking beverage and water, PET bottles are becoming more and more popular as a packaging choice for salad dressings, household cleaners, medications, dish detergents, and mouthwashes.

Global Polyethylene Terephthalate (PET) Bottle Market Dynamics

Drivers

- Demand for ready-to-drink beverages is driven by better packaging quality

The improvement in the quality of ready-to-drink beverages and flavored water may support the market growth for polyethylene terephthalate (PET) bottles. The market player is being forced to offer a new variety of water because of the shift in consumer preferences toward bottled water, including sparkling water, water with added minerals, water with flavors, and others. Additionally, because bottles are lightweight and can be thrown away if necessary, packaging trends are shifting in favor of them. Additionally, it is anticipated that increasing income levels and a rise in the consumption of attention-grabbing goods will support the growth of the polyethylene terephthalate (PET) bottle market.

- Features of PET create expansion in the market

The product is molded and extruded into plastic bottles and containers for packaging beverages, personal care, consumer, and other food items. Polyethylene's high strength, lightweight, and economical qualities also enable transporting more goods in contemporary packaging while consuming less fuel. PET is the best packaging material compared to substitutes like glass, paper, and aluminum. Consumer demand for the goods will rise as packaging in the e-commerce and healthcare industries expands and light-weighting technology advances.

Opportunities

- Technology advancements for producing PET bottles that are lightweight could accelerate market growth

The market is anticipated to grow faster through technological advancements in developing lightweight, high-strength PET bottles. For instance, pressure SAFE, an innovative PET aerosol container design, will allow home and personal care brands to offer more environmentally sustainable dispensing spray packaging in 2022. Sidel, one of the leading providers of equipment, service, and complete solutions for packaging liquids, home, food, and personal care products in PET can glass and other materials, will introduce pressure SAFE in 2022. The new PET product packaging option is accepted for recycling in the conventional PET stream.

- Growing Environmental friendly packaging solutions it can create a surge in the market to grow

The demand for sustainable packaging and environmentally friendly products, such as recyclable materials, has increased due to growing environmental impacts. Packaging manufacturers are concentrating on providing recyclable, environmentally friendly packaging. These manufacturers invest in technological advancements and research and development to offer affordable, environmentally friendly solutions without compromising the level of protection provided to the packaged goods. PepsiCo and Keurig Dr. Pepper have committed to using 25% less virgin plastic by 2025 and 25% more recycled material in all soft drink bottles. Businesses that make soft drinks are looking for equipment that is adaptable and simple to change so they can withstand changes in rPET quality.

Restraints/Challenges

- The presence of alternatives restricts market expansion

The availability of substitutes such as polypropylene, polyethylene, and polystyrene will constrain the market's ability to consume products. These alternatives are more affordable and process, such as polyethylene terephthalate. Furthermore, several strict government regulations regarding the use of plastics were also put into place. This is because the production of plastics generates a significant amount of pollution and has numerous adverse effects on the environment.

- The environmental consequences of packaging are stifling growth

The most widely used polymers in the packaging industry (PVC) are high-density polyethylene (HDPE), expanded polystyrene (EPS), polyethylene terephthalate (PET), and polyvinyl chloride. Many industries use rigid plastic packaging to preserve and store packaged goods such as industrial equipment, food, and medical supplies. The difficulty of recycling, reusing, and sorting plastic waste is the main problem these polymers pose. In landfills, bottled plastic packaging materials can decompose for up to 1,000 years, polluting the air, land, and water in the process. Furthermore, when exposed to direct sunlight, plastics lose their mechanical strength, whereas thermoplastics creep and soften at room temperature. As a result, rigid plastic packaging's detrimental environmental effects will restrain market expansion.

This polyethylene terephthalate (PET) bottle market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the polyethylene terephthalate (PET) bottle market contact data bridge market research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In 2022, Alpek recently finalized a deal to purchase OCTAL Holding SAOC (hereinafter "Octal"). The acquisition will strengthen Alpek's global position, and its value-added production options for Polyethylene Terephthalate (PET) sheets will increase.

- In 2022, Indorama Ventures proposed purchasing NN, a Vietnamese PET converter. Right now, the company is in process of acquiring NN shares. The planned acquisition is meant to help IVL solidify its position in the packaging market in high-growth regions of Asia-Pacific.

- In 2021, A subsidiary of Indorama Venture Public Company Limited, Indorama Synthetics Limited, has increased its capacity to produce polyethylene terephthalate. The company has invested about USD 82 million to upgrade the facility's equipment and increase capacity. To better serve customers across the county, the company will also include balanced equipment and various specialty yarns in this expansion.

- In 2020, Poland's Maurizio Peeuzzo Polowat, a facility for recycling polyethylene terephthalate, was purchased by Indorama Ventures Public Company Limited. Two strategically located assets in Leczyga and Bielsko-Biala make up the acquisition. These manufacturing facilities have a combined capacity of 23,000 tonnes of rPET FLAKES and 4000 tonnes of rPET pellets. With the help of this agreement, both businesses intend to increase their recycling capacity to 750000 tonnes by 2025.

Global Polyethylene Terephthalate (PET) Bottle Market Scope

The polyethylene terephthalate (pet) bottle market is segmented on the basis of type, capacity, distribution channel, color, technology, product type, volume, neck type, application, end- users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Virgin

- Blister Forming

- Food Packaging

- Automotive

- Others

- Recycled

- Fiber

- Sheet and Film

- Strapping

- Engineered Resin

- Food and Beverage bottles

- Non-Food Bottles

- Others

Capacity

- High

- Medium

- Low

Distribution Channel

- Business to Business

- Retail

- Supermarkets and hypermarkets

- Online

- Convenience store

- Other

Color

- Transparent

- Colored

Technology

- Stretch Blow Molding

- Injection Molding

- Extrusion Blow Molding

- Thermoforming

- Other

Product type

- Carbonated food drink

- Bottled water

- Other drinks

- Sheets and films

- Food

- Non food

Volume

- Up to 500 ml

- 500 ml to 1000 ml

- 1000 ml to 2000 m

- More than 2000 ml

Neck Type

- ROPP/BPV

- PCO/BPF

- ALASKA/BERICAP/OBRIST

Application

- Food and beverages

- Consumer Goods

- Automotive

- Textile

- Photovoltaic Modules

- Thermoplastic resin

- Packaging

- Rigid Packaging

- Flexible Packaging

- Film

- Sheet and straps

- Cosmetic Bottle

- House hold products

- Electronics

- Others

End- Users

- Food and Beverage

- Packaged Water

- Carbonated Soft Drinks

- Food Bottles and Jars

- Fruit Juice

- Beer

- Electrical and Electronics

- Automotive

- Healthcare

- Consumer Goods

- Construction

- Other

Polyethylene Terephthalate (PET) Bottle Regional Analysis/Insights

The polyethylene terephthalate (pet) bottle market is analysed and market size insights and trends are provided by country, type, capacity, distribution channel, color, technology, product type, volume, neck type, application, end- users as referenced above.

The countries covered in the polyethylene terephthalate (pet) bottle market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa

Asia-Pacific dominates the market and will continue to flourish its trend of dominance during the forecast period. The significant factors attributable to the region’s dominance are due to increasing urbanization and rising disposable income. Additionally, using engineering plastic products in the packaging sector (PET containers, bottles, and so on) has certain advantages over conventional packaging plastics. The demand from industries such as food and beverage, consumer goods, and others for packing materials is increasing in China, owing to the increasing exports and domestic consumption.

North America will undergo the highest growth rate during the forecast period due to the people's changing lifestyles. The growing demand for high-quality packaged products in the region will also enhance the market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Polyethylene Terephthalate (PET) Bottle Market Share Analysis

The polyethylene terephthalate (pet) bottle market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to polyethylene terephthalate (pet) bottle market.

Some of the major players operating in the polyethylene terephthalate (pet) bottle market are:

- Amcor plc (Australia)

- DuPont (U.S.)

- Crown Paper Mill LLC (U.A.E.)

- Westrock Company. (U.S.)

- Berry Global Inc.(U.S.)

- ALPLA (Austria)

- Cospack America Corp. (U.S.)

- BERICAP (Germany)

- Graham Packaging Company (U.S.)

- Ontario Plastic Container Producers Ltd. (Canada)

- Alpack Ltd (Ireland )

- PLASTIPAK HOLDINGS, INC. (U.S.)

- RESILUX NV (Belgium)

- Silgan Plastics (U.S.)

- Retal Industries LTD. (Cyprus)

- Esterform Ltd (U.K.)

- GTX HANEX Plastic Sp. z o. o ( Poland)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pet Bottle Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pet Bottle Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pet Bottle Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.