Market Analysis and Size

According to the Food and Agriculture Organization of the United Nations (FAO) nearly 25% of the world's food contains pesticide residues, which are toxic secondary metabolites of moulds. There are approximately 400 known species of pesticide residues of various chemical compound classes, with 25 being quite common due to their frequency of occurrence. With the world's population growing, the demand for food is increasing, necessitating a greater emphasis on pesticide residue testing.

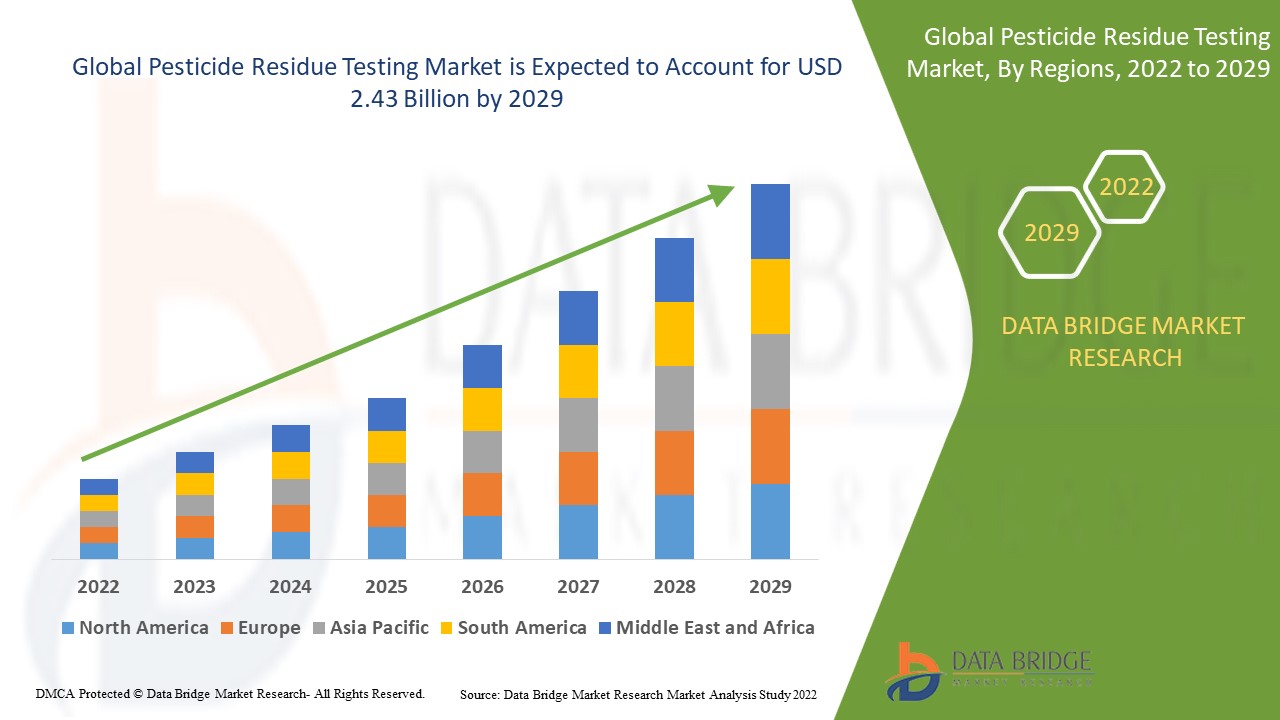

Data Bridge Market Research analyses that the pesticide residue testing market was valued at 1.34 billion in 2021 is expected to reach the value of USD 2.43 billion by 2029, at aw CAGR of 7.70% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and consumer behaviour.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Herbicides, Insecticides, Fungicides and Others), Technology (LC-MS/GC-MS, High Performance Liquid Chromatography (HPLC), Gas Chromatography and Others), Food Tested (Meat & Poultry, Dairy Products, Processes Food, Fruits & Vegetables, Cereals, Grains & Pulses, Others), Class (Organochlorines, Organophosphates, Organonitrogens & Carbamates, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Global (APAC) in the Global (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

SGS (Switzerland), Bureau Veritas (France), Eurofins (Luxembourg), Intertek (U.K.), Mérieux NutriSciences (U.S.), ALS Limited (Australia), Neogen (U.S.) AsureQuality (New Zealand), Charm Sciences (U.S.), Premier Analytical Services (U.K.), Dairyland Laboratories (U.S.), Bio-Check (U.K.), AES Laboratories (India), IEH Laboratories and Consulting Group (U.S.), Envirologix Inc. (U.S.), EMSL Analytical, Inc. (U.S.), and Krishgen Biosystems (U.S.) |

|

Opportunities |

|

Market Definition

Pesticide residue is subject to stringent legislation around the world in order to protect customers. Pesticide residue testing is an important tool for identifying and controlling pesticide residues in accordance with national and international regulations. Excessive pesticide use can result in dangerous levels of harmful chemicals entering the food chain. Fresh produce is the most vulnerable to pesticide residues and is consumed in more significant quantities.

Pesticide Residue Testing Market Dynamics

Drivers

- Rising risk of pesticide residue contamination

Pesticide residues testing market is expected to grow during the forecast period due to increased risk of pesticide residue contamination in livestock feed and rising incidences of pesticide residue occurrences in crops. With the global population growing, effective pesticide residue testing methods are required for sustainable food production. The global pesticide residue testing market is being driven by the implementation of stringent food safety regulations, advancements in testing technologies, and international trade of food materials.

Stringent regulations laid by government on implementation of testing

Throughout the world, various governments and regulatory bodies have made testing of animal feed and food ingredients mandatory. Animal feed is not approved for marketing unless its safety and efficacy have been proven. Such precautions to avoid contamination, chemicals, and toxic presence have significantly impacted the growth of the pesticide residue testing market. Many countries have enacted specific regulations for pesticide residues in food and animal feed to protect human and animal health.

Opportunity

Increasing food trade across the borders of emerging markets expands the market's opportunity for growth. The rising number of food-borne illnesses and poor sanitation and processing conditions in factories in a few countries necessitate the need for pesticide residue testing of food. The implementation of regulations in emerging economies that have entered the food trade and the authorization of authorities to prohibit the import and supply of contaminated food and enforce food recalls are expected to increase demand for testing services in these regions. Furthermore, increasing cases of mycotoxicosis outbreaks in Asia and Africa are expected to create significant growth opportunities for pesticide residue testing in these regions.

Restraints

Several developing regions' in pesticide residue testing markets lack organisation, sophistication, and technology. Food control laboratory infrastructure is likely to be scarce in many developing countries due to limited resources, limited technology, and poor management. There are numerous issues concerning food safety, such as a lack of institutional coordination, outdated technology, a lack of expertise for executing regulation at the lowest levels, and a lack of updated standards, all of which have hampered the testing market. Laboratories are under-equipped and lack appropriately by untrained analytical personnel.

This pesticide residue testing market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the pesticide residue testing market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Pesticide Residue Testing Market

COVID-19 has resulted in a significant shift in consumer demand, shifting away from restaurants, food service, and other types of "food away from home" and toward food consumed at home. This has resulted in numerous significant changes in the way food supply chains operate. As the COVID-19 pandemic spread, sales of "food away from home" (food consumed in hotels, restaurants, catering, and cafés) fell precipitously. COVID-19 has caused havoc in the food processing industry. Food companies in this industry have been impacted by social distancing rules, labour shortages due to movement restrictions, and lockdown measures to contain the virus's spread. Furthermore, regional governments' actions have limited the number of people working in small areas, which has hampered growth of the food industry.

Recent Development

- SGS announced the expansion of its new food microbiological testing lab in Fairfield, New Jersey, USA, in October 2019. The 2,000-square-foot microbiological testing facility employs an information technology platform to provide a wide range of testing services to food producers, manufacturers, and suppliers across all food categories.

- SGS announced the expansion of its new food microbiological testing lab in Carson, California, in March 2019. The microbiological testing facility is 2,400 square feet in size. This expansion aims to broaden the company's geographical coverage as well as its global network of agriculture and food labs.

Global Pesticide Residue Testing Market Scope

The pesticide residue testing market is segmented on the basis of type, technology, food tested and class. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Herbicides

- Insecticides

- Fungicides

- Others

Technology

- LC-MS/GC-MS

- High Performance Liquid Chromatography (HPLC)

- Gas Chromatography and Others

Food tested

- Meat & Poultry

- Dairy Products

- Processes Food

- Fruits & Vegetables

- Cereals

- Grains & Pulses

- Others

Class

- Organochlorines

- Organophosphates

- Organonitrogens

- Carbamates

- Others

Pesticide Residue Testing Market Regional Analysis/Insights

The pesticide residue testing market is analysed and market size insights and trends are provided by country, type, technology, food tested and class as referenced above.

The countries covered in the pesticide residue testing market report are U.S., Canada, Mexico, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa.

The United States dominates the North American market due to innovative industries and expanding research and development activities for providing product types such as devices, reagents & kits, and other services, as well as a promising growth rate from 2022 to 2029 due to the increasing use of reagents and kits, Germany is dominating the market and driving growth in Europe. China is expected to dominate the market in the Asia-Pacific region due to advances in technology and innovation in food testing as well as rising consumption in the region and the region's rising lifestyle.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Pesticide Residue Testing Market Share Analysis

The pesticide residue testing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to pesticide residue testing market.

Some of the major players operating in the pesticide residue testing market are:

- SGS (Switzerland)

- Bureau Veritas (France)

- Eurofins (Luxembourg)

- Intertek (U.K.)

- Mérieux NutriSciences (U.S.)

- ALS Limited (Australia)

- Neogen (U.S.)

- AsureQuality (New Zealand)

- Charm Sciences (U.S.)

- Premier Analytical Services (U.K.)

- Dairyland Laboratories (U.S.)

- Bio-Check (U.K.)

- AES Laboratories (India)

- IEH Laboratories and Consulting Group (U.S.)

- Envirologix Inc. (U.S.)

- EMSL Analytical, Inc. (U.S.)

- Krishgen Biosystems (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PROTECTIVE PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PROTECTIVE PACKAGING MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.10 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL PROTECTIVE PACKAGING MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 PORTER’S FIVE FORCES

5.2 VENDOR SELECTION CRITERIA

5.3 CONSUMERS BEHAVIOUR PATTERNS

5.4 FACTORS INFLUENCING BUYING DECISIONS

5.5 PRODUCT ADOPTION SCENARIO

5.6 PESTEL ANALYSIS

5.7 REGULATION COVERAGE

6. SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7. UPCOMING TESTING TECHNOLOGIES

8. GLOBAL PESTICIDE RESIDUE TESTING MARKET , BY TYPE, 2020-2029, (USD MILLION)

8.1 OVERVIEW

8.2 HERBICIDES

8.2.1 SULFONYLUREA HERBICIDES

8.2.2 PHENOXY ACIDIC HERBICIDES

8.2.3 GLYPHOSATE/GLUFOSINATE HERBICIDES

8.2.4 QUATERNARY AMMONIUM HERBICIDES

8.2.5 OTHERS

8.3 INSECTICIDES

8.3.1 SYNTHETIC INSECTICIDES

8.3.2 BIO-INSECTICIDES

8.4 FUNGICIDES

8.4.1 DITHIOCARBAMATE FUNGICIDES

8.4.2 QUINONE FUNGICIDES

8.4.3 OTHERS

8.5 DISINFECTANTS

8.5.1 ALCOHOLS

8.5.2 CHLORINE

8.5.3 QUATERNARY AMMONIUM

8.5.4 ALDEHYDES

8.5.5 OTHERS

8.6 NEMATICIDES

8.6.1 NON-FUMIGANTS

8.6.2 FUMIGANTS

8.7 BACTERICIDES

8.8 MOLLUSCICIDES

8.9 OTHERS

9. GLOBAL PESTICIDE RESIDUE TESTING MARKET , BY PRODUCT TYPE, 2020-2029, (USD MILLION)

9.1 OVERVIEW

9.2 DEVICES

9.3 REAGENTS & KITS

9.4 SERVICES

10. GLOBAL PESTICIDE RESIDUE TESTING MARKET, BY METHOD , 2020-2029, (USD MILLION)

10.1 OVERIVIEW

10.2 SINGLE RESIDUE METHOD

10.3 MULTIPLE RESIDUE METHOD

11. GLOBAL PESTICIDE RESIDUE TESTING MARKET, BY TECHNOLOGY , 2020-2029, (USD MILLION)

11.1 OVERVIEW

11.2 CHROMATOGRAPHY BASED

11.2.1 HPLC

11.2.2 GAS CHROMATOGRAPHY

11.2.3 MASS-SPECTROMETRY

11.2.4 LIQUID CHROMATOGRAPHY

11.2.5 COUPLED CHROMATOGRAPHY

11.2.6 TANDEM CHROMATOGRAPHY

11.2.7 LC-MS/MS

11.2.8 OTHERS

11.3 IMMUNOASSAY-BASED

11.3.1 RADIOIMMUNOASSAY (RIA)

11.3.2 COUNTING IMMUNOASSAY (CIA)

11.3.3 OTHERS

11.4 SPECTROSCOPY BASED

11.5 OTHERS

12. GLOBAL PESTICIDE RESIDUE TESTING MARKET , BY FOOD TYPE , 2020-2029, (USD MILLION)

12.1 OVERVIEW

12.2 CROPS

12.2.1 CORN

12.2.2 WHEAT

12.2.3 RYE

12.2.4 BARLEY

12.2.5 OTHERS

12.3 MEAT, POULTRY & SEA FOOD

12.3.1 MEAT

12.3.2 PORK

12.3.3 BEEH

12.3.4 FISH

12.3.5 OETHERS

12.4 FRUITS AND VEGETABLES

12.4.1 GRAPES

12.4.2 ORANGE

12.4.3 APPLE

12.4.4 COCOA

12.4.5 PINEAPPLE

12.4.6 PEAR

12.4.7 BERRIES

12.4.8 CABBAGE

12.4.9 CAULIFLOWER

12.4.10 LETTUCE

12.4.11 SPINACH

12.4.12 KALE

12.4.13 OTHERS

12.5 HERBS AND SPICES

12.5.1 ASAFOETIDA

12.5.2 BAY LEAF

12.5.3 BASIL

12.5.4 OTHERS

12.6 MILK & DAIRY PRODUCTS

12.6.1 CHEESE

12.6.2 MILK

12.6.3 OTHERS

12.7 BABY FOOD

12.8 GRAINS AND CEREAL PRODUCTS

12.8.1 SOY

12.8.2 WHEAT

12.8.3 CORN

12.8.4 BARLEY

12.8.5 OTHERS

12.9 TEA & COFFEE

12.10 FEED

12.10.1 ANIMAL FEED

12.10.2 POULTRY FEED

12.10.3 OTHERS

12.11 OTHERS

13. GLOBAL PESTICIDE RESIDUE TESTING MARKET , BY APPLICATION , 2020-2029, (USD MILLION)

13.1 OVERVIEW

13.2 RESEARCH LAB

13.3 RESEARCH INSTITUTES

13.4 FOOD TESTING INDUSTRIES

13.5 FEED TESTING INDUSTRIES

13.6 OTHERS

14. GLOBAL PESTICIDE RESIDUE TESTING MARKET , BY REGION

GLOBAL PESTICIDE RESIDUE TESTING MARKET , (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

14.2 EUROPE

14.2.1 GERMANY

14.2.2 FRANCE

14.2.3 U.K.

14.2.4 ITALY

14.2.5 SPAIN

14.2.6 RUSSIA

14.2.7 TURKEY

14.2.8 BELGIUM

14.2.9 NETHERLANDS

14.2.10 SWITZERLAND

14.2.11 REST OF EUROPE

14.3 ASIA-PACIFIC

14.3.1 JAPAN

14.3.2 CHINA

14.3.3 SOUTH KOREA

14.3.4 INDIA

14.3.5 AUSTRALIA

14.3.6 SINGAPORE

14.3.7 THAILAND

14.3.8 MALAYSIA

14.3.9 INDONESIA

14.3.10 PHILIPPINES

14.3.11 REST OF ASIA-PACIFIC

14.4 SOUTH AMERICA

14.4.1 BRAZIL

14.4.2 ARGENTINA

14.4.3 REST OF SOUTH AMERICA

14.5 MIDDLE EAST AND AFRICA

14.5.1 SOUTH AFRICA

14.5.2 SAUDI ARABIA

14.5.3 UAE

14.5.4 KUWAIT

14.5.5 REST OF MIDDLE EAST AND AFRICA

15. GLOBAL PESTICIDE RESIDUE TESTING MARKET , COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16. SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

17. GLOBAL PESTICIDE RESIDUE TESTING MARKET , COMPANY PROFILE

17.1 EUROFINS SCIENTIFIC

17.1.1 COMPANY OVERVIEW

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 BUREAU VERITAS S.A.

17.2.1 COMPANY OVERVIEW

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 SGS S.A.

17.3.1 COMPANY OVERVIEW

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 INTERTEK GROUP PLC

17.4.1 COMPANY OVERVIEW

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 QTS ANALYTICAL

17.5.1 COMPANY OVERVIEW

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 SILLIKER, INC.

17.6.1 COMPANY OVERVIEW

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 THERMO FISHER SCIENTIFIC INC.

17.7.1 COMPANY OVERVIEW

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 MERCK KGAA

17.8.1 COMPANY OVERVIEW

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 ALS LIMITED

17.9.1 COMPANY OVERVIEW

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.10 AGILENT TECHNOLOGIES, INC

17.10.1 COMPANY OVERVIEW

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 ASUREQUALITY LTD.

17.11.1 COMPANY OVERVIEW

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 SCS GLOBAL SERVICES

17.12.1 COMPANY OVERVIEW

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 MICROBAC LABORATORIES, INC

17.13.1 COMPANY OVERVIEW

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 SYMBIO LABORATORIES

17.14.1 COMPANY OVERVIEW

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 TÜV SÜD

17.15.1 COMPANY OVERVIEW

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 AGQ

17.16.1 COMPANY OVERVIEW

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 EMA INC

17.17.1 COMPANY OVERVIEW

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 WATERS

17.18.1 COMPANY OVERVIEW

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 R J HILL LABORATORIES LIMITED

17.19.1 COMPANY OVERVIEW

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.20 RING BIOTECHNOLOGY CO LTD, I

17.20.1 COMPANY OVERVIEW

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18. RELATED REPORTS

19. QUESTIONNAIRE

20. ABOUT DATA BRIDGE MARKET RESEARCH

Global Pesticide Residue Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pesticide Residue Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pesticide Residue Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.