Global Perfume Market

Market Size in USD Billion

CAGR :

%

USD

54.01 Billion

USD

74.49 Billion

2024

2032

USD

54.01 Billion

USD

74.49 Billion

2024

2032

| 2025 –2032 | |

| USD 54.01 Billion | |

| USD 74.49 Billion | |

|

|

|

|

What is the Global Perfume Market Size and Growth Rate?

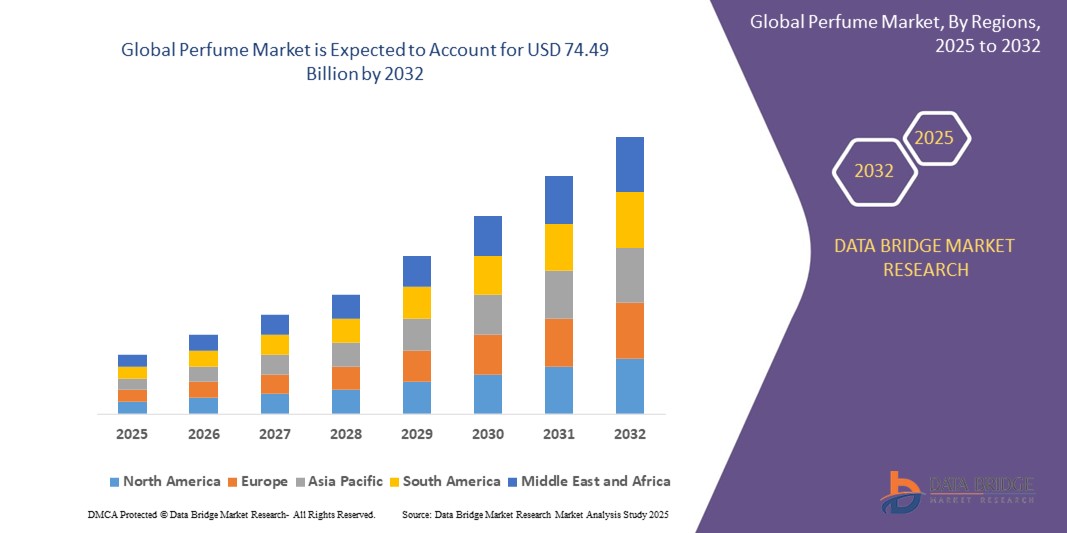

- The global perfume market size was valued at USD 54.01 billion in 2024 and is expected to reach USD 74.49 billion by 2032, at a CAGR of 4.10% during the forecast period

- The perfume market is rapidly advancing, driven by innovative technologies such as AI-driven scent design and sustainable extraction methods

- Latest trends include personalized fragrances and eco-friendly packaging. This growth is fueled by rising consumer demand for unique, high-quality scents and increased investment in research and development, ensuring continuous evolution and expansion of the market

What are the Major Takeaways of Perfume Market?

- Growing awareness of personal grooming has significantly boosted the demand for perfumes. As consumers increasingly prioritize personal hygiene and grooming standards, the perfume market experiences substantial growth

- For instance, a survey showed a 30% rise in fragrance purchases among young professionals who view scent as an essential part of their daily grooming routine, demonstrating how this heightened awareness directly drives market expansion

- Europe dominated the global perfume market in 2024, securing the largest revenue share of 35.9%, driven by the region's deep-rooted fragrance heritage, premium product demand, and strong presence of luxury perfume houses. European consumers prioritize high-quality, long-lasting fragrances, supported by a thriving personal care and luxury goods sector

- Asia-Pacific perfume market is projected to grow at the fastest CAGR of 24.1% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing Western influence on lifestyle and personal grooming habits

- The Eau de Perfume segment dominated the Perfume market with the largest revenue share of 39.2% in 2024, attributed to its optimal balance of fragrance concentration, long-lasting scent profile, and affordability, making it highly popular among both mass-market and premium consumers

Report Scope and Perfume Market Segmentation

|

Attributes |

Perfume Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Perfume Market?

“Growing Demand for Natural and Sustainable Fragrances”

- A significant trend shaping the global perfume market is the rising consumer preference for natural, organic, and sustainable ingredients, driven by increasing awareness of health, wellness, and environmental impact

- Consumers, particularly millennials and Gen Z, are seeking perfumes that are free from synthetic chemicals, phthalates, and animal-derived ingredients, fueling the demand for eco-friendly, vegan, and cruelty-free fragrance options

- Leading brands are introducing plant-based, biodegradable formulations and packaging innovations to meet sustainability goals. For instance, companies are adopting recyclable glass bottles, refillable perfume containers, and minimalistic packaging made from renewable materials

- The market is witnessing increased R&D in botanical extraction techniques, ethical sourcing of raw materials, and upcycled ingredients to create distinctive yet sustainable scent profiles

- Regulatory pressures and global initiatives to reduce environmental footprints are encouraging manufacturers to transition towards greener alternatives across both product and packaging levels

- This sustainability-focused trend is expected to redefine the future of the Perfume market, promoting innovation in both formulations and eco-conscious packaging

What are the Key Drivers of Perfume Market?

- Rising demand for premium, personalized, and natural fragrances is a major driver of the perfume market, supported by growing disposable incomes and evolving consumer lifestyles

- For instance, in April 2024, L’Oréal Group expanded its natural fragrance line under Yves Saint Laurent, emphasizing responsibly sourced ingredients and eco-friendly packaging to meet growing demand for sustainable luxury perfumes

- The booming personal grooming and beauty industry, along with increased social media influence and celebrity endorsements, is accelerating global perfume sales across mass and premium segments

- Innovations in fragrance delivery, such as long-lasting formulations, solid perfumes, and portable scent diffusers, are enhancing convenience and expanding product accessibility

- The expansion of e-commerce, travel retail, and duty-free channels, coupled with a rising preference for gender-neutral and niche perfumes, continues to propel market growth

- In addition, heightened focus on experiential marketing, fragrance layering, and customizable perfume options is driving consumer engagement and brand loyalty in the sector

Which Factor is challenging the Growth of the Perfume Market?

- The high cost of natural ingredients, coupled with supply chain volatility, poses a significant challenge to the perfume market, particularly for brands focusing on sustainable and organic product lines

- For instance, the global shortage of natural raw materials such as sandalwood, oud, and rose oil has driven up costs and limited supply, affecting production and pricing stability for premium perfumes

- In addition, strict regulatory requirements related to allergen disclosures, environmental impact, and product safety can complicate new product development and market entry, especially for emerging brands

- The availability of counterfeit perfumes and price-sensitive consumer segments, especially in developing regions, restricts the premium market's growth potential

- Overcoming these challenges will require investment in sustainable sourcing, transparent supply chains, and technological advancements in synthetic biology to create safe, eco-friendly alternatives that meet consumer expectations without compromising performance

How is the Perfume Market Segmented?

The market is segmented on the basis of type, product, ingredient, end-user, and distribution channel.

- By Type

On the basis of type, the perfume market is segmented into Extrait de Parfum, Eau de Perfume, Eau de Toilette, Eau de Cologne, and Eau Fraiche. The Eau de Perfume segment dominated the Perfume market with the largest revenue share of 39.2% in 2024, attributed to its optimal balance of fragrance concentration, long-lasting scent profile, and affordability, making it highly popular among both mass-market and premium consumers. Eau de Perfume offers noticeable longevity without being overpowering, driving widespread adoption across men’s and women’s product lines.

The Extrait de Parfum segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer preference for luxury, high-concentration fragrances that offer superior longevity and exclusivity. The growing demand for niche and artisanal perfumes is also boosting this segment's expansion.

- By Product

On the basis of product, the perfume market is segmented into Mass and Premium. The Mass segment accounted for the largest market revenue share of 58.7% in 2024, driven by widespread affordability, accessibility through retail and online platforms, and continuous product launches catering to budget-conscious consumers. Mass-market perfumes are favored for daily use and offer diverse scent options at competitive prices.

The Premium segment is anticipated to register the fastest CAGR from 2025 to 2032, fueled by rising disposable incomes, increasing demand for high-end, designer, and niche fragrances, and the growing trend of personalized and exclusive perfume experiences.

- By Ingredient

On the basis of ingredient, the perfume market is segmented into Natural and Synthetic. The Synthetic segment dominated the Perfume market with the largest revenue share of 65.4% in 2024, owing to its cost-effectiveness, consistent scent quality, and the ability to create complex, unique fragrance profiles not achievable with natural ingredients. Synthetic ingredients also offer better scalability and supply chain reliability.

The Natural segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer preference for clean-label, sustainable, and eco-friendly products, alongside growing awareness of health, wellness, and environmental concerns.

- By End-User

On the basis of end-user, the perfume market is segmented into Men and Women. The Women segment held the largest market revenue share of 55.9% in 2024, attributed to higher consumption rates, diverse fragrance offerings tailored to women, and the continuous launch of innovative scents and designer collaborations targeting the female demographic.

The Men segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing awareness of personal grooming, expanding men’s skincare and fragrance categories, and evolving social norms promoting men’s self-care routines.

- By Distribution Channel

On the basis of distribution channel, the perfume market is segmented into Offline and Online. The Offline segment dominated the market with the largest revenue share of 63.1% in 2024, driven by consumer preference for in-store fragrance trials, premium boutique experiences, and the established presence of department stores and specialty retailers.

The Online segment is projected to witness the fastest growth from 2025 to 2032, owing to the rapid growth of e-commerce, virtual try-on technologies, direct-to-consumer brand strategies, and increased convenience of doorstep delivery for fragrance products.

Which Region Holds the Largest Share of the Perfume Market?

- Europe dominated the global perfume market in 2024, securing the largest revenue share of 35.9%, driven by the region's deep-rooted fragrance heritage, premium product demand, and strong presence of luxury perfume houses. European consumers prioritize high-quality, long-lasting fragrances, supported by a thriving personal care and luxury goods sector

- Countries such as France, Italy, and Germany are at the forefront, owing to their global reputation for fine fragrances, product innovation, and established distribution networks across retail and specialty stores

- In addition, growing demand for sustainable, natural, and cruelty-free perfumes, coupled with rising disposable incomes and evolving consumer preferences for niche, artisanal scents, is fueling market expansion across Europe

France Perfume Market Insight

The France perfume market captured the largest revenue share within Europe in 2024, cementing its status as the global fragrance capital. Home to iconic perfume brands, advanced R&D, and a rich heritage in perfumery, France continues to dominate both premium and mass segments. Rising consumer interest in clean-label, organic, and sustainable fragrances, alongside increasing global exports, reinforces France's leadership in the market.

Germany Perfume Market Insight

The Germany perfume market is expected to grow steadily, supported by high consumer purchasing power, strong demand for premium and sustainable products, and a well-established retail infrastructure. Germany's emphasis on innovative product formulations, eco-conscious packaging, and expanding e-commerce channels is driving perfume consumption across both men's and women's categories

U.K. Perfume Market Insight

The U.K. perfume market is poised for significant growth, fueled by rising consumer preference for luxury fragrances, growing demand for personalized scents, and the increasing popularity of niche and independent perfume brands. In addition, the shift toward sustainable, vegan, and cruelty-free perfumes aligns with evolving consumer values, supporting the market's expansion.

Which Region is the Fastest Growing Region in the Perfume Market?

Asia-Pacific perfume market is projected to grow at the fastest CAGR of 24.1% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing Western influence on lifestyle and personal grooming habits. Increasing awareness of premium fragrances, the popularity of international brands, and the rise of e-commerce platforms are fueling market growth across key countries such as China, India, and Japan.

China Perfume Market Insight

China led the Asia-Pacific perfume market in 2024, supported by the country’s booming middle class, expanding beauty and personal care sector, and growing appetite for luxury products. International and domestic brands are capitalizing on consumer demand for high-end, long-lasting, and personalized fragrances. China's focus on premium retail experiences and innovative digital marketing further accelerates market expansion.

Japan Perfume Market Insight

The Japan perfume market is witnessing steady growth, driven by the country's strong beauty and grooming culture, emphasis on premium, minimalist products, and rising preference for subtle, sophisticated scents. Japanese consumers favor high-quality, aesthetically pleasing packaging, and there is growing demand for unisex and natural ingredient-based perfumes.

Which are the Top Companies in Perfume Market?

The perfume industry is primarily led by well-established companies, including:

- Natura&Co (Brazil)

- Coty Inc. (U.S.)

- CHANEL (France)

- LVMH (France)

- L’Oréal S.A. (France)

- Beiersdorf AG (Germany)

- Dior (France)

- Estée Lauder Inc. (U.S.)

- Giorgio Armani S.p.A (Italy)

- Elizabeth Arden, Inc. (U.S.)

- Lacoste (France)

- Puig (Spain)

- Unilever (U.K.)

- Procter & Gamble (U.S.)

- Raymond Limited (India)

- DOLCE&GABBANA s.r.l (Italy)

- REVLON (U.S.)

- Burberry Group Plc (U.K.)

- Tommy Hilfiger licensing, LLC (U.S.)

What are the Recent Developments in Global Perfume Market?

- In September 2022, Givaudan launched a pioneering collaboration with LanzaTech, focusing on developing sustainable fragrance ingredients sourced from renewable carbon. This partnership represents a significant step towards eco-friendly practices in the fragrance industry, aligning with growing consumer demand for environmentally responsible products

- In September 2021, Coty Inc. partnered with Perfect Corp., integrating advanced AI and AR technologies into its cosmetics brands' digital marketing toolkits. This innovative collaboration enhances the consumer experience, offering interactive and personalized engagement, and reflects Coty's commitment to leveraging cutting-edge solutions to drive brand success in the digital realm

- In January 2020, Ajmal & Sons, a prestigious perfume company based in the U.A.E., launched its exclusive perfume line, "Prestige," in collaboration with Shoppers Stop in India. This partnership celebrates the fusion of luxury and craftsmanship, introducing the globally acclaimed Aristocrat Eau De Parfum for Him & Her, marking a remarkable addition to the fragrance business landscape

- In October 2020, Marc Jacobs International, in conjunction with Coty Inc.'s Fragrances division, launched its latest women's fragrance, Perfect Marc Jacobs. This launch epitomizes Marc Jacobs' innovative spirit and commitment to timeless elegance, offering a captivating scent that captures the essence of modern femininity and reinforces the brand's iconic status in the realm of perfumery

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PERFUME MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PERFUME MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL PERFUME MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BUYING BEHAVIOUR

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 PORTER’S FIVE FORCES

5.5 REGULATION COVERAGE

5.6 RAW MATERIAL SOURCING ANALYSIS

5.7 IMPORT EXPORT SCENARIO

6 PRODUCTION CAPACITY OUTLOOK

7 PRICE INDEX

8 BRAND OUTLOOK

8.1 BRAND COMPARATIVE ANALYSIS

8.2 PRODUCT VS BRAND OVERVIEW

9 IMPACT OF ECONOMIC SLOWDOWN

9.1 IMPACT ON PRICES

9.2 IMPACT ON SUPPLY CHAIN

9.3 IMPACT ON SHIPMENT

9.4 IMPACT ON DEMAND

9.5 IMPACT ON STRATEGIC DECISIONS

10 SUPPLY CHAIN ANALYSIS

10.1 OVERVIEW

10.2 LOGISTIC COST SCENARIO

10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

11 ANALYSIS OF PERFUME MANUFACTURING UNIT

12 GLOBAL PERFUME MARKET, BY TYPE, 2022-2031 (USD MILLION) (MILLION UNITS)

(VALUE, VOLUME AND ASP FOR EACH SEGMENT WILL BE PROVIDED)

12.1 OVERVIEW

12.2 EXTRAIT DE PARFUM

12.3 EAU DE PERFUME

12.4 EAU DE TOILETTE

12.5 EAU DE COLOGNE

12.6 EAU FRAICHE

13 GLOBAL PERFUME MARKET, BY PRODUCT, 2022-2031 (USD MILLION) (MILLION UNITS)

13.1 OVERVIEW

13.2 MASS

13.3 PREMIUM

14 GLOBAL PERFUME MARKET, BY INGREDIENT, 2022-2031 (USD MILLION) (MILLION UNITS)

14.1 OVERVIEW

14.2 NATURAL

14.3 SYNTHETIC

15 GLOBAL PERFUME MARKET, BY END-USER, 2022-2031 (USD MILLION) (MILLION UNITS)

(VALUE, VOLUME FOR EACH SEGMENT WILL BE PROVIDED)

15.1 OVERVIEW

15.2 MEN

15.3 WOMEN

16 GLOBAL PERFUME MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION) (MILLION UNITS)

(VALUE, VOLUME FOR EACH SEGMENT WILL BE PROVIDED)

16.1 OVERVIEW

16.2 OFFLINE

16.2.1 SUPERMARKET

16.2.2 HYPERMARKET

16.2.3 SPECIALTY STORES

16.2.4 CONVENIENCE STORES

16.2.5 BRANDS STORES

16.2.6 OTHERS

16.3 ONLINE

16.3.1 E-COMMERCE WEBSITE

16.3.2 COMPANY OWNED WEBSITE

17 GLOBAL PERFUME MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION) (MILLION UNITS)

17.1 GLOBAL PERFUME MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.2 NORTH AMERICA

17.2.1 U.S.

17.2.2 CANADA

17.2.3 MEXICO

17.3 EUROPE

17.3.1 GERMANY

17.3.2 U.K.

17.3.3 ITALY

17.3.4 FRANCE

17.3.5 SPAIN

17.3.6 RUSSIA

17.3.7 SWITZERLAND

17.3.8 TURKEY

17.3.9 BELGIUM

17.3.10 NETHERLANDS

17.3.11 REST OF EUROPE

17.4 ASIA-PACIFIC

17.4.1 JAPAN

17.4.2 CHINA

17.4.3 SOUTH KOREA

17.4.4 INDIA

17.4.5 SINGAPORE

17.4.6 THAILAND

17.4.7 INDONESIA

17.4.8 MALAYSIA

17.4.9 PHILIPPINES

17.4.10 AUSTRALIA & NEW ZEALAND

17.4.11 REST OF ASIA-PACIFIC

17.5 SOUTH AMERICA

17.5.1 BRAZIL

17.5.2 ARGENTINA

17.5.3 REST OF SOUTH AMERICA

17.6 MIDDLE EAST AND AFRICA

17.6.1 SOUTH AFRICA

17.6.2 EGYPT

17.6.3 SAUDI ARABIA

17.6.4 UNITED ARAB EMIRATES

17.6.5 ISRAEL

17.6.6 REST OF MIDDLE EAST AND AFRICA

18 GLOBAL PERFUME MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 MERGERS AND ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

18.7 EXPANSIONS

18.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

20 GLOBAL PERFUME MARKET - COMPANY PROFILES

20.1 ESTEE LAUDER COMPANIES INC.

20.1.1 COMPANY SNAPSHOT

20.1.2 PRODUCT PORTFOLIO

20.1.3 REVENUE ANALYSIS

20.1.4 RECENT UPDATES

20.2 LVMH MOET HENNESSY LOUIS VUITTON

20.2.1 COMPANY SNAPSHOT

20.2.2 PRODUCT PORTFOLIO

20.2.3 REVENUE ANALYSIS

20.2.4 RECENT UPDATES

20.3 COTY INC.

20.3.1 COMPANY SNAPSHOT

20.3.2 PRODUCT PORTFOLIO

20.3.3 REVENUE ANALYSIS

20.3.4 RECENT UPDATES

20.4 L’ORÉAL S.A.

20.4.1 COMPANY SNAPSHOT

20.4.2 PRODUCT PORTFOLIO

20.4.3 REVENUE ANALYSIS

20.4.4 RECENT UPDATES

20.5 ELIZABETH ARDEN INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 PRODUCT PORTFOLIO

20.5.3 REVENUE ANALYSIS

20.5.4 RECENT UPDATES

20.6 SHISEIDO CO. LTD.

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 REVENUE ANALYSIS

20.6.4 RECENT UPDATES

20.7 PUIG SL.

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 REVENUE ANALYSIS

20.7.4 RECENT UPDATES

20.8 PERFUMANIA HOLDINGS INC.

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 REVENUE ANALYSIS

20.8.4 RECENT UPDATES

20.9 AVON PRODUCTS INC.

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 REVENUE ANALYSIS

20.9.4 RECENT UPDATES

20.1 HERMES INTERNATIONAL S.A.

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 REVENUE ANALYSIS

20.10.4 RECENT UPDATES

20.11 NATURA COSMETICS S.A.

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 REVENUE ANALYSIS

20.11.4 RECENT UPDATES

20.12 CHANNEL S.A.

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 REVENUE ANALYSIS

20.12.4 RECENT UPDATES

20.13 CLARINS COSMETICS COMPANY

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 REVENUE ANALYSIS

20.13.4 RECENT UPDATES

20.14 REVLON INC.

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 REVENUE ANALYSIS

20.14.4 RECENT UPDATES

20.15 GIVAUDAN

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 REVENUE ANALYSIS

20.15.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 RELATED REPORTS

22 QUESTIONNAIRE

23 CONCLUSION

24 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.