Global Pea Starch Market

Market Size in USD Million

CAGR :

%

USD

307.93 Million

USD

509.63 Million

2024

2032

USD

307.93 Million

USD

509.63 Million

2024

2032

| 2025 –2032 | |

| USD 307.93 Million | |

| USD 509.63 Million | |

|

|

|

|

Pea Starch Market Size

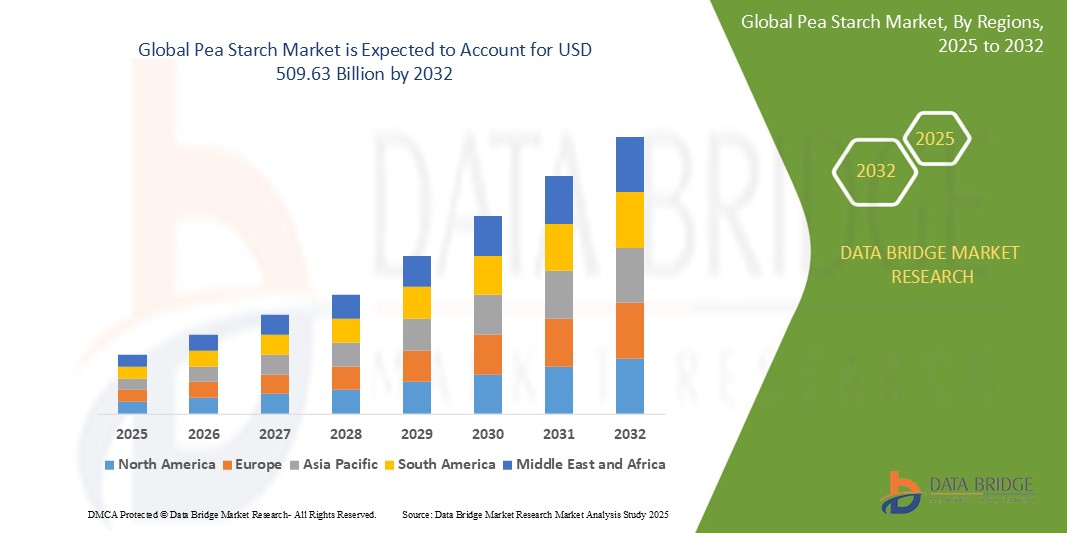

- The global pea starch market size was valued at USD 307.93 million in 2024 and is expected to reach USD 509.63 million by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the rising demand for clean-label and plant-based ingredients across food, beverage, and industrial applications

- Consumers are increasingly preferring natural, allergen-free alternatives such as pea starch for their functional properties such as thickening, binding, and gelling in processed foods, especially in gluten-free and vegan formulations

- Pea starch is gaining traction in non-food sectors such as pharmaceuticals and biodegradable packaging due to its sustainable sourcing, chemical-free processing, and compatibility with eco-friendly product development strategies

Pea Starch Market Analysis

- The pea starch market is steadily expanding as manufacturers increasingly adopt it as a clean-label ingredient in response to rising consumer demand for natural food components

- Its excellent functional properties such as thickening and gelling make it a preferred choice across processed food categories including bakery, dairy, and ready meals

- North America dominates the pea starch market with the largest revenue share of 48.13% in 2024, driven by driven by a surge in demand for clean-label, plant-based food products. This trend is supported by health-conscious consumers and a strong processed food industry

- Asia-pacific is expected to be the fastest growing region in the pea starch market during the forecast period driven by increasing urbanization, rising disposable incomes, and evolving dietary patterns. Rapid industrialization.

- The chemical modification segment held the largest market share in 2024, accounting for approximately 87.65% of the market. This dominance is driven by the enhanced functional properties it provides, such as improved stability, texture, and performance across diverse applications in food products, pharmaceuticals, and industrial uses

Report Scope and Pea Starch Market Segmentation

|

Attributes |

Pea Starch Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pea Starch Market Trends

“Clean-Label Innovations Driving Pea Starch Demand”

- The pea starch market is rapidly embracing clean-label trends as brands replace synthetic additives with natural starch alternatives to meet consumer expectations

- Food manufacturers are using pea starch in bakery and dairy products to simplify ingredient lists and appeal to label-conscious shoppers

- The demand for clean-label pea starch is also growing in pet food and nutraceuticals where transparency and ingredient origin play a key role

- Companies are focusing on native pea starch with minimal processing to align with the clean-label movement and maintain functional properties

- For instance, Roquette introduced a clean-label pea starch that supports plant-based and allergen-free claims without compromising texture or stability

- This strong focus on clean-label innovation continues to redefine product development strategies and drive momentum in the current pea starch market

Pea Starch Market Dynamics

Driver

“Growing Health Awareness and Diagnosis of Gluten-Related Disorders”

- Increasing diagnosis of gluten-related disorders such as celiac disease and gluten sensitivity has raised global awareness, leading more people to seek gluten-free products; for instance, the National Institute of Diabetes and Digestive and Kidney Diseases reported a steady rise in celiac diagnoses over the past decade

- Health-conscious consumers without medical conditions are adopting gluten-free diets as lifestyle choices to improve digestion and overall wellness, expanding the market beyond those with gluten intolerance

- Influencers, nutritionists, and health organizations actively promote the benefits of gluten-free diets through social media and campaigns, helping educate a wider audience about gluten-related health issues

- Food manufacturers are responding by investing in research and development to create diverse gluten-free options with improved taste, texture, and nutritional value, such as General Mills launching new gluten-free baking mixes in 2023

- Rising consumer demand and medical diagnoses are encouraging major retailers to expand gluten-free product lines, increasing availability and accessibility in mainstream supermarkets

Restraint/Challenge

“Higher Production Costs and Raw Material Availability”

- The higher cost of gluten-free raw materials such as rice, almond, sorghum, and tapioca flours significantly raises production expenses, resulting in pricier end products that many consumers find less affordable

- Strict quality control measures to prevent gluten cross-contamination require dedicated facilities or separate production lines, increasing operational complexity and costs especially for smaller manufacturers

- Sourcing consistent and high-quality gluten-free ingredients is challenging due to limited geographic cultivation and supply chain fluctuations, leading to price volatility and occasional shortages

- These supply and cost issues can disrupt manufacturing timelines, reduce product availability, and lower consumer confidence in gluten-free brands

- The premium pricing of gluten-free products confines their appeal mainly to niche markets with higher disposable income, limiting mass adoption among price-sensitive buyers

Pea Starch Market Scope

The global pea starch market is segmented on the basis of modification methods, source, product, form, grade, function, and application.

- By Modification Methods

On the basis of modification methods, the pea starch market is segmented into chemical modification and physical modification. The chemical modification segment held the largest market share in 2024, accounting for approximately 87.65% of the market. This dominance is driven by the enhanced functional properties it provides, such as improved stability, texture, and performance across diverse applications in food products, pharmaceuticals, and industrial uses. Chemical modifications allow for a broader range of functionalities, making it suitable for a wide array of specialized applications.

The physical modification segment is anticipated to witness the fastest share from 2025 to 2030. This growth is owing to the increasing consumer preference for natural and clean-label ingredients. Physical modifications, including heat treatment and mechanical processing, retain the natural qualities of pea starch while enhancing its functional attributes, aligning with the growing demand for healthier and minimally processed options in various industries.

- By Source

On the basis of source, the pea starch market is segmented into inorganic/GMO and organic/Non-GMO. The organic/non-gmo segment is currently dominating the market, primarily due to the increasing consumer preference for natural, chemical-free, and sustainably sourced products. This trend is driven by a growing awareness of health and environmental issues.

The inorganic/gmo segment is anticipated to witness significant growth, fueled by advancements in technology and the development of efficient compounds that offer superior performance and cost-effectiveness in various industrial applications.

- By Product

On the basis of product, the pea starch market is segmented into native pea starch and modified pea starch. The native pea starch segment held the largest market share in 2024, primarily due to its unaltered qualities, which appeal to consumers seeking clean-label foods with less processing. Its versatility as a thickening, gelling, and binding agent in food, beverages, and industrial applications contributes to its widespread use.

The modified pea starch segment is expected to witness significant growth, driven by its enhanced functionalities and tailored properties for specific applications, offering improved texture, stability, and versatility in complex formulations for various industries.

- By Form

On the basis of form, the pea starch market is segmented into powder and liquid. The powder segment held the largest market share in 2024, attributed to its versatility, ease of handling, storage, and wide range of applications across various industries, particularly in food and beverage formulations.

The liquid segment is anticipated to witness the fastest share during the forecast period. This growth can be attributed to its increasing applications in specific industrial sectors, such as textiles, adhesives, and paper manufacturing, where a viscous and adhesive solution is required.

- By Grade

On the basis of grade, the pea starch market is segmented into food, feed, and industrial. The food-grade segment held the largest market share in 2024, driven by its suitability for human consumption and its stability during food processing. The increasing focus on clean-label, plant-based, and gluten-free food products further propels its demand.

The feed-grade and industrial-grade segments are also experiencing substantial growth due to the expanding use of pea starch in animal nutrition and various industrial applications such as bioplastics, textiles, and paper, driven by its natural and sustainable properties.

- By Function

On the basis of function, the pea starch market is segmented into binding and thickening, gel forming, texturizing, film forming, coating swelling and solubility, enzymatic and acidic hydrolysis, and others. The binding and thickening segment held the largest market share in 2024, accounting for approximately 65.8% of the market. This dominance is due to pea starch's natural ability to improve texture, stability, and viscosity across a variety of food and industrial products, including plant-based meats, dairy alternatives, and sauces.

The gelling segment is expected to witness the fastest from 2025 to 2030. This growth is fueled by the increasing demand for innovative food products with unique textures and sensory experiences, particularly in the confectionery and dairy industries, where pea starch offers excellent gelling properties.

- By Application

On the basis of application, the pea starch market is segmented into food and beverages, pharmaceutical and nutraceuticals, industrial, feed, personal care and cosmetics, and others. The food and beverages segment held the largest market share in 2024, accounting for over 68.6% of the market. This is primarily due to the growing demand for clean-label, gluten-free, and plant-based ingredients in a wide range of products, including bakery items, snacks, soups, and sauces.

The pharmaceutical and nutraceuticals segment is anticipated to witness the fastest share by the next decade. This growth is propelled by the increasing use of pea starch as an excipient, binder, and disintegrant in various pharmaceutical formulations, driven by its natural origin and functional properties, as well as the rising demand for plant-based solutions in the health sector.

Pea Starch Market Regional Analysis

- North America dominates the pea starch market with the largest revenue share of 48.13% in 2024, driven by driven by a surge in demand for clean-label, plant-based food products. This trend is supported by health-conscious consumers and a strong processed food industry.

- Consumers in the region are increasingly shifting toward non-gmo, gluten-free, and allergen-free food alternatives, where pea starch serves as a preferred thickener and stabilizer

- Growth in convenience and ready-to-eat food products has boosted the usage of functional starches such as pea starch for texture enhancement and shelf-life extension. Favorable government policies promoting plant-based diets and sustainable agriculture are encouraging food manufacturers to adopt pea-based ingredients

U.S. Pea Starch Market Insight

The U.S. Pea starch market captured the largest revenue share within north America in 2025, fueled by the swift uptake of clean-label and non-gmo ingredients. Consumers are increasingly prioritizing nutritional value and ingredient transparency in food products. The growing trend of plant-based diets, coupled with advancements in food formulation technologies, is accelerating demand for functional pea starch. Moreover, the U.S. Market benefits from strong domestic agricultural production and innovation in pulse-based product development.

Europe Pea Starch Market Insight

The European pea starch market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by clean-label trends and the rising demand for plant-based alternatives. Stringent food safety regulations and sustainability goals are encouraging manufacturers to adopt eco-friendly, plant-derived ingredients. The surge in flexitarian diets and awareness around health and wellness are boosting consumption in food applications. Countries such as France, Germany, and the Netherlands are leading the way in integrating pea starch into both traditional and modern food formulations.

U.K. Pea Starch Market Insight

The U.K. Pea starch market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened consumer interest in sustainable and plant-based ingredients. The market is benefitting from increasing health awareness and demand for natural thickeners in packaged and processed foods. The country’s well-developed retail and e-commerce sectors are making clean-label and vegan products more accessible to the masses. Additionally, local manufacturers are focusing on product innovation and clean ingredient sourcing to align with evolving consumer preferences.

Germany Pea Starch Market Insight

The German pea starch market is expected to expand at a considerable CAGR during the forecast period, fueled by the nation’s focus on sustainable food systems and plant-based innovation. Germany's emphasis on food transparency and ecological responsibility is leading to higher adoption of plant-derived starches. The presence of a strong food processing industry, along with consumer preference for organic and non-gmo products, supports the market’s upward trajectory. Pea starch is increasingly being used in vegan dairy alternatives and meat substitutes.

Asia-Pacific Pea Starch Market Insight

the Asia-pacific pea starch market is poised to grow at the fastest CAGR in 2025, driven by increasing urbanization, rising disposable incomes, and evolving dietary patterns. rapid industrialization in countries such as China, India, and Japan is boosting the demand for cost-effective, plant-based ingredients. government initiatives supporting agricultural sustainability and food innovation are creating a favorable environment for pea starch expansion. additionally, the region’s emergence as a major exporter and processor of pulses enhances its market competitiveness on a global scale.

Japan Pea Starch Market Insight

The Japan pea starch market is gaining momentum due to a growing emphasis on health, nutrition, and environmentally conscious food consumption. Japanese consumers are highly receptive to clean-label and functional ingredients, which positions pea starch as a preferred choice in various food applications. With a strong focus on technological innovation and product miniaturization, Japan is witnessing increased use of pea starch in both traditional dishes and modern plant-based alternatives. Moreover, the aging population is driving demand for easy-to-digest, nutrient-dense food ingredients.

China Pea Starch Market Insight

The China pea starch market accounted for the largest market revenue share in Asia pacific in 2025, attributed to rapid industrial growth and expanding middle-class consumer base. The country’s large-scale food manufacturing and export capacity create a high demand for cost-effective, functional ingredients such as pea starch. Rising awareness of health and clean-label trends is encouraging food producers to shift toward non-gmo, plant-derived alternatives. Furthermore, China's investment in sustainable agriculture and strong domestic supply chains are key enablers of market growth.

Pea Starch Market Share

The pea starch industry is primarily led by well-established companies, including:

- Roquette Frères (France)

- AGT Food and Ingredients (Canada)

- Puris (U.S.)

- Meelunie B.V. (Netherlands)

- The Scoular Company (U.S.)

- Shandong Jianyuan group (China)

- American Key Food Products (U.S.)

- Dakota Ingredients (U.S.)

- Royal Ingredients Group B.V. (Netherlands)

- Agridient.nl (Netherlands)

- Euroduna Food Ingredients GmbH (Germany)

- NISCO ApS (U.K.)

- COSUCRA (Belgium)

- EMFOOD TRADING BV (Netherlands)

- Yantai Shuangta Food co., LTD (China)

- Healy Group (U.K.)

- AM Nutrition (U.S.)

- Vestkorn (Norway)

- Nutri-Pea. (Canada)

- ORGANICWAY FOOD INGREDIENTS INC. (U.S.)

Latest Developments in Global Pea Starch Market

- In October 2022, Roquette Freres launched a new range of organic pea ingredients, including pea starch and organic pea protein, across North America, Mexico, and Europe. This launch underscores the company's commitment to providing plant-based solutions to meet diverse consumer demands for organic and sustainable ingredients

- In May 2021, Gillco Ingredients and Cosucra Inc. formed a distribution partnership, enabling Gillco to distribute specialty ingredients such as Nastar native pea starch to end customers across various consumer sectors in the U.S. This collaboration enhances accessibility to innovative pea-based solutions in the U.S. market

- In August 2020, COSUCRA launched a line of pea-based ingredients in North America, featuring Nastar native pea starch. With applications in plant-based meat, dairy alternatives, baked goods, and snacks, it offers gelling properties and resistance to shearing, acid, and heat. Available in neutral-tasting powder and pregelatinized formats, this expansion boosts COSUCRA's global presence in the pea starch market

- In March 2020, Roquette Frères expanded its footprint by inaugurating new Research & Development Laboratory facilities in Panevezys, Lithuania. This strategic move bolsters the company's presence in Northern Europe, empowering it to address industrial, nutritional, and health challenges with enhanced research capabilities and localized support

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pea Starch Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pea Starch Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pea Starch Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.