Global Payment Wallet Market

Market Size in USD Billion

CAGR :

%

USD

117.03 Billion

USD

405.37 Billion

2024

2032

USD

117.03 Billion

USD

405.37 Billion

2024

2032

| 2025 –2032 | |

| USD 117.03 Billion | |

| USD 405.37 Billion | |

|

|

|

|

Payment Wallet Market Size

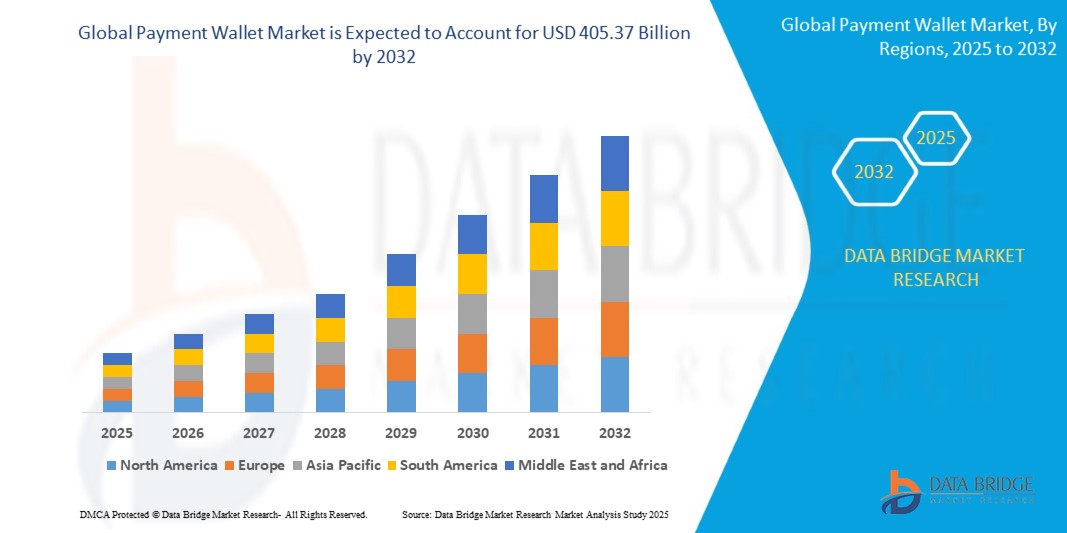

- The global payment wallet market size was valued at USD 117.03 billion in 2024 and is expected to reach USD 405.37 billion by 2032, at a CAGR of 16.8% during the forecast period

- The market growth is largely fueled by the increasing penetration of smartphones, widespread internet access, and the rapid shift toward digital financial services, enabling consumers and businesses to conduct seamless transactions through mobile and web-based wallet platforms

- Furthermore, rising consumer demand for secure, fast, and contactless payment solutions is positioning digital wallets as the preferred mode of transaction across retail, transportation, and e-commerce sectors. These converging factors are accelerating the adoption of payment wallets, thereby significantly boosting the industry's growth

Payment Wallet Market Analysis

- Payment wallets are digital applications that allow users to store payment credentials and perform transactions electronically through smartphones or other connected devices. These wallets support various features including peer-to-peer transfers, bill payments, in-store and online purchases, and integration with loyalty programs

- The growing adoption of digital wallets is primarily driven by increased demand for convenience in everyday payments, government initiatives promoting cashless economies, and advancements in security technologies such as biometric authentication and tokenization

- Asia-Pacific dominated the payment wallet market with a share of 49.5% in 2024, due to rapid smartphone penetration, expanding digital payment infrastructure, and government-backed initiatives promoting cashless economies

- North America is expected to be the fastest growing region in the payment wallet market during the forecast period due to increasing demand for secure, convenient, and seamless payment experiences across digital and physical platforms

- Digital wallets segment dominated the market with a market share of 64.6% in 2024, due to the rapid shift toward cashless transactions and the integration of digital wallets with mobile apps, loyalty cards, and banking services. Digital wallets provide an all-in-one solution for payments, bill transfers, and even cryptocurrency storage, attracting a wide range of tech-savvy consumers and businesses. Their role in streamlining online and in-store transactions, along with growing trust in encrypted digital platforms, contributes to their leading position

Report Scope and Payment Wallet Market Segmentation

|

Attributes |

Payment Wallet Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Payment Wallet Market Trends

Rising Blockchain integration

- The payment wallet market is rapidly evolving with the integration of blockchain technology, which delivers enhanced transparency, traceability, and security for peer-to-peer and cross-border transactions, making digital wallets more versatile and reliable for users worldwide

- For instance, leading card network giants such as Visa and Mastercard are rolling out blockchain-powered features for their wallet platforms, enabling near-instant settlement, support for multiple cryptocurrencies, and cost efficiencies for cross-border payments and remittances. Many wallets now facilitate QR-based and smart contract-driven transactions, automating settlements and boosting adoption in fintech and e-commerce

- Blockchain provides a decentralized ledger that enables users and businesses to track payment histories, validate ownership through digital signatures, and automate payments with smart contracts, significantly reducing fraud risk and operational delays

- The integration of blockchain with wallets supports seamless interoperability, allowing consumers to easily switch between fiat and crypto assets and transact securely within diverse financial ecosystems

- End-to-end payment data on permissioned blockchain networks ensures that audit trails and real-time compliance capabilities are available for businesses, further strengthening trust and transparency

- The trend also accelerates financial inclusion, offering low-cost, borderless digital wallet solutions to underserved populations and expanding access to global commerce and digital assets

Payment Wallet Market Dynamics

Driver

Rapid Technological Advancements

- The relentless pace of innovation in payment technologies—including mobile device biometrics, NFC, AI-driven personalization, and embedded loyalty programs—drives continuous upgrades and wider adoption of payment wallet platforms

- For instance, global financial giants and wallet providers such as Apple Pay, Google Pay, PayPal, and Samsung Pay are advancing wallet functionality with features such as Tap-to-Pay, voice-activated payments, and biometric authentication, creating intuitive, secure, and seamless customer experiences across physical and digital channels

- Advances in open banking APIs and integrations with banking apps allow users to manage, transfer, and receive funds instantly, promoting real-time payments and improving the utility of wallets for both merchants and consumers

- Adoption of augmented reality and AI is enhancing the appeal and accessibility of wallets, enabling customized rewards, dynamic bundling of digital payment options, and data-driven insights for merchants

- Wallets now support multi-currency, multi-card storage, and value-added financial services, making them central to digital banking, e-commerce, and emerging financial ecosystems globally

Restraint/Challenge

Increasing Security Concerns

- Despite robust growth, payment wallets are increasingly targeted by cybercriminals, making security a top concern among users, businesses, and regulators. Common threats include phishing, malware, data breaches, lost devices, and social engineering attacks

- For instance, recent research on Apple Pay, Google Pay, and PayPal has revealed vulnerabilities tied to outdated authentication and potential misuse of tokenized card information, with risks amplified if wallets are not protected by advanced security measures or the user is not vigilant about device security

- The complexity of safeguarding wallet infrastructure against evolving threats demands continuous investment in encryption, two-factor authentication, fraud detection, and rapid incident response

- Privacy is an added challenge, as wallet providers collect extensive transaction and behavioral data, raising concerns about third-party data sharing, tracking, and compliance with data protection standards

- Security gaps or high-profile breaches can undermine user trust and slow adoption, particularly in markets with low digital payment confidence or in segments with limited understanding of wallet security best practices

Payment Wallet Market Scope

The market is segmented on the basis of components, product, offering, and application.

- By Components

On the basis of components, the payment wallet market is segmented into mobile wallets, online wallets, and contactless payments. The mobile wallets segment accounted for the largest market revenue share in 2024, driven by the growing penetration of smartphones and mobile internet, along with increasing consumer preference for on-the-go digital transactions. Mobile wallets offer users convenience, speed, and integration with loyalty programs, banking apps, and QR-based payment systems, making them the preferred mode of payment in both urban and semi-urban settings. The widespread support from banks, fintech companies, and merchants further solidifies their market dominance.

The contactless payments segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing demand for hygienic and quick payment experiences post-pandemic. Contactless payments, enabled through NFC technology or QR codes, are gaining significant traction across public transport, food outlets, and retail chains due to reduced transaction times and enhanced user safety. Their rising acceptance globally, particularly in developing economies embracing cashless ecosystems, is accelerating segment growth.

- By Product

On the basis of product, the market is segmented into digital wallets and physical wallets. The digital wallets segment dominated the largest revenue share of 64.6% in 2024 owing to the rapid shift toward cashless transactions and the integration of digital wallets with mobile apps, loyalty cards, and banking services. Digital wallets provide an all-in-one solution for payments, bill transfers, and even cryptocurrency storage, attracting a wide range of tech-savvy consumers and businesses. Their role in streamlining online and in-store transactions, along with growing trust in encrypted digital platforms, contributes to their leading position.

The physical wallets segment is projected to register moderate growth, though innovations such as NFC-enabled smart cards and wearables are revitalizing demand. These solutions provide tangible, tap-to-pay experiences that merge traditional familiarity with modern functionality, appealing to users seeking simple, device-free alternatives to mobile-based payments. Physical wallets also serve as reliable payment tools in regions with limited smartphone penetration or digital literacy. Their durability, offline usability, and ease of adoption support continued relevance. As hybrid payment ecosystems evolve, physical wallets maintain a complementary role alongside digital platforms.

- By Offering

On the basis of offering, the payment wallet market is segmented into payment processing, security and fraud protection, and customer service. The payment processing segment captured the largest share in 2024, backed by its critical role in enabling seamless, real-time transactions between users and merchants across digital platforms. With the expansion of e-commerce and mobile-based purchases, efficient and scalable payment processing infrastructure remains vital. Key providers are investing in robust APIs and AI-based optimization tools to reduce transaction failures and latency, boosting demand.

The security and fraud protection segment is anticipated to record the fastest growth from 2025 to 2032, as rising cyber threats and regulatory compliance pressures force wallet providers to prioritize advanced encryption, tokenization, biometric verification, and AI-driven fraud detection systems. These technologies help detect anomalies in real time and prevent unauthorized access, safeguarding both user credentials and transaction data. The growing emphasis on consumer trust and data protection across financial services, especially in high-risk regions, drives the adoption of enhanced security offerings. Integration of compliance frameworks like PCI DSS and GDPR further strengthens demand.

- By Application

The e-commerce segment held the highest revenue share in 2024, propelled by the surge in online shopping, digital marketplaces, and personalized checkout solutions. Payment wallets enhance e-commerce by offering one-click payments, stored card data, and cashback incentives, creating a seamless user journey. Their integration with loyalty programs and BNPL (Buy Now, Pay Later) options further boosts customer engagement. The proliferation of app-based commerce and increasing cross-border purchases also support the segment's leadership. As digital-first retail models grow, wallets remain central to transaction efficiency and customer retention.

The transportation segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the adoption of digital fare systems in public transit, ride-hailing services, and toll booths. Wallet-based payments streamline operations by enabling contactless, automated fare collection and reducing reliance on physical currency. Smart city initiatives and government-backed digital payment mandates are promoting wallet integration into urban mobility platforms, reducing cash handling and improving operational efficiency. Real-time fare deduction and QR code scanning further enhance commuter convenience. As cities modernize infrastructure, payment wallets are becoming an essential enabler of frictionless transit experiences.

Payment Wallet Market Regional Analysis

- Asia-Pacific dominated the payment wallet market with the largest revenue share of 49.5% in 2024, driven by rapid smartphone penetration, expanding digital payment infrastructure, and government-backed initiatives promoting cashless economies

- The region’s strong fintech ecosystem, rise in QR-based and UPI transactions, and growing e-commerce activities are accelerating wallet adoption across urban and rural areas

- Supportive regulatory frameworks, increasing financial inclusion efforts, and growing consumer trust in mobile-based payment solutions are further boosting market expansion in the region

China Payment Wallet Market Insight

China held the largest share in the Asia-Pacific payment wallet market in 2024, led by its highly digitized payment ecosystem and the dominance of platforms such as Alipay and WeChat Pay. The integration of wallets into daily activities, strong government support for digital currency pilots, and advanced consumer analytics capabilities are major growth drivers. The country’s tech-savvy population and extensive mobile internet access continue to reinforce wallet usage in retail, transport, and peer-to-peer payments.

India Payment Wallet Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by initiatives such as Digital India and the explosive rise of UPI-based mobile payments. Increasing smartphone usage, financial literacy programs, and a surge in digital onboarding of MSMEs are driving wallet adoption. Government incentives for fintech growth, along with rising demand for secure and contactless transactions across sectors such as retail and transport, are further accelerating market expansion.

Europe Payment Wallet Market Insight

The Europe payment wallet market is expanding steadily, supported by growing consumer shift toward contactless and mobile payments, along with strong regulatory backing through PSD2 and open banking frameworks. High smartphone usage, security-conscious consumers, and bank-led wallet innovations are contributing to sustained growth. Emphasis on cross-border interoperability and rising demand for integrated loyalty-payment solutions are further enhancing market traction.

Germany Payment Wallet Market Insight

Germany’s payment wallet market is driven by increasing digitization of banking services, a growing preference for mobile-first payment experiences, and widespread merchant acceptance of contactless systems. Despite a historically cash-centric culture, rising demand for convenience, security, and integrated payment features is pushing adoption across retail and mobility services. Collaborations between traditional banks and fintechs are also shaping the wallet ecosystem.

U.K. Payment Wallet Market Insight

The U.K. market benefits from a mature digital economy, strong fintech innovation, and consumer openness to mobile banking and payment tools. Post-Brexit shifts toward domestic payment solutions, increasing usage of e-wallets for online shopping, and growing trust in secure biometric authentication are supporting demand. Continued investments in mobile-first financial services and smart retail integrations are driving wallet uptake across urban centers.

North America Payment Wallet Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing demand for secure, convenient, and seamless payment experiences across digital and physical platforms. The region's advanced fintech landscape, strong credit/debit card infrastructure, and widespread adoption of mobile apps for banking and retail support strong wallet usage. Rising adoption of contactless and embedded payments in wearables and IoT devices is also contributing to growth.

U.S. Payment Wallet Market Insight

The U.S. accounted for the largest share in the North America market in 2024, supported by its robust e-commerce sector, high digital literacy, and increasing adoption of Apple Pay, Google Pay, and PayPal. Key drivers include rising mobile commerce, embedded finance trends, and partnerships between tech giants and retailers. Security enhancements such as tokenization and multi-factor authentication are further building consumer confidence in wallet platforms across various applications.

Payment Wallet Market Share

The payment wallet industry is primarily led by well-established companies, including:

- PayPal Holdings, Inc. (U.S.)

- Apple Inc. (U.S.)

- Google LLC (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- Square, Inc. (U.S.)

- Visa Inc. (U.S.)

- Mastercard Incorporated (U.S.)

- Alibaba Group Holding Limited (China)

- Tencent Holdings Limited (China)

- American Express Company (U.S.)

Latest Developments in Global Payment Wallet Market

- In January 2025, MobiKwik (ONE MOBIKWIK SYSTEMS LIMITED), India’s largest digital wallet, launched the full version of India’s Central Bank Digital Currency (CBDC) – e-rupee (e₹), in collaboration with the Reserve Bank of India (RBI) and Yes Bank. This move marks a significant step toward mainstream digital currency adoption in India, enhancing the digital wallet ecosystem by enabling secure, sovereign-backed transactions. It is expected to drive user confidence, reduce dependency on traditional currency, and accelerate India’s transition to a digital-first financial infrastructure, especially among digitally literate users and small merchants

- In November 2024, Mastercard introduced Mastercard Pay Local, a global service that allows consumers to link their credit or debit cards to local digital wallets for seamless card-based payments. This launch eliminates the need for prepaid wallet top-ups and simplifies cross-border digital transactions. It strengthens Mastercard’s position in the digital wallet ecosystem while offering consumers a more integrated and frictionless payment experience. The initiative also supports merchant acceptance of diverse payment methods and enhances interoperability across markets, thereby promoting broader wallet usage

- In October 2024, the European Payments Initiative (EPI) launched Wero, an instant account-to-account payment solution designed to provide a sovereign and unified digital payment option for European consumers. Initially rolled out to customers of major French banks, Wero represents a strategic effort to reduce dependence on non-European payment systems. The launch is expected to bolster regional payment autonomy, streamline person-to-person and retail transactions, and increase adoption of real-time digital payments across Europe, strengthening the local digital economy

- In June 2023, PayPal Holdings, Inc. entered into a multi-year exclusive agreement with global investment firm KKR for a €3 billion (USD 3.37 billion) replenishing loan commitment. Under this agreement, KKR’s private credit funds will purchase up to €40 billion (USD 44.87 billion) in Buy Now, Pay Later (BNPL) loan receivables across Italy, France, the U.K., Spain, and Germany. This partnership significantly enhances PayPal’s BNPL capabilities in Europe, increases lending flexibility, and boosts liquidity. It positions PayPal to scale its installment payment services while reducing balance sheet risk, reinforcing its competitiveness in the European digital credit landscape

- In February 2023, HDFC Bank, in collaboration with Crunchfish, launched OfflinePay, a project under the RBI Regulatory Sandbox Program aimed at enabling offline digital payments for both merchants and customers. This initiative addresses connectivity challenges in remote and rural areas by allowing transactions without real-time internet access. It plays a crucial role in promoting digital inclusion, enhancing transaction resilience, and supporting the broader adoption of digital wallets across India’s diverse demographics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Payment Wallet Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Payment Wallet Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Payment Wallet Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.