Global Payment Gateway Market

Market Size in USD Billion

CAGR :

%

USD

35.17 Billion

USD

152.26 Billion

2024

2032

USD

35.17 Billion

USD

152.26 Billion

2024

2032

| 2025 –2032 | |

| USD 35.17 Billion | |

| USD 152.26 Billion | |

|

|

|

|

Payment Gateway Market Size

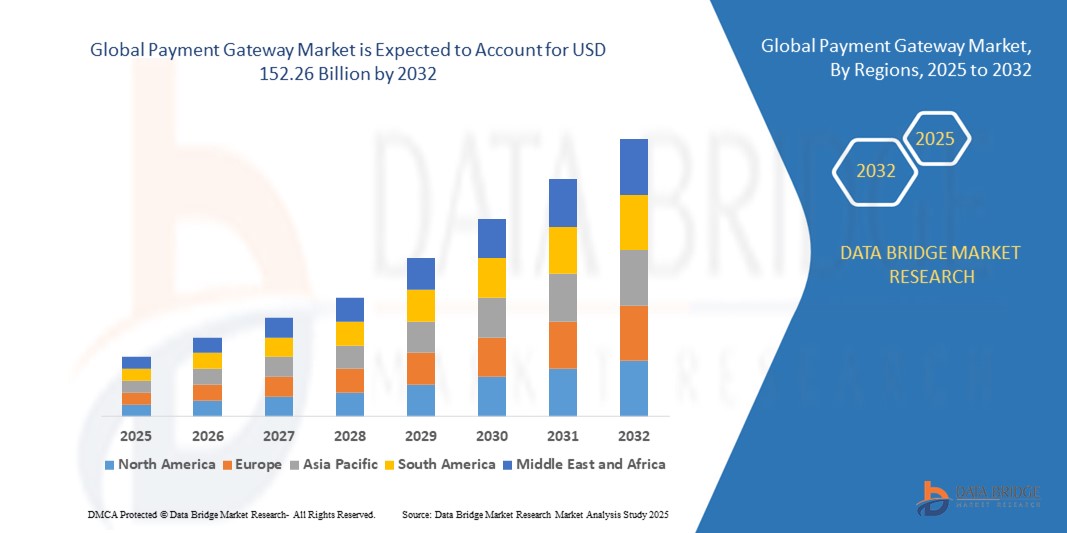

- The global payment gateway market size was valued at USD 35.17 billion in 2024 and is expected to reach USD 152.26 billion by 2032, at a CAGR of 20.10% during the forecast period

- The market growth is largely fueled by the rapid expansion of e-commerce, digital banking, and mobile commerce, leading to an increasing reliance on efficient, secure, and scalable online payment systems across industries

- Furthermore, rising demand for frictionless checkout experiences, real-time transaction processing, and robust fraud prevention is positioning payment gateways as an essential component of modern digital infrastructure. These converging factors are accelerating the adoption of advanced gateway solutions, thereby significantly boosting the industry's growth

Payment Gateway Market Analysis

- Payment gateways are technology platforms that authorize and process online payments between merchants and customers, supporting a range of payment methods including credit/debit cards, UPI, digital wallets, and net banking. They act as intermediaries ensuring secure, encrypted transmission of sensitive data, while also offering fraud detection and compliance features

- The accelerating demand for payment gateways is primarily driven by the surge in online transactions, increasing penetration of smartphones and internet services, and the push for digital transformation across both enterprise and SME segments

- North America dominated the payment gateway market with a share of 36.5% in 2024, due to the rapid growth of e-commerce, increasing digital payment adoption, and strong fintech infrastructure

- Asia-Pacific is expected to be the fastest growing region in the payment gateway market during the forecast period due to rapid internet penetration, expanding e-commerce, and increasing smartphone usage across emerging economies

- Hosted segment dominated the market with a market share of 57.5% in 2024, due to its ease of integration and high level of security, which makes it especially appealing to small and mid-sized businesses. Hosted gateways redirect customers to a secure payment service provider’s platform, reducing merchants’ PCI DSS compliance burden and minimizing risks related to fraud and data breaches. Their plug-and-play nature, paired with customer trust in third-party processors, has solidified hosted gateways as the preferred choice for businesses seeking simplicity and protection

Report Scope and Payment Gateway Market Segmentation

|

Attributes |

Payment Gateway Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Payment Gateway Market Trends

Rise of Digital Wallets

- Digital wallets are rapidly reshaping the payment gateway ecosystem as consumers and merchants increasingly favor them for their speed, security, and seamless checkout experience across e-commerce, retail, and peer-to-peer platforms

- For instance, leading payment gateway providers such as Stripe, PayPal, Adyen, and Razorpay are expanding integration options for Apple Pay, Google Pay, Amazon Pay, Paytm, and other digital wallets, allowing global businesses to support multiple wallet solutions and broaden customer reach

- Widespread smartphone penetration and mobile banking adoption drive the proliferation of digital wallets, enabling contactless and remote payments that are particularly valued in the post-pandemic, convenience-first landscape

- Innovations in QR-code based payments, tap-to-pay technology, and loyalty program integration further accelerate wallet adoption and recurrent digital wallet usage at both physical and digital points of sale

- Payment gateways increasingly prioritize interoperability, real-time settlement, and multi-currency support to ensure smooth cross-border transactions making digital wallets even more attractive for international commerce

- Regulatory harmonization and industry partnerships encourage interoperability standards, enabling consumers to link bank accounts and cards across wallets and payment gateways with improved security and lower friction

Payment Gateway Market Dynamics

Driver

Growing Online Shopping Landscape

- The exponential rise of global e-commerce and online shopping platforms is the principal driver of payment gateway market expansion, as merchants require robust, user-friendly, and secure transaction processing capabilities to meet soaring digital transaction volumes

- For instance, major online retail players such as Amazon, Flipkart, Alibaba, and Shopify partner with global and local payment gateway providers to offer localized payment experiences and support a wide array of payment options tailored to regional consumer preferences

- Increased consumer trust in online shopping and the demand for instant payment confirmation and refunds foster higher transaction throughput and the emergence of subscription billing, omnichannel retail, and marketplace models

- The rapid onboarding of small and medium businesses (SMEs) into digital commerce boosts demand for simple, cost-effective, and quick-to-integrate payment gateway solutions with built-in fraud detection and compliance features

- Seamless integration with digital wallets, buy-now-pay-later offerings, and value-added analytics services further cements the critical role of payment gateways in today's integrated e-commerce infrastructure

Restraint/Challenge

Growing Security Concerns and Fraud

- Security risks and rising instances of payment fraud, data breaches, and cyberattacks are key challenges for the payment gateway market, prompting the need for continuous investment in security technology, compliance, and risk management strategies

- For instance, breaches involving payment data—such as major incidents impacting retailers or financial service providers—have compelled gateway companies such as Worldline and Adyen to adopt EMV 3-D Secure, PCI DSS upgrades, end-to-end encryption, AI-powered fraud detection, and tokenization to protect customer and merchant data throughout the payment journey

- The complexity and variability of global regulations make it challenging for payment gateways to ensure consistent data protection and anti-fraud measures across regions, particularly in cross-border and multi-currency transactions

- Increasing sophistication of cybercriminal activities and attack vectors, such as phishing, card testing, and synthetic fraud, require ongoing vigilance and real-time anomaly detection

- Customers’ concerns about privacy and security can slow digital payment adoption, especially in regions with lower consumer trust or infrastructure gaps, posing an additional barrier for new entrants and smaller merchants

Payment Gateway Market Scope

The market is segmented on the basis of type, enterprise size, and end use.

- By Type

On the basis of type, the payment gateway market is segmented into hosted and non-hosted gateways. The hosted segment dominated the largest market revenue share of 57.5% in 2024, driven by its ease of integration and high level of security, which makes it especially appealing to small and mid-sized businesses. Hosted gateways redirect customers to a secure payment service provider’s platform, reducing merchants’ PCI DSS compliance burden and minimizing risks related to fraud and data breaches. Their plug-and-play nature, paired with customer trust in third-party processors, has solidified hosted gateways as the preferred choice for businesses seeking simplicity and protection.

The non-hosted segment is expected to register the fastest growth rate from 2025 to 2032, as large enterprises increasingly demand full control over the payment experience. Non-hosted gateways allow payments to be processed directly on the merchant’s website, offering enhanced brand consistency and seamless user experience. This model supports customization, advanced analytics, and upselling strategies, which are critical for high-volume platforms aiming to maximize conversion rates and maintain customer engagement.

- By Enterprise Size

On the basis of enterprise size, the payment gateway market is categorized into large enterprises and small & medium enterprises (SMEs). The large enterprise segment accounted for the highest revenue share in 2024, supported by the need for robust, scalable, and globally compatible payment infrastructure. These enterprises often operate across multiple geographies and require gateways that can process multi-currency payments, integrate with complex ERP systems, and meet stringent compliance standards. The demand from large businesses is also driven by high transaction volumes, which justify investment in advanced fraud detection and seamless omnichannel capabilities.

The SME segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by the digital transformation of small businesses and growing e-commerce participation. SMEs are increasingly adopting payment gateways to offer secure online transactions, streamline checkout experiences, and gain access to broader markets. The availability of affordable, API-driven, and easy-to-integrate gateway solutions is enabling SMEs to scale operations efficiently without investing heavily in infrastructure. As digital payment adoption becomes essential for competitiveness, payment gateway providers are tailoring solutions specifically for SME needs. Rising smartphone penetration and consumer preference for online shopping further accelerate this trend.

- By End Use

On the basis of end use, the payment gateway market is segmented into BFSI and retail & e-commerce. The retail & e-commerce segment held the largest revenue share in 2024, attributed to the exponential growth of online shopping and the need for fast, secure, and mobile-optimized payment solutions. Payment gateways play a central role in reducing cart abandonment, ensuring secure payment authentication, and supporting a variety of payment modes including digital wallets, BNPL, and UPI. The dynamic nature of the retail ecosystem and the push toward personalized customer experiences further amplify demand for intelligent payment systems.

The BFSI segment is projected to grow at the fastest rate from 2025 to 2032, fueled by rising digital banking penetration and fintech innovations. As banks and financial service providers expand their digital footprint, secure and compliant payment gateways are critical to managing online transactions, detecting fraud in real-time, and facilitating seamless integration with mobile apps and online platforms. The convergence of banking services with embedded finance also supports this segment’s rapid growth trajectory. Growing regulatory requirements and demand for frictionless customer experiences further drive the adoption of advanced gateway technologies in this sector.

Payment Gateway Market Regional Analysis

- North America dominated the payment gateway market with the largest revenue share of 36.5% in 2024, driven by the rapid growth of e-commerce, increasing digital payment adoption, and strong fintech infrastructure

- Businesses and consumers across the region are increasingly favoring seamless, secure, and fast transaction experiences, supported by high internet penetration and mobile usage

- The presence of major technology providers and payment gateway companies, along with favorable regulatory frameworks and consumer trust in digital transactions, solidifies North America's leadership in the market

U.S. Payment Gateway Market Insight

The U.S. payment gateway market captured the largest revenue share in 2024 within North America, primarily due to the country's mature online retail sector and rising preference for contactless payments. The expanding ecosystem of e-commerce platforms, digital wallets, and subscription-based services is fueling demand for robust and scalable payment gateways. Consumer expectations for real-time processing, enhanced fraud prevention, and omnichannel support continue to drive innovation and competition within the U.S. market. Furthermore, the presence of global payment leaders and active investments in fintech startups are accelerating market expansion.

Europe Payment Gateway Market Insight

The Europe payment gateway market is projected to grow at a significant CAGR during the forecast period, supported by the region's regulatory focus on secure and transparent financial transactions. The enforcement of PSD2 regulations and the growing popularity of open banking are enhancing cross-border payment capabilities and consumer confidence in digital platforms. Europe's high smartphone penetration and evolving retail landscape are increasing the reliance on integrated payment systems, especially across SMEs and direct-to-consumer businesses.

U.K. Payment Gateway Market Insight

The U.K. payment gateway market is expected to expand at a notable CAGR, driven by strong digital banking infrastructure, increasing online retail activity, and rising demand for real-time, secure transactions. Businesses are embracing innovative gateway solutions to manage high-volume payments and improve customer experiences across digital channels. The market benefits from a thriving fintech ecosystem, supportive regulatory environment, and consumer trust in online transactions, further reinforcing growth.

Germany Payment Gateway Market Insight

The Germany payment gateway market is anticipated to witness steady growth, bolstered by the country’s shift toward cashless transactions and strong demand for secure, localized payment solutions. As German businesses increasingly digitalize their operations, the need for integrated, GDPR-compliant gateways is rising. Consumers are also embracing mobile payments and digital wallets, contributing to increased adoption across sectors including e-commerce, healthcare, and financial services.

Asia-Pacific Payment Gateway Market Insight

The Asia-Pacific payment gateway market is set to grow at the fastest CAGR during the forecast period of 2025 to 2032, fueled by rapid internet penetration, expanding e-commerce, and increasing smartphone usage across emerging economies. Government-led digital initiatives, such as India’s Digital India and China’s smart city programs, are accelerating the use of digital payments. The region is also witnessing rising demand for low-cost, flexible gateway solutions catering to SMEs and mobile-first consumers.

Japan Payment Gateway Market Insight

The Japan payment gateway market is growing steadily, supported by the government’s push for a cashless society and rising consumer preference for seamless payment experiences. The integration of payment gateways with mobile wallets, QR-code systems, and loyalty platforms is enhancing customer convenience. Japan’s technologically advanced retail sector, combined with its strong cybersecurity standards, is driving demand for trusted and innovative gateway solutions.

China Payment Gateway Market Insight

The China payment gateway market accounted for the largest market revenue share in Asia-Pacific in 2024, powered by its booming e-commerce industry, widespread use of mobile payment platforms, and robust digital infrastructure. The dominance of platforms such as Alipay and WeChat Pay reflects the country’s mature digital payment ecosystem. The strong presence of domestic fintech companies, along with government support for innovation, continues to accelerate payment gateway adoption across retail, services, and cross-border commerce.

Payment Gateway Market Share

The payment gateway industry is primarily led by well-established companies, including:

- Adyen (Netherlands)

- Amazon Payments Inc. (U.S.)

- Authorize.Net (U.S.)

- Bitpay, Inc. (U.S.)

- Braintree (U.S.)

- PayPal Holdings, Inc. (U.S.)

- PayU Group (Netherlands)

- Stripe (U.S.)

- Verifone Holdings, Inc. (U.S.)

- Wepay, Inc. (U.S.)

Latest Developments in Global Payment Gateway Market

- In July 2025, CAMS Limited launched The CAMSPay’s New Payment Gateway, introducing a regulation-ready digital payment solution tailored to meet the evolving compliance and operational demands of modern Indian businesses. This launch arrives at a pivotal moment as India’s digital payments sector undergoes significant regulatory shifts driven by the Reserve Bank of India (RBI), including mandates on tokenization, data localization, and heightened compliance standards. The CAMSPay gateway strengthens the market by offering a future-ready, secure, and scalable platform, providing businesses with a compliant alternative amid growing pressure on legacy systems to adapt

- In May 2025, EnKash, a leading Indian spend management and payments platform, unveiled the EnKash Payment Gateway, designed specifically for India’s 63 million+ small to medium-sized enterprises (SMEs) and startup merchants. By addressing a long-standing gap in access to sophisticated digital payment infrastructure for underserved businesses, this launch positions EnKash as a critical enabler in India’s fintech landscape. The solution empowers SMEs with advanced payment capabilities, fostering broader digital inclusion and accelerating their participation in the country’s fast-expanding digital commerce ecosystem

- In August 2024, Zoho Corporation introduced Zoho Payments, a unified and secure digital payment solution that allows businesses to accept payments via UPI. Developed under its wholly-owned subsidiary, Zoho Payment Technologies, the solution extends Zoho’s ecosystem by integrating B2B payment capabilities through the Bharat Bill Payment System (BBPS) of NPCI Bharat BillPay Limited (NBBL). This strategic move enhances the business payment landscape in India by offering a seamless, enterprise-grade payment system that aligns with the country's growing demand for integrated and interoperable financial technologies

- In November 2022, Adyen, a global financial technology platform, partnered with Instacart, North America's leading grocery technology company, as an additional payments gateway processing partner. As part of the new partnership, Instacart would leverage Adyen functionality, including PINless debit enablement of transactions, to further optimize and improve authorization rates for an even more seamless customer experience

- In September 2022, Unified Payments Interface (UPI) leader PhonePe is working toward launching its own payments gateway as an extension to its QR code-based UPI Payments service and in-app payments. The gateway is expected to launch in the 1st Quarter of 2023

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.