Global Patient Monitoring Device/System/Equipment Market Segmentation, By Product (Hemodynamic, Neuro monitoring, Cardiac, Fetal and Neonatal, Respiratory, Multi parameter, Remote Patient, Weight, Temperature, and Urine Output Monitoring Devices), Type (Vibration, Thermal, Motor Current, Alarm, and GPS), Process (Online, and Portable), Deployment Type (On-Premise, and Cloud), End Use (Hospitals and Clinics, Home Setting, and Ambulatory Surgical Centres) - Industry Trends and Forecast to 2031

Patient Monitoring Device/System/Equipment Market Analysis

Ambulatory care involves the provision of healthcare services on an outpatient basis, outside of traditional hospital settings. Patient monitoring device/system/equipment plays a critical role in ambulatory care by enabling continuous monitoring of patients' vital signs and health parameters during their visit to outpatient clinics or while they are transported in ambulances. These devices ensure that healthcare providers can monitor patients' conditions in real-time, allowing for immediate interventions if necessary.

Patient Monitoring Device/System/Equipment Market Size

The global patient monitoring device/system/equipment market size was valued at USD 11.97 billion in 2023 and is projected to reach USD 23.02 billion by 2031, with a CAGR of 8.52% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024-2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Product (Hemodynamic, Neuro monitoring, Cardiac, Fetal and Neonatal, Respiratory, Multi parameter, Remote Patient, Weight, Temperature, and Urine Output Monitoring Devices), Type (Vibration, Thermal, Motor Current, Alarm, and GPS), Process (Online, and Portable), Deployment Type (On-Premise, and Cloud), End Use (Hospitals and Clinics, Home Setting, and Ambulatory Surgical Centres)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America

|

|

Market Players Covered

|

BioTelemetry, Inc. (U.S.), Onduo LLC (U.S.), Medtronic (Ireland), Compumedics Limited (Australia), NIHON KOHDEN CORPORATION (Japan), Natus Medical Incorporated (U.S.), GENERAL ELECTRIC (U.S.), Koninklijke Philips N.V. (Netherlands), F. Hoffmann-La Roche Ltd (Switzerland), Siemens Healthcare Private Limited (Germany), OMRON Corporation (Japan), Johnson and Johnson Services, Inc. (U.S.), Care Innovations, LLC (U.S.), Smiths Group plc (U.K.), Drägerwerk AG and Co. KGaA (Germany), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), CONTEC MEDICAL SYSTEMS CO., LTD (China), PRÜFTECHNIK Dieter Busch GmbH (Germany), Analog Devices, Inc. (U.S.)

|

|

Market Opportunities

|

|

Patient Monitoring Device/System/Equipment Market Definition

A patient monitoring device/system/equipment refers to technology used in healthcare settings to observe and track vital signs, physiological parameters, and other health-related data of patients. These devices can range from simple handheld monitors to complex systems integrated into hospital networks. They provide real-time information to healthcare providers, enabling continuous assessment of a patient's condition, early detection of changes, and timely intervention as needed, thereby improving patient care and safety.

Patient Monitoring Device/System/Equipment Market Dynamics

Drivers

- Increasing Incidence of Chronic Diseases

The increasing incidence of chronic diseases worldwide, such as diabetes, cardiovascular diseases, respiratory illnesses, and hypertension often require ongoing monitoring of vital signs, glucose levels, oxygen saturation, and other health parameters to manage effectively. Patient monitoring devices enable healthcare providers to continuously track patients' conditions, detect early signs of deterioration, and intervene promptly, thereby improving outcomes and reducing healthcare costs associated with hospitalizations. As the global population ages and lifestyles change, the prevalence of chronic diseases continues to rise, underscoring the critical need for advanced monitoring technologies that can support proactive management and personalized care strategies across diverse healthcare settings.

- Growing Aging Population

As people age, there is an increased incidence of chronic diseases such as cardiovascular conditions, diabetes, and respiratory disorders, which require continuous monitoring of vital signs and health parameters. The demand for these devices is further amplified by the preference for aging individuals to remain independent at home, necessitating remote monitoring solutions that ensure timely intervention and support. This demographic trend underscores the market's growth as healthcare providers and caregivers seek reliable and efficient monitoring technologies to cater to the healthcare needs of an aging population.

Opportunities

- Rising Healthcare Expenditure

As healthcare budgets increase, there is greater investment in advanced medical technologies to improve patient outcomes and operational efficiencies. Patient monitoring devices play a crucial role in this scenario by enabling healthcare providers to monitor patients continuously, thereby reducing the need for prolonged hospital stays and minimizing healthcare costs associated with preventable complications. Moreover, these devices support early detection of health issues, allowing for timely interventions and reducing overall healthcare spending on emergency treatments and acute care. The demand for efficient healthcare delivery systems further drives the adoption of patient monitoring technologies, ensuring optimized resource allocation and enhanced quality of care across diverse healthcare settings.

- Growing Regulatory Support

Growing regulatory support sets standards and guidelines that promote the adoption of advanced healthcare technologies. Regulatory bodies worldwide, such as the FDA in the United States and the EMA in Europe, establish rigorous requirements for safety, efficacy, and quality assurance of medical devices. Compliance with these regulations ensures that patient monitoring systems meet stringent standards, enhancing patient safety and confidence among healthcare providers. This supportive regulatory environment fosters market growth by creating a stable framework for manufacturers and healthcare institutions to adopt and integrate advanced patient monitoring solutions effectively.

Restraints/Challenges

- Data Privacy Concerns

With increased connectivity and data sharing capabilities, there are heightened risks of unauthorized access, breaches, and misuse of patient information. Healthcare providers and patients alike are cautious about the security measures implemented in these systems to protect personal health information (PHI) from cyber threats. Compliance with stringent data protection regulations, such as HIPAA in the United States and GDPR in Europe, adds complexity and cost to device development and deployment.

- Complexity in Integration

Healthcare facilities often have diverse and legacy IT systems that may not easily integrate with new monitoring technologies, leading to compatibility issues and delays in implementation. Integrating patient monitoring systems requires extensive planning, customization, and sometimes costly infrastructure upgrades, which can deter healthcare providers from adopting new technologies. Additinally, interoperability challenges between different devices and software platforms can hinder seamless data exchange and coordination of care, impacting the efficiency and effectiveness of patient monitoring solutions.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Patient Monitoring Device/System/Equipment Market Scope

The market is segmented on the basis of product, type, process, deployment type and end use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Hemodynamic

- Neuro Monitoring

- Cardiac

- Fetal and Neonatal

- Respiratory

- Multi Parameter

- Remote Patient

- Weight

- Temperature

- Urine Output Monitoring Devices

Type

- Vibration

- Thermal

- Motor Current

- Alarm

- GPS

Process

- Online

- Portable

Deployment Type

- On-Premise

- Cloud

End Use

- Hospitals and Clinics

- Home Setting

- Ambulatory Surgical Centres

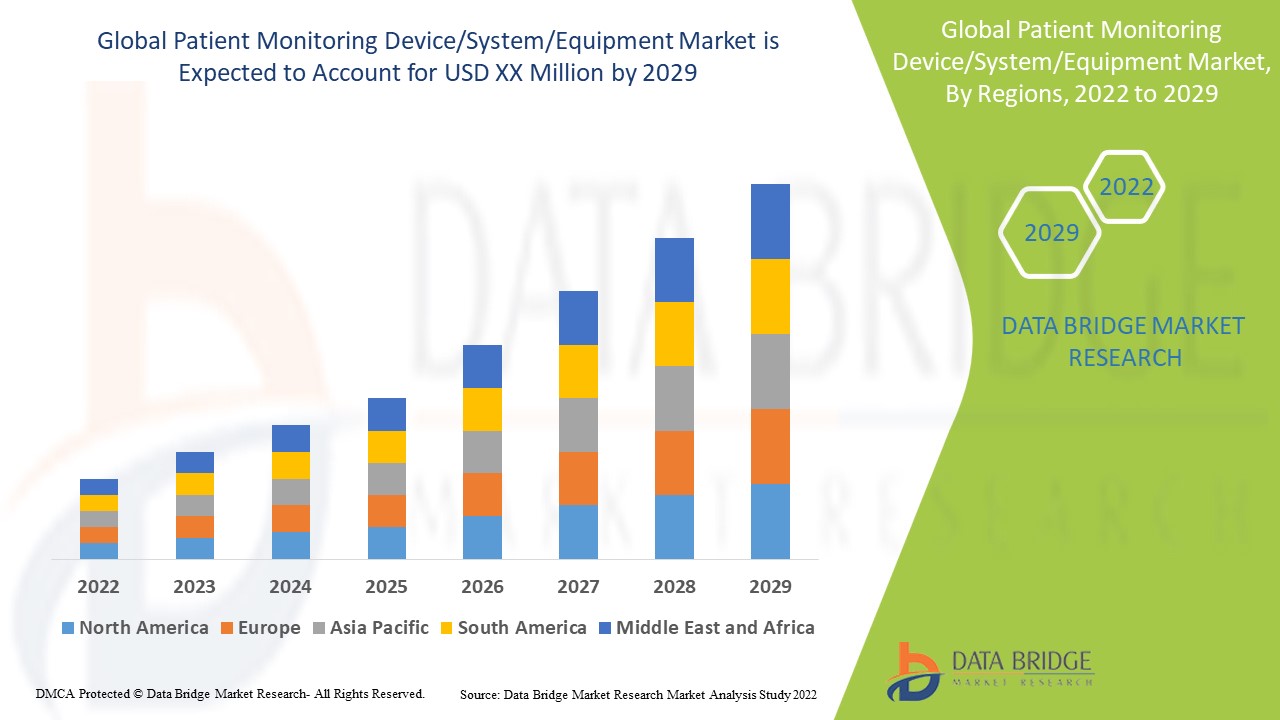

Patient Monitoring Device/System/Equipment Market Regional Analysis

The market is analyzed, and market size insights and trends are provided by country, product, type, process, deployment type and end use as referenced above

The countries covered in the market report are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America.

North America dominates the market due to the stringent government regulations in the region ensure high standards of quality and safety, which bolster consumer trust in these products. There is a growing awareness among healthcare providers and patients alike about the importance of reliable monitoring systems, driving demand. Additionally, North America benefits from a robust healthcare infrastructure and technological advancements that support the development and adoption of these devices, further consolidating its market leadership in patient monitoring technologies.

Asia-Pacific region is expected to experience significant growth in the market due to a growing elderly population and increasing disposable incomes in countries like China and Japan. These demographic trends are leading to higher demand for healthcare services and medical devices, including those offered by companies such as Nihon Kohden and OMRON Corporation. As these economies continue to develop, there is a greater emphasis on healthcare spending, technological advancements, and improving healthcare infrastructure, which further fuels the growth of companies operating in medical technology and healthcare solutions across the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Patient Monitoring Device/System/Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- BioTelemetry, Inc. (U.S.)

- Onduo LLC (U.S.)

- Medtronic (Ireland)

- Compumedics Limited (Australia)

- NIHON KOHDEN CORPORATION (Japan)

- Natus Medical Incorporated (U.S.)

- GENERAL ELECTRIC (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthcare Private Limited (Germany)

- OMRON Corporation (Japan)

- Johnson and Johnson Services, Inc. (U.S.)

- Care Innovations, LLC (U.S.)

- Smiths Group plc (U.K.)

- Drägerwerk AG and Co. KGaA (Germany)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- CONTEC MEDICAL SYSTEMS CO., LTD (China)

- PRÜFTECHNIK Dieter Busch GmbH (Germany)

- Analog Devices, Inc. (U.S.)

Latest Developments in Patient Monitoring Device/System/Equipment Market

- In April 2023, GE HealthCare's CARESCAPE Canvas Patient Monitoring Platform received FDA clearance. This platform, alongside CARESCAPE ONE, enhances patient monitoring capabilities by offering scalability tailored to individual patient needs. It adapts monitoring intensity based on disease severity, providing healthcare professionals with versatile tools to manage patient care effectively in diverse clinical settings.

- In June 2022, Abbott received FDA approval for the FreeStyle Libre 2 (iCGM) in the United States, targeting both adults and children with diabetes. This continuous glucose monitoring (CGM) system measures glucose levels every minute and includes real-time alarms for proactive diabetes management. It empowers users to monitor their glucose levels continuously, enhancing their ability to make timely adjustments to diet, medication, and lifestyle.

- In May 2022, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. introduced mWear, a novel wearable patient monitoring device. mWear offers dual monitoring modes—wearable and continuous—enabling caregivers to receive real-time updates on patient status based on personalized settings. This innovation enhances patient care by providing convenient and reliable monitoring solutions adaptable to varying healthcare needs and settings

SKU-