Global Patient Monitoring Device Market

Market Size in USD Billion

CAGR :

%

USD

12.98 Billion

USD

24.98 Billion

2024

2032

USD

12.98 Billion

USD

24.98 Billion

2024

2032

| 2025 –2032 | |

| USD 12.98 Billion | |

| USD 24.98 Billion | |

|

|

|

|

Patient Monitoring Device/System/Equipment Market Size

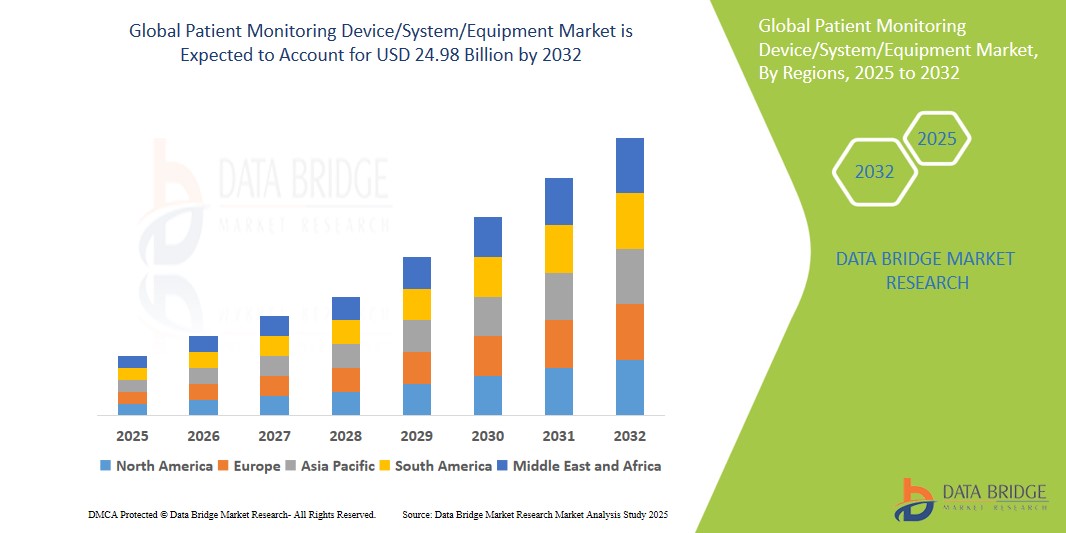

- The global patient monitoring device/system/equipment market size was valued at USD 12.98 billion in 2024 and is expected to reach USD 24.98 billion by 2032, at a CAGR of 8.52% during the forecast period

- This growth is driven by increasing incidence of chronic diseases

Patient Monitoring Device/System/Equipment Market Analysis

- Patient monitoring devices/systems/equipment are essential tools used for continuous monitoring of a patient's vital signs during surgical procedures, ICU stays, and remote healthcare settings. These devices enable healthcare providers to track real-time metrics such as heart rate, oxygen levels, blood pressure, and respiratory rate, improving patient outcomes, facilitating early detection of complications, and ensuring optimal treatment interventions

- The growing demand for patient monitoring devices/systems/equipment is primarily driven by the increasing prevalence of chronic diseases, the rising geriatric population, advancements in wearable technology, and the need for remote patient monitoring solutions

- North America is expected to dominate the patient monitoring device/system/equipment market with the largest market share of 42.54%, attributed to its advanced healthcare infrastructure, widespread adoption of wireless and portable monitoring technologies, and strong market presence of key industry players such as GE HealthCare and Medtronic

- Asia-Pacific is expected to witness the highest growth rate in the patient monitoring device/system/equipment market during the forecast period, driven by rapid healthcare infrastructure improvements, increasing investments in healthcare facilities, and the growing burden of chronic diseases

- The multi parameter segment is expected to dominate the patient monitoring device/system/equipment market with the largest market share of 23.69%, due to benefits offered by multi-parameter monitors, such as battery operation, low cost, and highly integrated silicon systems that combine multiple parameters into a compact, energy-efficient solution

Report Scope and Patient Monitoring Device/System/Equipment Market Segmentation

|

Attributes |

Patient Monitoring Device/System/Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Patient Monitoring Device/System/Equipment Market Trends

“Integration of Artificial Intelligence in Patient Monitoring Systems”

- A significant trend in the patient monitoring device/system/equipment market is the increasing integration of artificial intelligence (AI) into monitoring systems, enabling real-time data analysis, predictive analytics, and automated alerts, improving patient care and operational efficiency

- AI-based monitoring systems can process large amounts of patient data, identifying critical trends and patterns that may be missed by traditional monitoring, enhancing decision-making processes in high-risk environments

- The trend is supported by the rise of AI-powered algorithms that assist clinicians in detecting early signs of deterioration, offering personalized treatment recommendations based on real-time data analysis

- For instance, in 2023, GE HealthCare introduced AI-powered patient monitoring solutions that assist in predicting critical events such as sepsis and heart failure, increasing response time and improving patient outcomes

- The integration of AI in patient monitoring is transforming the healthcare industry by enabling more proactive and data-driven approaches to patient care, driving further adoption of these advanced technologies

Patient Monitoring Device/System/Equipment Market Dynamics

Driver

“Rise in Remote Patient Monitoring and Telehealth Adoption”

- A key driver in the patient monitoring device/system/equipment market is the increased adoption of remote patient monitoring (RPM) and telehealth services, particularly after the COVID-19 pandemic. This has led to greater demand for devices that can monitor patients' health metrics from the comfort of their homes

- The rising popularity of RPM is driven by its ability to track vital signs such as blood pressure, glucose levels, oxygen saturation, and heart rate in real-time, providing healthcare professionals with the ability to manage chronic diseases more effectively outside of clinical settings

- These technologies are becoming essential for managing chronic conditions such as diabetes, cardiovascular disease, and respiratory disorders, further propelling the market

- For instance, in 2023, Philips Healthcare launched a new RPM platform that integrates with wearable devices to provide continuous health monitoring for chronic disease management, improving patient engagement and care outcomes

- The ongoing trend of remote patient monitoring is helping reduce hospital readmissions and providing patients with more flexibility in their care, enhancing the overall healthcare experience

Opportunity

“Growth in Demand for Home Healthcare Solutions”

- A significant opportunity for the patient monitoring device/system/equipment market is the growth in demand for home healthcare solutions, as more patients opt for care at home instead of in hospitals or clinics

- Home healthcare systems require advanced patient monitoring devices that can remotely track vital signs, ensuring that patients receive timely interventions and reducing the need for hospital visits

- The shift toward home-based care is further supported by the aging population, the rise in chronic conditions, and advancements in telehealth technologies

- For instance, in 2023, Medtronic expanded its home healthcare monitoring solutions by launching a remote monitoring platform that integrates with wearables, allowing patients to manage their health at home and share real-time data with their healthcare providers

- The growing preference for home healthcare presents a significant opportunity for patient monitoring companies to innovate and provide scalable, reliable solutions tailored to the needs of patients and healthcare professionals

Restraint/Challenge

“High Costs of Advanced Monitoring Systems”

- A major challenge in the patient monitoring device/system/equipment market is the high costs associated with advanced monitoring systems, which can limit their adoption, especially in low-resource settings and emerging markets

- The upfront investment required for state-of-the-art devices, combined with maintenance costs, makes it difficult for smaller healthcare facilities or hospitals to adopt these technologies, potentially hindering market growth

- The cost of training healthcare personnel to use these advanced systems adds to the financial burden, making it harder to implement cutting-edge solutions across the healthcare system

- For instance, in 2023, a leading healthcare provider in Southeast Asia faced difficulties adopting advanced patient monitoring systems due to the high capital investment required, which delayed the rollout of critical monitoring solutions in rural hospitals

- The high costs of patient monitoring systems are a significant barrier to widespread adoption, especially in underserved regions, where affordability remains a key concern

Patient Monitoring Device/System/Equipment Market Scope

The market is segmented on the basis of product, type, process, deployment type, and end use.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By Process |

|

|

By Deployment Type |

|

|

By End Use |

|

In 2025, the multi parameter is projected to dominate the market with a largest share in product segment

The multi parameter segment is expected to dominate the patient monitoring device/system/equipment market with the largest market share of 23.69% in 2025 due to benefits offered by multi-parameter monitors, such as battery operation, low cost, and highly integrated silicon systems that combine multiple parameters into a compact, energy-efficient solution.

The On-Premise is expected to account for the largest share during the forecast period in deployment type segment

In 2025, the On-Premise segment is expected to dominate the market with the largest market share of 52.14% due to widespread adoption of sophisticated monitoring systems within hospital environments, which facilitate continuous monitoring of vital signs and early detection of potential health issues.

Patient Monitoring Device/System/Equipment Market Regional Analysis

“North America Holds the Largest Share in the Patient Monitoring Device/System/Equipment Market”

- North America is expected to dominate the patient monitoring device/system/equipment market with the largest market share of 42.54%, driven by the strong presence of leading industry players, highly advanced healthcare infrastructure, increasing adoption of remote and real-time patient monitoring technologies, and favorable reimbursement policies

- The U.S. holds the largest share within the region, supported by the widespread integration of portable and wireless monitoring systems, a high prevalence of chronic diseases such as cardiovascular conditions and diabetes

- Growing investments in telehealth, remote patient monitoring platforms, and AI-driven healthcare applications, along with regulatory initiatives promoting digital health adoption, are expected to further reinforce North America's dominant position in the global patient monitoring device/system/equipment market

“Asia-Pacific is Projected to Register the Highest CAGR in the Patient Monitoring Device/System/Equipment Market”

- Asia-Pacific is expected to witness the highest growth rate in the patient monitoring device/system/equipment market, fueled by rapid enhancements in healthcare infrastructure, increasing incidence of chronic diseases, rising awareness of continuous patient monitoring benefits, and expanding healthcare access in emerging economies

- Countries such as China, India, and Japan are key contributors to regional growth, supported by government initiatives promoting healthcare digitization, large-scale investments in hospital modernization, and the growing demand for cost-effective, portable monitoring devices in rural and urban settings

- Japan, recognized for its technological advancements and high healthcare standards, is actively adopting next-generation patient monitoring solutions, while China and India are experiencing a surge in demand driven by healthcare reforms, strategic public-private collaborations, and increased focus on telemedicine and home-based care services

Patient Monitoring Device/System/Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BioTelemetry (U.S.)

- Onduo LLC (U.S.)

- Medtronic (Ireland)

- Compumedics Limited (Australia)

- NIHON KOHDEN CORPORATION (Japan)

- Natus Medical Incorporated (U.S.)

- General Electric Company (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens (Germany)

- OMRON Corporation (Japan)

- Johnson and Johnson Services, Inc. (U.S.)

- Care Innovations (U.S.)

- Smiths Group plc (U.K.)

- Drägerwerk AG and Co. KGaA (Germany)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- CONTEC MEDICAL SYSTEMS CO., LTD (China)

- Fluke Deutschland GmbH (Germany)

- Analog Devices, Inc. (U.S.)

Latest Developments in Global Patient Monitoring Device/System/Equipment Market

- In April 2023, GE HealthCare’s CARESCAPE Canvas Patient Monitoring Platform received FDA clearance, with CARESCAPE Canvas and CARESCAPE ONE working together to create a scalable platform capable of adjusting monitoring capabilities based on each patient's disease severity, strengthening GE HealthCare's leadership in adaptive patient monitoring solutions

- In April 2023, Honeywell announced the development of a real-time health monitoring system that captures and records patients' vital signs both in hospitals and remotely, using a skin patch equipped with advanced sensing technology connected to mobile devices and an online dashboard, marking Honeywell’s expansion into the digital health space

- In January 2023, Senet and Telli Health launched the first remote patient monitoring (RPM) hardware powered by LoRaWAN, enabling healthcare providers to extend services to patients in remote and underserved areas globally, reinforcing their commitment to enhancing healthcare equity and smart home healthcare capabilities

- In June 2022, Abbott received FDA approval for the FreeStyle Libre 2 (iCGM) system for adults and children with diabetes in the U.S., which measures blood glucose levels every minute and offers real-time alarms, further solidifying Abbott’s position in continuous glucose monitoring technologies

- In May 2022, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. launched the mWear wearable patient monitoring device, offering both wearable and continuous monitoring modes for customized patient status updates, expanding Mindray’s innovative product offerings in the wearable healthcare device segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.