Global Passive Fire Protection Market

Market Size in USD Billion

CAGR :

%

USD

8.24 Billion

USD

11.55 Billion

2024

2032

USD

8.24 Billion

USD

11.55 Billion

2024

2032

| 2025 –2032 | |

| USD 8.24 Billion | |

| USD 11.55 Billion | |

|

|

|

|

What is the Global Passive Fire Protection Market Size and Growth Rate?

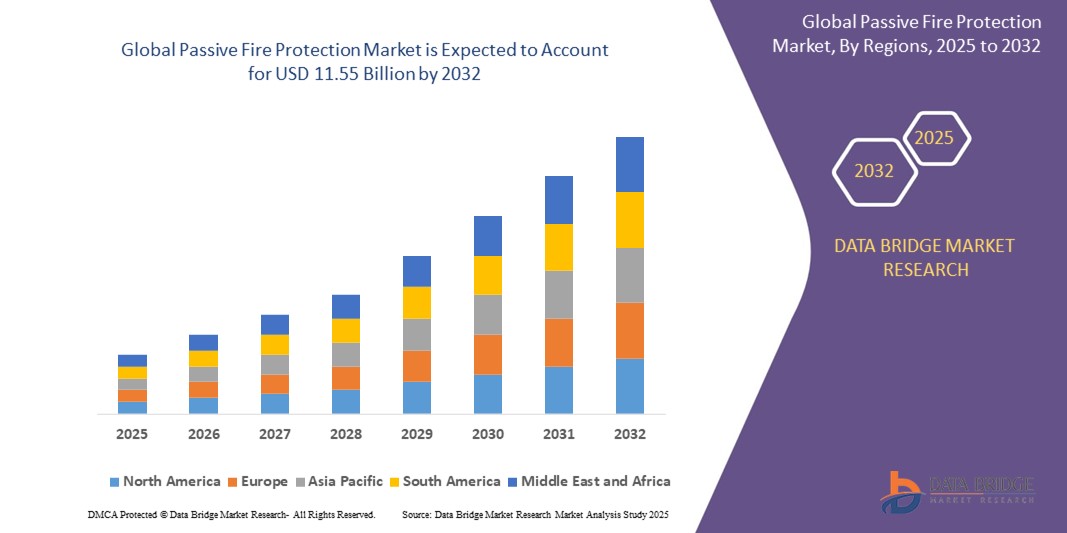

- The global passive fire protection market size was valued at USD 8.24 billion in 2024 and is expected to reach USD 11.55 billion by 2032, at a CAGR of 7.90% during the forecast period

- Market growth is driven by increasing urbanization, stringent fire safety regulations, and heightened awareness about building safety across residential, commercial, and industrial sectors

- Technological advancements in fire-resistant materials and coatings, along with rising demand for sustainable and eco-friendly passive fire protection solutions, are further accelerating market expansion

What are the Major Takeaways of Passive Fire Protection Market?

- Passive Fire Protection solutions, including fireproof coatings, claddings, and cementitious materials, play a crucial role in safeguarding structures by enhancing fire resistance and maintaining structural integrity during fire incidents

- The rising focus on regulatory compliance, building safety standards, and the need to protect critical infrastructure are key factors propelling demand for passive fire protection across various industries such as oil and gas, construction, transportation, and warehousing

- Asia-Pacific dominated the passive fire protection market with the largest revenue share of 40.52% in 2024, driven by rapid urbanization, expanding infrastructure projects, and stringent fire safety regulations across countries such as China, India, Japan, and South Korea

- North America is poised to grow at the fastest CAGR of 11.8% during the forecast period from 2025 to 2032, supported by rising investments in upgrading aging infrastructure and stringent fire safety regulations in the U.S. and Canada

- The cementitious materials segment dominated the market with the largest revenue share of 41.5% in 2024, driven by its high durability, cost-effectiveness, and widespread use in structural fireproofing applications

Report Scope and Passive Fire Protection Market Segmentation

|

Attributes |

Passive Fire Protection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Passive Fire Protection Market?

“Advancements in Fire-Resistant Materials and Regulatory Compliance”

- A prominent trend in the global passive fire protection market is the continuous development of innovative fire-resistant materials such as intumescent coatings, fireproof boards, and advanced sealants that improve safety and durability in construction and industrial applications

- For instance, intumescent coatings now offer better expansion rates and longer fire resistance durations, meeting increasingly stringent building codes and regulations worldwide. Leading manufacturers are integrating eco-friendly formulations to reduce environmental impact while maintaining performance

- Passive Fire Protection solutions are being designed for easier application and maintenance, enabling faster installation on critical infrastructure such as tunnels, bridges, and high-rise buildings. Enhanced testing standards and certifications are driving product adoption across commercial and industrial sectors

- Increasing urbanization and infrastructure development globally are boosting demand for fireproofing in both new builds and renovation projects. Integration of passive fire protection with overall building management systems is gaining traction for holistic safety management.

- The trend towards green construction is encouraging the use of sustainable fire protection materials that comply with environmental standards, pushing manufacturers to innovate. Companies such as 3M and Jotun are leading the way with products combining fire resistance and environmental compliance

- This evolving landscape is driving market players to invest in R&D, ensuring that Passive Fire Protection solutions meet future safety requirements while catering to growing construction and industrial needs

What are the Key Drivers of Passive Fire Protection Maret?

- Increasing global construction activities, especially in urban areas, are fueling demand for passive fire protection systems to ensure structural fire safety and comply with stringent regulations

- Rising awareness of fire hazards in commercial, residential, and industrial buildings is driving demand for passive solutions such as fire-resistant walls, coatings, and barriers

- Regulatory mandates and updated building codes in regions such as North America and Europe require installation of certified passive fire protection, expanding the market’s growth opportunities

- Growing investments in infrastructure projects such as airports, tunnels, and power plants emphasize robust fire safety systems, increasing demand for high-performance passive fire protection products

- The trend of retrofitting aging buildings with advanced fire protection measures is further propelling the market, as safety upgrades become mandatory in many countries

- Increasing focus on occupant safety and insurance compliance is encouraging builders and property owners to adopt comprehensive passive fire protection systems

Which Factor is challenging the Growth of the Passive Fire Protection Market?

- High installation and maintenance costs of advanced passive fire protection systems can deter adoption, especially in cost-sensitive emerging markets and smaller construction projects.

- The complexity of integrating multiple fire protection components while meeting diverse regulatory standards poses challenges for builders and manufacturers alike.

- Limited awareness in certain developing regions about the long-term benefits of passive fire protection versus initial costs slows market penetration.

- Supply chain disruptions and raw material price volatility can impact production costs and product availability, affecting market growth.

- The need for skilled labor to properly install and maintain passive fire protection systems remains a bottleneck in some regions.

- Overcoming these challenges will require increased education, cost optimization, and streamlined regulatory frameworks to accelerate adoption globally

How is the Passive Fire Protection Market Segmented?

The market is segmented on the basis of product and application.

• By Product

On the basis of product, the passive fire protection market is segmented into cementitious materials, intumescent coatings, fireproofing cladding, and others. The cementitious materials segment dominated the market with the largest revenue share of 41.5% in 2024, driven by its high durability, cost-effectiveness, and widespread use in structural fireproofing applications. Cementitious fireproofing offers excellent resistance to high temperatures and mechanical damage, making it a preferred choice for protecting steel frameworks in commercial and industrial buildings.

The intumescent coatings segment is expected to witness the fastest growth rate of 19.8% from 2025 to 2032, fueled by increasing demand for aesthetic, thin-film fire protection solutions that are easy to apply and environmentally friendly. Intumescent coatings are gaining popularity for their ability to expand and insulate surfaces during a fire, making them suitable for both new construction and retrofit projects.

• By Application

On the basis of application, the passive fire protection market is segmented into oil and gas, building and construction, industrial, transportation, warehousing, and others. The building and construction segment accounted for the largest market revenue share of 46.3% in 2024, supported by rising infrastructure development, urbanization, and stringent fire safety regulations in residential and commercial buildings worldwide.

The oil and gas segment is projected to experience the fastest CAGR from 2025 to 2032, driven by growing investments in energy infrastructure and the critical need for robust fire protection systems in hazardous environments. This sector demands specialized fireproofing solutions that comply with rigorous safety standards to mitigate fire risks and ensure operational continuity.

Which Region Holds the Largest Share of the Passive Fire Protection Market?

- Asia-Pacific dominated the passive fire protection market with the largest revenue share of 40.52% in 2024, driven by rapid urbanization, expanding infrastructure projects, and stringent fire safety regulations across countries such as China, India, Japan, and South Korea

- The region benefits from massive investments in commercial, residential, and industrial construction, alongside government initiatives promoting fire-resistant building materials and smart city developments

- Growing awareness of fire safety, combined with increasing manufacturing capabilities for passive fire protection products, positions Asia-Pacific as the leading market globally

China Passive Fire Protection Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by extensive urban development and rising regulatory standards for fire safety. The country’s role as a major manufacturing hub for fire protection materials supports affordability and availability, aiding widespread adoption. Government policies encouraging the use of advanced fireproofing solutions in public infrastructure and industrial facilities also drive market growth.

Japan Passive Fire Protection Market Insight

Japan’s passive fire protection market is expanding steadily due to the nation’s focus on disaster resilience and smart building technologies. The adoption of advanced fireproof coatings and materials is increasing, supported by regulatory frameworks that mandate fire safety enhancements in urban developments. Japan’s aging population further stimulates demand for reliable and easy-to-maintain fire protection systems.

Which Region is the Fastest Growing Region in the Passive Fire Protection Market?

North America is poised to grow at the fastest CAGR of 11.8% during the forecast period from 2025 to 2032, supported by rising investments in upgrading aging infrastructure and stringent fire safety regulations in the U.S. and Canada. The increasing retrofit of commercial and residential properties with passive fire protection systems, combined with heightened awareness of fire hazards, drives market expansion. Technological advancements and growing integration of fireproofing solutions with building automation systems further fuel growth. Government incentives and growing demand for eco-friendly, sustainable fireproofing materials are also key contributors to the market’s rapid growth in North America.

U.S. Passive Fire Protection Market Insight

The U.S. market accounted for the largest share within North America in 2024, driven by significant investments in commercial infrastructure and strict fire safety codes. The demand for cementitious materials and intumescent coatings is rising, particularly in sectors such as oil and gas, transportation, and healthcare. The trend towards sustainable building practices and smart fire safety systems is also accelerating market growth.

Europe Passive Fire Protection Market Insight

Europe is expected to witness moderate growth, with increasing adoption of passive fire protection solutions driven by strict regulations and focus on building safety. Countries such as Germany, the U.K., and France are key markets, emphasizing fire resilience in new constructions and renovations. The growing trend of green building certifications further supports demand for environmentally friendly fire protection materials.

Germany Passive Fire Protection Market Insight

Germany’s market growth is supported by strong regulatory frameworks and a growing focus on sustainability and innovation in construction. The adoption of advanced fireproofing technologies in industrial and commercial buildings is on the rise, alongside integration with building management systems.

U.K. Passive Fire Protection Market Insight

The U.K. market is growing steadily, driven by updated fire safety regulations and increased investments in public infrastructure and commercial real estate. Rising concerns about fire hazards in densely populated urban areas encourage the use of effective passive fire protection systems.

Which are the Top Companies in Passive Fire Protection Market?

The passive fire protection industry is primarily led by well-established companies, including:

- Lloyd Insulations (India) Limited (India)

- 3M (U.S.)

- Sharpfibre Limited (U.K.)

- Hempel A/S (Denmark)

- The Sherwin-Williams Company (U.S.)

- Rudolf Hensel GmbH (Germany)

- Hilti (Liechtenstein)

- Carboline Company (U.S.)

- Akzo Nobel N.V. (Netherlands)

- PPG Industries, Inc. (U.S.)

- Teknos Group (Finland)

- Kansai Paint Co., Ltd (Japan)

- Etex Group (Belgium)

- Contego International Inc. (U.S.)

- Isolatek International (U.S.)

- Envirograf Passive Fire Products (U.K.)

- Arabian Vermiculite Industries (Saudi Arabia)

- Albi Protective Coatings (U.S.)

- No-Burn, Inc. (U.S.)

- Bollom (U.K.)

What are the Recent Developments in Global Passive Fire Protection Market?

- In December 2023, Hempel A/S introduced HEET Dynamic, an intumescent coating estimation software designed to help engineers and estimators quickly and easily calculate the volume and thickness required for steel coatings. This innovation streamlines project planning and enhances accuracy in passive fire protection applications

- In February 2023, PPG Industries, Inc. launched PPG STEELGUARD 951, an epoxy intumescent fire protection coating tailored to meet modern architectural steel requirements, providing up to three hours of cellulosic fire resistance. The coating expands during a fire into a lightweight, foam-such as layer that safeguards steel structures and preserves their integrity, representing a significant advancement in fireproofing technology

- In January 2023, the Halton Group acquired full ownership of Flamgard Calidar, a South Wales-based designer of dampers and fire dampers, positioning the company for growth in green transition projects, nuclear power, and underground infrastructure. This acquisition strengthens Halton's capabilities in critical and sustainable infrastructure sectors

- In August 2022, Promat launched SYSTEMGLAS Stratum, a fire-rated walk-on floor made from structural glass with insulation ratings of EI30 or EI60, backed by independent testing to ensure reliability. The product’s performance is further guaranteed by Promat’s SYSTEMGLAS 360 Degree Wheel of Assurance, highlighting its quality and safety in demanding environments

- In October 2020, CharCoat Passive Fire Protection Inc., specializing in electrical fire protection and insulation coatings, announced the successful completion of another test for its CharCoat CC Electrical Cable Coating. This milestone demonstrates the company’s ongoing commitment to advancing effective fire protection solutions for electrical infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.