Global Parking Sensor Market

Market Size in USD Million

CAGR :

%

USD

3,224.45 Million

USD

10,390.19 Million

2021

2029

USD

3,224.45 Million

USD

10,390.19 Million

2021

2029

| 2022 –2029 | |

| USD 3,224.45 Million | |

| USD 10,390.19 Million | |

|

|

|

|

Parking Sensor Market Analysis and Size

Parking sensors are largest adopted sensors in the automotive sector since last few decades. These sensors prevent physical damages to the vehicle by notifying the driver when the automotive or vehicle approaches to an obstacle. Moreover, the “ultrasonic parking sensors” is the highest growing technology segment because it helps to overcome issues such as presence of visible parts on the vehicle’s bumper. Parking sensors are extensively used in several application such as passenger cars, light commercial vehicles, heavy commercial vehicles among others passenger cars, light commercial vehicles, heavy commercial vehicles among others because it help to prevent potential injury to pedestrians and useful in changing dimensions of the average car and light of reducing parking spaces.

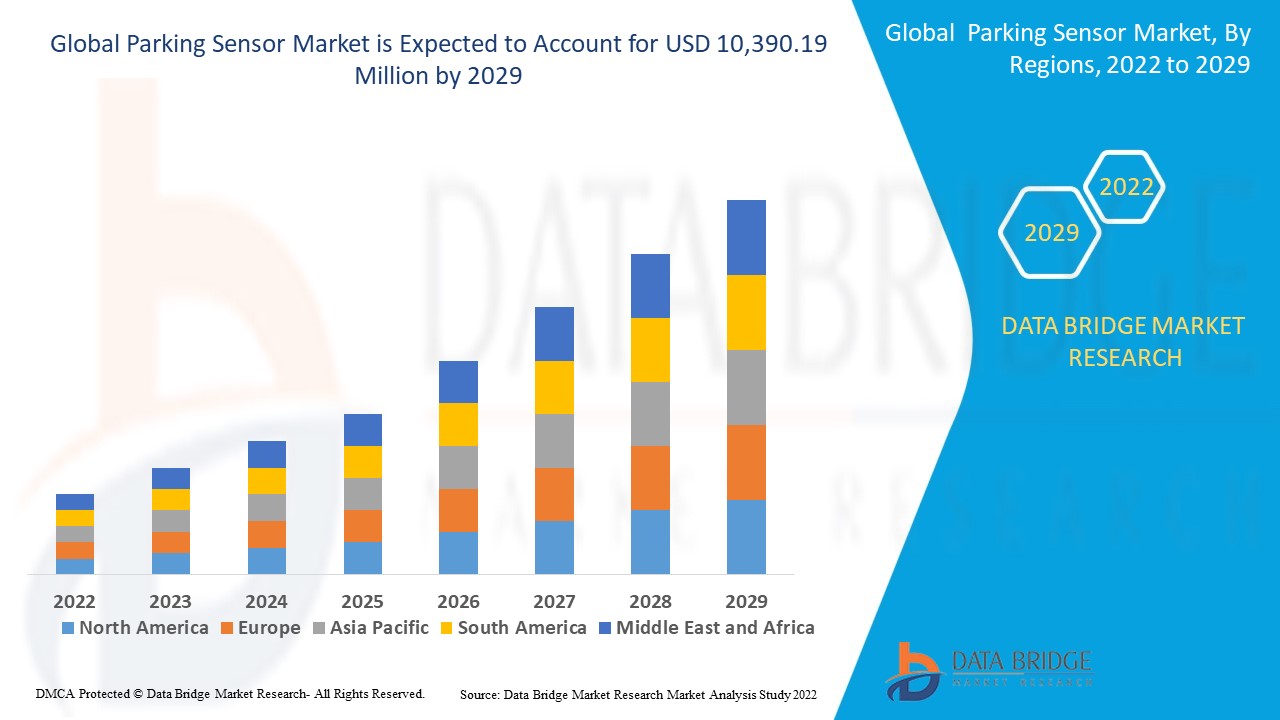

Data Bridge Market Research analyses that the parking sensor market was valued at USD 3,224.45 million in 2021 and is expected to reach USD 10,390.19 million by 2029, registering a CAGR of 15.75 % during the forecast period of 2022 to 2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Parking Sensor Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Reverse Parking, Front Parking, Others), Technology (Ultrasonic Sensors, Electromagnetic Sensors, Infrared Sensors, Others), Component (Displays, Control Modules, Sensors, Others), Sales Channel (OEM, Aftermarket), Application (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Robert Bosch GmbH (Germany), Aptiv (U.S.), Denso Corporation (Japan), Valeo (France), Autoliv (Sweden), Gentex Corporation (U.S.), Continental AG (Germany), Murata Manufacturing Co., Ltd. (Japan), Analog Devices, Inc. (U.S.), Freescale Semiconductor (U.S.), STMicroelectronics (Switzerland), NXP Semiconductors (Japan), Texas Instruments Incorporated (U.S.), Mercedes-Benz (Germany), Ford Motor Company (U.S.), Hyundai Motor India (south Korea), American Honda Motor Co., Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

Parking sensors are proximity sensors designed for road vehicles to alert the driver of obstacles while parking. These parking sensor use either ultrasonic or electromagnetic sensors. These systems invokes ultrasonic proximity detectors which measure the distances to nearby objects via sensors located in the rear or front bumper.

Global Parking Sensor Market Dynamics

Drivers

- Rising adoption of parking sensor for various applications

Parking sensor is widely used in several applications such as passenger cars, light commercial vehicles, and heavy commercial vehicles to reduce accidents and easily identify vacant parking spaces. This is one of the major factors expected to drive the growth of the parking sensor market.

- Growing regulations by government

The growing regulations by the government towards the safety of passengers is the major factor which are expected to drive the parking sensors market. For instance, The Hon Paul Fletcher MP, which was the former Australian minister of urban infrastructure had told that the government has initiated a project for installing the parking sensors and thus allowing the drivers to link the parking information which is available through mobile applications.

Furthermore, Increasing need of rear cameras in vehicles, rising usages of sensor due to its fuel efficiency, time effectiveness, cost saving and others, prevalence of advanced technology, growing awareness among the people regarding the benefits of safety technology which will likely to accelerate the growth of the parking sensor market in the forecast period of 2022-2029.

Opportunities

- Growing adoption of advanced technology

The significant growth of parking sensors is due to mounting automotive industry and increasing government regulations in several countries for adopting advanced safety standards in vehicles to easily identify vacant parking spaces and decrease accidents. For instance, it has been witnessed that the governments in some countries such as India, Russia and France are installing parking sensors for traffic management and parking space management.

Moreover, growing adoption of artificial intelligence and advanced driver assistance system (ADAS) will also create several opportunities to boost the parking sensor's growth during the forecast period.

Restraints/ Challenges

- High cost associated with parking sensor raw materials

Volatility in the cost of raw materials which is used for the manufacturing of parking sensor along with increasing cost of installation and research and development activities are acting as restraints for parking sensor market in the above mentioned forecasted period.

Complexity in probability and system design of component failure along with limited detection range are acting as market restraints for the demand of parking sensor and might hinder the growth of the global parking sensor market during the forecast period of 2022-2029.

This parking sensor market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the parking sensor market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Parking Sensor Market

The COVID-19 negatively impacted the parking sensor market due to the stringent rules for social distancing and lockdowns imposed by government in several nations. The partial shutdown of the business, uncertainty in economic growth and low consumer confidence has mainly impacted the demand of the parking sensor based technology. The decrease in the demand of automotive, and disruption in supply chain has hindered the growth of the parking sensor market during this pandemic along with the delay logistics activities. However, the parking sensor market is projected to recover its pace during the post pandemic scenario.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In August 2021, Continental company acquired a minority stake in Kopernikus automotive to create an autonomous parking procedure backed by intelligent infrastructure-based solutions and vehicle sensor data.

- In October 2020, Robert Bosch, LLC revealed its new ADAS and body electronics catalogue, that includes various features including park pilot ultrasonic parking sensors. This catalogue was designed with a goal to provide accurate information, high visibility and access to images and application data of around body electronics parts and 230 ADAS.

Global Parking Sensor Market Scope

The parking sensor market is segmented on the basis of type, technology, sales channel and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Reverse Parking

- Front Parking

- Others

Technology

- Ultrasonic Sensors

- Electromagnetic Sensors

- Infrared Sensors

- Others

Component

- Displays

- Control Modules

- Sensors

- Others

Sales Channel

- OEM

- Aftermarket

Application

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Parking Sensor Market Regional Analysis/Insights

The parking sensor market is analysed and market size insights and trends are provided by country, type, technology, sales channel and application as referenced above.

The countries covered in the parking sensor market report U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the parking sensor market in terms of revenue growth and market share. This is due to the growing cases of potential damage due to driver error along with increasing sensor application in this region's automotive sector.

Asia-Pacific is projected to be the fastest developing region during the forecast period of 2022-2029 due to growing demand for compact and mid-sized vehicles with safety features.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Parking Sensor Market Share Analysis

The parking sensor market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to parking sensor market.

Some of the major players operating in the parking sensor market are:

- Robert Bosch GmbH (Germany)

- Aptiv (U.S.)

- Denso Corporation (Japan)

- Valeo (France)

- Autoliv (Sweden)

- Gentex Corporation (U.S.)

- Continental AG (Germany)

- Murata Manufacturing Co., Ltd. (Japan)

- Analog Devices, Inc. (U.S.)

- Freescale Semiconductor (U.S.)

- STMicroelectronics (Switzerland)

- NXP Semiconductors (Japan)

- Texas Instruments Incorporated (U.S.)

- Mercedes-Benz (Germany)

- Ford Motor Company (U.S.)

- Hyundai Motor India (south Korea)

- American Honda Motor Co., Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PARKING SENSOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PARKING SENSOR MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PARKING SENSOR MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

6 GLOBAL PARKING SENSOR MARKET, BY TECHNOLOGY

6.1 OVERVIEW

6.2 ULTRASONIC SENSORS

6.2.1 BY APPLICATION

6.2.1.1. MANUAL PARKING

6.2.1.2. AUTOMATIC PARKING

6.2.1.3. LOW SPEED DRIVING

6.3 WIRELESS SENSOR NETWORK

6.4 ELECTROMAGNETIC/RADAR SENSORS

6.5 INFRARED SENSORS

6.6 PARKING CAMERAS

6.7 OTHERS

7 GLOBAL PARKING SENSOR MARKET, BY TYPE OF ALERTS

7.1 OVERVIEW

7.2 AUDIBLE BEEPS

7.2.1 HIGH TONED BEEPS

7.2.2 LOW-TONED BEEPS

7.3 LED DISPLAY

8 GLOBAL PARKING SENSOR MARKET, BY VEHICLE AUTONOMY

8.1 OVERVIEW

8.2 SEMI AUTONOMOUS VEHICLE

8.3 FULLY AUTONOMOUS VEHICLE

8.4 MANUAL VEHICLE

9 GLOBAL PARKING SENSOR MARKET, BY DESIGN TYPE

9.1 OVERVIEW

9.2 SURFACE MOUNT DESIGN

9.3 FLUSH MOUNT DESIGN

9.4 IN-GROUND SENSOR

10 GLOBAL PARKING SENSOR MARKET, BY PRICE

10.1 OVERVIEW

10.2 HIGH

10.3 MEDIUM

10.4 LOW

11 GLOBAL PARKING SENSOR MARKET, BY CONNECTIVITY TECHNOLOGIES

11.1 OVERVIEW

11.2 ZIGBEE

11.3 NB-IOT

11.4 SIGFOX

11.5 LORA WAN

11.6 Z-WAVE

11.7 OTHERS

12 GLOBAL PARKING SENSOR MARKET, BY DEPLOYMENT MODEL

12.1 OVERVIEW

12.2 SOFTWARE-AS-A-SERVICE (SAAS)

12.3 PLATFORM-AS-A-SERVICE (PAAS)

13 GLOBAL PARKING SENSOR MARKET, BY PARKING TYPE

13.1 OVERVIEW

13.2 FRONT PARKING

13.3 REVERSE PARKING

14 GLOBAL PARKING SENSOR MARKET, BY POSITION

14.1 OVERVIEW

14.2 PARKING SENSOR

14.2.1 ON-ROAD

14.2.1.1. BY APPLICATION

14.2.1.1.1. SHORT TERM PARKING

14.2.1.1.2. CURBSIDE

14.2.1.1.3. LOADING DOCKS

14.2.1.1.4. PARKING GARAGES

14.2.1.1.5. EV CHARGING

14.2.1.1.6. SURFACE PARKING LOTS

14.2.1.1.7. OTHERS

14.2.2 OFF-ROAD

14.2.2.1. RETAIL SHOPS

14.2.2.2. SHOPPING CENTER

14.2.2.3. OFFICES

14.2.2.4. OTHERS

14.3 AUTOMOTIVE SENSOR

14.3.1 BY TYPE

14.3.1.1. FRONT PARKING SENSOR

14.3.1.2. REVERSE PARKING SENSOR

15 GLOBAL PARKING SENSOR MARKET, BY VEHICLE TYPE

15.1 OVERVIEW

15.2 PASSENGER CARS

15.2.1 BY TYPE

15.2.1.1. HATCHBACK

15.2.1.2. SEDAN

15.2.1.3. MPV

15.2.1.4. SUV

15.2.1.5. CROSSOVER

15.2.1.6. COUPE

15.2.1.7. CONVERTIBLE

15.2.1.8. OTHERS

15.3 COMMERCIAL VEHICLES

15.3.1 LIGHT COMMERCIAL VEHICLES

15.3.1.1. BY TYPE

15.3.1.1.1. VANS

15.3.1.1.2. PASSENGER VANS

15.3.1.1.3. CARGO VANS

15.3.1.1.4. PICK UP TRUCKS

15.3.1.1.5. MINI BUS

15.3.1.1.6. OTHER

15.3.2 HEAVY COMMERCIAL VEHICLES

15.3.2.1. BY TYPE

15.3.2.1.1. TRUCKS

15.3.2.1.1.1 DUMP TRUCKS

15.3.2.1.1.2 CEMENT TRUCKS

15.3.2.1.1.3 TOW TRUCKS

15.3.2.1.1.4 OTHERS

15.3.2.1.2. COACHES

15.3.2.1.3. BUSES

15.4 ELECTRIC VEHICLE

15.4.1 BATTERY ELECTRIC VEHICLE (BEV)

15.4.2 HYBRID ELECTRIC VEHICLE (HEV)

15.4.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

15.4.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

16 GLOBAL PARKING SENSOR MARKET, BY SALES CHANNEL

16.1 OVERVIEW

16.2 OEM

16.3 AFTERMARKET

16.3.1 DISTRIBUTORS

16.3.2 DEALERS

16.3.3 OTHERS

17 GLOBAL PARKING SENSOR MARKET, BY APPLICATION

17.1 OVERVIEW

17.2 COLLISION DETECTION

17.3 DISTANCE DETECTION

17.4 HUMAN DETECTION

17.5 REAL-TIME PARKING SPACE INFORMATION

17.5.1 SMART PHONE

17.5.2 TABLET

17.5.3 DESKTOP

17.6 OTHERS

18 GLOBAL PARKING SENSOR MARKET, BY GEOGRAPHY

18.1 GLOBAL PARKING SENSOR MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.1.1 NORTH AMERICA

18.1.1.1. U.S.

18.1.1.2. CANADA

18.1.1.3. MEXICO

18.1.2 EUROPE

18.1.2.1. GERMANY

18.1.2.2. FRANCE

18.1.2.3. U.K.

18.1.2.4. ITALY

18.1.2.5. SPAIN

18.1.2.6. RUSSIA

18.1.2.7. TURKEY

18.1.2.8. BELGIUM

18.1.2.9. NETHERLANDS

18.1.2.10. SWITZERLAND

18.1.2.11. DENMARK

18.1.2.12. SWEDEN

18.1.2.13. POLAND

18.1.2.14. REST OF EUROPE

18.1.3 ASIA PACIFIC

18.1.3.1. JAPAN

18.1.3.2. CHINA

18.1.3.3. SOUTH KOREA

18.1.3.4. INDIA

18.1.3.5. AUSTRALIA AND NEW ZEALAND

18.1.3.6. SINGAPORE

18.1.3.7. THAILAND

18.1.3.8. MALAYSIA

18.1.3.9. INDONESIA

18.1.3.10. PHILIPPINES

18.1.3.11. TAIWAN

18.1.3.12. VIETNAM

18.1.3.13. REST OF ASIA PACIFIC

18.1.4 SOUTH AMERICA

18.1.4.1. BRAZIL

18.1.4.2. ARGENTINA

18.1.4.3. REST OF SOUTH AMERICA

18.1.5 MIDDLE EAST AND AFRICA

18.1.5.1. SOUTH AFRICA

18.1.5.2. EGYPT

18.1.5.3. SAUDI ARABIA

18.1.5.4. U.A.E

18.1.5.5. ISRAEL

18.1.5.6. KUWAIT

18.1.5.7. QATAR

18.1.5.8. REST OF MIDDLE EAST AND AFRICA

18.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

19 GLOBAL PARKING SENSOR MARKET,COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

19.5 MERGERS & ACQUISITIONS

19.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

19.7 EXPANSIONS

19.8 REGULATORY CHANGES

19.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

20 GLOBAL PARKING SENSOR MARKET, SWOT & DBMR ANALYSIS

21 GLOBAL PARKING SENSOR MARKET, COMPANY PROFILE

21.1 VALEO

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT DEVELOPMENT

21.2 TGS GROUP

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENT

21.3 PARKHELP TECHNOLOGIES

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENT

21.4 MURATA MANUFACTURING CO., LTD

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENT

21.5 STKR CONCEPTS.

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT DEVELOPMENT

21.6 STONKAM CO.,LTD.

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENT

21.7 HONEYWELL INTERNATIONAL INC.

21.7.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 RECENT DEVELOPMENT

21.8 SPACETI.

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENT

21.9 JABLOTRON

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 GEOGRAPHIC PRESENCE

21.9.4 PRODUCT PORTFOLIO

21.9.5 RECENT DEVELOPMENT

21.1 BORGWARNER INC. (DELPHI TECHNOLOGIES)

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 RECENT DEVELOPMENT

21.11 BANNER ENGINEERING CORP

21.11.1 COMPANY SNAPSHOT

21.11.2 REVENUE ANALYSIS

21.11.3 PRODUCT PORTFOLIO

21.11.4 RECENT DEVELOPMENT

21.12 ROBERT BOSCH GMBH

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENT

21.13 CLEVERCITI SYSTEMS GMBH

21.13.1 COMPANY SNAPSHOT

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 RECENT DEVELOPMENT

21.14 PLACEPOD

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENT

21.15 AG ELECTRONICS

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 RECENT DEVELOPMENT

21.16 SMART PARKING LTD

21.16.1 COMPANY SNAPSHOT

21.16.2 REVENUE ANALYSIS

21.16.3 PRODUCT PORTFOLIO

21.16.4 RECENT DEVELOPMENT

21.17 CONTINENTAL AG

21.17.1 COMPANY SNAPSHOT

21.17.2 REVENUE ANALYSIS

21.17.3 PRODUCT PORTFOLIO

21.17.4 RECENT DEVELOPMENT

21.18 TEXAS INSTRUMENTS INCORPORATED

21.18.1 COMPANY SNAPSHOT

21.18.2 REVENUE ANALYSIS

21.18.3 PRODUCT PORTFOLIO

21.18.4 RECENT DEVELOPMENT

21.19 ANALOG DEVICES, INC

21.19.1 COMPANY SNAPSHOT

21.19.2 REVENUE ANALYSIS

21.19.3 PRODUCT PORTFOLIO

21.19.4 RECENT DEVELOPMENT

21.2 STMICROELECTRONICS

21.20.1 COMPANY SNAPSHOT

21.20.2 REVENUE ANALYSIS

21.20.3 PRODUCT PORTFOLIO

21.20.4 RECENT DEVELOPMENT

21.21 NWAVE

21.21.1 COMPANY SNAPSHOT

21.21.2 REVENUE ANALYSIS

21.21.3 PRODUCT PORTFOLIO

21.21.4 RECENT DEVELOPMENT

21.22 SANDHAR

21.22.1 COMPANY SNAPSHOT

21.22.2 REVENUE ANALYSIS

21.22.3 PRODUCT PORTFOLIO

21.22.4 RECENT DEVELOPMENT

21.23 ANZENTRONIC

21.23.1 COMPANY SNAPSHOT

21.23.2 REVENUE ANALYSIS

21.23.3 PRODUCT PORTFOLIO

21.23.4 RECENT DEVELOPMENT

21.24 PROXEL

21.24.1 COMPANY SNAPSHOT

21.24.2 REVENUE ANALYSIS

21.24.3 PRODUCT PORTFOLIO

21.24.4 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 CONCLUSION

23 QUESTIONNAIRE

24 RELATED REPORTS

25 ABOUT DATA BRIDGE MARKET RESEARCH

Global Parking Sensor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Parking Sensor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Parking Sensor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.