Global Pallet Box Market

Market Size in USD Billion

CAGR :

%

USD

2.19 Billion

USD

3.02 Billion

2024

2032

USD

2.19 Billion

USD

3.02 Billion

2024

2032

| 2025 –2032 | |

| USD 2.19 Billion | |

| USD 3.02 Billion | |

|

|

|

|

Pallet Box Market Size

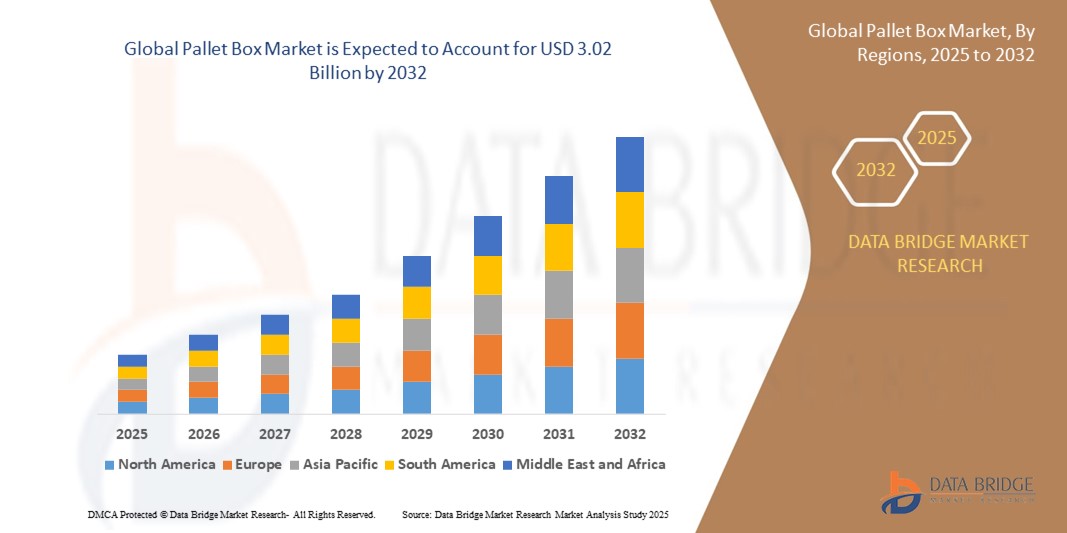

- The global pallet box market size was valued at USD 2.19 billion in 2024 and is expected to reach USD 3.02 billion by 2032, at a CAGR of 4.1% during the forecast period

- The market growth is largely fueled by increasing demand for reusable and durable packaging solutions across industries such as food and beverages, automotive, and chemicals, driven by a growing focus on supply chain efficiency and sustainability

- Furthermore, rising emphasis on regulatory compliance, cost-effective logistics, and the transition toward circular economy models is positioning pallet boxes as essential components in modern industrial packaging, thereby significantly accelerating market expansion

Pallet Box Market Analysis

- A pallet box is a large, rigid container typically made from materials such as wood, plastic, or metal. It is designed to be used with pallets for efficient handling and storage of goods. Pallet boxes are characterized by their sturdy construction and often feature collapsible or stackable designs to maximize storage space when not in use. They are commonly used in logistics, warehousing, and shipping industries to transport and store bulk goods

- The escalating demand for pallet boxes is primarily fueled by the rise in global trade, the growing emphasis on sustainable and circular packaging solutions, and the increasing need for efficient bulk handling and storage in both manufacturing and distribution environments

- North America dominated the pallet box market with a share of 29.5% in 2024, due to well-established industrial infrastructure, high-volume manufacturing activities, and the widespread use of reusable packaging solutions

- Asia-Pacific is expected to be the fastest growing region in the pallet box market during the forecast period due to rapid industrialization, expanding manufacturing capacity, and growing intra-Asia trade

- Standard size segment dominated the market with a market share of 64.4% in 2024, due to its compatibility with global logistics systems, ease of stacking, and regulatory compliance across international shipping standards. Standard pallet boxes simplify warehouse operations and offer economies of scale in production

Report Scope and Pallet Box Market Segmentation

|

Attributes |

Pallet Box Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pallet Box Market Trends

“Growing Focus on Sustainability”

- A significant and accelerating trend in the global pallet box market is the rising emphasis on sustainability and circular economy principles, driving industries to adopt reusable, recyclable, and eco-conscious packaging alternatives to reduce environmental impact and comply with evolving global regulations

- For instance, in November 2024, Heartland introduced carbon-neutral pallets utilizing a composite of recycled plastic and hemp fiber, offering a renewable and low-emission alternative to traditional wooden or virgin plastic pallets, signaling a shift toward bio-based packaging materials

- Pallet boxes made from HDPE, LDPE, and cardboard are witnessing increased demand, especially in food, pharmaceutical, and agricultural sectors, where hygiene, moisture resistance, and sustainability are prioritized in handling and storage

- Companies are increasingly implementing closed-loop and reverse logistics systems that facilitate the retrieval, cleaning, and reuse of pallet boxes, significantly reducing packaging waste, minimizing total lifecycle costs, and contributing to carbon footprint reduction

- The integration of RFID tags and IoT-enabled sensors into pallet boxes is further enhancing sustainable practices by enabling real-time asset tracking, reducing loss and damage, optimizing transportation routes, and supporting data-driven inventory management

- This trend is influencing procurement policies across sectors, with buyers giving preference to vendors offering eco-friendly, returnable transport packaging (RTP) solutions that align with corporate sustainability goals, regulatory requirements (such as the EU Packaging Waste Directive), and broader ESG commitments

Pallet Box Market Dynamics

Driver

“Increasing Demand for Efficient Logistics Solutions”

- The rising complexity of global supply chains, coupled with rapid industrialization and growing international trade, is creating a strong demand for high-performance, reliable, and space-optimized material handling solutions, positioning pallet boxes as a critical component of modern logistics systems

- For instance, PalletTrader and PopCapacity formed a strategic partnership aimed at digitizing pallet and warehousing operations, enabling seamless order tracking, inventory visibility, and load matching—key benefits in minimizing downtime and optimizing storage

- Pallet boxes offer superior stacking, structural integrity, and compatibility with forklifts, conveyors, and automated storage/retrieval systems (AS/RS), making them highly suitable for dynamic warehouse environments, distribution centers, and export operations across sectors

- Industries such as automotive, chemicals, engineering products, and agriculture are increasingly shifting toward pallet boxes for their ability to securely handle heavy, irregular, or bulk loads while reducing the risk of contamination, spillage, and product damage during transport

- The growth of pallet pooling and leasing models, where pallet boxes are shared and reused across multiple users in a controlled network, is driving broader market access, especially for businesses seeking efficiency without heavy capital investment in packaging assets

Restraint/Challenge

“High Investment Costs of Pallet Box”

- The initial capital required for procuring durable pallet boxes, particularly those made from high-grade plastics, metals, or reinforced composites, is significantly higher compared to single-use alternatives, acting as a major restraint for small to mid-sized enterprises and cost-sensitive industries

- For instance, small-scale businesses and emerging market players often face financial constraints that lead them to opt for traditional wooden pallets or corrugated containers, which offer lower upfront costs despite reduced durability and reusability

- Maintaining a fleet of reusable pallet boxes also involves recurring operational expenses including cleaning, inspection, repair, and reverse logistics, which can strain the operational budgets of companies lacking dedicated infrastructure or transport systems. Although pallet boxes offer long-term cost advantages through multiple reuse cycles, reduced waste, and fewer replacements, the high entry cost, especially when scaled across large operations, can delay adoption or limit deployment to select segments

- In rural regions and developing economies, inadequate awareness of the long-term return on investment (ROI), limited access to efficient pooling systems, and lack of supporting infrastructure hinder widespread market penetration

- To address this challenge, leading manufacturers and pooling providers are developing lightweight, modular pallet box designs, launching rental and subscription models, and offering scalable RTP solutions aimed at minimizing upfront expenditures while promoting sustainable logistics practices

Pallet Box Market Scope

The market is segmented on the basis of type, pallet type, material, load capacity, size, and end-use.

• By Type

On the basis of type, the pallet box market is segmented into wooden pallet box, plastic pallet box, metal pallet box, and paper pallet box. The wooden pallet box segment held the largest revenue share in 2024, primarily due to its widespread availability, cost-effectiveness, and high strength-to-weight ratio. Wooden pallet boxes are widely preferred across agriculture, construction, and manufacturing sectors for their durability, reusability, and ease of repair. Their biodegradability and compatibility with traditional handling systems further bolster their dominance.

The plastic pallet box segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for lightweight, hygienic, and moisture-resistant packaging solutions. Plastic pallet boxes are extensively adopted in food processing, pharmaceuticals, and export applications due to their resistance to contaminants, long service life, and recyclability. The rising emphasis on sustainability and smart supply chains also supports their expanding role in returnable transit packaging.

• By Pallet Type

On the basis of pallet type, the market is segmented into block pallet, stringer pallet, and customized pallet. The block pallet segment led the market in 2024, owing to its superior strength, four-way entry capability, and robust load-bearing performance, making it suitable for automated warehousing and high-volume logistics operations. These pallets are favored in retail and FMCG industries due to their standardized design and compatibility with forklifts and pallet jacks.

The customized pallet segment is expected to grow at the highest CAGR from 2025 to 2032, propelled by growing demand for tailor-made logistics solutions across specialized industries. Customized pallets offer flexibility in design, dimensions, and materials, aligning with evolving supply chain requirements and unique packaging standards in automotive, aerospace, and chemical industries.

• By Material

On the basis of material, the pallet box market is categorized into softwood, hardwood, HDPE, LDPE, stainless steel, aluminum, and cardboard. The hardwood segment accounted for the largest share in 2024 due to its superior strength, shock resistance, and long-lasting performance, particularly in export and industrial packaging. Hardwood materials are often used where durability and load-bearing capability are critical.

The HDPE segment is expected to register the fastest growth through 2032, driven by the shift toward reusable and chemically resistant pallet solutions. HDPE pallet boxes are widely used in food, chemical, and pharmaceutical industries due to their hygienic properties, structural consistency, and environmental sustainability through recyclability.

• By Load Capacity

On the basis of load capacity, the market is segmented into light-duty, medium-duty, and heavy-duty pallet boxes. The heavy-duty segment dominated the market in 2024, attributed to its application in industrial and logistics environments requiring robust containment and safe transport of heavy goods. Industries such as automotive, engineering, and building materials rely on heavy-duty pallet boxes for their load endurance and longevity.

The medium-duty segment is expected to grow at the fastest pace during the forecast period, fueled by the rising use in e-commerce, retail, and intra-warehouse movements where a balance between strength, mobility, and cost efficiency is required.

• By Size

On the basis of size, the pallet box market is divided into standard and custom. The standard size segment accounted for the largest revenue share of 64.4% in 2024, supported by its compatibility with global logistics systems, ease of stacking, and regulatory compliance across international shipping standards. Standard pallet boxes simplify warehouse operations and offer economies of scale in production.

The custom size segment is projected to grow at the fastest CAGR from 2025 to 2032, as businesses increasingly demand bespoke packaging solutions tailored to specific product dimensions, handling equipment, and storage layouts. Custom sizing enhances space utilization and reduces transit damage, especially in niche and high-value product categories.

• By End-Use

On the basis of end-use, the market is segmented into agriculture and allied industries, building and construction, chemical and pharmaceutical, food and beverages, engineering products, textile and handicraft, automotive, and other industries. The food and beverages segment led the market in 2024, driven by the sector’s high turnover, hygiene standards, and demand for reusable, contamination-resistant containers. Pallet boxes in this sector support cold chain logistics, efficient inventory handling, and compliance with safety regulations.

The automotive segment is expected to witness the highest growth rate through 2032, propelled by the increasing emphasis on safe, organized, and returnable packaging systems for components and parts. Pallet boxes support efficient sequencing, modular storage, and just-in-time delivery practices across OEMs and tier suppliers, reinforcing their strategic importance in automotive supply chains.

Pallet Box Market Regional Analysis

- North America dominated the pallet box market with the largest revenue share of 29.5% in 2024, driven by well-established industrial infrastructure, high-volume manufacturing activities, and the widespread use of reusable packaging solutions

- The region’s strong focus on sustainable supply chain practices and strict regulations regarding material handling and safety have led to increased adoption of pallet boxes across sectors such as automotive, food and beverages, and chemicals

- High demand for efficient storage, handling, and transportation systems, coupled with the presence of leading logistics companies, continues to support the growth of pallet box usage across both domestic and cross-border supply chains

U.S. Pallet Box Market Insight

The U.S. pallet box market captured the largest revenue share in 2024 within North America, driven by robust industrial output, technological integration in logistics, and increasing adoption of reusable transit packaging. With the rise of automation and smart warehousing, pallet boxes are being widely utilized for space optimization and product safety. Sectors such as automotive and food processing are particularly strong adopters, favoring heavy-duty and hygienic pallet solutions. The shift toward circular packaging models and environmental compliance is further accelerating the market.

Europe Pallet Box Market Insight

The Europe pallet box market is projected to grow at a steady CAGR throughout the forecast period, fueled by rising environmental regulations promoting recyclable and reusable packaging materials. The European Union’s packaging waste directives and growing adoption of pallet pooling systems are enhancing the use of pallet boxes across industries. Demand is especially strong in chemical, retail, and food sectors, where handling efficiency and safety are paramount. The integration of smart tracking solutions in logistics operations is also encouraging adoption across Western Europe.

U.K. Pallet Box Market Insight

The U.K. pallet box market is expected to grow steadily due to the country’s advanced logistics infrastructure, rising e-commerce activity, and push for sustainable packaging. Businesses are increasingly adopting returnable packaging solutions to meet carbon reduction goals and improve operational efficiency. The demand for hygienic, durable pallet boxes is particularly high in food and pharmaceutical supply chains. In addition, the U.K.'s focus on waste reduction and circular economy initiatives continues to drive the transition from single-use packaging to long-life pallet boxes.

Germany Pallet Box Market Insight

The Germany pallet box market is anticipated to expand at a considerable CAGR during the forecast period, supported by the country’s strong manufacturing base and highly regulated logistics environment. With Germany being a key exporter, pallet boxes are widely used for safe and compliant transport of goods. German industries favor robust and sustainable pallet solutions, especially in automotive, chemicals, and engineering sectors. The push toward Industry 4.0 and automation in warehousing is also boosting demand for smart, durable pallet box systems.

Asia-Pacific Pallet Box Market Insight

The Asia-Pacific pallet box market is set to grow at the fastest CAGR from 2025 to 2032, led by rapid industrialization, expanding manufacturing capacity, and growing intra-Asia trade. Countries such as China, India, and Japan are increasingly adopting pallet boxes for their cost-efficiency, reusability, and compatibility with automated systems. Government support for logistics modernization and rising demand from e-commerce, automotive, and agriculture sectors are accelerating adoption. The emergence of local pallet box manufacturers is also driving down costs and improving accessibility.

Japan Pallet Box Market Insight

The Japan pallet box market is expanding due to the country's emphasis on quality, precision logistics, and compact storage solutions. Japanese companies prioritize durability, hygiene, and space optimization—making pallet boxes an ideal fit for sectors such as automotive, electronics, and food processing. In addition, Japan’s focus on smart factories and lean supply chains is encouraging the adoption of high-performance pallet solutions, particularly those made from plastic and metal for long-term reuse.

China Pallet Box Market Insight

The China pallet box market held the largest revenue share within Asia-Pacific in 2024, bolstered by the country's dominant position in global manufacturing and logistics. As supply chains become more sophisticated, demand for standardized and reusable packaging is surging across construction, consumer goods, and export-oriented industries. The government’s push for greener logistics practices and the strong presence of domestic pallet box producers ensure a robust and scalable market. Rising investments in warehouse automation are also increasing the appeal of pallet boxes in China.

Pallet Box Market Share

The pallet box industry is primarily led by well-established companies, including:

- Brambles (Australia)

- Schoeller Allibert (France)

- DS Smith (U.K.)

- Myers Industries (U.S.)

- CABKA (Germany)

- PGS Group (France)

- PalletOne (U.S.)

- ORBIS Corporation (U.S.)

- Dynawest (Spain)

- Rehrig Pacific Company (U.S.)

- TranPak (U.S.)

Latest Developments in Global Pallet Box Market

- In January 2025, UFP Industries, through its affiliate UFP Packaging, acquired the assets of C&L Wood Products, a pallet and mulch manufacturer based in Hartselle, Alabama. This strategic acquisition strengthens UFP’s pallet manufacturing footprint in the Southeast U.S., enhancing regional supply capabilities and supporting market expansion through improved production capacity and distribution efficiency

- In January 2024, Smurfit Kappa introduced new eco-friendly packaging solutions aimed at improving the sustainability of its pallet boxes. This initiative reflects the rising demand for environmentally responsible packaging and reinforces Smurfit Kappa’s position in the market as a key player driving innovation in sustainable pallet box solutions

- In February 2024, PalletTrader and PopCapacity entered a strategic partnership to digitize the pallet and warehousing industry. By integrating digital tools for pallet management, this collaboration is expected to boost operational efficiency and transparency in supply chains, accelerating the adoption of smart, tech-enabled pallet solutions

- In November 2024, Heartland launched a new line of carbon-neutral pallets made from recycled plastic and reinforced with hemp fiber. This innovation contributes to the growing shift toward sustainable alternatives in the pallet box market and highlights the increasing role of bio-based and recycled materials in meeting environmental compliance and circular economy goals

- In January 2023, Goplasticpallets.com expanded its portfolio of foldable pallet boxes, designed to optimize space and reduce costs when transporting bulk goods. This development addresses the market's need for efficient and cost-effective packaging solutions, particularly for sectors dealing with large-volume logistics and storage challenges

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pallet Box Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pallet Box Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pallet Box Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.