Global Packaging Resins Market

Market Size in USD Billion

CAGR :

%

USD

329.53 Billion

USD

557.78 Billion

2024

2032

USD

329.53 Billion

USD

557.78 Billion

2024

2032

| 2025 –2032 | |

| USD 329.53 Billion | |

| USD 557.78 Billion | |

|

|

|

|

Packaging Resins Market Size

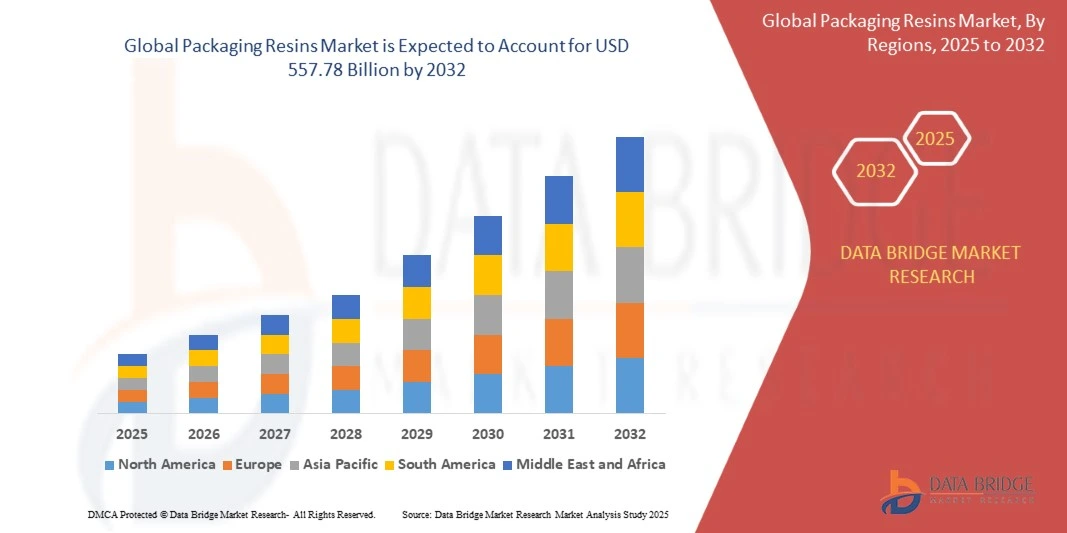

- The global packaging resins market size was valued at USD 329.53 billion in 2024 and is expected to reach USD 557.78 billion by 2032, at a CAGR of 6.8% during the forecast period

- The market growth is largely fueled by the increasing demand for lightweight, durable, and cost-effective packaging solutions across food and beverage, healthcare, and consumer goods industries. Rising consumption of packaged products, rapid urbanization, and the expansion of e-commerce are driving greater reliance on resin-based packaging materials globally

- Furthermore, the growing shift toward sustainable and recyclable packaging solutions is pushing manufacturers to innovate with advanced resin formulations. These converging factors are accelerating the adoption of packaging resins, thereby significantly boosting the market’s growth

Packaging Resins Market Analysis

- Packaging resins are versatile polymer materials used in producing flexible films, rigid containers, bottles, and industrial packaging applications. They offer properties such as durability, chemical resistance, and lightweight performance, making them essential for protecting goods, extending shelf life, and ensuring safe transportation

- The rising demand for packaging resins is primarily fueled by the growth of the packaged food industry, increasing healthcare packaging needs, and expanding e-commerce shipments. Additionally, sustainability initiatives and regulations promoting recyclable and eco-friendly materials are shaping the future of resin innovation in the packaging sector

- Asia-Pacific dominated the packaging resins market with a share of over 50% in 2024, due to the rapid growth of food and beverage consumption, expansion of e-commerce packaging, and the presence of large-scale plastic resin manufacturing hubs

- North America is expected to be the fastest growing region in the packaging resins market during the forecast period due to the rising consumption of packaged foods, increasing healthcare packaging demand, and growth in online retail shipments

- Polypropylene (PP) segment dominated the market with a market share of 31.9% in 2024, due to its widespread use in flexible packaging, rigid containers, and labeling applications. PP offers excellent clarity, high chemical resistance, and lightweight properties, making it the preferred material across multiple end-use industries. Its cost-effectiveness and recyclability also enhance its adoption in sustainable packaging solutions. With growing demand from food, beverage, and consumer goods packaging, PP remains a critical material in both developed and emerging markets

Report Scope and Packaging Resins Market Segmentation

|

Attributes |

Packaging Resins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Packaging Resins Market Trends

Increasing Focus on Sustainability

- The packaging resins market is being strongly influenced by the rising demand for sustainable packaging solutions as consumers and regulators seek materials with reduced environmental impact. The shift toward recyclable, biodegradable, and bio-based resins is reshaping product development, emphasizing circular economy principles and material efficiency across industries such as food & beverage, pharmaceuticals, and consumer goods

- For instance, ExxonMobil Chemical and SABIC are leading innovations with lines of certified renewable polypropylene and chemically recycled polyethylene resins, enabling brands to meet sustainability commitments without compromising performance. Green Dot Bioplastics introduced compostable resin grades compatible with existing packaging processes, illustrating the growing traction of biodegradable alternatives in flexible and rigid packaging

- Technological advancements are enhancing barrier properties, clarity, and strength in recycled and bio-based resins, allowing expanded use in sensitive food packaging applications where product preservation and shelf life extension are critical. Smart packaging integrations such as IoT sensors and QR codes are also being incorporated to improve transparency and consumer engagement

- Industry-wide collaborations involving resin producers, converters, brand owners, and recyclers are accelerating adoption of sustainable resin products and supply chain transparency. Initiatives in resin-to-resin recycling, deposit-return systems, and renewable content certification are becoming mainstream, driving ongoing market transformation

- Rising e-commerce growth requires durable, lightweight, and protective packaging materials, further fueling demand for high-performance, sustainable resins. Consumer preference for convenience and safety, coupled with regulatory mandates on plastic waste reduction, underscore the long-term importance of sustainable resin adoption

- The sustainable packaging focus is poised to be the defining trend shaping the packaging resins market with continued innovation, expanding applications, and regulatory momentum driving exponential growth and widespread acceptance

Packaging Resins Market Dynamics

Driver

Rising Consumer Demand for Convenience

- Growing consumer preference for convenient, ready-to-use, and on-the-go packaging formats is a significant driver propelling the packaging resins market. Resins enable the production of flexible packaging, resealable containers, and lightweight films that support extended shelf life and ease of use

- For instance, rapid growth in single-serve snack packaging and ready meals markets is driving resin demand, with manufacturers such as Dow and LyondellBasell tailoring resins for flexible and multilayer packaging solutions. The surge in e-commerce has further elevated demand for durable and protective resin-based packaging to ensure safe product delivery

- Consumers increasingly seek packaging formats that offer convenience without compromising product integrity, pushing demand for innovations such as microwavable, recyclable, and peelable packaging. These features enhance user experience and align with busy lifestyles, further expanding resin applications

- Packaging resins are crucial in maintaining product freshness, preventing contamination, and minimizing food waste, reinforcing their importance in convenience-driven markets. The continuing emphasis on functional packaging solutions supports rising resin consumption across food, beverage, and personal care industries

- This consumer-driven demand for convenience packaging forms a core growth engine in the packaging resins market, encouraging resin producers and converters to innovate rapidly and expand offerings to meet evolving consumer behavior

Restraint/Challenge

Fluctuating Raw Material Prices

- Volatility in raw material pricing remains a significant restraint for the packaging resins market, impacting production costs and profitability across the supply chain. Changes in prices of key petrochemical feedstocks such as ethylene, propylene, and benzene lead to unpredictable cost structures for resin manufacturers

- For instance, global supply disruptions and geopolitical tensions have periodically caused sharp fluctuations in resin prices, complicating procurement and pricing strategies for major players such as BASF, Dow, and SABIC. Fluctuating raw material prices also affect contract negotiations and margins for brand owners and converters

- Raw material price instability hinders long-term investment planning and innovation efforts within the packaging resin industry. It increases uncertainty and risk, particularly for smaller manufacturers and startups striving to compete on sustainability and performance attributes

- The market’s dependency on fossil-derived feedstocks exacerbates exposure to crude oil price variability, though growing bio-based resin production offers some mitigation potential. However, scaling bio-based alternatives remains capital intensive and subject to agricultural commodity price swings

- In conclusion, while demand for packaging resins is strong, raw material price volatility poses challenges to stable market growth. Strategic sourcing, diversified feedstock development, and cost optimization will be crucial for market resilience and continued innovation

Packaging Resins Market Scope

The market is segmented on the basis of type and application.

• By Type

On the basis of type, the packaging resins market is segmented into Low Density Polyethylene (LDPE), Polypropylene (PP), High Density Polyethylene (HDPE), Polystyrene (PS) and Expanded Polystyrene (EPS), Polyethylene Terephthalate (PET), and Polyvinyl Chloride (PVC). The Polypropylene (PP) segment dominated the largest market revenue share of 31.9% in 2024, attributed to its widespread use in flexible packaging, rigid containers, and labeling applications. PP offers excellent clarity, high chemical resistance, and lightweight properties, making it the preferred material across multiple end-use industries. Its cost-effectiveness and recyclability also enhance its adoption in sustainable packaging solutions. With growing demand from food, beverage, and consumer goods packaging, PP remains a critical material in both developed and emerging markets.

The Polyethylene Terephthalate (PET) segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for PET bottles and containers in the beverage and healthcare industries. PET’s strength, transparency, and barrier properties against gases make it a superior choice for carbonated drinks, bottled water, and pharmaceutical packaging. Increasing consumer preference for lightweight, recyclable, and eco-friendly materials further accelerates the adoption of PET in sustainable packaging initiatives. The push from governments and brands towards circular economy practices is also expected to strengthen PET demand over the forecast period.

• By Application

On the basis of application, the packaging resins market is segmented into Food and Beverage, Consumer Goods, Healthcare, Industrial, and Others. The Food and Beverage segment dominated the largest market revenue share in 2024, supported by the massive consumption of packaged food products, bottled drinks, and ready-to-eat meals. Rising urbanization, growing middle-class populations, and changing dietary patterns are boosting demand for durable, safe, and lightweight packaging solutions. The need for extended shelf life and protection against contamination has further driven reliance on resins in food and beverage packaging.

The Healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for safe, sterile, and tamper-evident packaging for medicines, medical devices, and diagnostic products. Increasing healthcare expenditure, advancements in pharmaceutical manufacturing, and the growing trend of personalized medicine are key factors accelerating the adoption of high-performance resins. Moreover, the global emphasis on ensuring product integrity and patient safety continues to push innovations in resin-based healthcare packaging solutions, positioning this segment for robust future expansion.

Packaging Resins Market Regional Analysis

- Asia-Pacific dominated the packaging resins market with the largest revenue share of over 50% in 2024, driven by the rapid growth of food and beverage consumption, expansion of e-commerce packaging, and the presence of large-scale plastic resin manufacturing hubs

- The region’s cost-effective production ecosystem, rising investments in packaging innovation, and growing exports of resin-based packaging materials are accelerating market expansion

- The availability of skilled labor, supportive government initiatives, and fast-paced industrialization across emerging economies are contributing to the increasing demand for packaging resins in multiple end-use industries

China Packaging Resins Market Insight

China held the largest share in the Asia-Pacific packaging resins market in 2024, supported by its dominance in plastic resin production and processing capacities. The country’s strong consumer base, growing packaged food and beverage sector, and leadership in e-commerce packaging drive significant resin consumption. Government focus on recycling infrastructure and the promotion of sustainable packaging also enhance the long-term growth outlook.

India Packaging Resins Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, propelled by surging demand from food and beverage packaging, rapid expansion of FMCG, and increasing healthcare packaging needs. Initiatives promoting domestic resin production, rising middle-class consumption, and booming retail and e-commerce activities are boosting adoption. The government’s push toward sustainable packaging solutions and increasing investments in recycling infrastructure further reinforce market momentum.

Europe Packaging Resins Market Insight

The Europe packaging resins market is expanding steadily, supported by stringent environmental regulations, high demand for recyclable packaging materials, and increasing emphasis on circular economy initiatives. The region’s mature food and pharmaceutical industries drive consistent demand for high-quality, compliant packaging solutions. Ongoing R&D investments into biodegradable and bio-based resin alternatives are further shaping market dynamics.

Germany Packaging Resins Market Insight

Germany’s packaging resins market is driven by its advanced manufacturing base, leadership in sustainable packaging innovation, and strong demand from the country’s food and healthcare industries. The presence of key chemical and packaging firms, combined with well-established recycling infrastructure, supports long-term market growth. Demand for high-performance resins in industrial and consumer packaging also contributes to its leading role in Europe.

U.K. Packaging Resins Market Insight

The U.K. market benefits from strong consumer demand for packaged goods, government policies promoting sustainable packaging, and rising adoption of recyclable resins. Efforts to reduce single-use plastics are creating opportunities for high-performance and bio-based resin alternatives. The presence of a dynamic retail sector, expanding e-commerce penetration, and a growing focus on localized production strengthen market demand.

North America Packaging Resins Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by the rising consumption of packaged foods, increasing healthcare packaging demand, and growth in online retail shipments. Strong focus on sustainable and recyclable resins, coupled with rapid adoption of advanced packaging technologies, is fueling regional expansion. Supportive regulations and industry collaborations are further accelerating market adoption.

U.S. Packaging Resins Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its extensive packaged food industry, leadership in healthcare packaging, and strong presence of resin manufacturers. The country’s robust R&D ecosystem, investments in sustainable packaging solutions, and expanding e-commerce sector are key growth drivers. Increasing regulatory emphasis on recycling and eco-friendly packaging further strengthens the U.S.'s dominant position in the region.

Packaging Resins Market Share

The packaging resins industry is primarily led by well-established companies, including:

- China Petroleum & Chemical Corporation (China)

- Exxon Mobil Corporation (U.S.)

- Lyondellbasell Industries Holdings B.V (Netherlands)

- SABIC (Saudi Arabia)

- PetroChina Company Limited (China)

- Borealis AG (Austria)

- Braskem (Brazil)

- Dow (U.S.)

- DuPont (U.S.)

- Indorama Ventures Public Company Limited (Thailand)

- MG Chemicals (Canada)

- Arkema (France)

- BASF SE (Germany)

- BOROUGE (UAE)

- DAK Americas (U.S.)

- Far Eastern New Century Corporation (Taiwan)

- INEOS (U.K.)

- BY Sanfame Group (China)

- Reliance Industries Ltd. (India)

Latest Developments in Packaging Resins Market

- In June 2024, Dow announced a collaboration with RKW Group, a German producer of polyolefin-based films, to launch two new grades of resins under its Revoloop recycled plastic resin range. One of these grades contains up to 100 percent post-consumer recycled (PCR) plastic, marking a significant advancement in sustainable packaging solutions. This development is expected to strengthen Dow’s leadership in the circular economy by expanding the availability of high-quality recycled resins. By being approved for use in non-food contact packaging, the initiative reduces reliance on virgin plastics and also supports growing industry and regulatory demand for eco-friendly packaging materials

- In August 2022, BASF partnered with Nippon Paint China, a leading coatings manufacturer, to introduce an eco-friendly industrial packaging solution for dry-mixed mortar products. The packaging utilizes BASF's Joncryl High-Performance Barrier (HPB), a water-based acrylic dispersion that replaces traditional non-recyclable barriers. This collaboration reflects the market’s shift toward sustainable packaging that balances performance with recyclability. The solution highlights how resin producers are innovating to meet rising environmental regulations and consumer demand for greener packaging alternatives in the industrial sector

- In October 2020, LyondellBasell and Sasol signed a USD 2 billion agreement to form Louisiana Integrated PolyEthylene JV LLC, acquiring half of Sasol's low and linear low-density polyethylene plants, ethane cracker, and related infrastructure. This move significantly expanded LyondellBasell’s resin production capacity and enhanced supply chain integration in North America. The deal positioned the joint venture as a stronger competitor in the global packaging resins market, enabling improved economies of scale, wider product availability, and greater ability to serve the fast-growing demand for polyethylene-based packaging solutions

- In September 2020, ExxonMobil introduced its foamable Achieve Advanced Polypropylene, designed as an affordable and sustainable solution for high-volume food and beverage, industrial, and automotive packaging applications. This innovation addressed the industry’s growing need for lightweight materials with reduced environmental impact. By enabling improved resource efficiency without compromising performance, the development strengthened ExxonMobil’s role in advancing next-generation resin solutions and supported the broader industry trend toward cost-effective, sustainable packaging technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Packaging Resins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Packaging Resins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Packaging Resins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.