Global Over The Counter Otc Drugs Market

Market Size in USD Million

CAGR :

%

USD

190.78 Million

USD

318.12 Million

2024

2032

USD

190.78 Million

USD

318.12 Million

2024

2032

| 2025 –2032 | |

| USD 190.78 Million | |

| USD 318.12 Million | |

|

|

|

|

Over the Counter (OTC) Drugs Market Size

- The global over the counter (OTC) drugs market size was valued at USD 190.78 Million in 2024 and is expected to reach USD 318.12 million by 2032, at a CAGR of 6.60% during the forecast period

- The market growth is largely fueled by the increasing shift towards self-medication and the growing trust in OTC products for managing minor ailments, supported by expanding retail availability and favorable regulatory frameworks across regions

- Furthermore, rising consumer demand for affordable, accessible, and effective healthcare solutions—especially in light of rising healthcare costs and aging populations—is establishing OTC drugs as a reliable first line of treatment. These converging factors are accelerating the uptake of OTC drug products, thereby significantly boosting the industry’s growth

Over the Counter (OTC) Drugs Market Analysis

- Over the Counter (OTC) drugs, which are medications available without a prescription, are increasingly vital components of global healthcare systems due to their accessibility, cost-effectiveness, and role in promoting self-care for common health issues such as colds, allergies, gastrointestinal problems, and pain management

- The escalating demand for OTC drugs is primarily fueled by growing consumer awareness of health and wellness, increased self-medication trends, and expanded availability of these products through online and retail pharmacies

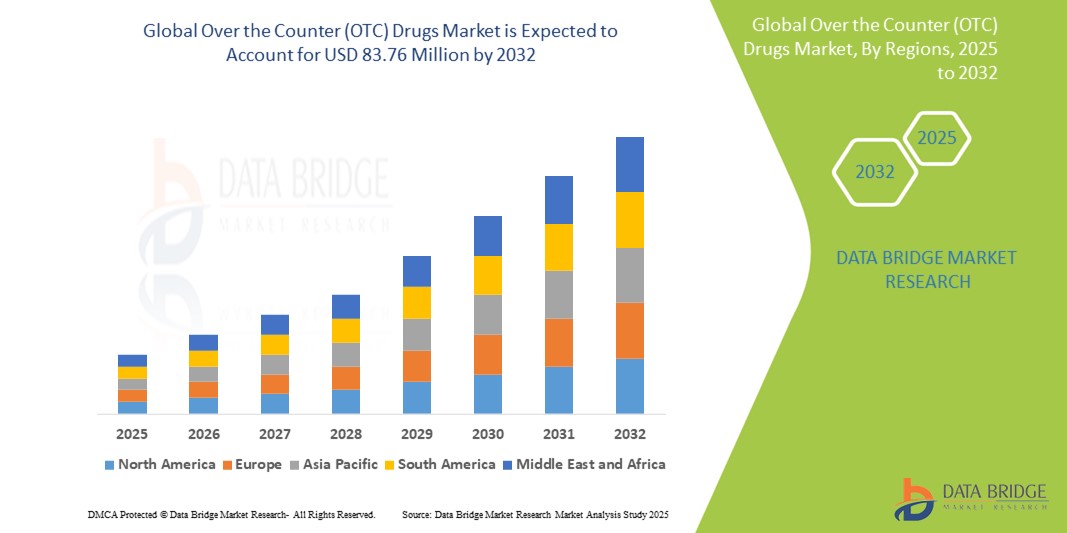

- North America dominates the over the counter (OTC) drugs market with the largest revenue share of 38.3% in 2024, characterized by mature healthcare infrastructure, high consumer awareness, and widespread availability of OTC products across well-established retail chains and e-commerce platforms

- Asia-Pacific is expected to be the fastest growing region in the over the counter (OTC) drugs market during the forecast period due to a rising middle-class population, improving healthcare access, and an expanding pharmacy retail network, particularly in countries such as China and India

- Cold, cough and flu products segment dominates the over the counter (OTC) drugs market with a market share of 26% in 2024, driven by the seasonal prevalence of respiratory infections and the consistent demand for symptomatic relief, further amplified by pandemic-related health consciousness and product innovations

Report Scope and Over the Counter (OTC) Drugs Market Segmentation

|

Attributes |

Over the Counter (OTC) Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Over the Counter (OTC) Drugs Market Trends

“Rising Demand for Personalized and Preventive Self-Care Solutions”

- A significant and accelerating trend in the global OTC drugs market is the rising consumer preference for personalized and preventive self-care solutions, driven by increasing health awareness, digital health innovations, and a growing desire to manage minor health conditions independently without professional medical intervention

- For instance, major players such as Johnson & Johnson and Bayer are expanding their OTC portfolios to include personalized vitamins, digestive health solutions, and sleep aids tailored to specific demographics and health profiles. Digital platforms now offer AI-powered tools and health apps that guide consumers in selecting the right OTC products based on symptoms, lifestyle, and health goals

- Digitalization and data analytics are enabling OTC brands to offer tailored health recommendations through e-commerce platforms and mobile apps. For instance, platforms such as Hims & Hers and Nurx provide symptom-based OTC product recommendations, enhancing user experience through personalization and convenience

- This trend is further bolstered by the increasing number of Rx-to-OTC switches, where formerly prescription-only medications become available over the counter. These switches reflect regulatory support for consumer-driven healthcare and expand the OTC product range to include treatments for chronic conditions such as allergies, heartburn, and high cholesterol

- The growing adoption of wearable health technologies and health monitoring apps also supports the preventive self-care trend by allowing consumers to track symptoms and act promptly with OTC treatments. For instance, devices such as fitness trackers often integrate with wellness apps that recommend OTC solutions for sleep support or pain relief

- Consequently, OTC brands are responding to this trend by investing in product innovations such as sugar-free, vegan, or organic formulations, personalized supplement regimens, and user-friendly packaging. The demand for convenient, transparent, and self-directed healthcare solutions is rapidly transforming the OTC drugs landscape across global markets

Over the Counter (OTC) Drugs Market Dynamics

Driver

“Rising Self-Medication Trends and Expanding Consumer Access to Healthcare”

- The growing global inclination towards self-medication for the treatment of minor health conditions, alongside the expansion of consumer access to healthcare products through various retail and digital channels, is a significant driver for the increasing demand for OTC drugs

- For instance, in February 2024, the U.S. FDA approved the first daily oral contraceptive (Opill) for over-the-counter sale without a prescription, marking a major milestone in making essential medications more accessible. Such regulatory advancements are expected to further drive the OTC drugs industry growth during the forecast period

- As healthcare costs continue to rise and healthcare systems in many regions remain overburdened, consumers are increasingly turning to cost-effective OTC solutions for immediate symptom relief without the need for physician visits. This shift is bolstered by greater awareness and education regarding self-care and the safety of OTC medications

- In addition, the global expansion of pharmacies, supermarkets, and e-commerce platforms has significantly improved the accessibility of OTC drugs. The proliferation of online pharmacies with home delivery options and symptom-based product search tools enhances convenience for users, encouraging frequent OTC product usage

- The demand is also fueled by changing consumer lifestyles, a growing focus on preventive healthcare, and the availability of specialized OTC product ranges for conditions such as allergies, digestive issues, pain relief, and sleep disorders. This trend is particularly strong in urban populations and aging demographics

- Furthermore, the introduction of innovative, easy-to-use packaging, clear dosage instructions, and targeted marketing by key players supports consumer confidence in self-medication, contributing to sustained growth in the OTC drugs market across both developed and developing regions

Restraint/Challenge

“Risk of Misuse, Misdiagnosis, and Regulatory Limitations”

- Concerns surrounding the potential misuse and incorrect self-diagnosis associated with OTC drug use pose a significant challenge to the broader adoption and safe utilization of these products. While OTC drugs are generally safe when used as directed, the absence of medical supervision increases the risk of inappropriate dosing, drug interactions, or overlooking more serious underlying health conditions

- For instance, reports of excessive use of pain relievers such as acetaminophen and ibuprofen leading to liver and kidney complications have raised public health concerns, prompting regulatory agencies to call for clearer labeling and consumer education

- Addressing these challenges requires robust public health communication efforts, including consumer education campaigns, clear and standardized labeling, and pharmacist engagement to guide users in appropriate OTC drug use. Organizations such as the FDA and EMA are actively working on updating labeling requirements to include more explicit warnings and dosage guidelines

- In addition, stringent regulations in some regions regarding the classification and approval of OTC drugs can limit the introduction of new products or the switching of prescription drugs to OTC status. These regulatory complexities vary across markets, making it difficult for global brands to maintain consistent offerings or expand into emerging markets

- Furthermore, the lack of comprehensive consumer knowledge on drug interactions, especially in populations managing multiple health conditions, remains a restraint. The absence of personalized guidance may lead to unintentional misuse or suboptimal outcomes

Over the Counter (OTC) Drugs Market Scope

The market is segmented on the basis of product type, end-user, and distribution channel

- By Product Type

On the basis of product type, the over the counter (OTC) drugs market is segmented into analgesics, cold, cough and flu products, gastrointestinal products, ophthalmic products, dermatology products, and others. The cold, cough, and flu products segment dominated the largest market revenue share in 2024, accounting for 26%, driven by the seasonal nature of respiratory illnesses and the sustained demand for fast-acting relief solutions. Consumers frequently turn to OTC medications for immediate symptom management of common colds and flu without needing medical consultation, contributing to the segment’s strong growth. Innovative product formulations and combination therapies further support its dominance.

The analgesics segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing incidences of lifestyle-related stress, chronic pain conditions, and musculoskeletal issues. The accessibility of pain relief products, including acetaminophen and ibuprofen-based OTC options, combined with growing awareness of self-medication practices, is boosting the demand for this segment globally

- By End User

On the basis of end-user, the over the counter (OTC) drugs market is segmented into specialty clinics, homecare, hospitals, and others. The homecare segment accounted for the largest market share in 2024, driven by the global shift towards self-care and the growing consumer preference for managing minor ailments at home. The increasing availability of user-friendly OTC products, coupled with the convenience of treating symptoms without visiting healthcare facilities, makes homecare a dominant segment in both developed and emerging markets.

The specialty clinic segment is expected to grow fastest over the forecast period, as clinics increasingly recommend OTC drugs for continued care post-consultation. OTC solutions for dermatological, gastrointestinal, and pain relief applications are often recommended as supplementary or follow-up treatments by clinicians, further supporting growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the over the counter (OTC) drugs market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The retail pharmacy segment held the largest market revenue share in 2024, owing to the widespread physical presence of pharmacies, drugstores, and supermarkets offering a broad range of OTC products. Easy accessibility, pharmacist consultations, and immediate product availability are key factors driving this segment’s leadership.

The online pharmacy segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing consumer shift towards digital health platforms, especially post-pandemic. Online pharmacies provide the advantage of home delivery, product comparison, and AI-driven personalized recommendations, making them an increasingly attractive channel for purchasing OTC drugs, particularly among tech-savvy and younger populations.

Over the Counter (OTC) Drugs Market Regional Analysis

- North America dominates the over the counter (OTC) drugs market with the largest revenue share of 38.31% in 2024, driven by mature healthcare infrastructure, high consumer awareness, and widespread availability of OTC products across well-established retail chains and e-commerce platforms

- Consumers in the region highly value the accessibility, affordability, and time-saving benefits of OTC medications for managing common conditions such as allergies, digestive discomfort, pain, and cold/flu symptoms. This trend is further reinforced by proactive health behavior and the availability of a wide range of trusted OTC brands

- The region’s strong regulatory support for Rx-to-OTC switches, robust distribution networks through retail pharmacies and e-commerce platforms, and growing emphasis on preventive healthcare significantly contribute to the sustained growth of the market

U.S. Over the Counter (OTC) Drugs Market Insight

The U.S. over the counter (OTC) drugs market captured the largest revenue share in 2024 within North America, driven by a highly developed healthcare ecosystem, widespread health awareness, and consumer preference for self-managed care. American consumers increasingly rely on OTC drugs for managing common ailments such as allergies, pain, and cold symptoms, owing to the convenience, cost savings, and immediate relief these products offer. In addition, regulatory support for Rx-to-OTC switches, along with strong retail pharmacy penetration and the rapid rise of e-commerce, continue to propel market growth. The expansion of wellness-focused and preventive care products also reflects evolving consumer expectations in the U.S. market.

Europe Over the Counter (OTC) Drugs Market Insight

The Europe over the counter (OTC) drugs market is projected to grow at a steady CAGR throughout the forecast period, largely influenced by aging populations, rising healthcare costs, and a growing emphasis on self-medication. European countries are increasingly encouraging responsible self-care practices, with OTC drugs playing a pivotal role in managing minor conditions without burdening healthcare systems. The region also benefits from strong pharmaceutical infrastructure, regulatory backing for non-prescription products, and rising consumer trust in pharmacy professionals. Growth is evident across various therapeutic categories, including pain relief, gastrointestinal health, and dermatology.

U.K. Over the Counter (OTC) Drugs Market Insight

The U.K. over the counter (OTC) drugs market is anticipated to grow at a notable CAGR during the forecast period, supported by increasing public interest in health and wellness, and NHS initiatives promoting self-care to reduce pressure on healthcare services. Consumers are increasingly purchasing OTC products for everyday conditions such as cold/flu, digestive issues, and pain management. The robust pharmacy network, combined with expanding online platforms and supermarket availability, enhances accessibility. In addition, consumer trust in pharmacist advice plays a vital role in shaping the OTC landscape in the U.K.

Germany Over the Counter (OTC) Drugs Market Insight

The Germany over the counter (OTC) drugs market is expected to expand steadily, fueled by the country’s well-established pharmaceutical sector and high consumer confidence in non-prescription treatments. German consumers actively engage in self-care, particularly for managing minor gastrointestinal, dermatological, and respiratory conditions. The market benefits from strong regulatory oversight, a widespread pharmacy presence, and increasing digital access to health information. Moreover, innovation in natural and herbal OTC formulations is resonating with Germany’s environmentally conscious and health-aware population.

Asia-Pacific Over the Counter (OTC) Drugs Market Insight

The Asia-Pacific over the counter (OTC) drugs market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising disposable incomes, expanding access to healthcare, and increased consumer awareness across key markets such as China, Japan, and India. The rapid urbanization and adoption of self-medication practices are accelerating demand for OTC solutions for everyday ailments. In addition, government policies supporting affordable healthcare and expanding retail and e-commerce distribution channels are enhancing market penetration. The region’s diverse population and growing middle class make it a critical growth engine for global OTC brands.

Japan Over the Counter (OTC) Drugs Market Insight

The Japan over the counter (OTC) drugs market is gaining traction due to the country’s aging population, high healthcare engagement, and strong consumer preference for self-treatment. Japanese consumers often rely on OTC products for chronic condition symptom management, including pain, allergies, and gastrointestinal issues. The market benefits from advanced retail pharmacy infrastructure and a culturally ingrained focus on preventive health. In addition, innovations in combination therapies and easy-to-use dosage forms support growing demand, particularly among older adults.

India Over the Counter (OTC) Drugs Market Insight

The India over the counter (OTC) drugs market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by a burgeoning middle class, rapid urbanization, and increasing health awareness. Consumers are turning to OTC solutions for quick relief from common conditions such as fever, cold, indigestion, and minor skin issues. The expansion of modern retail chains, strong domestic pharmaceutical manufacturing, and growing digital health platforms are catalyzing market expansion. Government initiatives promoting generic medicines and the rise of health-tech startups offering OTC consultations further accelerate India’s market growth trajectory.

Over the Counter (OTC) Drugs Market Share

The over the counter (OTC) drugs industry is primarily led by well-established companies, including:

- Johnson & Johnson Services, Inc. (U.S.)

- Dr. Reddy's Laboratories Ltd. (India)

- Reckitt Benckiser Group PLC (U.K.)

- Takeda Pharmaceutical Company Limited (Japan)

- Sanofi (France)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Bayer AG (Germany)

- Teva Pharmaceutical Industries Ltd. (Israel)

- GSK plc. (U.K.)

- Novartis AG (Switzerland)

- Sun Pharmaceutical Industries Ltd. (India)

- Alkem Labs (India)

- Cipla Inc. (India)

- Piramal Enterprises Ltd. (India)

- Pfizer Inc. (U.S.)

- Procter & Gamble (U.S.)

- Perrigo Company plc (Ireland)

- DAIICHI SANKYO COMPANY, LIMITED (Japan)

Latest Developments in Global Over the Counter (OTC) Drugs Market

- In November 2024, a New York federal judge dismissed around 100 lawsuits alleging that companies such as Procter & Gamble and Haleon marketed OTC decongestants containing phenylephrine, a supposedly ineffective ingredient. The judge ruled that the companies were not required to update their product labels with new efficacy information unless mandated by the FDA

- In September 2023, an FDA advisory panel concluded that phenylephrine, a common decongestant in OTC medications such as Sudafed PE and DayQuil, is no more effective than a placebo at relieving nasal congestion. This unanimous decision was based on modern studies that contradicted earlier research from the 1960s and 70s. The FDA is now considering whether to mandate the removal of all such products from the market

- In December 2023, House Republicans, led by Rep. Lisa McClain, initiated an investigation into the FDA's handling of phenylephrine. The inquiry seeks to understand the FDA's delayed action on over-the-counter cough and cold medications containing phenylephrine, which accounted for approximately USD 1.8 billion in sales in the previous year

- In December 2023, Family Dollar voluntarily recalled nearly 300 over-the-counter drugs and medical devices after discovering that these products were stored at incorrect temperatures before being shipped to stores in 23 states. Although no consumer complaints or reports of illness were filed, the recall was announced as a precaution

- In 2023, the FDA approved Narcan and RiVive, naloxone nasal sprays for the emergency treatment of opioid overdose, for over-the-counter use. This move aims to enhance consumer access to essential treatments and underscores the growing trend towards self-managed healthcare solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.