Global Outboard Engines Market

Market Size in USD Billion

CAGR :

%

USD

11.90 Billion

USD

17.72 Billion

2025

2033

USD

11.90 Billion

USD

17.72 Billion

2025

2033

| 2026 –2033 | |

| USD 11.90 Billion | |

| USD 17.72 Billion | |

|

|

|

|

Outboard Engines Market Size

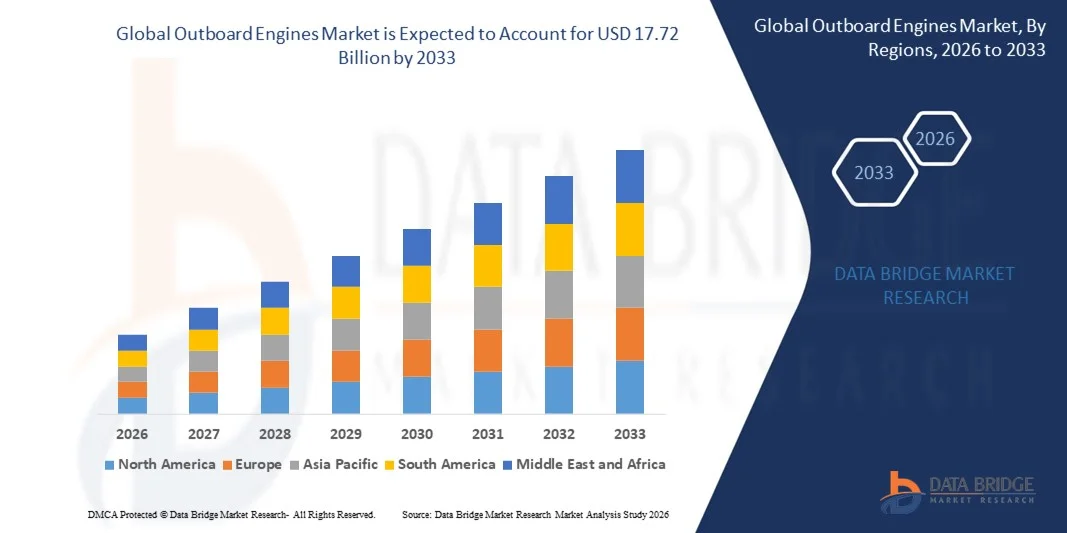

- The global outboard engines market size was valued at USD 11.90 billion in 2025 and is expected to reach USD 17.72 billion by 2033, at a CAGR of 5.10% during the forecast period

- The market growth is largely fuelled by the rising demand for recreational boating, fishing activities, and marine tourism, particularly across coastal and inland waterways

- Increasing adoption of fuel-efficient, lightweight, and low-emission outboard engines is supporting replacement demand and new boat installations

Outboard Engines Market Analysis

- The market is characterized by steady demand driven by leisure boating, commercial fishing, and patrol applications, supported by continuous innovation in engine efficiency and emissions compliance

- In addition, growing focus on electric and hybrid outboard engines, along with expanding marina infrastructure and water-based recreation, is shaping long-term market growth and competitive dynamics

- North America dominated the outboard engines market with the largest revenue share in 2025, driven by high recreational boating participation, extensive freshwater and coastal waterways, and strong adoption of fuel-efficient and high-performance engines

- Asia-Pacific region is expected to witness the highest growth rate in the global outboard engines market, driven by rapid urbanization, increasing marine tourism, rising adoption of fuel-efficient and low-emission engines, and government initiatives supporting waterway development

- The 4-stroke segment held the largest market revenue share in 2025, driven by its fuel efficiency, lower emissions, and longer engine life. 4-stroke outboard engines are widely preferred for recreational and commercial vessels due to their reliability, smooth operation, and compliance with environmental regulations. Increasing adoption of 4-stroke engines in eco-sensitive areas and the growing trend of upgrading older boats are further supporting market demand

Report Scope and Outboard Engines Market Segmentation

|

Attributes |

Outboard Engines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Outboard Engines Market Trends

Rising Demand for Fuel-Efficient, Low-Emission, And High-Performance Engines

- The growing focus on eco-friendly and high-performance marine propulsion systems is significantly shaping the global outboard engines market, as consumers increasingly prefer engines that offer fuel efficiency, low emissions, and reliable performance. Outboard engines are gaining traction due to their ability to enhance boating experience, reduce operational costs, and comply with environmental regulations. This trend strengthens their adoption across recreational, commercial, and fishing applications, encouraging manufacturers to innovate with new engine technologies that cater to evolving consumer and regulatory demands

- Increasing awareness around environmental sustainability and operational efficiency has accelerated the demand for advanced outboard engines in small boats, yachts, and fishing vessels. Environmentally conscious consumers and commercial operators are actively seeking engines that minimize fuel consumption and reduce emissions, prompting brands to prioritize sustainable materials, cleaner propulsion systems, and advanced engine designs

- Eco-efficiency and performance trends are influencing purchasing decisions, with manufacturers emphasizing low-emission technologies, corrosion-resistant materials, and integrated digital controls. These factors are helping brands differentiate products in a competitive market and build consumer trust, while also driving the adoption of certifications and eco-friendly labeling. Companies are increasingly using marketing campaigns to highlight these benefits to reinforce brand positioning and appeal to conscious consumers

- For instance, in 2024, BRP in Canada and Yamaha Motor Co., Ltd. in Japan expanded their outboard engine portfolios by introducing fuel-efficient and low-emission models for recreational and commercial applications. These launches were introduced in response to rising consumer preference for sustainable and high-performance propulsion systems, with distribution across retail, marine dealerships, and online channels. The products were also marketed as environmentally responsible and technologically advanced choices, enhancing brand loyalty and repeat purchases among boat owners

- While demand for advanced outboard engines is growing, sustained market expansion depends on continuous R&D, cost-effective production, and maintaining engine performance and durability. Manufacturers are also focusing on improving supply chain efficiency, enhancing service networks, and developing innovative solutions that balance cost, quality, and sustainability for broader adoption

Outboard Engines Market Dynamics

Driver

Growing Preference for Fuel-Efficient, Low-Emission, And High-Performance Engines

- Rising consumer demand for fuel-efficient and environmentally friendly engines is a major driver for the global outboard engines market. Manufacturers are increasingly replacing older or conventional engines with advanced alternatives to meet regulatory requirements, reduce operational costs, and improve boating experience. This trend is also pushing research into new propulsion technologies, supporting product diversification

- Expanding applications in recreational boating, fishing, marine tourism, and small commercial vessels are influencing market growth. Outboard engines help improve speed, maneuverability, and fuel efficiency while reducing emissions, enabling manufacturers to meet consumer expectations for high-quality and sustainable solutions. Increasing interest in leisure boating and water-based activities further reinforces this trend

- Marine engine manufacturers are actively promoting outboard engines through product innovation, marketing campaigns, and industry certifications. These efforts are supported by the growing consumer preference for environmentally responsible, efficient, and reliable propulsion systems, and they also encourage partnerships between component suppliers and marine brands to improve product performance and reduce environmental footprint

- For instance, in 2023, Yamaha Motor Co., Ltd. in Japan and Mercury Marine in the U.S. reported increased incorporation of advanced fuel-efficient outboard engines across recreational and commercial vessel segments. This expansion followed higher consumer demand for low-emission, high-performance, and durable marine engines, driving repeat purchases and product differentiation. Both companies also highlighted sustainability and regulatory compliance in marketing campaigns to strengthen consumer trust and brand loyalty

- Although rising eco-efficiency and performance trends support growth, wider adoption depends on cost optimization, technology availability, and scalable production processes. Investment in R&D, sustainable sourcing, and advanced manufacturing technology will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

High Cost And Regulatory Compliance Compared To Conventional Engines

- The relatively higher cost of advanced outboard engines compared to conventional models remains a key challenge, limiting adoption among price-sensitive consumers and small-scale commercial operators. Advanced materials, digital controls, and emission-compliant systems contribute to elevated pricing, which can restrict demand in cost-conscious segments

- Consumer and operator awareness remains uneven, particularly in developing markets where eco-friendly boating is still emerging. Limited understanding of functional benefits, fuel efficiency, and emission reduction restricts adoption across certain marine applications. This also leads to slower uptake in emerging economies where educational initiatives on advanced outboard engines are minimal

- Supply chain and distribution challenges also impact market growth, as outboard engines require sourcing of high-quality components and adherence to stringent quality and emission standards. Logistical complexities, seasonal demand, and specialized maintenance requirements increase operational costs. Companies must invest in dealer training, proper handling, and efficient transport networks to maintain product integrity

- For instance, in 2024, marine dealerships in Southeast Asia supplying advanced outboard engines reported slower uptake due to higher prices and limited awareness of fuel efficiency and emission benefits compared to conventional engines. Service and maintenance requirements were additional barriers affecting adoption and repeat purchases

- Overcoming these challenges will require cost-efficient production, expanded distribution networks, and focused educational initiatives for consumers and operators. Collaboration with dealerships, marine associations, and certification bodies can help unlock the long-term growth potential of the global outboard engines market. Furthermore, developing cost-competitive solutions and strengthening marketing strategies around performance, fuel efficiency, and sustainability benefits will be essential for widespread adoption

Outboard Engines Market Scope

The market is segmented on the basis of engine type, fuel type, power type, technology type, ignition type, boat type, and applications.

- By Engine Type

On the basis of engine type, the global outboard engines market is segmented into 2-stroke, 4-stroke, and electric. The 4-stroke segment held the largest market revenue share in 2025, driven by its fuel efficiency, lower emissions, and longer engine life. 4-stroke outboard engines are widely preferred for recreational and commercial vessels due to their reliability, smooth operation, and compliance with environmental regulations. Increasing adoption of 4-stroke engines in eco-sensitive areas and the growing trend of upgrading older boats are further supporting market demand.

The electric segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for eco-friendly propulsion systems, low maintenance requirements, and quieter operation. Electric outboard engines are gaining popularity for both recreational boating and environmentally sensitive water bodies, supported by government incentives and stricter emission regulations.

- By Fuel Type

On the basis of fuel type, the market is segmented into diesel, gasoline, and electric. The gasoline segment dominated in 2025 due to its high availability, lower upfront costs, and suitability for a wide range of vessels, including fishing and recreational boats. Gasoline engines are also preferred for their ease of maintenance and proven performance in different water conditions. Increasing leisure boating activities and replacement demand for older gasoline engines continue to support this segment.

The electric segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing awareness of sustainability, government incentives, and technological advancements in battery efficiency and motor performance. Electric engines provide quieter operation and minimal environmental impact, attracting recreational users and operators in eco-sensitive zones. Partnerships between manufacturers and battery technology companies are driving innovation and improved consumer adoption.

- By Power Type

On the basis of power type, the market is segmented into less than 30 HP, 30 HP to 100 HP, and above 100 HP. The 30 HP to 100 HP segment held the largest share in 2025, driven by its versatility across small and medium-sized recreational and commercial vessels. Engines in this range are widely used in fishing boats, speedboats, and leisure crafts due to balanced fuel efficiency and performance. Replacement demand and aftermarket upgrades also contribute to segment growth. Manufacturers are focusing on optimizing torque, fuel efficiency, and durability to meet evolving consumer preferences.

The above 100 HP segment is expected to witness the fastest growth rate from 2026 to 2033, supported by demand for high-performance boats in offshore fishing, water sports, and commercial applications. Rising investments in recreational and competitive boating, coupled with increasing consumer spending on premium boats, is boosting demand for powerful engines. Technological improvements such as turbocharging and direct fuel injection are enhancing performance and efficiency in this segment.

- By Technology Type

On the basis of technology type, the market is segmented into two-stroke carbureted, two-stroke electronic fuel injection, two-stroke direct injection system, four-stroke carbureted, and four-stroke electronic fuel injection. The four-stroke electronic fuel injection segment held the largest market share in 2025 due to better fuel efficiency, reduced emissions, and higher reliability. Advanced digital controls enable precise fuel management and lower operational costs, making it suitable for both recreational and commercial vessels. The increasing adoption of digital monitoring systems is supporting market expansion.

The two-stroke direct injection system segment is expected to witness the fastest growth rate from 2026 to 2033, driven by performance efficiency, lightweight design, and regulatory compliance for low emissions. Direct injection technology improves power output and fuel economy while minimizing environmental impact. The segment is popular in high-performance and racing boats, creating opportunities for aftermarket upgrades and specialized engine offerings.

- By Ignition Type

On the basis of ignition type, the market is segmented into electric and manual. The electric ignition segment dominated in 2025, attributed to ease of use, reliability, and growing consumer preference for hassle-free starting systems. Electric ignition enhances operational convenience and is widely adopted in recreational and commercial vessels. The segment benefits from advancements in battery systems and integration with digital engine management for improved safety and performance.

The manual ignition segment is expected to witness the fastest growth rate from 2026 to 2033, particularly in smaller and traditional boats where simplicity and cost-effectiveness are prioritized. Manual ignition systems are preferred in regions with limited access to advanced maintenance facilities. Manufacturers continue to refine reliability and durability in manual ignition engines to support emerging markets and budget-conscious consumers.

- By Boat Type

On the basis of boat type, the market is segmented into fishing vessels, recreational vessels, and special purpose boats. The recreational vessels segment accounted for the largest share in 2025, driven by increasing leisure boating, tourism activities, and water sports. Recreational users are upgrading engines to improve speed, efficiency, and reliability. Marina development and growing disposable incomes further support segment growth.

The fishing vessels segment is expected to witness the fastest growth rate from 2026 to 2033, supported by rising commercial fishing activities and demand for fuel-efficient, durable engines. Increasing adoption of larger boats for offshore fishing and regulatory pressure for low-emission engines is driving new engine installations. Manufacturers are introducing corrosion-resistant materials and digital monitoring features to improve vessel longevity.

- By Applications

On the basis of applications, the market is segmented into commercial, recreational, and military. The recreational segment held the largest revenue share in 2025 due to growing participation in leisure boating, water sports, and marine tourism. Consumer demand for easy-to-use, high-performance engines drives aftermarket sales and new installations.

The commercial segment is expected to witness the fastest growth rate from 2026 to 2033, driven by expanding small-scale fisheries, passenger transport, and cargo operations in inland and coastal waters. Engine efficiency, reliability, and compliance with emission regulations are key factors influencing purchase decisions. Increasing government support for sustainable marine operations further boosts segment expansion.

Outboard Engines Market Regional Analysis

- North America dominated the outboard engines market with the largest revenue share in 2025, driven by high recreational boating participation, extensive freshwater and coastal waterways, and strong adoption of fuel-efficient and high-performance engines

- Consumers in the region highly value reliability, fuel efficiency, low emissions, and advanced engine technology, supporting widespread adoption across recreational, commercial, and small-scale fishing vessels

- This growth is further supported by high disposable incomes, well-developed marina and boating infrastructure, and increasing interest in water sports and leisure activities, establishing outboard engines as a preferred choice for boat owners

U.S. Outboard Engines Market Insight

The U.S. outboard engines market captured the largest revenue share in North America in 2025, fueled by increasing recreational boating and commercial fishing activities. Consumers are prioritizing fuel-efficient, low-emission, and high-performance engines, while manufacturers are integrating digital monitoring and electronic fuel injection technologies. The growing popularity of leisure boating, offshore fishing, and marine tourism, along with the adoption of smart and connected engine technologies, is further propelling market expansion.

Europe Outboard Engines Market Insight

The Europe outboard engines market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent emission regulations, rising demand for eco-friendly propulsion systems, and increasing recreational and commercial boating. European consumers prefer engines that offer low fuel consumption, reduced noise, and minimal environmental impact. The region is also experiencing growth in marine tourism, sport fishing, and luxury boating applications, with upgraded engines being incorporated in both new and renovated vessels.

U.K. Outboard Engines Market Insight

The U.K. outboard engines market is expected to witness significant growth from 2026 to 2033, driven by rising recreational boating and fishing activities, increasing environmental awareness, and demand for low-emission, high-performance engines. In addition, government initiatives promoting clean energy and boating safety, coupled with strong marina infrastructure and e-commerce availability of marine engines, are expected to stimulate market growth.

Germany Outboard Engines Market Insight

The Germany outboard engines market is expected to witness robust growth from 2026 to 2033, fueled by growing adoption of technologically advanced, fuel-efficient, and low-emission engines. Germany’s emphasis on sustainability, well-developed marine infrastructure, and increasing participation in water sports encourage adoption across recreational and commercial vessels. The integration of digital engine management systems and maintenance monitoring is also driving preference for modern outboard engines.

Asia-Pacific Outboard Engines Market Insight

The Asia-Pacific outboard engines market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising disposable incomes, expanding recreational boating, and growth in commercial fishing in countries such as China, Japan, and India. Government initiatives supporting waterway development, tourism, and marine trade are boosting engine adoption. Furthermore, APAC is emerging as a manufacturing hub for outboard engine components, improving affordability and availability for recreational and commercial users.

Japan Outboard Engines Market Insight

The Japan outboard engines market is expected to witness strong growth from 2026 to 2033 due to the country’s high boating culture, increasing leisure fishing, and demand for fuel-efficient, low-emission engines. The market emphasizes reliability, advanced technology integration, and compact engine design suitable for smaller vessels. In addition, Japan’s aging population is likely to increase demand for easy-to-operate engines that provide safe and convenient access for recreational and commercial boating.

China Outboard Engines Market Insight

The China outboard engines market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, rising disposable incomes, and growing recreational and commercial boating activities. China is one of the largest markets for marine engines, and outboard engines are increasingly used in fishing, leisure, and tourism vessels. Government support for clean and sustainable waterways, along with strong domestic manufacturing capabilities, is accelerating adoption of fuel-efficient and low-emission outboard engines.

Outboard Engines Market Share

The Outboard Engines industry is primarily led by well-established companies, including:

• Cox Marine (U.K.)

• Elco Motor Yachts (U.S.)

• Golden Motor Technology Co., Ltd. (China)

• BRP (Canada)

• Honda Motor Co., Ltd. (Japan)

• RAI Amsterdam (Netherlands)

• Mercury Marine (U.S.)

• Mud Motors by Mudd Hog Mud Motors, LLC (U.S.)

• Powertec Supplies (I) Pvt., Ltd (India)

• Suzuki Marine (Japan)

• Tohatsu Corporation (Japan)

• Yongkang Longxiao Industry (China)

• Torqeedo GmbH (Germany)

• AB Volvo (Sweden)

• Yamaha Motor Co., Ltd (Japan)

• YANMAR HOLDINGS CO., LTD (Japan)

• Deutz AG (Germany)

• Brunswick Corporation (U.S.)

• Kräutler Elektromaschinen (Germany)

• Parsun Power Machine (China)

Latest Developments in Global Outboard Engines Market

- In February 2023, Cox Marine expanded its distribution network through a strategic contract with Ring Power in the U.S., extending coverage from Florida and the Caribbean to Georgia, North Carolina, South Carolina, and Bermuda. This development strengthens Cox Marine’s market presence, enhances regional accessibility for its outboard engines, and supports sales growth by leveraging Ring Power’s established distribution network

- In May 2022, Volvo Penta, in collaboration with Marell Boats and Hurtigruten Svalbard, launched a hybrid-electric vessel powered by the Volvo Penta twin D4-320 DPI Aquamatic hybrid-electric system. This initiative promotes electrification in marine commercial operations, reduces emissions, and improves fuel efficiency, setting a benchmark for sustainable vessel propulsion and encouraging wider adoption of hybrid technology in the market

- In February 2022, Volvo Penta signed a partnership agreement with Danfoss’ Editron division to advance marine electrification. This collaboration focuses on developing electric propulsion solutions, enhancing energy efficiency, and supporting the transition to low-emission marine operations, positioning Volvo Penta as a key innovator in sustainable marine technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.