Global Orthopaedic Imaging Equipment Market, By Product (Drill Guide, Guide Tubs, Implant Holders, Custom Clamps, Distracters, Screwdrivers), Systems (X-ray Systems, CT-Scanners, MRI Systems, EOS Imaging Systems, Ultrasound and Nuclear Imaging Systems), Indication (Acute Injuries and Chronic Disorders, Osteoarthritis), Application (Hip Orthopaedic Devices, Knee Orthopaedic Devices, Spine Orthopaedic Devices, Craniomaxillofacial Orthopaedic Devices, Dental Orthopaedic Devices, Sports Injuries, Trauma Orthopaedic Devices), End User (Hospitals, Radiology Centres, Emergency Care Facility and Ambulatory Surgical Centre) - Industry Trends and Forecast to 2030.

Orthopaedic Imaging Equipment Market Analysis and Size

Orthopaedic imaging equipment has changed medical imaging by improving the examination of bone detail and implant position to expand the market care segment for orthopaedic imaging equipment. This apparatus is used to identify a particular kind ocondition or injury. Medical organizations and research facilities will continue to make more efforts to advance cutting-edge imaging equipment. People are becoming more accepting of portable devices with orthopaedic imaging features as a result of the significance of bone-related diseases, fractures, and disorders.

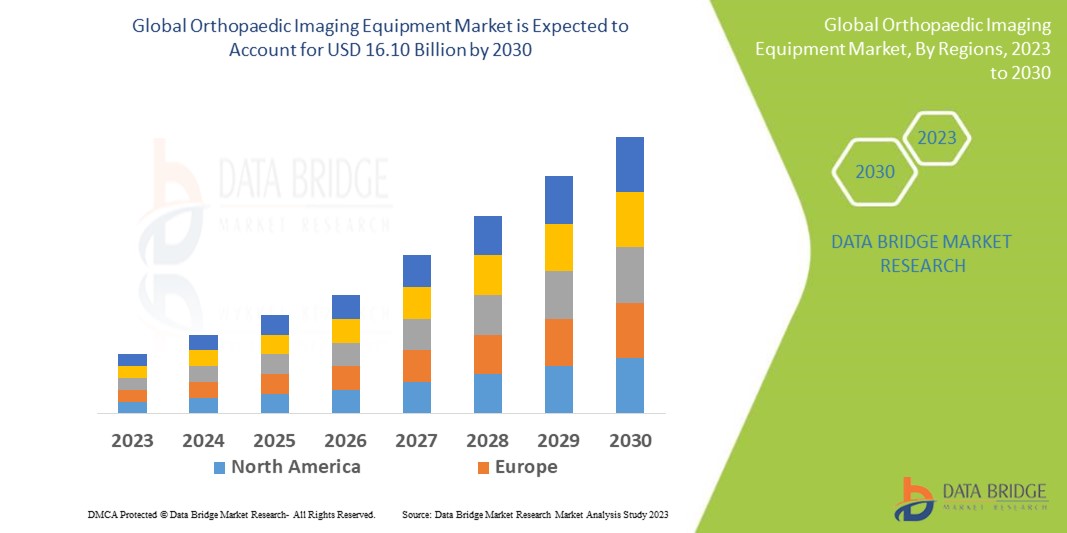

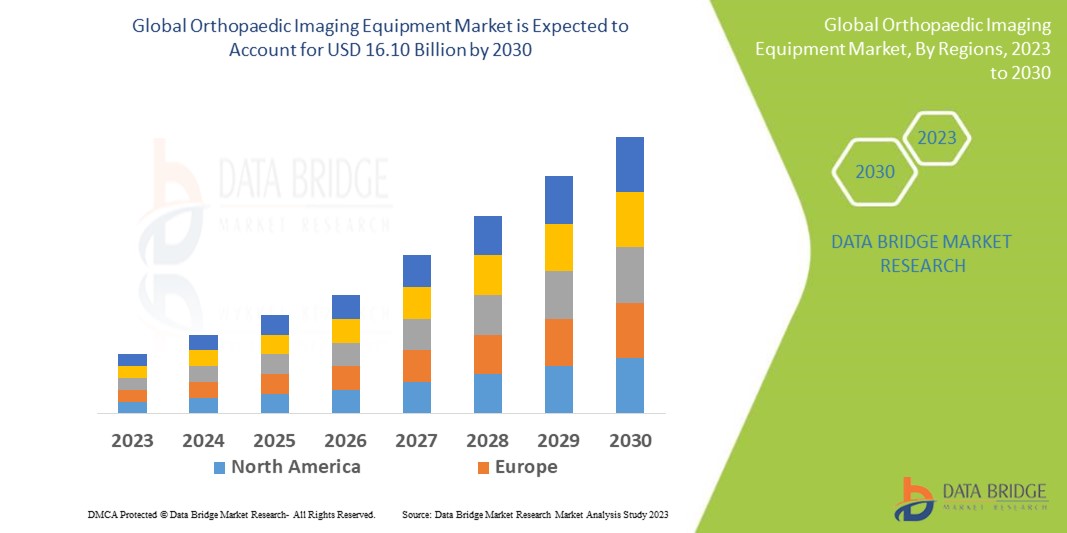

Data Bridge Market Research analyses that the orthopaedic imaging equipment market, valued at USD 10.36 billion in 2022, will reach USD 16.10 billion by 2030, growing at a CAGR of 5.67% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Orthopaedic Imaging Equipment Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Product (Drill Guide, Guide Tubs, Implant Holders, Custom Clamps, Distracters, Screwdrivers), Systems (X-ray Systems, CT-Scanners, MRI Systems, EOS Imaging Systems, Ultrasound and Nuclear Imaging Systems), Indication (Acute Injuries and Chronic Disorders, Osteoarthritis), Application (Hip Orthopaedic Devices, Knee Orthopaedic Devices, Spine Orthopaedic Devices, Craniomaxillofacial Orthopaedic Devices, Dental Orthopaedic Devices, Sports Injuries, Trauma Orthopaedic Devices), End User (Hospitals, Radiology Centres, Emergency Care Facility and Ambulatory Surgical Centre)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Market Players Covered

|

Siemens Healthcare Private Limited (Germany), GE HealthCare (U.S.), Koninklijke Philips N.V. (Netherlands), CANON MEDICAL SYSTEMS CORPORATION (Japan), Hologic, Inc. (U.S.), Carestream Health (U.S.), Hitachi, Ltd. (Japan), ESAOTE SPA (Italy), Planmed Oy (Finland), Shimadzu Corporation (Japan), Ziehm Imaging GmbH (Germany), Agfa-Gevaert Group (Belgium), Swissray. (U.S.), Xoran Technologies, LLC. (U.S.), Konica Minolta Healthcare Americas, Inc. (U.S.), NeuroLogica Corp. (U.S.), Accuray Incorporated (U.S.), Stryker Corporation (U.S.), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), Allengers (India), PTW Freiburg GmbH (Germany)

|

|

Market Opportunities

|

|

Market Definition

The orthopaedic imaging equipment market encompasses the global market for specialized medical imaging devices used for diagnosing and treating orthopaedic conditions. It includes X-ray systems, CT scanners, MRI systems, ultrasound machines, and nuclear medicine cameras. These devices enable healthcare professionals to obtain detailed images of the musculoskeletal system, aiding in the diagnosis, treatment planning, and monitoring of orthopaedic conditions like fractures and arthritis

Orthopaedic Imaging Equipment Market Dynamics

Drivers

- Increasing prevalence of orthopaedic conditions drives the market

The increasing prevalence of orthopaedic conditions, including fractures, osteoarthritis, and musculoskeletal injuries, is a significant driver for the orthopaedic imaging equipment market. As the global population ages and engages in more physical activities, the demand for accurate diagnosis and treatment of orthopaedic disorders is rising.. With the growing burden of orthopaedic conditions, the demand for orthopaedic imaging equipment is expected to increase to meet the diagnostic needs of patients worldwide.

- Growing demand for minimally invasive procedures drives the market

The growing demand for minimally invasive procedures in orthopaedics is driving the need for advanced orthopaedic imaging equipment. Minimally invasive techniques offer benefits such as smaller incisions, reduced tissue trauma, faster recovery, and shorter hospital stays. Fluoroscopy provides dynamic imaging during procedures, while image-guided navigation systems offer 3D guidance based on preoperative imaging. The increased demand for minimally invasive procedures has led to a corresponding rise in the adoption of orthopaedic imaging equipment, supporting market growth in this segment.

Opportunities

- Technological advancement surges market growth

Technological advancements have been a major driver of growth in the orthopaedic imaging equipment market. Continuous innovations in imaging technology, such as digital X-ray systems, 3D imaging, and portable ultrasound machines, have significantly enhanced the capabilities of orthopaedic imaging equipment. Digital X-ray systems offer higher image quality, faster image acquisition, and lower radiation doses, improving diagnostic accuracy and patient safety. Portable ultrasound machines enable point-of-care imaging, allowing for immediate assessment and guidance during procedures. These technological advancements have led to increased adoption of orthopaedic imaging equipment, creates market growth.

- Geographical expansion of healthcare facilities surge market expansion

The geographic distribution of healthcare facilities in developing countries has a significant impact on sales of orthopaedic medical equipment. As these economies experience economic growth and place more emphasis on healthcare infrastructure, the number of hospitals, clinics, and diagnostic facilities is expanding quickly. In order to provide comprehensive orthopaedic care services, advanced orthopaedic imaging equipment is required for precise diagnosis and treatment. There is an increasing need for high-quality imaging technology to support healthcare services as the importance of orthopaedic care is becoming more widely recognized.

Restraints/Challenges

- High costs can impede the market growth

The high cost of orthopaedic imaging equipment, such as MRI systems and CT scanners, presents a significant restraint on the market. The initial investment required to purchase these devices, along with the ongoing maintenance and operational expenses, can strain the budgets of healthcare facilities, especially in resource-constrained settings. Limited financial resources may lead to delayed or restricted adoption of advanced imaging technology, affecting the availability and accessibility of orthopaedic imaging services

- Limited skilled workforce can impede the market

The limited availability of a skilled workforce proficient in orthopaedic imaging techniques is a significant restraint on the orthopaedic imaging equipment market. Operating and interpreting the complex imaging equipment used in orthopaedics requires specialized training and expertise. However, in certain regions, there may be a shortage of radiologists and technicians with the necessary skills and knowledge. This shortage can restrict the utilization of orthopaedic imaging equipment, as healthcare facilities may not have sufficient personnel to operate and interpret the imaging results.

This orthopaedic imaging equipment market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the orthopaedic imaging equipment market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

In 2019, To support its AI and imaging analytics initiatives for joint reconstruction surgeries, DePuy Synthes, a Johnson & Johnson division, announced a collaboration with Zebra Medical Vision, a deep learning medical imaging analytics startup.

Global Orthopaedic Imaging Equipment Market Scope

The orthopaedic imaging equipment market is segmented on the basis of product, system, indication application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Drill Guide

- Guide Tubs

- Implant Holders

- Custom Camps

- Distracters

- Screwdrivers

Systems

- X-ray Systems

- CT-Scanners

- MRI Systems

- EOS Imaging Systems

- Ultrasound

- Nuclear Imaging Systems

Indication

- Acute injuries

- Sport Injuries

- Trauma Cases

- Chronic disorders

- Osteoarthritis

- Osteoporosis

- Prolapsed Disc

- Degenerative Joint Diseases

- Others

Application

- Hip Orthopaedic Devices

- Knee Orthopaedic Devices

- Spine Orthopaedic Devices

- Craniomaxillofacial Orthopaedic Devices

- Dental Orthopaedic Devices

- Sports Injuries

- Trauma Orthopaedic Devices

End User

- Hospitals

- Radiology Centres

- Emergency Care facility

- Ambulatory Surgical Centre

Orthopaedic Imaging Equipment Market Regional Analysis/Insights

The orthopaedic imaging equipment market is analysed and market size insights and trends are provided by country, product, system, indication application, and end user as referenced above.

The countries covered in the orthopaedic imaging equipment market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the orthopaedic imaging equipment market because of the growing of the numbers of producers and the increasing sales for orthopaedic imaging equipment in the region. Furthermore, growing incidence of arithmetic, acute injuries and increasing geriatric population and per capita healthcare spending has booted the market

Asia Pacific will undergo the highest growth rate during the forecast period owing to geriatric and growing prevalence of osteoarthritis and other bone diseases propelling the market in china.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Orthopaedic Imaging Equipment Market Share Analysis

The orthopaedic imaging equipment market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to orthopaedic imaging equipment market.

Some of the major players operating in the orthopaedic imaging equipment market are:

- Siemens Healthcare Private Limited (Germany)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Hologic, Inc. (U.S.)

- Carestream Health (U.S.)

- Hitachi, Ltd. (Japan)

- ESAOTE SPA (Italy)

- Planmed Oy (Finland)

- Shimadzu Corporation (Japan)

- Ziehm Imaging GmbH (Germany)

- Agfa-Gevaert Group (Belgium)

- Swissray (U.S.)

- Xoran Technologies, LLC. (U.S.)

- Konica Minolta Healthcare Americas, Inc. (U.S.)

- NeuroLogica Corp. (U.S.)

- Accuray Incorporated (U.S.)

- Stryker (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Allengers (India)

- PTW Freiburg GmbH (Germany)

SKU-