Global Organic Pigments Market

Market Size in USD Billion

CAGR :

%

USD

4.40 Billion

USD

6.00 Billion

2024

2032

USD

4.40 Billion

USD

6.00 Billion

2024

2032

| 2025 –2032 | |

| USD 4.40 Billion | |

| USD 6.00 Billion | |

|

|

|

|

Organic Pigments Market Size

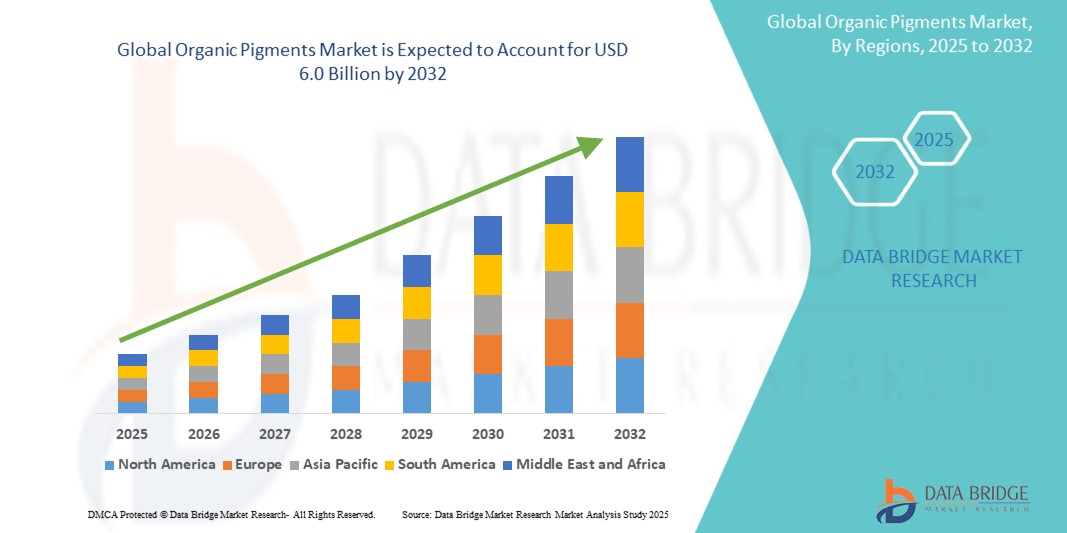

- The global Organic Pigments market size was valued at USD 4.4 billion in 2024 and is expected to reach USD 6.0 billion by 2032, at a CAGR of 8.7% during the forecast period

- This growth is driven by factors such as rising demand for eco-friendly products, stricter environmental regulations, and increased application in various industries

Organic Pigments Market Analysis

- The global Organic Pigments market is driven by the increasing demand for eco-friendly and sustainable colorants across industries

- The demand for organic pigments is significantly influenced by their use in paints, coatings, plastics, and textiles, with growing consumer preference for environmentally conscious products

- North America is expected to dominate the organic pigments market due to strong industrial sectors, high awareness, and stringent environmental regulations favoring eco-friendly alternatives

- Asia-Pacific is expected to be the fastest growing region in the Organic Pigments market during the forecast period, driven by rapid industrialization, expanding manufacturing sectors, and rising environmental awareness

- The paints and coatings segment is expected to dominate the market, holding a significant share due to increased demand from the construction, automotive, and consumer goods industries for sustainable and vibrant color options

Report Scope and Organic Pigments Market Segmentation

|

Attributes |

Organic Pigments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Pigments Market Trends

Increasing Consumer Preference for Sustainable Products

- One prominent trend in the adoption of organic pigments across various industries is the increasing consumer preference for sustainable and eco-friendly products

- This shift is driven by growing awareness and demand for environmentally conscious choices, leading to greater utilization of organic pigments as a sustainable alternative

- For instance, industries such as cosmetics, textiles, and packaging are increasingly incorporating organic pigments to align with consumer expectations for sustainability, reducing their environmental impact while maintaining product quality.

- This growing trend is transforming industries, encouraging the development of more eco-friendly products and driving the demand for sustainable solutions in production processes

Organic Pigments Market Dynamics

Driver

Rising Demand from the Paints and Coatings Industry

- The rising demand from the paints and coatings industry is significantly contributing to the increased adoption of organic pigments

- Continuous growth in the construction and automotive sectors is fueling the need for high-quality, vibrant, and durable coatings, where organic pigments play a crucial role

- As manufacturers aim to deliver visually appealing and long-lasting finishes, organic pigments are preferred for their superior color strength, stability, and environmental benefits

For instance

- The shift toward sustainable packaging in the food and beverage industry has led to increased use of organic pigments in biodegradable and compostable inks, aligning with regulatory and consumer demand for greener solutions

- As a result of this sustained demand from the paints and coatings industry, organic pigments are gaining traction as a vital component in delivering performance and sustainability

Opportunity

Technological Advancements in Pigment Manufacturing

- Technological advancements in pigment manufacturing are significantly enhancing the performance and versatility of organic pigments, enabling broader applications across multiple industries

- Innovations in production techniques and formulation development are improving color strength, stability, and compatibility with various substrates, making organic pigments more competitive and efficient

- Additionally, these advancements are paving the way for tailored pigment properties—such as enhanced lightfastness, heat resistance, and environmental compliance—meeting the evolving demands of specialized end-use sectors

For instance

- In recent years, companies like Clariant and DIC Corporation have introduced next-generation organic pigments using sustainable synthesis methods and advanced dispersion technologies, enabling high-performance pigments for digital printing, high-end automotive coatings, and functional textiles. These innovations not only meet regulatory standards but also expand the application scope into areas such as bio-based packaging and 3D printing

- As a result, cutting-edge pigment manufacturing technologies are opening up new markets, improving product value, and supporting the global shift toward sustainable, high-performance materials

Restraint/Challenge

High Production Costs

- The high production costs of organic pigments present a significant challenge for their widespread adoption, particularly in price-sensitive markets

- Compared to synthetic alternatives, organic pigments require more complex synthesis processes and higher-quality raw materials, which contribute to their elevated manufacturing costs

- This cost barrier can deter manufacturers in budget-constrained industries—such as low-cost printing, packaging, or textiles—from opting for organic pigments, thereby limiting their market penetration

For instance

- According to a 2023 industry report by ChemAnalyst, the cost of raw materials and compliance with environmental regulations in organic pigment production significantly increases operational expenses. These high costs make it difficult for small and medium-sized enterprises (SMEs) to switch from traditional synthetic pigments, especially in regions like Southeast Asia and Latin America, where cost competitiveness is crucial

- Consequently, these cost-related limitations can hinder the adoption of organic pigments in developing markets, restrict innovation opportunities, and slow down the transition to more sustainable pigment solutions globally

Organic Pigments Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Source |

|

|

By Application |

|

|

By Color

|

|

In 2025, the Azo Pigments is projected to dominate the market with a largest share in type segment

The Azo Pigments segment is expected to lead the Organic Pigments market with the largest share in 2025 due to their widespread application across printing inks, plastics, textiles, and coatings. Their relatively low cost, bright color range, and good overall performance characteristics make them a preferred choice in both developing and developed markets. Rising demand from the packaging and textile industries further supports their market dominance

The Printing Inks is expected to account for the largest share during the forecast period in application segment

In 2025, the Printing Inks segment is expected to dominate the market with the largest market share of 51.31% due to its increasing demand from the packaging, commercial printing, and publishing sectors. The rising preference for eco-friendly inks and the growth of digital printing technologies further contribute to the dominance of organic pigments in this application area.

Organic Pigments Market Regional Analysis

North America Holds the Largest Share in the Organic Pigments Market

-

North America dominates the Organic Pigments market, driven by robust industrial infrastructure, growing demand for sustainable products, and strong presence of key manufacturers and end-use industries

- The U.S. holds a significant share due to the increasing use of organic pigments in high-value sectors such as printing inks, automotive coatings, plastics, and cosmetics, coupled with a growing emphasis on environmentally friendly formulations

- The region also benefits from stringent environmental regulations by agencies like the EPA, which encourage the shift from synthetic to non-toxic organic pigments, especially in packaging and consumer goods applications

- In addition, ongoing innovation in pigment formulation and strong investments in R&D by leading chemical companies support the growth of high-performance and specialty organic pigments in North America

Asia-Pacific is Projected to Register the Highest CAGR in the Organic Pigments Market

-

The Asia-Pacific region is expected to witness the highest growth rate in the Organic Pigments market, fueled by rapid industrialization, urbanization, and increasing demand for colored materials in packaging, textiles, plastics, and paints

- Countries such as China, India, and Japan are emerging as key markets due to booming construction, automotive, and textile industries, which significantly boost the consumption of organic pigments

- In China and India, the rising middle-class population, increased consumer spending, and shift toward sustainable and aesthetically appealing products are driving demand across various applications, including printing inks and decorative coatings

- Japan remains a significant contributor with its focus on high-quality industrial products, advanced manufacturing technologies, and regulatory alignment with environmentally safe pigment formulations. The expansion of local production and export capacities further accelerates regional market growth

Organic Pigments Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- FERRO CORPORATION (U.S.)

- Dainichiseika Color & Chemicals Mfg. Co. Ltd. (Japan)

- Sudarshan Chemical Industries Limited (India)

- LANXESS (Germany)

- Atul Ltd (India)

- Synthesia a.s. (Czech Republic)

- Heubach GmbH (Germany)

- Trust Chem Co. Ltd. (China)

- CATHAY INDUSTRIES (China)

- Merck KGaA (Germany)

- BASF (Germany)

- SEDIC CORPORATION (Japan)

- Clariant (Switzerland)

- Carl Schlenk AG (Germany)

- apollocolours (India)

Latest Developments in Global Organic Pigments Market

- In December 2022, Sudarshan Chemical Industries Limited expanded its organic pigments portfolio by launching two new pigment products designed for use in plastics and coatings applications

- In January 2022, Heubach successfully completed the acquisition of Clariant’s global pigment business, a strategic move that strengthens its market position and opens up new avenues for growth and expansion within the pigments industry.

- In July 2022, DIC Corporation entered into a second-phase collaboration agreement with Debut Biotechnology, Inc. to develop natural red pigments intended for use in nutrition, food, and cosmetic products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.