Global Organic Acids For Feed Market

Market Size in USD Billion

CAGR :

%

USD

4.60 Billion

USD

6.55 Billion

2025

2033

USD

4.60 Billion

USD

6.55 Billion

2025

2033

| 2026 –2033 | |

| USD 4.60 Billion | |

| USD 6.55 Billion | |

|

|

|

|

Organic Acids for Feed Market Size

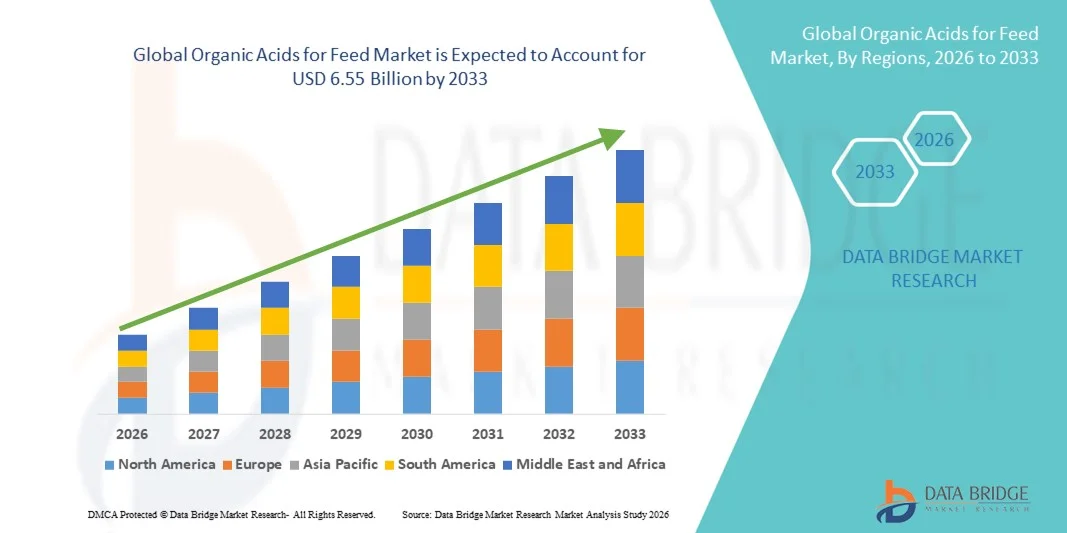

- The global organic acids for feed market size was valued at USD 4.60 billion in 2025 and is expected to reach USD 6.55 billion by 2033, at a CAGR of 4.50% during the forecast period

- The market growth is largely fuelled by the increasing demand for natural feed additives that improve animal health, gut microbiota balance, and nutrient absorption

- Rising adoption of organic acids in poultry, swine, and aquaculture feed to enhance growth performance and reduce reliance on antibiotics is supporting steady market expansion

Organic Acids for Feed Market Analysis

- The market is witnessing consistent growth due to the multifunctional benefits of organic acids, including improved feed digestibility, pathogen control, and reduced ammonia emissions in livestock production

- Increasing consumer preference for antibiotic-free meat and dairy products is driving manufacturers to incorporate organic acids in feed formulations to maintain animal health and performance

- North America dominated the organic acids for feed market with the largest revenue share of 35.80% in 2025, driven by high adoption of natural feed additives, well-established livestock production systems, and strong demand for antibiotic-free poultry, swine, and aquaculture feed

- Asia-Pacific region is expected to witness the highest growth rate in the global organic acids for feed market, driven by rising livestock production, increasing awareness of animal health and feed efficiency, rapid urbanization, and government initiatives promoting sustainable and natural feed additives

- The Lactic Acid segment held the largest market revenue share in 2025, driven by its multifunctional benefits, including improved gut health, nutrient absorption, and growth performance in poultry and swine. Lactic acid is widely used for its antimicrobial properties, supporting antibiotic-free feed initiatives and enhancing feed efficiency. Its versatility across multiple livestock types and feed formulations makes it a preferred choice for feed manufacturers

Report Scope and Organic Acids for Feed Market Segmentation

|

Attributes |

Organic Acids for Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Acids for Feed Market Trends

Rising Demand for Natural and Sustainable Feed Additives

- The growing focus on natural and sustainable livestock farming practices is significantly shaping the organic acids for feed market, as producers increasingly prefer feed additives that enhance gut health, improve nutrient absorption, and reduce reliance on antibiotics. Organic acids are gaining traction due to their multifunctional benefits, including improved animal performance, pathogen control, and feed digestibility. This trend strengthens their adoption across poultry, swine, and aquaculture feed, encouraging manufacturers to innovate with new acid blends and formulations that cater to evolving livestock nutrition requirements

- Increasing awareness around animal health, food safety, and environmental sustainability has accelerated the demand for organic acids in feed. Livestock producers are actively seeking feed solutions that enhance productivity, reduce ammonia emissions, and support antibiotic-free production systems. This has led to collaborations between ingredient suppliers and feed manufacturers to develop blends that optimize animal growth and overall farm sustainability

- Sustainability and clean-feed trends are influencing purchasing decisions, with manufacturers emphasizing natural sourcing, eco-friendly production, and regulatory compliance. These factors are helping brands differentiate feed products in competitive markets and build trust with producers, while also driving adoption of certifications and quality standards for organic feed additives

- For instance, in 2024, ADM Animal Nutrition in the U.S. and Evonik Industries in Germany expanded their feed additive portfolios by incorporating organic acids for poultry and swine. These launches were introduced in response to rising livestock producer demand for natural, antibiotic-free feed solutions, with distribution across feed mills, commercial farms, and online channels. The products were also marketed as sustainable and performance-enhancing choices, improving brand credibility and repeat adoption among target customers

- While demand for organic acids is growing, sustained market expansion depends on continuous R&D, cost-efficient production, and ensuring functional performance comparable to conventional additives. Manufacturers are also focusing on improving scalability, supply chain reliability, and developing innovative solutions that balance cost, efficacy, and sustainability for broader adoption

Organic Acids for Feed Market Dynamics

Driver

Growing Preference for Natural and Sustainable Feed Additives

- Rising demand for natural, multifunctional feed ingredients is a major driver for the organic acids for feed market. Livestock producers are increasingly replacing synthetic additives with organic acids to improve gut health, nutrient utilization, and overall animal performance, while complying with regulatory standards and sustainability goals. This trend is also pushing research into novel acid blends and delivery systems for feed formulations, supporting product diversification

- Expanding applications in poultry, swine, aquaculture, and ruminant feed are influencing market growth. Organic acids help control pathogenic bacteria, improve feed efficiency, and enhance growth performance while maintaining natural positioning of feed products. The increasing shift toward antibiotic-free livestock diets globally further reinforces this trend

- Feed manufacturers are actively promoting organic acid-based solutions through product innovation, farm trials, and certifications. These efforts are supported by growing producer preference for health-oriented and sustainable feed solutions, and they also encourage partnerships between suppliers and feed companies to optimize formulations and reduce environmental impact

- For instance, in 2023, Evonik Industries in Germany and ADM Animal Nutrition in the U.S. reported increased incorporation of organic acids in poultry and swine feed. This expansion followed higher livestock producer demand for natural, antibiotic-free, and performance-enhancing feed additives, driving repeat adoption and product differentiation. Both companies also highlighted sustainability, traceability, and regulatory compliance in marketing campaigns to strengthen producer trust and loyalty

- Although rising clean-feed and sustainability trends support growth, wider adoption depends on cost optimization, ingredient availability, and scalable production processes. Investment in supply chain efficiency, sustainable sourcing, and advanced formulation technology will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

Higher Cost And Limited Awareness Compared To Conventional Feed Additives

- The relatively higher cost of organic acids compared to conventional synthetic feed additives remains a key challenge, limiting adoption among cost-sensitive livestock producers. Higher raw material costs, complex production processes, and variable purity levels contribute to elevated pricing. In addition, fluctuating supply of certified raw materials can affect cost stability and market penetration

- Awareness among livestock producers and feed manufacturers remains uneven, particularly in developing regions where demand for natural feed additives is still emerging. Limited understanding of functional benefits restricts adoption across certain animal species and feed categories. This also leads to slower uptake in emerging economies where educational initiatives on organic acids are minimal

- Supply chain and distribution challenges also impact market growth, as organic acids require sourcing from certified suppliers and adherence to stringent quality standards. Logistical complexities, storage conditions, and shorter shelf life of some organic acids increase operational costs. Companies must invest in proper handling, storage, and efficient transport networks to maintain product integrity

- For instance, in 2024, distributors in Brazil and India supplying poultry and swine feed reported slower uptake due to higher prices and limited awareness of functional advantages compared to conventional feed additives. Storage requirements and certification compliance were additional barriers. These factors also prompted some feed mills to limit adoption of premium organic acid-based products, affecting visibility and sales

- Overcoming these challenges will require cost-efficient production, expanded distribution networks, and focused educational initiatives for livestock producers and feed manufacturers. Collaboration with feed associations, certification bodies, and agricultural extension services can help unlock the long-term growth potential of the global organic acids for feed market. Furthermore, developing cost-competitive formulations and strengthening marketing strategies around functional and sustainability benefits will be essential for widespread adoption

Organic Acids for Feed Market Scope

The market is segmented on the basis of type, livestock, source, and end-user.

- By Type

On the basis of type, the global organic acids for feed market is segmented into Acetic Acid, Citric Acid, Formic Acid, Lactic Acid, Malic Acid, Succinic Acid, Gluconic Acid, Ascorbic Acid, Fumaric Acid, Propionic Acid, and Others. The Lactic Acid segment held the largest market revenue share in 2025, driven by its multifunctional benefits, including improved gut health, nutrient absorption, and growth performance in poultry and swine. Lactic acid is widely used for its antimicrobial properties, supporting antibiotic-free feed initiatives and enhancing feed efficiency. Its versatility across multiple livestock types and feed formulations makes it a preferred choice for feed manufacturers.

The Formic Acid segment is expected to witness the fastest growth rate from 2026 to 2033, supported by its strong antimicrobial activity, ease of incorporation into feed, and ability to enhance feed digestibility. Formic acid is increasingly adopted in poultry and swine feed to control pathogenic bacteria and improve growth performance. Growing awareness of natural feed additives and regulatory push for reduced antibiotic usage is further driving the adoption of formic acid in livestock nutrition.

- By Livestock

On the basis of livestock, the market is segmented into Poultry, Ruminants, Swine, Aquatic Animals, and Others. The Poultry segment held the largest share in 2025 due to high global demand for chicken and egg production. Organic acids help maintain gut health, improve feed conversion ratios, and reduce microbial contamination in poultry, making them essential for sustainable production. Rapid expansion of poultry farming and organized production systems further support market growth.

The Swine segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing pork consumption and growing adoption of antibiotic-free feed. Swine producers are incorporating organic acids to improve nutrient absorption, reduce gastrointestinal infections, and enhance overall growth performance. Rising awareness of feed safety and sustainable livestock practices is accelerating market adoption.

- By Source

On the basis of source, the market is segmented into Biomass, Molasses, Starch, Chemical Synthesis, and Agro-Industrial Residue. The Chemical Synthesis segment accounted for the largest market share in 2025, owing to consistent quality, scalability, and cost-effectiveness. Chemical synthesis enables large-scale production of organic acids with standardized purity, supporting widespread adoption across livestock feed industries. Manufacturers rely on this source for reliable supply and uniform performance.

The Biomass segment is expected to witness the fastest growth from 2026 to 2033, supported by increasing focus on sustainable production and renewable feedstock utilization. Biomass-derived organic acids are gaining popularity as environmentally friendly alternatives to chemically synthesized acids. Rising regulatory support and consumer preference for natural feed additives further drive adoption.

- By End-User

On the basis of end-user, the market is segmented into Food and Beverage, Animal Feed, Chemicals and Industrial, Pharmaceuticals, Personal Care, and Agriculture. The Animal Feed segment dominated the market in 2025 due to widespread use of organic acids to enhance animal health, growth performance, and feed efficiency. The segment benefits from strong demand across poultry, swine, ruminant, and aquaculture sectors. Feed manufacturers are increasingly integrating organic acids to comply with antibiotic-free production trends and regulatory standards.

The Pharmaceuticals segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the use of organic acids in veterinary formulations, supplements, and health-promoting feed additives. Organic acids help improve immunity and overall animal wellness, supporting increased adoption in pharmaceutical applications. Growing awareness of animal health and nutrition is further boosting market expansion.

Organic Acids for Feed Market Regional Analysis

- North America dominated the organic acids for feed market with the largest revenue share of 35.80% in 2025, driven by high adoption of natural feed additives, well-established livestock production systems, and strong demand for antibiotic-free poultry, swine, and aquaculture feed

- Livestock producers in the region highly value the benefits of organic acids in improving gut health, nutrient absorption, and growth performance, supporting sustainable and efficient feed solutions

- This widespread adoption is further supported by organized feed production, advanced cold chain infrastructure, and growing awareness of food safety and regulatory compliance, establishing organic acids as a preferred solution across poultry, swine, and aquaculture segments

U.S. Organic Acids for Feed Market Insight

The U.S. organic acids for feed market captured the largest revenue share in 2025 within North America, fueled by the increasing demand for natural, antibiotic-free feed additives and advancements in livestock nutrition. Producers are focusing on improving animal performance and feed efficiency while complying with stringent regulations on antibiotic usage. The growing trend of precision farming, coupled with investments in feed R&D and innovative acid blends, is further propelling market growth. Moreover, strong awareness of food safety, sustainable livestock practices, and premium meat production is significantly contributing to the expansion of organic acids in the U.S.

Canada Organic Acids for Feed Market Insight

The Canada organic acids for feed market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by rising adoption of organic acids in poultry and swine feed and increasing demand for high-quality, antibiotic-free livestock products. The expansion of organized farming systems and feed mill infrastructure, combined with growing awareness of animal health and environmental sustainability, is fostering market adoption. Canadian producers are also emphasizing natural feed solutions to enhance growth performance and gut health, further supporting market growth.

Europe Organic Acids for Feed Market Insight

The Europe organic acids for feed market is expected to witness significant growth from 2026 to 2033, driven by strict regulations on antibiotic use in animal feed, rising demand for organic and sustainable feed additives, and increasing focus on animal health and productivity. European livestock producers are increasingly incorporating organic acids into poultry, swine, and aquaculture feed to comply with regulatory standards and improve feed efficiency. Investments in feed R&D and sustainable livestock practices are further strengthening the market in the region.

Germany Organic Acids for Feed Market Insight

The Germany organic acids for feed market is expected to witness the fastest growth rate from 2026 to 2033, fueled by strong regulatory support for antibiotic-free feed, growing awareness of animal welfare, and technological advancements in feed formulation. German producers are actively adopting organic acids to improve nutrient absorption, gut health, and overall livestock performance. The integration of organic acids with precision feeding systems and sustainable livestock practices is also promoting growth in both poultry and swine segments.

Asia-Pacific Organic Acids for Feed Market Insight

The Asia-Pacific organic acids for feed market is expected to witness robust growth from 2026 to 2033, driven by increasing demand for livestock products, rising awareness of animal health, and rapid urbanization in countries such as China, Japan, and India. The region's growing livestock industry, coupled with government initiatives promoting sustainable farming, is driving the adoption of organic acids. Furthermore, as APAC becomes a major feed production hub, affordability, accessibility, and availability of organic acids are expanding to meet the needs of both small-scale and industrial livestock producers.

Japan Organic Acids for Feed Market Insight

The Japan organic acids for feed market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high focus on livestock health, stringent regulations on feed additives, and rising demand for antibiotic-free poultry and swine products. Japanese producers prioritize animal performance, gut health, and feed efficiency, driving the adoption of organic acids. In addition, integration with precision feeding and sustainability-focused farming practices is supporting market growth in both poultry and swine sectors.

China Organic Acids for Feed Market Insight

The China organic acids for feed market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rapidly expanding livestock industry, increasing demand for poultry and swine products, and growing adoption of natural feed additives. Chinese producers are increasingly using organic acids to improve growth performance, gut health, and feed efficiency while complying with stricter regulations on antibiotic use. Strong domestic production capacity, government support for sustainable farming, and rising awareness of feed safety are key factors propelling the market in China.

Organic Acids for Feed Market Share

The Organic Acids for Feed industry is primarily led by well-established companies, including:

- ADM (U.S.)

- BASF SE (Germany)

- BP Plc (U.K.)

- BioAmber Inc. (U.S.)

- Cargill, Incorporated (U.S.)

- Celanese Corporation (U.S.)

- Corbion NV (Netherlands)

- DOW (U.S.)

- Du Pont De (U.S.)

- Eastman Chemicals Company (U.S.)

- Elekeiroz S.A (Brazil)

- Feichang Acid Chemicals Co., Ltd. (China)

- Fuso Chemical Co. Ltd (Japan)

- Henan Jindan Lactic Acid Technology Co., Ltd. (China)

- Jiangsu SOPO (Group) Co., Ltd (China)

- Jungbunzlauer Suisse AG (Switzerland)

- Myriant Corporation (U.S.)

- Nature Works LLC (U.S.)

- Shandong Liaocheng Luxi Chemical Co., Ltd. (China)

- Tate & Lyle (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.