Global Oral Care Oral Hygiene Products Market

Market Size in USD Billion

CAGR :

%

USD

1.09 Billion

USD

1.46 Billion

2023

2031

USD

1.09 Billion

USD

1.46 Billion

2023

2031

| 2024 –2031 | |

| USD 1.09 Billion | |

| USD 1.46 Billion | |

|

|

|

|

Oral Care and Oral Hygiene Product Market Overview

The Oral care and oral hygiene products market plays a crucial role in maintaining dental health and overall well-being. These products are essential for controlling plaque buildup and preventing gum diseases such as gingivitis and periodontitis, which can lead to serious complications such as tooth caries, tooth loss, and systemic health issues. According to the WHO Global Oral Health Status Report (2022), nearly 3.5 billion people worldwide are affected by oral diseases, with three-quarters of them residing in middle-income countries. Globally, around 2 billion people experience caries in their permanent teeth, and 514 million children are affected by caries in their primary teeth. The high prevalence of these diseases drives increasing demand for oral care and hygiene products, fueling market growth as people seek to prevent oral health issues.

This market report provides details of new recent developments, market share, market trends on the basis of segmentations and regional analysis, impact of market leaders, analysis of the opportunities in terms of emerging revenue pockets, market regulations, strategic market growth analysis, market size, category wise market growths, application niches and dominance, product approvals, product launches, geographic expansions, and technological innovations in the market. To gain more info on the market, contact Data Bridge Market Research’s team of expert analysts. Our team will help you make an informed market decision to achieve market growth

Global Oral Care and Oral Hygiene Products Market Size

|

Oral Care and Oral Hygiene Report Metric Details |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

Historic Year |

2022 (Customizable 2016-2021) |

|

Measuring Unit |

USB Million |

|

Data Pointers |

market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

The rising incidence of oral diseases, such as dental caries and periodontal disease, poses a significant global health concern. These conditions disproportionately affect vulnerable groups, particularly the elderly and those from lower socioeconomic backgrounds. For instance, Edentulism (total tooth loss) is estimated to affect as many as 78% of the elderly population that negatively impacts on eating, speaking, smiling, sleeping, and social interactions. The increasing concerns of oral care and hygiene to prevent oral diseases is driving growth in the Oral Care and Oral Hygiene Market. Databridge Market Research took a dive into comprehensively analyzing the market and unveiled that the Global Oral Care and Oral Hygiene Product Market is increasing at a CAGR of 3.75%. The market size was valued at USD 1.09 billion in 2023 and is expected to grow up to USD 1.46 billion by 2031.

Oral Care and Oral Hygiene Products Market Dynamics

Oral Care and Oral Hygiene Products Market Growth Drivers

Rising Oral Health Awareness

The increasing awareness of the connection between oral health and overall health is reshaping consumer attitudes and behaviors towards oral hygiene, driving significant growth in the Oral Care and Oral Hygiene Market. Poor oral health can lead to various systemic diseases, including cardiovascular issues, diabetes, and respiratory conditions. For instance, gum disease, or periodontal disease, triggers inflammation and bacterial infection that can contribute to heart disease by causing blood vessel damage and arterial plaque buildup. Conversely, chronic conditions such as diabetes can impair immune response and blood sugar control, making gums more susceptible to infection and exacerbating gum disease. This reciprocal relationship intensifies both conditions, creating a harmful cycle. As a result, consumers are becoming more proactive about their oral hygiene, recognizing that maintaining good oral health is crucial for preventing dental issues and safeguarding overall health. This growth in awareness is driving heightened demand for a wide range of dental products and services, including toothpaste, mouthwash, and professional dental care. Additionally, healthcare professionals are increasingly emphasizing the importance of oral health in preventive care which leads to more dental visits and a growing market for innovative oral care products designed for health-conscious consumers. This integration of oral health into overall wellness is fueling the expansion of the Oral Care and Oral Hygiene Market.

Changing Consumer Preferences

Growing changes in consumer preferences play a crucial role in the growth of the oral care and oral hygiene market by directly influencing purchase decisions and brand loyalty. Consumer preferences shift based on product attributes such as texture, flavor, and packaging, which significantly affect satisfaction and choice. For instance, studies reveal that 89.6% of respondents consider the texture of toothbrush bristles when choosing a product which indicates that consumers seek functional effectiveness and sensory experiences that align with their individual preferences. Moreover, the choice between different types of toothpaste, such as herbal versus fluoride, highlights how cultural contexts and health perceptions shape consumer behavior. Companies that respond to these preferences by innovating and offering varied textures, flavors, and natural ingredients are better positioned to attract a broader customer base. This interplay between consumer preferences and product attributes is essential for companies aiming to enhance customer satisfaction and drive market growth.

Growing Urbanization

Urbanization and changing dietary habits significantly contribute to the growth of the oral care and hygiene market by increasing the prevalence of dietary-related health issues, particularly non-communicable diseases (NCDs) linked to poor nutrition. As populations migrate from rural to urban areas, they often adopt Western-style diets characterized by high sugar and processed food consumption, which leads to a rise in obesity and dental problems such as cavities and gum disease. This dietary transition is marked by a greater reliance on fast food and sugary beverages, which are easily accessible in the urban environment and associated with a decline in the intake of fruits, vegetables, and other healthful foods. Consequently, the demand for oral care products such as toothpaste, mouthwashes, and professional dental services has surged as consumers become more aware of the importance of maintaining oral hygiene in the face of these dietary challenges, leading to growth in the oral care and hygiene market.

Oral Care and Oral Hygiene Products Market Growth Opportunities

The rapid growth of the oral care and oral hygiene products market is expected to continue due to various innovations such as electric toothbrushes, specialized mouthwashes, and diverse flavors in dental products. These advancements enhance the effectiveness of oral hygiene practices and cater to consumer preferences for enjoyable and engaging experiences. Companies have distinct opportunities to broaden their product ranges as consumers increasingly seek products that combine efficacy with pleasure. The integration of technology, such as smart toothbrushes that track brushing habits and provide feedback, aligns with the growing trend of personalized health solutions, further driving consumer interest. Additionally, the rise of health-conscious consumers creates fertile ground for product development. Companies can leverage these trends by investing in research and development to create innovative products that meet evolving consumer needs. Brands can differentiate themselves in a competitive market by focusing on sustainability and health benefits, such as natural ingredients in mouthwashes or eco-friendly packaging. This ongoing innovation cycle fosters customer loyalty and opens avenues for the global expansion of the oral care and oral hygiene products market.

Oral Care and Oral Hygiene Products Market Growth Challenges

The rising cost of raw materials and manufacturing presents significant challenges for the oral care and oral hygiene products market by impacting its growth potential in the future. Manufacturers are grappling with escalating prices for essential inputs such as polymers and packaging materials, which are often derived from crude oil. This situation forces companies to make a difficult choice to either absorb the costs themselves, which may lead to financial difficulties and reduced profitability, or pass the costs on to consumers. If companies choose to transfer the costs, they risk driving up retail prices, which could decrease consumer demand and potentially lower the sales. The outcome depends on how each company balances its financial health with its pricing strategy and market competitiveness. Additionally, ongoing supply chain disruptions, exacerbated by labor shortages and increased shipping costs, hinder the ability to maintain consistent production levels. These pressures can become barriers to the future innovation and limit the investment in new product development. As a result, the Oral Care and Oral Hygiene Products Market faces a stagnation in the growth.

Oral Care and Oral Hygiene Products Market Size Growth Restraints

Product recalls pose a substantial challenge to the growth of the Oral Care and Oral Hygiene Products Market, primarily due to their profound impact on consumer trust, the financial stability of manufacturers, and regulatory dynamics. When a product is recalled due to safety concerns, such as contamination or defective components, consumers may develop a heightened perception of risk associated with oral care products as a whole. This skepticism can lead to a decline in purchasing behavior, as individuals become wary of trying new products or returning to previously trusted brands. For instance, high-profile recalls of electric toothbrushes belonging to some leading companies due to the issues of overheating and risk of shock, have significantly impacted consumer perceptions. These incidents have raised concerns about the safety of specific products and led consumers to question the overall reliability of similar oral hygiene items. Additionally, the regulatory landscape becomes more complex following a recall, as companies face increased scrutiny from health authorities, which can delay the approval of new products and innovations. The cumulative effect of these challenges can result in long-term market stagnation, as consumers may shift towards alternative solutions that are safe and effective. Consequently, these factors limit the Oral Hygiene and Oral Care Products Market size.

Oral Care and Oral Hygiene Products Market Scope and Trends

|

Oral Care and Oral Hygiene Products Market Segmentation Overview |

|

|

Segments Type |

Sub-Segments |

|

Product |

Toothpastes (Pastes, Gels, Powders and Polishes), Toothbrushes and Accessories (Manual Toothbrushes, Electric Toothbrushes, Battery-Powered Toothbrushes and Replacement Toothbrush Heads), Mouthwashes/Rinses (Non-Medicated Mouthwashes and Medicated Mouthwashes), Dental Accessories/Ancillaries (Dental Flosses, Tongue Scrapers, Breath Fresheners, Cosmetic Dental Whitening Products and Dental Water Jets and Others), Denture Products (Cleaners, Fixatives, Floss, and Others), and Dental Prosthesis Cleaning Solutions |

|

Age Group |

Kids, Adults, and Geriatric |

|

Price Range |

High (USD 100 - 250), Medium (USD 20 - 100), and Low (Below USD 20) |

|

Distribution Channel |

Consumer Stores, Retail Pharmacies, Online Distribution, Dental Dispensaries, and Drug Store |

- A new toothpaste featuring calcium phosphate technology aims to boost remineralization and offer enhanced protection against decay by replenishing minerals in tooth enamel, thus improving overall oral health.

- Whitening toothpastes are now designed to be gentle on sensitive gums while effectively removing surface stains. The trend is toward products that combine whitening with fluoride for cavity prevention and mild abrasives for stain removal.

- Electric toothbrushes are gaining popularity for their superior plaque removal and gum health benefits, although manual toothbrushes remain a common choice due to their simplicity and affordability.

- Alcohol-free mouthwashes containing antibacterial enzymes are being formulated to soothe and moisturize the mouth, making it ideal for regular use throughout the day.

- Cosmetic dental whitening products, including activated charcoal, are increasingly popular as they cater to consumer demand for aesthetic improvements in addition to oral health benefits.

Oral Care and Oral Hygiene Products Market Regional Analysis – Market Trends

|

Oral Care and Oral Hygiene Products Market Regional Overview |

|

|

Regions |

Countries |

|

Europe |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe |

|

APAC |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific |

|

North America |

U.S., Canada, and Mexico |

|

MEA |

Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East, and Africa |

|

South America |

Brazil, Argentina, and Rest of South America |

Key Insights

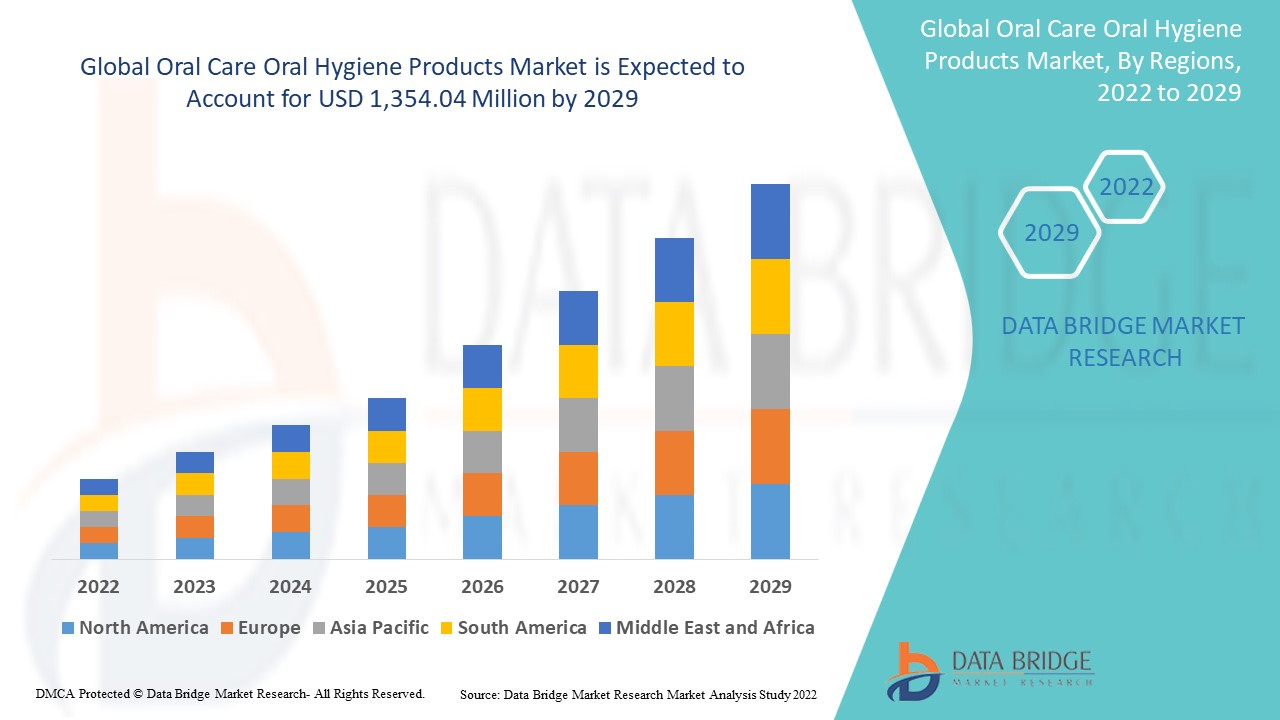

- North America dominates the oral care market due to extensive consumer awareness and established dental care practices.

- The region benefits from advanced healthcare systems and high standards of dental hygiene, contributing to market dominance.

- Asia-Pacific is expected to experience growth in the market due to increased medical tourism in that drives the demand for oral care services.

- Governments in the Asia-Pacific are implementing policies and programs that support oral health, fostering market expansion.

- In April 2023, the WHO reported that the European Region had the highest prevalence of major oral diseases, affecting 50.1% of adults. This region also had the highest rate of caries in permanent teeth, with 33.6% of the population affected, totaling nearly 335 million cases in 2019.

- In April 2023, the WHO reported that Europe had the second highest number of new oral cancer cases worldwide, with nearly 70,000 cases, accounting for 18.5% of all global cases. Additionally, in 2020, over 26,500 deaths in the region were attributed to oral cancers, underscoring a major public health issue in Europe.

Leading Players in Oral Care and Oral Hygiene Products Market

- Colgate-Palmolive Company (U.S.)

- Procter & Gamble (U.S.)

- Unilever (U.K./Netherlands)

- Koninklijke Philips N.V. (Netherlands)

- GlaxoSmithKline plc. (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- GC Corporation (Japan)

- Fresh, LLC. (U.S.)

- 3M (U.S.)

- Young Innovations, Inc. (U.S.)

- Ultradent Products Inc. (U.S.)

- Lion Corporation (Japan)

- Henkel Adhesives Technologies India Private Limited (India)

- Merck KGaA, Darmstadt, Germany (Germany)

- Sunstar Suisse S.A. (Switzerland)

- Kao Corporation (Japan)

- Church & Dwight Co., Inc (U.S.)

Recent Developments in Oral Care and Oral Hygiene Products Market

- In January 2024, Dr. Dento launched a new range of oral health products, including electric toothbrushes, toothpaste, and mouthwash. These products feature natural ingredients and advanced technology, offering vegan, fluoride-free, and alcohol-free options for sustainable and effective oral care.

- In November 2023, Lion's new Dent Health Medicated Toothpaste DX is designed to protect weakened gums and teeth while preventing periodontitis and cavities. It offers enhanced care for oral health by targeting common issues that affect gum and tooth strength.

- In February 2022, Colgate-Palmolive launched its "Recycle Me!" toothpaste tube, the first recyclable tube recognized by external recycling authorities. Made from High-Density Polyethylene (HDPE), it simplifies recycling without the need for rinsing.

- In January 2021, Dabur released Dabur Red Pulling Oil, an Ayurvedic mouthwash based on traditional practices such as Kavala Gandusha. This product aims to enhance oral health by incorporating techniques from ancient Ayurvedic texts.

- In January 2020, Colgate-Palmolive acquired Hello Products LLC, a premium oral care brand known for its "naturally-friendly” products. The acquisition enhances Colgate's appeal to younger, environmentally conscious consumers with Hello's range of toothpaste, mouth rinses, toothbrushes, and dental floss.

DBMR’s market report on the global oral care/oral hygiene products market takes you through valuable insights that can contribute to making several important business decisions. Based on our reports and research expertise you can create realistic growth strategies for your business.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.