Global Oracle Services Market

Market Size in USD Billion

CAGR :

%

USD

12.77 Billion

USD

35.43 Billion

2024

2032

USD

12.77 Billion

USD

35.43 Billion

2024

2032

| 2025 –2032 | |

| USD 12.77 Billion | |

| USD 35.43 Billion | |

|

|

|

|

Oracle Services Market Analysis

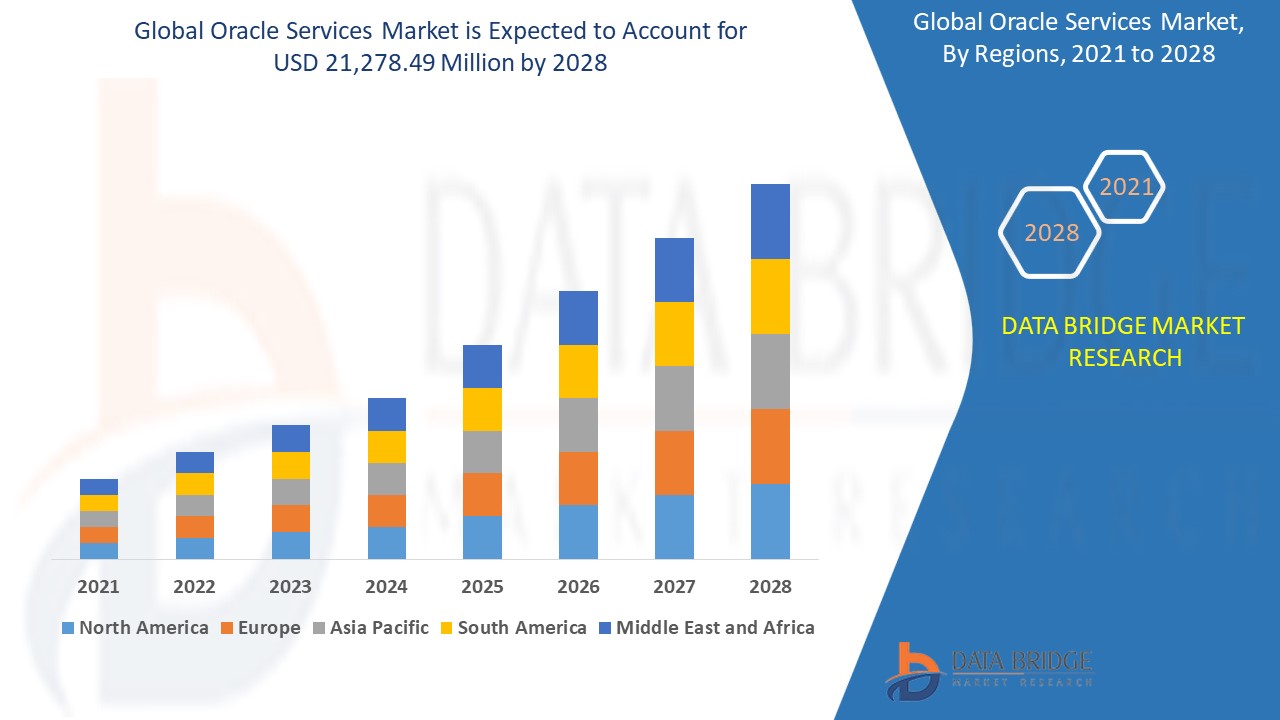

The Oracle services market is experiencing significant growth, driven by increasing cloud adoption, digital transformation, and the rising demand for AI-powered enterprise solutions. Businesses across industries, including BFSI, healthcare, retail, and manufacturing, are leveraging Oracle Cloud Infrastructure (OCI) for enhanced scalability, security, and cost-efficiency. Recent advancements such as Oracle DatabaseAzure, Oracle DatabaseAWS, and OCI Generative AI services are expanding the platform’s capabilities, enabling seamless integration with multi-cloud environments and AI-driven applications. The market is further propelled by Oracle’s continuous investments in automation, machine learning, and advanced analytics, allowing enterprises to optimize operations and improve decision-making. North America leads the market due to its robust IT infrastructure and high cloud adoption, while Asia-Pacific is expected to witness rapid growth, fueled by economic expansion and increasing digitalization. Moreover, Oracle’s strategic partnerships with Microsoft, AWS, and leading consulting firms strengthen its position in the enterprise IT ecosystem. As organizations prioritize data security and efficiency, Oracle’s suite of cloud-based services is poised to play a pivotal role in transforming global business operations, making it a key player in the evolving technology landscape.

Oracle Services Market Size

The global oracle services market size was valued at USD 12.77 billion in 2024 and is projected to reach USD 35.43 billion by 2032, with a CAGR of 13.60% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Oracle Services Market Trends

“Rapid Multi-Cloud Adoption”

The oracle services market is rapidly evolving, with multi-cloud adoption emerging as a key trend, enabling enterprises to leverage multiple cloud environments for enhanced flexibility and efficiency. Oracle’s strategic collaboration with Microsoft Azure and Amazon Web Services (AWS), exemplified by Oracle Database@Azure and Oracle Database@AWS, allows businesses to run Oracle Cloud Infrastructure (OCI) services within third-party cloud ecosystems. This trend is driven by the increasing need for hybrid cloud solutions, enabling enterprises to optimize workloads while maintaining compliance and security. For instance, financial institutions are integrating OCI Autonomous Database with Azure to improve real-time analytics and risk management. The demand for cloud interoperability and AI-driven automation is further fueling Oracle’s expansion, as businesses seek to unify their database management and enterprise applications seamlessly. With digital transformation accelerating across industries, Oracle’s multi-cloud capabilities position it as a leading provider in the enterprise cloud solutions market.

Report Scope and Oracle Services Market Segmentation

|

Attributes |

Oracle Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of Sonouth America as part of South America |

|

Key Market Players |

Oracle (U.S.), IBM Corporation (U.S.), Deloitte Touche Tohmatsu Limited (U.K.), Capgemini (France), DXC Technology Company (U.S.), HCL Technologies Limited (India), Wipro (India), Accenture (Ireland), Tata Consultancy Services Limited (India), Cognizant (U.S.), Tech Mahindra Limited (India), Infosys Limited (India), PwC (U.K.), Arista Networks, Inc. (U.S.), Broadcom (U.S.), Cyber Power Systems (USA), Inc. (U.S.), Delta Electronics, Inc. (Taiwan), Huawei Technologies Co., Ltd. (China), Nuance Communications, Inc. (U.S.), Mastek (India), and IT Convergence (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Oracle Services Market Definition

Oracle Services refer to a comprehensive suite of cloud-based and on-premises solutions offered by Oracle Corporation to support businesses in optimizing their IT infrastructure, applications, and data management. These services include Oracle Cloud Infrastructure (OCI) for computing, storage, and networking, Oracle Database Services for secure and scalable data management, and Enterprise Applications such as ERP, CRM, and HCM to streamline business operation.

Oracle Services Market Dynamics

Drivers

- Rising Cloud Adoption

Organizations worldwide are rapidly migrating to Oracle Cloud Infrastructure (OCI) to enhance scalability, security, and cost efficiency. With the increasing complexity of enterprise workloads, businesses are shifting from traditional on-premises infrastructure to cloud-based environments that offer high availability, disaster recovery, and reduced operational costs. OCI provides a comprehensive suite of compute, storage, and database services, making it an attractive choice for companies looking to streamline operations. For instance, FedEx adopted OCI to modernize its IT infrastructure, enabling faster logistics data processing while significantly reducing infrastructure costs. As businesses prioritize cloud-native applications and AI-driven automation, Oracle’s continued investment in cloud computing, AI, and edge services is further driving market growth. The growing preference for hybrid and multi-cloud strategies ensures that enterprises can seamlessly integrate OCI with other cloud providers, making cloud adoption a critical driver for the expansion of Oracle’s service market.

- Growing Demand for Multi-Cloud and Hybrid Cloud Solutions

The rising need for multi-cloud and hybrid cloud solutions is another key driver shaping the Oracle services market. Enterprises seek flexibility, interoperability, and redundancy, which has led to Oracle’s strategic partnerships with Microsoft Azure and Amazon Web Services (AWS). These collaborations have resulted in offerings such as Oracle Database@Azure and Oracle Database@AWS, allowing businesses to run Oracle workloads on third-party cloud platforms while maintaining performance and security. A prime instance is UBS, the global financial services provider, which adopted Oracle Database@Azure to enable real-time data processing and regulatory compliance across its multi-cloud ecosystem. This trend is particularly crucial for BFSI, healthcare, and government sectors, where data sovereignty, disaster recovery, and compliance requirements demand seamless integration between multiple cloud providers. As organizations continue to embrace multi-cloud architectures to optimize performance and cost-efficiency, Oracle’s cross-cloud solutions will remain a significant growth driver in the market.

Opportunities

- Increasing Advancements in AI and Automation

The integration of AI-driven analytics, machine learning (ML), and automation tools within Oracle’s databases and enterprise applications presents a major market opportunity for businesses seeking improved efficiency and decision-making. Oracle’s AI-powered solutions, such as Oracle Autonomous Database, automate routine database management tasks, including performance tuning, security patching, and backups, reducing manual workload and operational costs. In addition, Oracle’s Fusion Cloud Applications Suite leverages AI and ML to provide predictive insights, process automation, and personalized user experiences. For instance, Sinclair Broadcast Group adopted Oracle AI-powered ERP and HCM solutions to optimize workforce management and financial operations, significantly improving business agility. As organizations look to streamline processes and leverage AI for business intelligence and automation, Oracle’s continued advancements in this space create substantial opportunities for enterprises to enhance operational efficiency and competitiveness in the evolving digital landscape.

- Increasing Digital Transformation Initiatives

The accelerating pace of digital transformation across industries has opened significant growth opportunities for Oracle’s enterprise applications, including ERP, CRM, and HCM. Organizations are modernizing their IT infrastructure to achieve greater agility, automation, and data-driven decision-making, positioning Oracle as a key technology partner. With businesses shifting towards cloud-based enterprise resource planning (ERP) systems, Oracle’s Fusion Cloud ERP has seen widespread adoption, offering seamless financial management, procurement, and risk management capabilities. For instance, CERN, the European research organization, implemented Oracle Fusion Cloud ERP to optimize financial operations and enhance cost management. Similarly, companies in retail, manufacturing, and healthcare are leveraging Oracle CRM and HCM solutions to improve customer engagement, workforce productivity, and HR automation. As enterprises increasingly invest in cloud-driven modernization, Oracle’s robust suite of applications positions it to capitalize on this growing demand, further strengthening its market presence.

Restraints/Challenges

- High Implementation Costs

One of the biggest challenges in the Oracle Services Market is the high cost of implementation. Oracle’s enterprise solutions, such as Oracle Cloud ERP, Oracle Database, and Oracle Fusion Applications, require significant upfront investment in licensing, infrastructure, and skilled workforce. In addition, businesses often face hidden costs in customization, integration with legacy systems, and ongoing maintenance. For instance, a mid-sized retail company looking to migrate to Oracle Cloud ERP may find itself spending not just on the software and on consultation services, training, and data migration, significantly increasing the total cost of ownership. This challenge makes Oracle’s solutions less attractive for small and mid-sized enterprises (SMEs), pushing them toward competitors such as Microsoft Dynamics 365 or SAP Business One, which offer more cost-effective and scalable alternatives.

- Security and Compliance Concerns

With the increasing volume of sensitive enterprise data moving to Oracle’s cloud infrastructure, security and compliance remain major concerns. Oracle operates in industries such as finance, healthcare, and government, where data protection laws such as GDPR (Europe), HIPAA (U.S.), and CCPA (California) impose strict regulatory requirements. Any breach or misconfiguration can lead to data leaks, financial penalties, and reputational damage. For instance, in 2022, a financial services firm using Oracle Cloud faced compliance issues due to improper access controls, leading to regulatory fines. Moreover, businesses operating in multiple regions must ensure their Oracle deployments adhere to varying national data policies, making compliance management complex and costly. This concern makes some companies hesitant to adopt Oracle services, especially when competitors such as AWS and Microsoft Azure offer more granular security control options and region-specific compliance tools.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Oracle Services Market Scope

The market is segmented on the basis of service, enterprise size, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service

- Consulting Service

- Financial Service

- Cloud Service

Enterprise Size

- Small and Medium Enterprise (SME)

- Large Enterprise

Vertical

- BFSI

- High Tech

- Communication and Media

- Retail and CPG

- Energy and Utilities

- Healthcare and Life Sciences

- Public Sector

- Others

Oracle Services Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, service, enterprise size, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is dominating the oracle services market, driven by the increasing adoption of cloud-based solutions. The region's strong digital infrastructure and growing investments in cloud technologies further contribute to this dominance. Businesses across various industries are shifting towards Oracle cloud services to enhance operational efficiency and scalability. In addition, the rising demand for advanced analytics and data management solutions strengthens North America's market leadership.

Asia-Pacific is projected to experience fastest growth in the oracle services market from 2025 to 2032, driven by rapid economic expansion. Increasing digital transformation initiatives and cloud adoption across industries are fueling market demand. Governments and enterprises are investing heavily in advanced IT infrastructure to enhance operational efficiency. In addition, the growing number of startups and technological advancements further contribute to the region's strong market potential.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Oracle Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Oracle Services Market Leaders Operating in the Market Are:

- Oracle (U.S.)

- IBM Corporation (U.S.)

- Deloitte Touche Tohmatsu Limited (U.K.)

- Capgemini (France)

- DXC Technology Company (U.S.)

- HCL Technologies Limited (India)

- Wipro (India)

- Accenture (Ireland)

- Tata Consultancy Services Limited (India)

- Cognizant (U.S.)

- Tech Mahindra Limited (India)

- Infosys Limited (India)

- PwC (PricewaterhouseCoopers) (U.K.)

- Arista Networks, Inc. (U.S.)

- Broadcom (U.S.)

- Cyber Power Systems (USA), Inc. (U.S.)

- Delta Electronics, Inc. (Taiwan)

- Huawei Technologies Co., Ltd. (China)

- Nuance Communications, Inc. (U.S.)

- Mastek (India)

- IT Convergence (U.S.)

Latest Developments in Oracle Services Market

- In November 2024 Oracle Partner Network (OPN) member Reaktr, the global business unit of Exela Technologies, Inc., and XBP Europe announced the availability of SecAi on Oracle Cloud Infrastructure (OCI) and in the Oracle Cloud Marketplace

- In September 2024 Oracle and Amazon Web Services, Inc. (AWS) introduced Oracle Database@AWS, a new offering that enables customers to access Oracle Autonomous Database on dedicated infrastructure and Oracle Exadata Database Service within AWS. This service ensures a seamless experience between Oracle Cloud Infrastructure (OCI) and AWS, simplifying database management, billing, and customer support

- In September 2023 Oracle launched new application development tools designed to help developers rapidly build and deploy applications on Oracle Cloud Infrastructure. These tools cater to cloud-native and Java developers, enabling them to create highly responsive and cost-efficient cloud-native applications

- In September 2023 Oracle and Microsoft expanded their collaboration by launching Oracle Database@Azure, providing users with direct access to Oracle database services running on Oracle Cloud Infrastructure (OCI) within Microsoft Azure data centers

- In February 2024 Oracle introduced the Oracle Cloud Infrastructure (OCI) Generative AI service in Australia and New Zealand, a fully managed solution that allows enterprises to integrate Cohere and Meta Llama 2 large language models (LLMs) into their applications through an API

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ORACLE SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ORACLE SERVICES MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ORACLE SERVICES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW AND INDUSTRY TRENDS

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 USE CASE ANALYSIS

5.2 REGULATORY FRAMEWORK

5.3 TECHNOLOGY TREND ANALYSIS

5.4 INVESTMENT VS ADOPTION MODEL

5.5 PORTER’S FIVE FORCE MODEL

5.6 PATENT ANALYSIS

6. GLOBAL ORACLE SERVICES MARKET, BY SERVICE

6.1 OVERVIEW

6.2 ORACLE CONSULTING SERVICES

6.3 ORACLE FINANCIAL SERVICES

6.4 ORACLE CLOUD SERVICES

6.4.1 INFRASTRUCTURE AS A SERVICE (IAAS)

6.4.2 PLATFORM AS A SERVICE (PAAS)

6.4.3 SOFTWARE AS A SERVICE (SAAS)

6.4.4 ENTERPRISE RESOURCE PLANNING (ERP) SERVICES

6.4.5 HUMAN CAPITAL MANAGEMENT (HCM) SERVICES

6.4.6 CUSTOMER EXPERIENCE (CX) SERVICES

6.4.7 CUSTOMER EXPERIENCE MANAGEMENT (CXM) SERVICES

7. GLOBAL ORACLE SERVICES MARKET, BY DEPLOYMENT MODEL\

7.1 OVERVIEW

7.2 ON-PREMISE

7.3 CLOUD BASED

7.3.1 PRIVATE CLOUD

7.3.2 PUBLIC CLOUD

7.3.3 HYBRID CLOUD

8. GLOBAL ORACLE SERVICES MARKET, BY ENTERPRISE SIZE

8.1 OVERVIEW

8.2 SMALL & MEDIUM ENTERPRISE

8.3 LARGE ENTERPRISE

9. GLOBAL ORACLE SERVICES MARKET, BY VERTICAL

9.1 OVERVIEW

9.2 BFSI

9.2.1 BY SERVICE

9.2.1.1. ORACLE CONSULTING SERVICES

9.2.1.2. ORACLE FINANCIAL SERVICES

9.2.1.3. ORACLE CLOUD SERVICES

9.2.1.3.1. INFRASTRUCTURE AS A SERVICE (IAAS)

9.2.1.3.2. PLATFORM AS A SERVICE (PAAS)

9.2.1.3.3. SOFTWARE AS A SERVICE (SAAS)

9.2.1.3.4. ENTERPRISE RESOURCE PLANNING (ERP) SERVICES

9.2.1.3.5. HUMAN CAPITAL MANAGEMENT (HCM) SERVICES

9.2.1.3.6. CUSTOMER EXPERIENCE (CX) SERVICES

9.2.1.3.7. CUSTOMER EXPERIENCE MANAGEMENT (CXM) SERVICES

9.3 COMMUNICATION AND MEDIA

9.3.1 BY SERVICE

9.3.1.1. ORACLE CONSULTING SERVICES

9.3.1.2. ORACLE FINANCIAL SERVICES

9.3.1.3. ORACLE CLOUD SERVICES

9.3.1.3.1. INFRASTRUCTURE AS A SERVICE (IAAS)

9.3.1.3.2. PLATFORM AS A SERVICE (PAAS)

9.3.1.3.3. SOFTWARE AS A SERVICE (SAAS)

9.3.1.3.4. ENTERPRISE RESOURCE PLANNING (ERP) SERVICES

9.3.1.3.5. HUMAN CAPITAL MANAGEMENT (HCM) SERVICES

9.3.1.3.6. CUSTOMER EXPERIENCE (CX) SERVICES

9.3.1.3.7. CUSTOMER EXPERIENCE MANAGEMENT (CXM) SERVICES

9.4 SEMICONDUCTOR & ELECTRONICS

9.4.1 BY SERVICE

9.4.1.1. ORACLE CONSULTING SERVICES

9.4.1.2. ORACLE FINANCIAL SERVICES

9.4.1.3. ORACLE CLOUD SERVICES

9.4.1.3.1. INFRASTRUCTURE AS A SERVICE (IAAS)

9.4.1.3.2. PLATFORM AS A SERVICE (PAAS)

9.4.1.3.3. SOFTWARE AS A SERVICE (SAAS)

9.4.1.3.4. ENTERPRISE RESOURCE PLANNING (ERP) SERVICES

9.4.1.3.5. HUMAN CAPITAL MANAGEMENT (HCM) SERVICES

9.4.1.3.6. CUSTOMER EXPERIENCE (CX) SERVICES

9.4.1.3.7. CUSTOMER EXPERIENCE MANAGEMENT (CXM) SERVICES

9.5 MANUFACTURING

9.5.1 BY SERVICE

9.5.1.1. ORACLE CONSULTING SERVICES

9.5.1.2. ORACLE FINANCIAL SERVICES

9.5.1.3. ORACLE CLOUD SERVICES

9.5.1.3.1. INFRASTRUCTURE AS A SERVICE (IAAS)

9.5.1.3.2. PLATFORM AS A SERVICE (PAAS)

9.5.1.3.3. SOFTWARE AS A SERVICE (SAAS)

9.5.1.3.4. ENTERPRISE RESOURCE PLANNING (ERP) SERVICES

9.5.1.3.5. HUMAN CAPITAL MANAGEMENT (HCM) SERVICES

9.5.1.3.6. CUSTOMER EXPERIENCE (CX) SERVICES

9.5.1.3.7. CUSTOMER EXPERIENCE MANAGEMENT (CXM) SERVICES

9.6 RETAIL

9.6.1 BY SERVICE

9.6.1.1. ORACLE CONSULTING SERVICES

9.6.1.2. ORACLE FINANCIAL SERVICES

9.6.1.3. ORACLE CLOUD SERVICES

9.6.1.3.1. INFRASTRUCTURE AS A SERVICE (IAAS)

9.6.1.3.2. PLATFORM AS A SERVICE (PAAS)

9.6.1.3.3. SOFTWARE AS A SERVICE (SAAS)

9.6.1.3.4. ENTERPRISE RESOURCE PLANNING (ERP) SERVICES

9.6.1.3.5. HUMAN CAPITAL MANAGEMENT (HCM) SERVICES

9.6.1.3.6. CUSTOMER EXPERIENCE (CX) SERVICES

9.6.1.3.7. CUSTOMER EXPERIENCE MANAGEMENT (CXM) SERVICES

9.7 ENERGY AND UTILITIES

9.7.1 BY SERVICE

9.7.1.1. ORACLE CONSULTING SERVICES

9.7.1.2. ORACLE FINANCIAL SERVICES

9.7.1.3. ORACLE CLOUD SERVICES

9.7.1.3.1. INFRASTRUCTURE AS A SERVICE (IAAS)

9.7.1.3.2. PLATFORM AS A SERVICE (PAAS)

9.7.1.3.3. SOFTWARE AS A SERVICE (SAAS)

9.7.1.3.4. ENTERPRISE RESOURCE PLANNING (ERP) SERVICES

9.7.1.3.5. HUMAN CAPITAL MANAGEMENT (HCM) SERVICES

9.7.1.3.6. CUSTOMER EXPERIENCE (CX) SERVICES

9.7.1.3.7. CUSTOMER EXPERIENCE MANAGEMENT (CXM) SERVICES

9.8 HEALTHCARE

9.8.1 BY SERVICE

9.8.1.1. ORACLE CONSULTING SERVICES

9.8.1.2. ORACLE FINANCIAL SERVICES

9.8.1.3. ORACLE CLOUD SERVICES

9.8.1.3.1. INFRASTRUCTURE AS A SERVICE (IAAS)

9.8.1.3.2. PLATFORM AS A SERVICE (PAAS)

9.8.1.3.3. SOFTWARE AS A SERVICE (SAAS)

9.8.1.3.4. ENTERPRISE RESOURCE PLANNING (ERP) SERVICES

9.8.1.3.5. HUMAN CAPITAL MANAGEMENT (HCM) SERVICES

9.8.1.3.6. CUSTOMER EXPERIENCE (CX) SERVICES

9.8.1.3.7. CUSTOMER EXPERIENCE MANAGEMENT (CXM) SERVICES

9.9 PUBLIC SECTOR

9.9.1 BY SERVICE

9.9.1.1. ORACLE CONSULTING SERVICES

9.9.1.2. ORACLE FINANCIAL SERVICES

9.9.1.3. ORACLE CLOUD SERVICES

9.9.1.3.1. INFRASTRUCTURE AS A SERVICE (IAAS)

9.9.1.3.2. PLATFORM AS A SERVICE (PAAS)

9.9.1.3.3. SOFTWARE AS A SERVICE (SAAS)

9.9.1.3.4. ENTERPRISE RESOURCE PLANNING (ERP) SERVICES

9.9.1.3.5. HUMAN CAPITAL MANAGEMENT (HCM) SERVICES

9.9.1.3.6. CUSTOMER EXPERIENCE (CX) SERVICES

9.9.1.3.7. CUSTOMER EXPERIENCE MANAGEMENT (CXM) SERVICES

9.10 OTHERS

10. GLOBAL ORACLE SERVICES MARKET, BY GEOGRAPHY

10.1 GLOBAL ORACLE SERVICES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.1.1 NORTH AMERICA

10.1.1.1. U.S.

10.1.1.2. CANADA

10.1.1.3. MEXICO

10.1.2 EUROPE

10.1.2.1. GERMANY

10.1.2.2. FRANCE

10.1.2.3. U.K.

10.1.2.4. ITALY

10.1.2.5. SPAIN

10.1.2.6. RUSSIA

10.1.2.7. TURKEY

10.1.2.8. BELGIUM

10.1.2.9. NETHERLANDS

10.1.2.10. SWITZERLAND

10.1.2.11. DENMARK

10.1.2.12. POLAND

10.1.2.13. SWEDEN

10.1.2.14. NORWAY

10.1.2.15. FINLAND

10.1.2.16. REST OF EUROPE

10.1.3 EUROPE

10.1.3.1. CHINA

10.1.3.2. JAPAN

10.1.3.3. INDIA

10.1.3.4. SOUTH KOREA

10.1.3.5. AUSTRALIA

10.1.3.6. SINGAPORE

10.1.3.7. MALAYSIA

10.1.3.8. THAILAND

10.1.3.9. INDONESIA

10.1.3.10. PHILIPPINES

10.1.3.11. NEW ZEALAND

10.1.3.12. TAIWAN

10.1.3.13. VIETNAM

10.1.3.14. REST OF ASIA-PACIFIC

10.1.4 SOUTH AMERICA

10.1.4.1. BRAZIL

10.1.4.2. ARGENTINA

10.1.4.3. REST OF SOUTH AMERICA

10.1.5 MIDDLE EAST AND AFRICA

10.1.5.1. SOUTH AFRICA

10.1.5.2. EGYPT

10.1.5.3. SAUDI ARABIA

10.1.5.4. U.A.E

10.1.5.5. ISRAEL

10.1.5.6. KUWAIT

10.1.5.7. OMAN

10.1.5.8. QATAR

10.1.5.9. BAHRAIN

10.1.5.10. REST OF MIDDLE EAST AND AFRICA

10.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

11. GLOBAL ORACLE SERVICES MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12. GLOBAL ORACLE SERVICES MARKET, SWOT & DBMR ANALYSIS

13. GLOBAL ORACLE SERVICES MARKET, COMPANY PROFILE

13.1 ORACLE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 GEOGRAPHIC PRESENCE

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 IT CONVERGENCE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 GEOGRAPHIC PRESENCE

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 NTT DATA AMERICAS, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 GEOGRAPHIC PRESENCE

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 IBM

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 GEOGRAPHIC PRESENCE

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 ACCENTURE

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 GEOGRAPHIC PRESENCE

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 EVOSYS

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 GEOGRAPHIC PRESENCE

13.6.4 PRODUCT PORTFOLIO

13.6.5 RECENT DEVELOPMENTS

13.7 WIPRO

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 GEOGRAPHIC PRESENCE

13.7.4 PRODUCT PORTFOLIO

13.7.5 RECENT DEVELOPMENTS

13.8 CAPGEMINI

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 GEOGRAPHIC PRESENCE

13.8.4 PRODUCT PORTFOLIO

13.8.5 RECENT DEVELOPMENTS

13.9 INFOSYS

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 GEOGRAPHIC PRESENCE

13.9.4 PRODUCT PORTFOLIO

13.9.5 RECENT DEVELOPMENTS

13.10 COGNIZANT

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 GEOGRAPHIC PRESENCE

13.10.4 PRODUCT PORTFOLIO

13.10.5 RECENT DEVELOPMENTS

13.11 DXC TECHNOLOGY COMPANY

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 GEOGRAPHIC PRESENCE

13.11.4 PRODUCT PORTFOLIO

13.11.5 RECENT DEVELOPMENTS

13.12 KPMG LLP

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 GEOGRAPHIC PRESENCE

13.12.4 PRODUCT PORTFOLIO

13.12.5 RECENT DEVELOPMENTS

13.13 DELOITTE TOUCHE TOHMATSU LIMITED

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 GEOGRAPHIC PRESENCE

13.13.4 PRODUCT PORTFOLIO

13.13.5 RECENT DEVELOPMENTS

13.14 HCL TECHNOLOGIES LIMITED

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 GEOGRAPHIC PRESENCE

13.14.4 PRODUCT PORTFOLIO

13.14.5 RECENT DEVELOPMENTS

13.15 FUJITSU

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 GEOGRAPHIC PRESENCE

13.15.4 PRODUCT PORTFOLIO

13.15.5 RECENT DEVELOPMENTS

13.16 ARISTA NETWORKS, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 GEOGRAPHIC PRESENCE

13.16.4 PRODUCT PORTFOLIO

13.16.5 RECENT DEVELOPMENTS

13.17 HUAWEI TECHNOLOGIES CO., LTD

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 GEOGRAPHIC PRESENCE

13.17.4 PRODUCT PORTFOLIO

13.17.5 RECENT DEVELOPMENTS

13.18 PWC

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 GEOGRAPHIC PRESENCE

13.18.4 PRODUCT PORTFOLIO

13.18.5 RECENT DEVELOPMENTS

13.19 TATA CONSULTANCY SERVICES LIMITED

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 GEOGRAPHIC PRESENCE

13.19.4 PRODUCT PORTFOLIO

13.19.5 RECENT DEVELOPMENTS

13.20 INSPIRAGE

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 GEOGRAPHIC PRESENCE

13.20.4 PRODUCT PORTFOLIO

13.20.5 RECENT DEVELOPMENTS

13.21 NAGARRO

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 GEOGRAPHIC PRESENCE

13.21.4 PRODUCT PORTFOLIO

13.21.5 RECENT DEVELOPMENTS

13.22 SPERIDIAN

13.22.1 COMPANY SNAPSHOT

13.22.2 REVENUE ANALYSIS

13.22.3 GEOGRAPHIC PRESENCE

13.22.4 PRODUCT PORTFOLIO

13.22.5 RECENT DEVELOPMENTS

13.23 ACCELALPHA INC

13.23.1 COMPANY SNAPSHOT

13.23.2 REVENUE ANALYSIS

13.23.3 GEOGRAPHIC PRESENCE

13.23.4 PRODUCT PORTFOLIO

13.23.5 RECENT DEVELOPMENTS

13.24 TIER1 INC.

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 GEOGRAPHIC PRESENCE

13.24.4 PRODUCT PORTFOLIO

13.24.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

14. CONCLUSION

15. RELATED REPORTS

16. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.