Global Optometry Eye Exam Equipment Market

Market Size in USD Billion

CAGR :

%

USD

3.51 Billion

USD

6.11 Billion

2024

2032

USD

3.51 Billion

USD

6.11 Billion

2024

2032

| 2025 –2032 | |

| USD 3.51 Billion | |

| USD 6.11 Billion | |

|

|

|

|

Optometry/Eye Exam Equipment Market Size

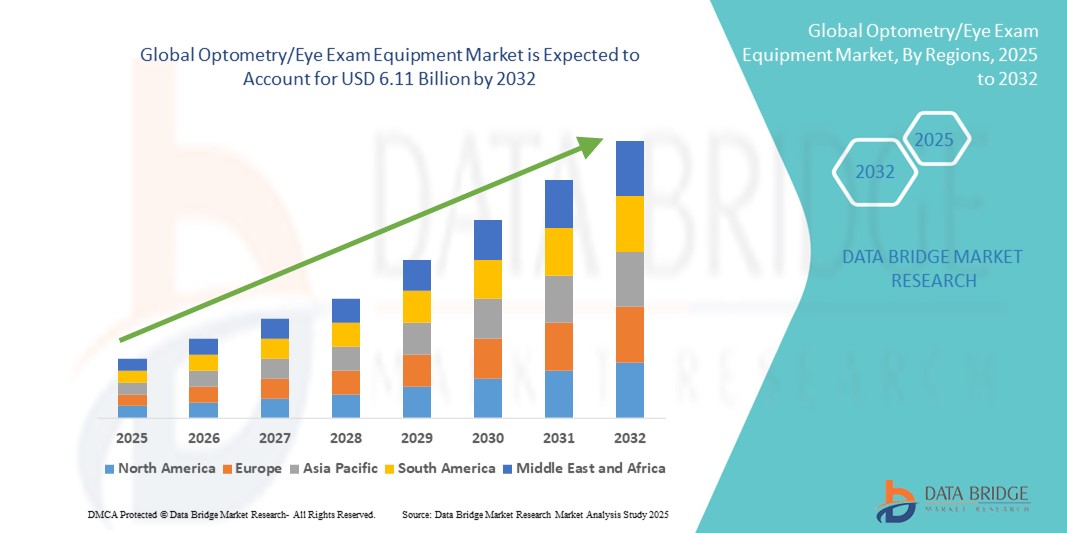

- The global optometry/eye exam equipment market size was valued at USD 3.51 billion in 2024 and is expected to reach USD 6.11 billion by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is largely driven by the increasing prevalence of vision-related disorders, a rapidly aging global population, and the expanding awareness regarding routine eye checkups, which is prompting greater investment in ophthalmic diagnostics

- Furthermore, advancements in diagnostic imaging technologies and the integration of AI in eye care are enhancing the accuracy and efficiency of eye exams, making optometry equipment more indispensable for both clinical and retail eye care providers. These dynamics are significantly advancing the adoption of modern eye exam solutions and fueling overall market expansion

Optometry/Eye Exam Equipment Market Analysis

- Optometry/eye exam equipment, encompassing devices for diagnosing vision disorders and assessing ocular health, plays a critical role in modern eye care practices across both clinical and retail settings due to its ability to detect and monitor a wide range of conditions, from refractive errors to chronic eye diseases

- The rising demand for optometry equipment is primarily fueled by the increasing global prevalence of vision impairment, growing awareness of preventive eye care, and technological advancements in diagnostic imaging and digital refraction systems

- North America dominated the optometry/eye exam equipment market with the largest revenue share of 39.4% in 2024, supported by advanced healthcare infrastructure, growing geriatric population, and high adoption of AI-integrated ophthalmic diagnostic tools, with the U.S. being a frontrunner in leveraging OCT and fundus imaging technologies

- Asia-Pacific is expected to be the fastest growing region in the optometry/eye exam equipment market during the forecast period due to rapid urbanization, increased healthcare spending, and the rising burden of undiagnosed eye conditions

- Retina and glaucoma examination products segment dominated the optometry/eye exam equipment market with a market share of 41.8% in 2024, driven by the need for early detection of chronic conditions such as glaucoma and diabetic retinopathy and growing use of advanced retinal imaging systems in both primary and specialized eye care

Report Scope and Optometry/Eye Exam Equipment Market Segmentation

|

Attributes |

Optometry/Eye Exam Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Optometry/Eye Exam Equipment Market Trends

AI-Driven Diagnostics and Portable Imaging Solutions

- A prominent and accelerating trend in the global optometry/eye exam equipment market is the integration of artificial intelligence (AI) into diagnostic platforms and the growing availability of compact, portable imaging devices. These innovations are transforming how eye care is delivered by enhancing diagnostic accuracy, accessibility, and efficiency

- For instance, companies such as Topcon Healthcare and Eyenuk have developed AI-powered retinal screening solutions capable of detecting diabetic retinopathy and other retinal disorders with high accuracy, even in primary care or telehealth settings

- AI integration in optometry equipment enables real-time analysis of imaging data, reduces subjectivity in diagnosis, and supports faster decision-making by eye care professionals. Moreover, portable fundus cameras and handheld autorefractors are improving eye care access in rural and underserved areas, where traditional full-sized ophthalmic equipment may not be feasible

- The adoption of AI-based diagnostic systems and mobile eye exam tools is streamlining workflows in clinics and optical retail outlets, enabling more screenings in less time. These tools often come with cloud connectivity, allowing for remote consultation, image sharing, and integration into electronic medical records (EMR) systems

- This trend toward smarter, more accessible, and data-driven eye exam solutions is redefining the standard of care in optometry. As patient expectations grow and healthcare providers seek efficiency, manufacturers are increasingly focusing on devices that blend portability, AI, and interoperability into their product lines

- Consequently, companies such as ZEISS and Optomed are investing in AI-backed diagnostic devices and expanding their portable imaging portfolio to meet the evolving needs of eye care professionals in diverse clinical environments

Optometry/Eye Exam Equipment Market Dynamics

Driver

Rising Vision Disorders and Expanding Access to Eye Care

- The increasing prevalence of eye diseases such as glaucoma, diabetic retinopathy, and myopia, combined with aging populations and greater screen exposure, is a primary driver for the growing demand for optometry and eye exam equipment

- For instance, according to the International Agency for the Prevention of Blindness (IAPB), uncorrected refractive errors and cataracts remain leading causes of visual impairment globally, highlighting the need for widespread access to diagnostic equipment

- With rising health awareness, both governments and private providers are expanding eye care outreach and screening programs, particularly in emerging markets. Eye care professionals increasingly depend on accurate, user-friendly equipment to diagnose, monitor, and manage these conditions effectively

- Moreover, the evolution of outpatient care, including optical retail chains and tele-optometry platforms, is broadening the usage of eye exam tools beyond hospitals and specialty clinics. This shift supports the market for compact and versatile diagnostic instruments suitable for a variety of clinical settings

- The availability of government funding, insurance support, and public-private partnerships for eye health programs is also contributing to higher equipment procurement and deployment rates across regions

Restraint/Challenge

High Cost of Advanced Equipment and Skilled Workforce Shortage

- The high cost associated with advanced optometry equipment, particularly AI-integrated diagnostic systems and high-resolution imaging tools, poses a challenge for widespread adoption especially among small clinics, independent practitioners, and in low-income regions

- For instance, comprehensive diagnostic platforms such as optical coherence tomography (OCT) and corneal topography systems often require significant capital investment and maintenance, limiting their affordability and accessibility

- In addition, the effective use of such sophisticated tools demands skilled optometrists and technicians. However, many regions particularly in developing countries—face a shortage of trained professionals, leading to underutilization of available equipment

- To overcome these challenges, manufacturers are increasingly focusing on developing cost-effective, compact, and user-friendly solutions that require minimal training. Remote training modules, AI-assisted diagnostics, and cloud-based platforms are also helping bridge the gap between equipment availability and skilled operation

- Further advancements in affordability, user interfaces, and global training initiatives will be essential to address these limitations and drive equitable growth in the optometry/eye exam equipment market

Optometry/Eye Exam Equipment Market Scope

The market is segmented on the basis of type and end-user.

- By Type

On the basis of type, the global optometry/eye exam equipment market is segmented into retina and glaucoma examination products, general examination products, and cornea and cataract examination products. The Retina and Glaucoma Examination Products segment dominated the market with the largest revenue share of 41.8% in 2024, driven by the rising prevalence of chronic eye conditions such as diabetic retinopathy, glaucoma, and age-related macular degeneration. This segment includes advanced diagnostic tools such as fundus cameras, OCT systems, and visual field analyzers that are essential for early detection and ongoing monitoring of retinal and optic nerve disorders. Their integration with AI and digital platforms is further enhancing diagnostic precision, contributing to segment growth.

The cornea and cataract examination products segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by increasing global incidences of cataracts and refractive errors. Technological advancements in corneal topographers, pachymeters, and biometry devices are enabling more accurate pre-surgical assessments and post-operative monitoring. The growth is also supported by the rising demand for cataract surgeries and premium intraocular lens (IOL) options, particularly in aging populations and emerging markets.

- By End-User

On the basis of end-user, the global optometry/eye exam equipment market is segmented into hospitals, clinics, ambulatory surgical centers (ASCs), and others. The Hospitals segment held the largest market share of 46.8% in 2024, owing to their comprehensive diagnostic capabilities, availability of specialized ophthalmologists, and high patient inflow. Hospitals often invest in advanced and integrated eye examination systems for the management of complex eye diseases, ensuring a steady demand for high-end optometry equipment. Moreover, favorable reimbursement policies and access to government and private healthcare funding contribute to this segment’s leadership.

The Ambulatory Surgical Centers (ASCs) segment is expected to grow at the fastest rate during the forecast period, driven by the rising trend of outpatient ophthalmic procedures, cost-efficiency, and shorter recovery times. ASCs are increasingly adopting compact, high-precision diagnostic tools that support efficient patient throughput and minimally invasive eye surgeries, particularly in developed and fast-developing healthcare systems.

Optometry/Eye Exam Equipment Market Regional Analysis

- North America dominated the optometry/eye exam equipment market with the largest revenue share of 39.4% in 2024, supported by advanced healthcare infrastructure, growing geriatric population, and high adoption of AI-integrated ophthalmic diagnostic tools, with the U.S. being a frontrunner in leveraging OCT and fundus imaging technologies

- Consumers and healthcare providers in the region prioritize early detection and effective management of eye conditions, supported by the integration of AI and digital imaging tools within clinical and retail optometry settings

- This robust market presence is further bolstered by well-established healthcare infrastructure, favorable reimbursement policies, and ongoing innovation from key industry players, making North America a central hub for advanced eye care solutions across both public and private sectors

U.S. Optometry/Eye Exam Equipment Market Insight

The U.S. optometry/eye exam equipment market captured the largest revenue share of 79.5% in 2024 within North America, driven by the high prevalence of vision disorders, early adoption of advanced diagnostic technologies, and a strong focus on preventive eye care. The demand is further propelled by a growing geriatric population, widespread availability of AI-enabled diagnostic tools, and the integration of digital imaging in routine eye exams. The presence of leading ophthalmic device manufacturers and supportive reimbursement frameworks contributes significantly to the country’s dominant market position.

Europe Optometry/Eye Exam Equipment Market Insight

The Europe optometry/eye exam equipment market is projected to expand at a substantial CAGR throughout the forecast period, fueled by increasing awareness of eye health, aging demographics, and technological advancements in diagnostic systems. Stringent regulations on eye care standards and an increase in routine eye checkups are fostering demand across public and private healthcare sectors. The region is experiencing growth in both primary care and specialized ophthalmology practices, with a shift toward digitized, high-efficiency eye exam solutions.

U.K. Optometry/Eye Exam Equipment Market Insight

The U.K. optometry/eye exam equipment market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by strong public health initiatives, increased awareness of age-related vision loss, and investment in NHS eye care services. Growing demand for early detection of eye conditions such as glaucoma and macular degeneration is prompting widespread adoption of OCT and fundus imaging technologies in both clinics and optical retail chains. The U.K.'s well-structured healthcare system and emphasis on preventive care are key drivers of market expansion.

Germany Optometry/Eye Exam Equipment Market Insight

The Germany optometry/eye exam equipment market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s advanced healthcare infrastructure and a high adoption rate of cutting-edge medical technologies. Increased demand for accurate diagnostics in ophthalmology and the integration of AI into optometry workflows are enhancing clinical outcomes and efficiency. Government funding and insurance coverage for routine eye care further stimulate market growth, particularly in hospital-based ophthalmology departments and private clinics.

Asia-Pacific Optometry/Eye Exam Equipment Market Insight

The Asia-Pacific optometry/eye exam equipment market is poised to grow at the fastest CAGR of 23.6% during the forecast period of 2025 to 2032, fueled by expanding healthcare access, rising eye disease prevalence, and technological innovation across countries such as China, India, and Japan. Government initiatives promoting primary eye care and digital health infrastructure are boosting adoption. The region’s growing population, increasing screen time, and efforts to reduce preventable blindness support broad demand for both basic and advanced eye exam tools.

Japan Optometry/Eye Exam Equipment Market Insight

The Japan optometry/eye exam equipment market is gaining traction due to the country’s aging population, high-tech medical landscape, and commitment to early diagnosis of chronic eye conditions. The integration of compact, AI-driven diagnostic devices into local clinics and retail optometry outlets is growing. Japan’s focus on precision healthcare and its widespread use of digital health solutions is reinforcing demand for retinal imaging systems, OCT, and non-invasive screening technologies across urban and rural settings.

India Optometry/Eye Exam Equipment Market Insight

The India optometry/eye exam equipment market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by a rising middle class, improved healthcare infrastructure, and a growing burden of uncorrected refractive errors and cataract cases. Government-backed programs such as Ayushman Bharat and smart city initiatives are enabling greater deployment of mobile and affordable diagnostic tools. Local manufacturing and public-private partnerships are also strengthening domestic supply, making eye exam solutions more accessible across tier 2 and tier 3 cities.

Optometry/Eye Exam Equipment Market Share

The optometry/eye exam equipment industry is primarily led by well-established companies, including:

- Carl Zeiss AG (Germany)

- Haag-Streit (Switzerland)

- Topcon (Japan)

- NIDEK (Japan)

- Heidelberg Engineering (Germany)

- Escalon (U.S.)

- Canon, Inc., (Japan)

- Essilor (France)

- Heine Optotechnik (Germany)

- Novartis AG (Switzerland)

- Johnson & Johnson and its affiliates (U.S.)

- TOPCON CORPORATION (Japan)

- Visionix USA Inc. (U.S.)

What are the Recent Developments in Global Optometry/Eye Exam Equipment Market?

- In August 2025, Topcon Healthcare, Inc announced it has acquired cloud-based retinal screening technology company Intelligent Retinal Imaging Systems (IRIS). In a press release, Topcon expressed its intention to integrate IRIS technologies into its Healthcare from the Eye initiative and further empower clinical decision-making using artificial intelligence (AI), especially for patients with diabetic retinopathy and other diabetic eye diseases

- In July 2024, Heidelberg Engineering, a global leader in ophthalmic imaging and healthcare data solutions, announces FDA clearance of SPECTRALIS OCTA Module with SHIFT technology, which reduces acquisition time by 50%1. The preset OCTA speed of 125 kHz is designed to help streamline workflow, enhance clinical efficiencies, and maintain Heidelberg image quality

- In May 2024, ZEISS Medical Technology announced that the CIRRUS 6000 from ZEISS now enables a highly efficient and data-driven workflow for ophthalmologists, supported by the largest OCT (optical coherence tomography) reference database in the U.S. market, as well as newly enhanced cybersecurity features.

- In April 2024, RetiSpec, Inc., an innovator in AI-powered eye diagnostics for brain health, and Topcon Healthcare, Inc. a leading provider of medical devices and software solutions announced today that Topcon has invested in RetiSpec and the two companies are collaborating to bring the RetiSpec technology to market. The collaboration will bring neurology and eye care closer together

- In October 2023, Topcon Healthcare, a leading provider of medical devices and software solutions for the global eye care community, is pleased to announce that it launched the NW500 to the European market during the 23rd Euretina Congress in Amsterdam on October 5-8, 2023. The NW500 is a new user-friendly, robotic colour fundus camera that provides enhanced image quality in ambient light, even through small pupils

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.