Global Opportunity In Document Outsourcing Services Market

Market Size in USD Billion

CAGR :

%

USD

1.00 Billion

USD

1.28 Billion

2025

2033

USD

1.00 Billion

USD

1.28 Billion

2025

2033

| 2026 –2033 | |

| USD 1.00 Billion | |

| USD 1.28 Billion | |

|

|

|

|

Opportunity in Document Outsourcing Services Market Size

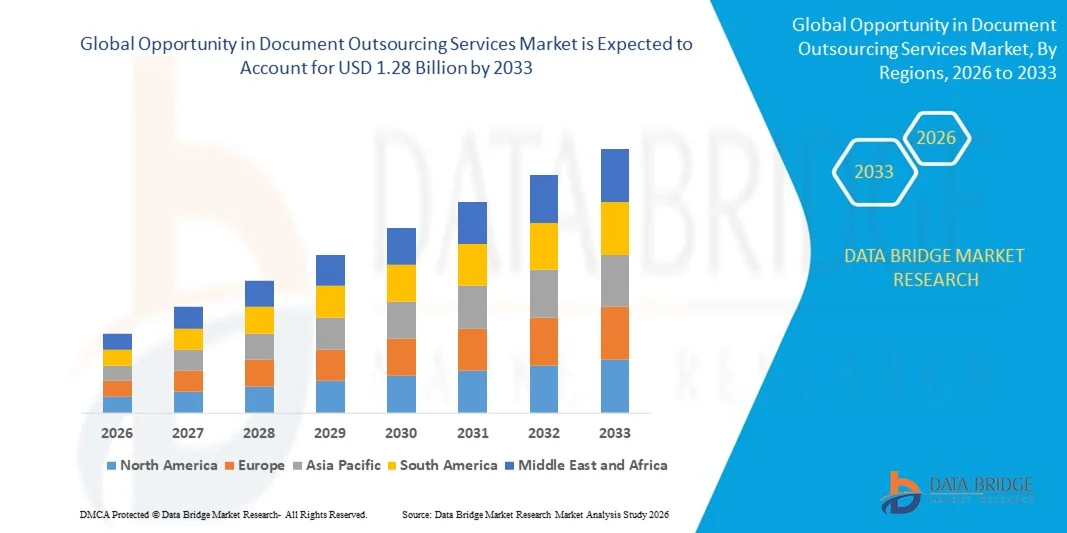

- The global opportunity in document outsourcing services market size was valued at USD 1.00 billion in 2025 and is expected to reach USD 1.28 billion by 2033, at a CAGR of 3.20% during the forecast period

- The market growth is largely fueled by the increasing need for enterprises to manage high volumes of documents efficiently and securely, driving the adoption of outsourcing services for document processing, imaging, content management, and records management across industries such as BFSI, healthcare, legal, and government

- Furthermore, the rising focus on digital transformation, automation, and compliance is encouraging organizations to leverage specialized document outsourcing providers. These converging factors are accelerating the adoption of outsourced document solutions, thereby significantly boosting market growth

Opportunity in Document Outsourcing Services Market Analysis

- Document outsourcing services encompass a wide range of solutions, including document scanning, data capture, digital archiving, content management, and workflow automation. These services help organizations reduce manual processing, improve accuracy, ensure regulatory compliance, and optimize operational efficiency

- The escalating demand for document outsourcing is primarily fueled by the growing volumes of unstructured and structured data, increasing regulatory requirements, rising operational costs, and the need for scalable, technology-enabled solutions that support both on-premises and cloud-based workflows

- North America dominated the opportunity in document outsourcing services market with a share of over 40% in 2025, due to early adoption of digital transformation initiatives across enterprises and the strong presence of established outsourcing service providers

- Asia-Pacific is expected to be the fastest growing region in the opportunity in document outsourcing services market during the forecast period due to rapid economic growth, expanding enterprise base, and accelerating digitalization initiatives

- Document processing services segment dominated the market with a market share in 2025, due to the growing need for efficient handling of high-volume transactional documents across BFSI, healthcare, and government sectors. Enterprises increasingly outsource document processing to improve accuracy, reduce turnaround time, and ensure compliance with regulatory requirements

Report Scope and Opportunity in Document Outsourcing Services Market Segmentation

|

Attributes |

Opportunity in Document Outsourcing Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Opportunity in Document Outsourcing Services Market Trends

Rising Adoption of AI-Enabled Document Processing

- A key trend in the document outsourcing services market is the increasing adoption of AI-enabled solutions for document processing, driven by the need to improve accuracy, speed, and efficiency in handling large volumes of unstructured data. These AI-driven tools are enhancing capabilities in areas such as invoice processing, legal document review, and claims management, thereby transforming traditional outsourcing models

- For instance, companies such as Infosys BPM and Genpact have integrated AI-based document automation platforms to streamline data extraction and classification for clients across banking, insurance, and healthcare sectors. This adoption reduces manual intervention, lowers errors, and accelerates turnaround times

- The market is witnessing growing interest in cloud-based document processing solutions that enable secure remote access and collaboration among distributed teams. AI-powered platforms facilitate automated workflows, enabling organizations to handle complex document types while maintaining compliance and data integrity

- Enterprises are increasingly leveraging natural language processing and machine learning algorithms to analyze and categorize large datasets efficiently. These capabilities are enabling more informed decision-making and improved customer service, positioning AI-driven document outsourcing as a critical growth area

- There is rising integration of AI with robotic process automation in document management services, allowing repetitive tasks to be automated while maintaining human oversight for exceptions. This integration is enhancing operational efficiency and enabling service providers to deliver faster, more scalable solutions

- The trend toward AI-enabled document processing is reshaping outsourcing strategies, emphasizing the value of intelligence, adaptability, and data-driven insights in managing enterprise information flows

Opportunity in Document Outsourcing Services Market Dynamics

Driver

Growing Enterprise Focus on Digital Transformation and Operational Efficiency

- Enterprises are increasingly prioritizing digital transformation initiatives that aim to enhance operational efficiency, reduce costs, and improve service delivery. Document outsourcing providers are responding by offering solutions that integrate AI, automation, and analytics to optimize document-centric workflows

- For instance, Wipro Digital has deployed AI-driven document processing solutions for clients in banking and insurance, enabling real-time data capture and streamlined operations. This deployment supports faster processing cycles, improves accuracy, and frees internal teams to focus on higher-value tasks

- The shift toward remote work and decentralized operations is pushing organizations to adopt outsourced document management services that ensure secure, efficient access to critical information. Providers are leveraging cloud infrastructure and automated platforms to meet these evolving enterprise requirements

- Companies are increasingly focused on compliance and audit-readiness, prompting the adoption of document outsourcing services that integrate secure data handling, tracking, and reporting features. This focus ensures adherence to regulatory standards while maintaining operational efficiency

- Rising volumes of structured and unstructured data are driving demand for scalable document outsourcing services that can handle complex workflows without compromising speed or accuracy. This scalability is enabling enterprises to achieve cost efficiencies while maintaining high service quality

Restraint/Challenge

Data Security and Compliance Concerns

- The document outsourcing services market faces significant challenges related to data security, privacy, and regulatory compliance, particularly in industries such as healthcare, finance, and legal services. Service providers must implement robust security measures to protect sensitive client information

- For instance, IBM’s document outsourcing solutions incorporate advanced encryption, access controls, and compliance monitoring to address stringent data protection requirements. Ensuring compliance with GDPR, HIPAA, and other regulations adds operational complexity and cost

- Handling cross-border data transfers and maintaining audit trails further complicates compliance for global enterprises. Outsourcing providers must balance efficiency with adherence to regional and international data protection laws

- The risk of cyber threats, data breaches, and insider misuse continues to be a barrier to broader adoption of document outsourcing services. Providers are investing in continuous monitoring, AI-based threat detection, and secure cloud infrastructures to mitigate these risks

- Ongoing regulatory changes and evolving compliance standards require service providers to regularly update policies, processes, and technologies. This constant evolution adds operational strain and may slow adoption despite clear efficiency and cost advantages in outsourced document management

Opportunity in Document Outsourcing Services Market Scope

The market is segmented on the basis of service type, organization size, and end user.

- By Service Type

On the basis of service type, the document outsourcing services market is segmented into document imaging and scanning services, archive and records management services, content management services, document processing services, and others. The document processing services segment dominated the largest market revenue share in 2025, driven by the growing need for efficient handling of high-volume transactional documents across BFSI, healthcare, and government sectors. Enterprises increasingly outsource document processing to improve accuracy, reduce turnaround time, and ensure compliance with regulatory requirements. The integration of automation and AI-enabled data extraction further strengthens the demand for outsourced document processing solutions. Organizations also benefit from cost optimization and scalability when managing fluctuating document workloads. The rising focus on digitization of core business operations continues to reinforce the dominance of this segment.

The content management services segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing enterprise demand for centralized, secure, and searchable digital repositories. Businesses are adopting outsourced content management solutions to enhance collaboration, enable remote access, and improve information governance. The rapid growth of unstructured data and the need for lifecycle management of digital content are accelerating adoption. Cloud-based content management platforms offered by outsourcing providers further support scalability and real-time access. Regulatory pressure for data retention and audit readiness also contributes to strong growth. This segment benefits from long-term contracts and recurring service models.

- By Organization Size

On the basis of organization size, the document outsourcing services market is segmented into small and medium-sized enterprises and large enterprises. The large enterprises segment accounted for the dominant market revenue share in 2025, supported by their high document volumes and complex operational structures. Large organizations frequently outsource document-intensive processes to streamline workflows and focus internal resources on strategic activities. The need for standardized document handling across multiple departments and locations further drives adoption. These enterprises also prioritize compliance, data security, and service-level agreements, favoring established outsourcing providers. Long-term outsourcing contracts and global delivery models strengthen revenue contribution from this segment. The increasing use of analytics and automation within outsourced services sustains demand among large enterprises.

The small and medium-sized enterprises segment is expected to register the fastest growth during the forecast period, driven by rising awareness of cost-effective outsourcing solutions. SMEs increasingly rely on document outsourcing to overcome resource limitations and reduce capital investment in IT infrastructure. Access to advanced technologies without upfront costs makes outsourcing attractive for smaller organizations. The growth of cloud-based and subscription-driven service offerings further supports adoption. SMEs also benefit from faster scalability as business volumes fluctuate. This shift positions SMEs as a key growth opportunity for service providers.

- By End User

On the basis of end user, the document outsourcing services market is segmented into banking, financial services, and insurance, government, healthcare, media and entertainment, IT and telecom, manufacturing, legal, retail, and others. The banking, financial services, and insurance segment dominated the market revenue share in 2025, driven by extensive documentation requirements related to transactions, compliance, and customer onboarding. BFSI institutions outsource document handling to ensure accuracy, data security, and faster processing timelines. The growing emphasis on regulatory compliance and audit readiness further strengthens outsourcing adoption. High volumes of structured and unstructured documents create sustained demand for specialized service providers. Digital transformation initiatives within BFSI also accelerate outsourcing of legacy document workflows.

The healthcare segment is projected to witness the fastest growth from 2026 to 2033, supported by increasing digitization of medical records and administrative documents. Healthcare providers outsource document services to manage patient records, billing documentation, and regulatory paperwork efficiently. The rising adoption of electronic health records increases the need for secure scanning, indexing, and content management services. Outsourcing helps healthcare organizations reduce administrative burden and improve operational efficiency. Data privacy regulations further drive demand for compliant outsourcing partners. This segment presents strong long-term growth potential due to ongoing healthcare modernization efforts.

Opportunity in Document Outsourcing Services Market Regional Analysis

- North America dominated the opportunity in document outsourcing services market with the largest revenue share of over 40% in 2025, driven by early adoption of digital transformation initiatives across enterprises and the strong presence of established outsourcing service providers

- Organizations in the region place high importance on operational efficiency, regulatory compliance, and secure management of large document volumes, particularly across BFSI, healthcare, and government sectors

- This strong adoption is further supported by advanced IT infrastructure, high enterprise spending capacity, and widespread acceptance of cloud-based and automated document solutions, positioning document outsourcing as a strategic operational tool

U.S. Document Outsourcing Services Market Insight

The U.S. document outsourcing services market captured the largest revenue share within North America in 2025, supported by high volumes of transactional and compliance-related documentation across BFSI, healthcare, and legal industries. Enterprises increasingly outsource document-intensive processes to reduce administrative burden and improve turnaround time. The growing focus on data security, regulatory adherence, and business process optimization continues to drive demand. The widespread use of cloud platforms and AI-enabled document processing further strengthens market expansion. In addition, the presence of large multinational outsourcing firms accelerates service adoption across industries.

Europe Document Outsourcing Services Market Insight

The Europe document outsourcing services market is projected to expand at a substantial CAGR during the forecast period, primarily driven by strict data protection regulations and rising demand for compliant document handling solutions. Enterprises across the region are increasingly outsourcing records management and content digitization to meet regulatory and audit requirements. Growing digitization initiatives across public and private sectors are fostering adoption. The region also benefits from rising demand for multilingual document processing services. Strong emphasis on data governance and information lifecycle management supports long-term market growth.

U.K. Document Outsourcing Services Market Insight

The U.K. document outsourcing services market is anticipated to grow at a noteworthy CAGR over the forecast period, driven by increasing adoption of digital workflows across financial services, healthcare, and government institutions. Organizations are outsourcing document management to enhance efficiency and reduce operational costs. The growing use of cloud-based platforms and remote work models is further supporting demand. Regulatory compliance requirements also encourage enterprises to rely on specialized outsourcing providers. The U.K.’s mature service sector and strong digital infrastructure continue to stimulate market growth.

Germany Document Outsourcing Services Market Insight

The Germany document outsourcing services market is expected to expand at a considerable CAGR, supported by the country’s strong industrial base and emphasis on process standardization. Manufacturing, healthcare, and government sectors increasingly outsource document services to streamline operations and ensure compliance. Germany’s focus on data security and structured information management aligns well with outsourced document solutions. The adoption of automation and digital archiving is gaining traction among enterprises. These factors collectively strengthen the market outlook across the country.

Asia-Pacific Document Outsourcing Services Market Insight

The Asia-Pacific document outsourcing services market is poised to grow at the fastest CAGR during the forecast period, driven by rapid economic growth, expanding enterprise base, and accelerating digitalization initiatives. Organizations across emerging economies are increasingly outsourcing document services to manage growing data volumes cost-effectively. Government-led digital transformation programs further support market expansion. The region’s large pool of skilled labor and cost advantages attract global outsourcing contracts. These factors position Asia-Pacific as a high-growth opportunity region.

Japan Document Outsourcing Services Market Insight

The Japan document outsourcing services market is gaining momentum due to increasing digitization of business processes and a strong focus on operational efficiency. Enterprises are outsourcing document management to address labor shortages and improve workflow automation. The adoption of secure digital archiving and content management solutions is rising across healthcare and government sectors. Japan’s emphasis on accuracy and compliance supports demand for specialized outsourcing services. The integration of advanced technologies further contributes to steady market growth.

China Document Outsourcing Services Market Insight

The China document outsourcing services market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid enterprise expansion and large-scale digitization initiatives. Organizations increasingly outsource document processing and records management to handle high data volumes efficiently. The strong presence of domestic outsourcing providers enhances service accessibility. Government policies promoting digital governance further accelerate adoption. These factors collectively position China as a key revenue contributor within the region.

Opportunity in Document Outsourcing Services Market Share

The opportunity in document outsourcing services industry is primarily led by well-established companies, including:

- Ricoh Company, Ltd. (Japan)

- Fuji Xerox Co. Ltd. (Japan)

- Iron Mountain Incorporated (U.S.)

- Max BPO (Canada)

- Hewlett-Packard Development Company L.P. (U.S.)

- Lexmark International Inc. (U.S.)

- Invensis Technologies Pvt Ltd. (India)

- Sumasoft (India)

- NIMBLE Information Strategies Inc. (U.S.)

- ABBYY (U.S.)

- Accenture Plc (Ireland)

- Canon Europe Ltd. (U.K.)

- Konica Minolta Business Solutions (Thailand) Co., Ltd. (Thailand)

- Williams Lea (U.K.)

- Integreon Inc. (U.S.)

- KYOCERA Document Solutions Inc. (Japan)

- Swiss Post Solutions Limited (Switzerland)

- Pitney Bowes Inc. (U.S.)

Latest Developments in Global Opportunity in Document Outsourcing Services Market

- In June 2025, IBM and Kofax entered a strategic partnership to deliver integrated document outsourcing services by combining IBM’s cloud infrastructure with Kofax’s intelligent automation platforms. This development strengthened the market by enabling end-to-end document digitization, processing, and workflow automation for enterprises. The collaboration enhanced service accuracy, reduced processing time, and supported large-scale digital transformation initiatives. It also accelerated enterprise adoption of outsourced document services across regulated industries, expanding overall market opportunity

- In March 2025, the enforcement of the European Union’s GDPR compliance requirements significantly influenced the document outsourcing services market by compelling organizations to prioritize secure document handling. Enterprises increasingly shifted toward compliant outsourcing partners capable of managing sensitive data securely. This regulatory impact boosted demand for certified document processing, secure storage, and audit-ready outsourcing solutions. As a result, service providers offering compliance-driven solutions experienced increased engagement and long-term contracts

- In October 2024, Kodak Alaris completed the acquisition of Software Intelligence Group for approximately USD 220 million, enhancing its document capture and information extraction capabilities. This acquisition expanded Kodak Alaris’s software portfolio and improved its ability to deliver advanced document outsourcing solutions. The move supported growing demand for intelligent data capture and analytics-driven document processing. It also intensified competition among providers offering technology-enabled outsourcing services

- In September 2024, Ricoh Company, Ltd. expanded its digital outsourcing portfolio by launching enhanced cloud-based document management and workflow automation services for enterprises. This development strengthened the market by offering integrated document lifecycle management solutions tailored for remote and hybrid work environments. The expansion increased enterprise reliance on outsourced document services to improve collaboration and information accessibility. It further highlighted the shift toward cloud-enabled document outsourcing as a key growth opportunity

- In February 2024, Xerox Corporation launched expanded document outsourcing services covering document scanning, data capture, and business process automation to address rising enterprise digitization needs. This initiative strengthened Xerox’s market position by enabling organizations to modernize legacy document workflows efficiently. The expansion supported demand for scalable outsourcing solutions that improve operational efficiency and reduce manual processing. It also reinforced the growing role of automation in document outsourcing opportunities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Opportunity In Document Outsourcing Services Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Opportunity In Document Outsourcing Services Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Opportunity In Document Outsourcing Services Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.