Global Ophthalmology Devices Market

Market Size in USD Billion

CAGR :

%

USD

62.23 Billion

USD

86.49 Billion

2024

2032

USD

62.23 Billion

USD

86.49 Billion

2024

2032

| 2025 –2032 | |

| USD 62.23 Billion | |

| USD 86.49 Billion | |

|

|

|

|

Ophthalmology Devices Market Size

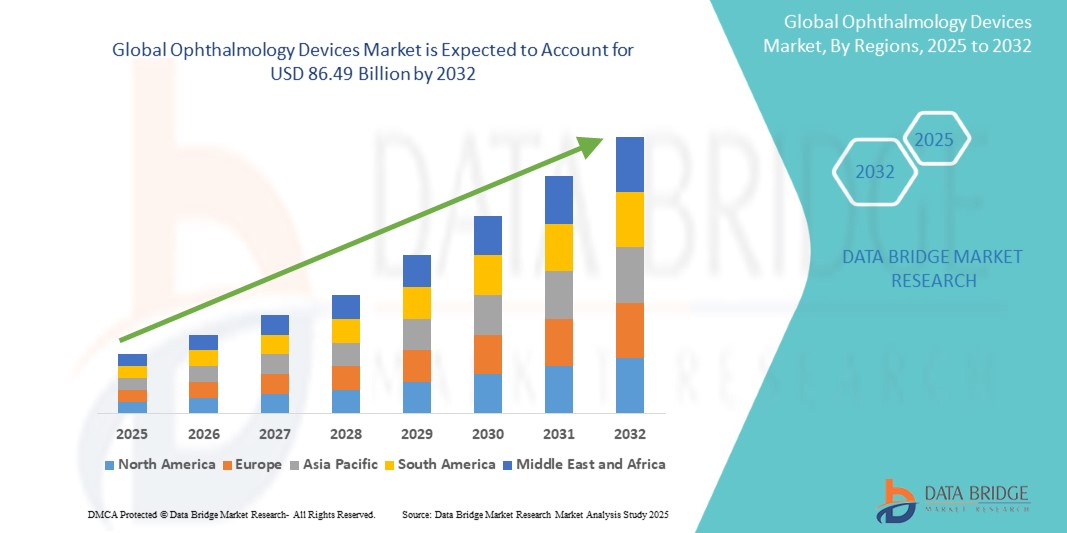

- The global ophthalmology devices market size was valued at USD 62.23 billion in 2024 and is expected to reach USD 86.49 billion by 2032, at a CAGR of 4.20% during the forecast period

- This growth is driven by growing burden of diseases

Ophthalmology Devices Market Analysis

- Ophthalmology devices play a critical role in the diagnosis, monitoring, and treatment of a wide range of vision disorders, including cataracts, glaucoma, and age-related macular degeneration (AMD)

- The demand for ophthalmology devices is increasing due to the rising global prevalence of eye diseases, growing elderly population, and expanding access to routine eye exams and surgical interventions

- Technological advancements, such as AI-integrated diagnostic tools, portable imaging systems, and minimally invasive surgical platforms, are further boosting the adoption of ophthalmology devices across developed and emerging markets

- North America is expected to dominate the ophthalmology devices market with the largest market share of 33.85%, driven by the strong presence of established ophthalmic device manufacturers, widespread access to advanced eye care services, and high patient awareness regarding eye disorders such as cataracts and glaucoma

- Asia-Pacific is projected to register the highest growth rate in the ophthalmology devices market during the forecast period, driven by rising elderly population, growing prevalence of diabetes-related eye conditions, and improving healthcare access

- The optical coherence tomography (OCT) segment is expected to dominate the ophthalmology devices market with the largest market share of 24.56%, due to high-resolution cross-sectional and 3D images of biological microstructures and is widely used in diagnosing conditions such as glaucoma, age-related macular degeneration (AMD), and diabetic retinopathy

Report Scope and Ophthalmology Devices Market Segmentation

|

Attributes |

Ophthalmology Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ophthalmology Devices Market Trends

“Integration of Artificial Intelligence (AI) in Diagnostic Imaging”

- A growing trend in the ophthalmology devices market is the integration of AI and machine learning algorithms into diagnostic imaging tools, enhancing accuracy, speed, and early detection of ocular diseases

- AI-enabled systems are increasingly being used to analyze retinal scans, detect diabetic retinopathy, glaucoma, and AMD, and provide clinical decision support in real-time

- The trend is driven by the need for scalable diagnostic solutions in resource-limited settings and the rising burden of chronic eye conditions

- For instance, in 2024, Google Health partnered with Aravind Eye Hospital in India to deploy AI tools for retinal disease screening, enabling automated diagnosis at primary care levels

- This trend is expected to revolutionize ophthalmic diagnostics by improving efficiency, reducing costs, and making eye care more accessible globally

Ophthalmology Devices Market Dynamics

Driver

“Rising Geriatric Population and Age-Related Eye Disorders”

- An significant driver for the ophthalmology devices market is the rapid increase in the global elderly population, which is more prone to cataracts, glaucoma, macular degeneration, and presbyopia

- According to WHO, over 2 billion people globally suffer from visual impairment, with the majority being over the age of 50

- Governments and health systems are expanding screening and surgical programs to meet the growing demand for elderly eye care

- For instance, in 2023, Japan’s Ministry of Health announced subsidies for cataract surgeries and vision rehabilitation programs targeting people above 60

- The demographic shift is significantly driving the demand for both diagnostic and surgical ophthalmology devices

Opportunity

“Teleophthalmology and Remote Eye Care Expansion”

- A major opportunity in the ophthalmology devices market is the rise of teleophthalmology, which enables remote eye examinations using digital imaging and cloud-connected diagnostic tools

- This model is gaining traction in rural and underserved areas, where access to ophthalmologists is limited

- Startups and established companies are investing in portable eye examination devices and smartphone-based vision screening tools to support remote diagnostics

- For instance, in 2024, Remidio Innovative Solutions launched a smartphone-based fundus camera approved by the Indian FDA for teleophthalmology use in community health camps

- This shift is expected to unlock vast market potential, especially in emerging economies and public health systems

Restraint/Challenge

“Shortage of Skilled Ophthalmic Technicians and Surgeons”

- A key challenge facing the ophthalmology devices market is the limited availability of trained ophthalmologists and technicians, especially in rural and developing regions

- While device innovation is advancing rapidly, the human expertise required to operate complex diagnostic and surgical equipment remains insufficient

- The steep learning curve for certain devices and lack of standardized training programs further compound the issue

- For instance, in 2023, the International Agency for the Prevention of Blindness (IAPB) reported that over half of low-income countries face severe ophthalmic workforce shortages

- This human resource gap is a bottleneck to the effective deployment and utilization of ophthalmology technologies across global markets

Ophthalmology Devices Market Scope

The market is segmented on the basis of product type, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

By End User |

|

In 2025, the optical coherence tomography (OCT) is projected to dominate the market with a largest share in product segment

The optical coherence tomography (OCT) segment is expected to dominate the ophthalmology devices market with the largest market share of 24.56% in 2025 due to high-resolution cross-sectional and 3D images of biological microstructures and is widely used in diagnosing conditions such as glaucoma, age-related macular degeneration (AMD), and diabetic retinopathy.

The cataract surgery is expected to account for the largest share during the forecast period in application segment

In 2025, the cataract surgery segment is expected to dominate the market with the largest market share of 42.44% due to its widespread use of ophthalmic devices in performing cataract surgeries.

Ophthalmology Devices Market Regional Analysis

“North America Holds the Largest Share in the Ophthalmology Devices Market”

- North America is expected to dominate the global ophthalmology devices market with the largest market share of 33.85%, driven by the strong presence of established ophthalmic device manufacturers, widespread access to advanced eye care services, and high patient awareness regarding eye disorders such as cataracts and glaucoma

- The U.S. holds the largest share within the region due to well-developed healthcare infrastructure, high adoption rates of advanced diagnostic and surgical ophthalmic technologies, and a growing aging population at risk for vision-related diseases

- Government initiatives to improve access to vision care, coupled with rising demand for outpatient procedures and early diagnosis, continue to drive North America’s market leadership in ophthalmology

“Asia-Pacific is Projected to Register the Highest CAGR in the Ophthalmology Devices Market”

- Asia-Pacific is expected to witness the highest compound annual growth rate (CAGR) in the ophthalmology devices market driven by rising elderly population, growing prevalence of diabetes-related eye conditions, and improving healthcare access

- Countries such as India, China, and Japan are witnessing rapid advancements in ophthalmic services through increased investment in specialty hospitals, vision screening programs, and the local production of affordable diagnostic devices

- Japan remains a key technology hub with early adoption of digital ophthalmic instruments, while China and India are expanding their vision care capacity through government-subsidized programs and public-private partnerships aimed at reducing preventable blindness

Ophthalmology Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- EssilorLuxottica (France)

- Alcon Inc. (U.S.)

- Johnson & Johnson Vision Care, Inc. (U.S.)

- HOYA Corporation (Japan)

- Bausch + Lomb (U.S.)

- Zeiss Group (Germany)

- Neovision (Korea)

- Lumenis Be Ltd. (Israel)

- Clearlab SG Pte, Ltd (Singapore)

- Ophtec BV (Netherlands)

- HEINE Optotechnik GmbH & Co. KG (Germany)

- TOPCON CORPORATION (Japan)

- Glaukos Corporation (U.S.)

- Haag-Streit (Switzerland)

- NIDEK CO., LTD. (Japan)

- STAAR SURGICAL (U.S.)

- Ziemer Ophthalmic Systems AG (Switzerland)

- Oculentis (Germany)

- Heidelberg Engineering GmbH (Germany)

- Canon India Pvt Ltd. (Japan)

Latest Developments in Global Ophthalmology Devices Market

- In July 2024, Alcon Research, LLC. received U.S. FDA approval for its UNIPURE C3F8 Ophthalmic Gas, designed for intraocular injection to manage uncomplicated retinal detachment. The gas is compatible with the company’s UNIFEYE and UNIPEXY Gas Delivery Systems and is expected to become commercially available in 2025

- In June 2024, C3 Med-Tech secured a funding of USD 0.24 million from Industrial Metal Powers India Pvt Ltd. to support the development of AI-powered portable ophthalmic devices. These devices are aimed at telemedicine applications, enhancing real-time diagnostics and preventive eye care to reduce the risk of blindness

- In August 2023, Johnson & Johnson Vision unveiled its Elita laser correction system during its U.S. launch, marking a breakthrough in myopia (short-sightedness) treatment. The system enables a minimally invasive lens removal procedure using laser-assisted technology, offering patients a new alternative in vision correction

- In June 2023, Bausch + Lomb Corporation introduced its INFUSE Multifocal daily disposable contact lenses made from silicone hydrogel (SiHy) material. These lenses are designed to provide long-lasting comfort and hydration, helping users maintain clear and irritation-free vision throughout the day

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.