Global Ophthalmology Biomaterial Market

Market Size in USD Billion

CAGR :

%

USD

10.20 Billion

USD

16.39 Billion

2025

2033

USD

10.20 Billion

USD

16.39 Billion

2025

2033

| 2026 –2033 | |

| USD 10.20 Billion | |

| USD 16.39 Billion | |

|

|

|

|

Ophthalmology Biomaterial Market Size

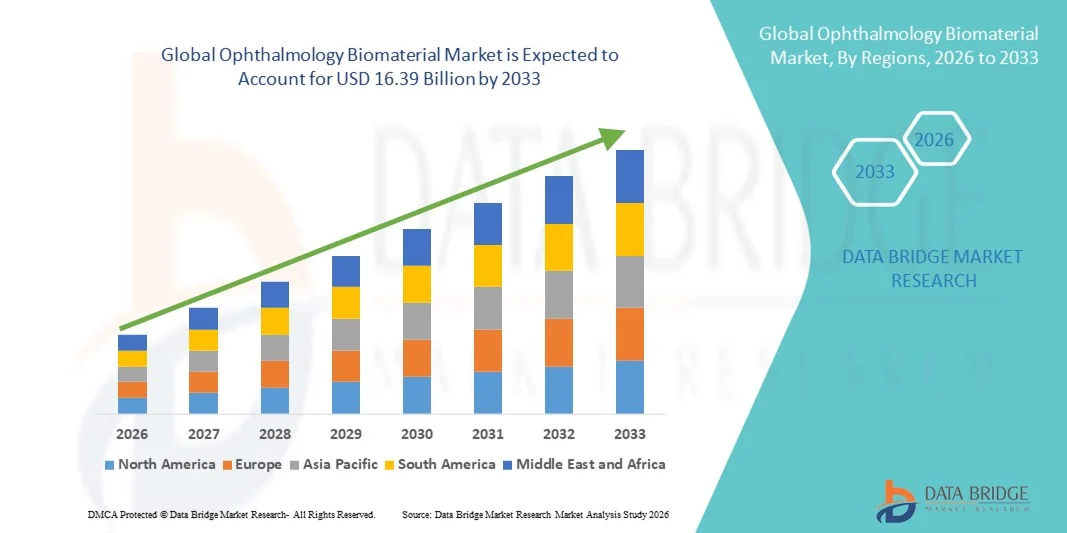

- The global ophthalmology biomaterial market size was valued at USD 10.20 billion in 2025 and is expected to reach USD 16.39 billion by 2033, at a CAGR of 6.11% during the forecast period

- The market growth is largely propelled by the rapid increase in ophthalmic disorders globally, coupled with advancements in biomaterial technologies used for ocular implants, surgical devices, and vision restoration solutions. Continued research and development in materials that improve biocompatibility, safety, and functional performance are driving greater adoption across clinical settings

- Furthermore, rising patient preference for minimally invasive procedures, along with enhanced patient outcomes and quicker recovery times, is elevating demand for advanced ophthalmology biomaterial solutions. The convergence of these factors — including increasing healthcare expenditure, expansion of geriatric populations, and growing access to quality eye care — is significantly boosting the overall growth of the Ophthalmology Biomaterial Market

Ophthalmology Biomaterial Market Analysis

- Ophthalmology biomaterials encompassing materials used in intraocular lenses, corneal implants, contact lenses, and other implantable devices are becoming essential in modern eye care due to their ability to enhance biocompatibility, improve surgical outcomes, and support tissue regeneration. Growth is driven by increased prevalence of ophthalmic disorders like cataracts and glaucoma, along with continuous material innovations such as hydrophilic acrylics, polymers, and bioengineered scaffolds. These technological advances make biomaterials central to safe, effective ophthalmic implants and restorative procedures, fueling substantial market expansion

- The escalating demand for advanced ophthalmology biomaterial solutions is primarily supported by rising patient preference for minimally invasive eye surgeries, higher global healthcare spending on eye care, and growing awareness of vision health. In addition, the integration of biomaterials with digital and imaging innovations helps improve diagnosis and procedural precision, further elevating adoption rates across hospitals and specialty eye clinics worldwide

- North America dominated the ophthalmology biomaterial market with the largest revenue share of around 34% in 2025, driven by advanced healthcare infrastructure, substantial R&D investments, a high volume of corrective eye surgeries (such as cataract and glaucoma interventions), and strong uptake of premium biomaterial‑enhanced implants. The U.S. market, in particular, exhibits robust growth through innovations by major eye‑care technology companies and increased integration of cutting‑edge biomaterials in routine ophthalmic procedures

- Asia‑Pacific is expected to be the fastest‑growing regional market during the forecast period, propelled by rapidly expanding healthcare infrastructure, a growing elderly population with high incidence of vision impairment, increased healthcare spending, and broader access to ophthalmic surgical care. Countries such as China and India are significant contributors to this growth trajectory as demand for biomaterial‑based solutions strengthen

- The Metallic segment dominated the largest market revenue share of 43.5% in 2025, driven by its exceptional biocompatibility, mechanical strength, and long-term stability

Report Scope and Ophthalmology Biomaterial Market Segmentation

|

Attributes |

Ophthalmology Biomaterial Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Ophthalmology Biomaterial Market Trends

Rising Demand for Advanced Biomaterials in Ophthalmic Surgeries

- A key trend in the global ophthalmology biomaterial market is the increasing adoption of advanced, biocompatible materials in ophthalmic procedures such as cataract surgery, corneal transplants, retinal repair, and glaucoma treatments. These materials are being designed to mimic natural eye tissue, reduce post-operative complications, and enhance visual recovery

- The development of novel hydrogels, bioengineered corneas, and polymer-based intraocular lenses (IOLs) is gaining traction due to their ability to provide higher precision, flexibility, and long-term stability

- For instance, in March 2024, CorneaGen introduced a next-generation bioengineered corneal implant that closely mimics natural corneal tissue, reducing rejection risks and promoting faster healing

- Minimally invasive ophthalmic procedures are becoming increasingly popular, prompting manufacturers to create biomaterials that are compatible with microsurgical techniques and laser-assisted interventions

- Growing awareness among surgeons and patients about personalized ophthalmic solutions is driving the demand for biomaterials tailored to specific eye conditions and patient demographics

- In addition, ongoing research in nanotechnology and tissue engineering is contributing to the development of smart biomaterials capable of controlled drug release, anti-inflammatory effects, and improved integration with ocular tissue

- The increasing focus on improving patient comfort, safety, and surgical outcomes is expected to continue shaping product innovation and adoption in this market

Ophthalmology Biomaterial Market Dynamics

Driver

Growing Prevalence of Eye Disorders and Aging Population

- The rising prevalence of eye disorders, including cataracts, glaucoma, macular degeneration, diabetic retinopathy, and corneal injuries, is a major driver for ophthalmology biomaterials. An aging global population, particularly in North America, Europe, and Asia-Pacific, is further amplifying this demand

- According to the World Health Organization (WHO), the number of people affected by age-related eye disorders is projected to increase significantly over the next decade, creating a substantial market for advanced biomaterials

- For instance, In January 2025, Bausch + Lomb launched a range of IOLs with enhanced biocompatibility and anti-inflammatory properties aimed at improving outcomes for elderly patients undergoing cataract surgery

- Increasing patient awareness about early diagnosis and treatment of ocular diseases has prompted ophthalmologists to prefer advanced biomaterials that offer better surgical efficiency and post-operative recovery

- Expanding healthcare infrastructure, improved access to eye care facilities, and rising government initiatives promoting eye health in emerging economies are supporting market growth

- Rising investment in R&D by key market players for innovative biomaterials with multifunctional properties, such as anti-bacterial coatings, UV protection, and drug-delivery capabilities, is further driving adoption

- The trend toward personalized medicine in ophthalmology, where biomaterials are customized based on patient-specific requirements, is also emerging as a critical driver of market expansion

Restraint/Challenge

High Cost of Advanced Biomaterials and Regulatory Barriers

- The relatively high cost of advanced ophthalmology biomaterials remains a significant restraint, especially for healthcare providers in developing regions or for smaller clinics with limited budgets. Premium products such as bioengineered corneas, advanced IOLs, and polymer-based implants require complex R&D and manufacturing processes, which increase overall costs.

- Regulatory challenges across global markets pose additional barriers. Stringent approval processes by authorities such as the U.S. FDA, European Medicines Agency (EMA), and other regional bodies require extensive clinical trials, documentation, and compliance checks, delaying time-to-market for new products

- For instance, in 2023, a leading biomaterial developer, Tarsus Medical, faced a 12-month delay in FDA approval for its novel corneal implant due to additional safety and efficacy testing requirements, highlighting the impact of regulatory hurdles on market entry

- Variations in healthcare reimbursement policies and limited insurance coverage for advanced ophthalmic procedures can also restrict adoption among cost-sensitive patients.

- Manufacturing challenges, including maintaining consistent quality, sterility, and biocompatibility, add to the overall complexity and cost of ophthalmology biomaterials.

- Limited awareness among ophthalmologists in certain regions about the benefits of next-generation biomaterials may also slow adoption rates.

- To overcome these challenges, companies are focusing on developing cost-effective biomaterial production methods, expanding clinical education initiatives, and working closely with regulatory bodies to streamline approvals.

- Ensuring sustainable and scalable manufacturing processes while maintaining high-quality standards will be vital for long-term market growth.

Ophthalmology Biomaterial Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Ophthalmology Biomaterial market is segmented into Metallic, Ceramic, Polymers, and Natural. The Metallic segment dominated the largest market revenue share of 43.5% in 2025, driven by its exceptional biocompatibility, mechanical strength, and long-term stability. Metallic biomaterials, including titanium, stainless steel, and cobalt-chromium alloys, are widely used in intraocular lenses, ocular implants, and surgical devices due to their reliability and proven clinical performance. The segment benefits from established regulatory approvals, widespread use in hospitals and specialty eye centers, and compatibility with advanced ophthalmic surgical tools. Its durability and resistance to corrosion make it ideal for complex ocular reconstructions and long-lasting implants. Rising geriatric populations and increasing prevalence of ocular disorders such as cataracts and corneal injuries further support demand. Technological advancements in surface coatings and texturing enhance tissue integration and reduce complications. The segment is also favored for its performance in both developed and emerging markets, supporting consistent growth. Overall, metallic biomaterials continue to dominate due to their versatility across multiple ophthalmic applications.

The Ceramic segment is anticipated to witness the fastest growth rate of 21.9% CAGR from 2026 to 2033, driven by increasing adoption in synthetic corneas, intraocular lenses, and ocular implants requiring superior optical clarity and biocompatibility. Ceramics such as alumina and zirconia provide excellent wear resistance, low inflammatory response, and long-term tissue integration. Technological advancements in additive manufacturing, nano-ceramic coatings, and precision molding support customization for patient-specific implants. The growing awareness among ophthalmologists about long-term outcomes and superior visual performance is accelerating adoption. Ceramics are particularly favored in minimally invasive procedures due to their lightweight, durable, and high-precision properties. Emerging markets are witnessing increasing uptake as ophthalmic infrastructure expands. Rising investments in research and development, along with increasing availability of premium implants, further strengthen growth prospects. Patient preference for long-lasting and high-performance biomaterials drives continued adoption globally.

- By Application

On the basis of application, the Ophthalmology Biomaterial market is segmented into Contact Lens, Intraocular Lens, Functional Replacements of Ocular Tissues, Synthetic Corneas, and Others. The Contact Lens segment accounted for the largest market revenue share of 37.2% in 2025, driven by the increasing prevalence of myopia, astigmatism, and presbyopia across both developed and emerging regions. Innovations in polymeric hydrogels and silicone hydrogels ensure high oxygen permeability, comfort, and durability, enhancing wearer compliance. The availability of daily disposable lenses, lenses with UV protection, and specialty therapeutic or cosmetic lenses further supports adoption. E-commerce platforms and subscription-based distribution models improve accessibility, particularly for younger populations. Rising awareness of eye care, coupled with urbanization and lifestyle changes, drives sustained demand. Contact lenses are cost-effective compared to surgical alternatives, making them accessible to a broad patient base. The segment also benefits from ongoing R&D in drug-eluting and smart contact lenses. Eye care professionals increasingly recommend modern lenses for both vision correction and ocular health. Overall, the segment dominates due to widespread adoption and consistent growth in vision correction needs.

The Intraocular Lens (IOL) segment is expected to witness the fastest CAGR of 23.2% from 2026 to 2033, fueled by the growing number of cataract surgeries and rising adoption of premium multifocal, toric, and extended-depth-of-focus lenses. Advanced IOLs made of foldable acrylic, hydrophobic polymers, and hybrid materials provide improved visual outcomes and reduced post-operative complications. Increasing geriatric populations, rising disposable incomes, and awareness about early cataract interventions further drive growth. Technological innovations in lens design enhance quality of vision and patient satisfaction. Emerging markets are seeing rapid adoption due to expansion of ophthalmic healthcare infrastructure and availability of advanced surgical tools. Hospitals and eye clinics prefer IOLs for predictable surgical outcomes and improved recovery. Government initiatives promoting eye health and insurance coverage for cataract surgeries also support accelerated adoption. The segment is expected to expand rapidly as demand for premium IOLs grows globally.

Ophthalmology Biomaterial Market Regional Analysis

- North America dominated the ophthalmology biomaterial market with the largest revenue share of around 34% in 2025, driven by advanced healthcare infrastructure, substantial R&D investments, a high volume of corrective eye surgeries such as cataract and glaucoma interventions, and strong uptake of premium biomaterial-enhanced implants

- Consumers and healthcare providers in the region highly value the safety, biocompatibility, and improved surgical outcomes offered by advanced ophthalmology biomaterials, particularly in intraocular lenses, corneal implants, and retinal repair solutions

- This widespread adoption is further supported by well-established healthcare systems, high healthcare spending, and the strong presence of leading ophthalmic device manufacturers, establishing North America as a dominant market for premium biomaterials

U.S. Ophthalmology Biomaterial Market Insight

The U.S. ophthalmology biomaterial market captured the largest revenue share in 2025 within North America, fueled by rapid adoption of innovative biomaterials in routine ophthalmic procedures. Market growth is driven by advancements from major eye-care technology companies, extensive clinical research, and the integration of cutting-edge biomaterials into cataract, glaucoma, and corneal surgeries. Increasing patient awareness about improved visual outcomes, faster recovery, and reduced post-operative complications further propels market expansion. Strong healthcare infrastructure, insurance coverage, and partnerships between hospitals and biomaterial manufacturers enhance accessibility and adoption across the country.

Europe Ophthalmology Biomaterial Market Insight

The Europe ophthalmology biomaterial market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising prevalence of eye disorders, a growing geriatric population, and increasing adoption of advanced ophthalmic surgeries. Increasing urbanization and government initiatives promoting high-quality eye care are supporting the adoption of premium biomaterials.

U.K. Ophthalmology Biomaterial Market Insight

The U.K. ophthalmology biomaterial market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing adoption of advanced ophthalmic procedures and a focus on patient-centered care. Rising prevalence of eye disorders and emphasis on early diagnosis encourage both public and private healthcare providers to adopt high-quality biomaterials for surgeries, while the country’s well-developed healthcare infrastructure and robust clinical research ecosystem continue to stimulate market growth.

Germany Ophthalmology Biomaterial Market Insight

Germany ophthalmology biomaterial market is expected to expand at a considerable CAGR, fueled by increasing awareness of advanced ophthalmic solutions, demand for innovative and eco-conscious biomaterials, and strong emphasis on patient safety. Germany’s well-established healthcare system, combined with a focus on technological advancement and sustainability, promotes the adoption of premium biomaterials in cataract, retinal, and corneal surgeries, with integration of advanced biomaterials in routine procedures becoming increasingly prevalent in both public and private healthcare facilities.

Asia-Pacific Ophthalmology Biomaterial Market Insight

The Asia-Pacific ophthalmology biomaterial market is poised to grow at the fastest CAGR during the forecast period (2026–2033), driven by rapidly expanding healthcare infrastructure, increasing elderly population with a high incidence of vision impairment, growing healthcare spending, and broader access to ophthalmic surgical care. Countries such as China, India, and Japan are major contributors, with rising adoption of cataract, glaucoma, and corneal surgeries and increased demand for biomaterial-based solutions. The region’s growing healthcare awareness, combined with government initiatives improving surgical care access, is accelerating market expansion.

Japan Ophthalmology Biomaterial Market Insight

Japan’s ophthalmology biomaterial market is gaining momentum due to the country’s high-tech healthcare culture, rapid urbanization, and increasing demand for patient-friendly surgical solutions. Adoption of advanced intraocular lenses, corneal implants, and other biomaterials is rising, supported by an aging population and preference for minimally invasive procedures. Hospitals and clinics are increasingly integrating biomaterials into routine ophthalmic surgeries to improve safety and post-operative outcomes.

China Ophthalmology Biomaterial Market Insight

China ophthalmology biomaterial market accounted for the largest revenue share in Asia-Pacific in 2025, driven by an expanding middle-class population, rapid urbanization, and rising demand for advanced eye care solutions. High incidence of cataracts, glaucoma, and retinal disorders, along with government initiatives promoting eye care, are supporting the adoption of premium biomaterials. Strong domestic manufacturing capacity and collaborations between hospitals and biomaterial producers are enhancing accessibility and affordability, driving market growth across both urban and semi-urban regions.

Ophthalmology Biomaterial Market Share

The Ophthalmology Biomaterial industry is primarily led by well-established companies, including:

- Johnson & Johnson (U.S.)

- Carl Zeiss Meditec (Germany)

- Hoya Corporation (Japan)

- Essilor International (France)

- STAAR Surgical (U.S.)

- Rayner (U.K.)

- Omega Ophthalmics (U.S.)

- PhysIOL (Belgium)

- Nidek Co., Ltd. (Japan)

- Medennium (U.S.)

- AJL Ophthalmic (Spain)

- Eyetec (Germany)

- VSY Biotechnology (U.S.)

- Oculentis (Germany)

- HumanOptics (Germany)

- iSTAR Medical (Luxembourg)

- ReVision Optics (U.S.)

- LENSAR (U.S.)

Latest Developments in Global Ophthalmology Biomaterial Market

- In October 2021, CorNeat Vision’s artificial cornea project was awarded a €2.5 million grant by the European Innovation Council to support clinical activities, manufacturing scale‑up, and regulatory advancement of its synthetic corneal biomaterial designed to permanently integrate with host tissue — a significant milestone toward commercializing non‑donor based corneal implants

- In November 2023, Pantheon Vision, an early‑stage ophthalmic medical device company focused on corneal blindness solutions, raised USD2.5 million in seed funding from KeraLink International to launch the development of advanced bioengineered corneal implants, aiming to reduce dependence on donor tissue and accelerate product development with planned FDA engagement

- In April 2024, Pantheon Vision secured an additional USD1.8 million in funding from KeraLink International as a second tranche to advance its bioengineered corneal implants, bringing total backing to about USD4.3 million and reinforcing efforts to reduce reliance on donated corneal tissue for treating corneal blindness

- In June 2024, CorNeat Vision completed a first patient implantation of its CorNeat KPro synthetic artificial cornea in Paris, France, marking a major clinical therapy milestone in ophthalmic biomaterials — with the patient regaining significant vision following decades of blindness, highlighting real‑world potential of fully synthetic corneal implants

- In March 2025, Pantheon Vision announced a collaborative agreement with Eyedeal Medical to jointly develop and commercialize its bioengineered corneal implant, aiming to accelerate global adoption and tackle limitations of donor tissue by combining design and manufacturing expertise to bring a novel biomaterial‑based solution closer to commercialization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.