Global Operational Analytics Market

Market Size in USD Billion

CAGR :

%

USD

13.93 Billion

USD

50.71 Billion

2024

2032

USD

13.93 Billion

USD

50.71 Billion

2024

2032

| 2025 –2032 | |

| USD 13.93 Billion | |

| USD 50.71 Billion | |

|

|

|

|

Operational Analytics Market Size

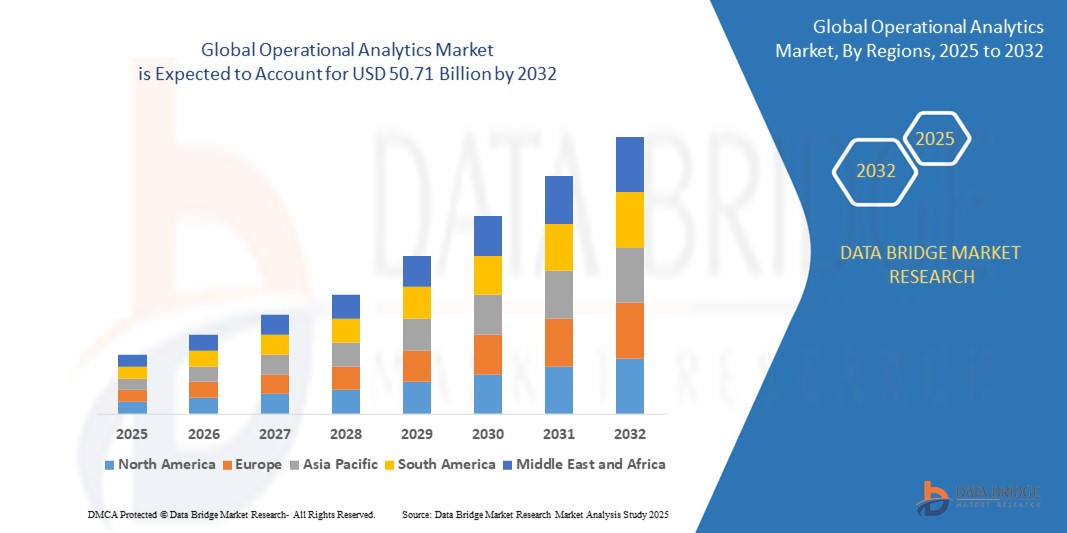

- The global operational analytics market size was valued at USD 13.93 billion in 2024 and is expected to reach USD 50.71 billion by 2032, at a CAGR of 17.53% during the forecast period

- This growth is driven by factors such as the rising demand for data-driven decision-making, the increasing adoption of cloud computing and IoT technologies, and the need for real-time insights to enhance operational efficiency across industries

Operational Analytics Market Analysis

- Operational analytics refers to the use of data analysis tools and techniques to improve day-to-day business operations, providing real-time insights that support faster, data-driven decision-making across various functions such as supply chain, finance, and customer service

- The demand for operational analytics is significantly driven by the increasing volume of business data, the growing need for process optimization, and advancements in artificial intelligence (AI) and machine learning technologies

- North America is expected to dominate the global operational analytics market with largest market share of 38.7%, due to the widespread adoption of advanced analytics solutions, a strong presence of leading tech companies, and the growing demand for digital transformation in industries such as retail, manufacturing, and healthcare

- Asia-Pacific is expected to be the fastest growing region in the operational analytics market during the forecast period due to rapid digitalization, increasing investments in IT infrastructure, and the growing adoption of cloud-based analytics solutions in emerging economies like India and China

- Network management segment is expected to dominate the market with a largest market share of 75% due to its critical role in optimizing IT infrastructure and ensuring seamless connectivity. As organizations increasingly rely on complex, hybrid, and cloud-based environments, the need for real-time monitoring and proactive management of network performance has intensified. Network management solutions provide actionable insights that help in identifying bottlenecks, predicting potential failures, and enhancing overall network efficiency

Report Scope and Operational Analytics Market Segmentation

|

Attributes |

Operational Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Operational Analytics Market Trends

"Advancements in AI and Machine Learning for Operational Analytics"

- One key trend in the operational analytics market is the increasing integration of AI and machine learning algorithms, which are enhancing the ability to analyze large volumes of real-time data

- These innovations allow organizations to automate decision-making processes, uncover hidden patterns, and predict potential issues before they arise, leading to improved operational efficiency

- For instance, AI-driven analytics tools can provide insights into inventory management, workforce optimization, and predictive maintenance, helping businesses reduce costs and improve performance across various departments

- These advancements are revolutionizing industries such as manufacturing, retail, and logistics, driving the demand for more sophisticated operational analytics solutions that leverage cutting-edge AI and machine learning technologies

Operational Analytics Market Dynamics

Driver

"Rising Demand for Data-Driven Decision-Making in Businesses"

- The increasing need for data-driven decision-making across industries is significantly contributing to the growing demand for operational analytics solutions

- As organizations generate vast amounts of data, the ability to analyze this data in real-time to make informed decisions has become crucial to optimizing operations and staying competitive

- Businesses across sectors such as manufacturing, retail, and logistics are leveraging operational analytics to enhance efficiency, improve customer satisfaction, and reduce costs

For instance,

- In a report published by McKinsey in 2023, it was highlighted that companies leveraging data analytics saw a 5-6% improvement in their profit margins due to better operational decisions and process optimizations

- As more businesses recognize the value of operational analytics in optimizing performance and driving innovation, the demand for these solutions continues to rise globally

Opportunity

"Growing Demand for Cloud-Based Operational Analytics Solutions"

- The increasing adoption of cloud computing is creating significant opportunities for operational analytics solutions, as businesses look for flexible, scalable, and cost-effective platforms to manage and analyze their data

- Cloud-based operational analytics enables organizations to access real-time insights, collaborate across locations, and scale analytics capabilities as needed, without the burden of maintaining on-premise infrastructure

- This trend is particularly beneficial for small and medium-sized enterprises (SMEs) that may lack the resources to invest in expensive on-premise solutions but still require advanced analytics to drive decision-making

For instance,

- In a 2023 report from Gartner, cloud-based analytics platforms are expected to account for over 50% of global operational analytics market share by 2026, as companies continue to prioritize cloud-first strategies for operational optimization

- The shift to the cloud represents a major growth opportunity for operational analytics providers, as demand for these solutions increases across industries seeking to enhance operational efficiency and reduce IT costs

Restraint/Challenge

"Data Privacy and Security Concerns"

- The growing use of operational analytics across industries raises significant concerns about data privacy and security, particularly as businesses collect and analyze vast amounts of sensitive information

- With stricter data protection regulations, such as the GDPR in Europe, businesses must ensure that their operational analytics platforms comply with legal requirements while safeguarding customer and operational data from potential breaches or misuse

- These concerns can delay the adoption of operational analytics solutions, especially in sectors like healthcare, finance, and government, where sensitive data handling is crucial

For instance,

- According to a report published by McKinsey in 2023, 42% of organizations cited data privacy and security concerns as the primary barriers to fully adopting operational analytics, particularly in regions with stringent regulatory requirements

- As a result, these challenges may slow the growth of the operational analytics market, with businesses prioritizing solutions that offer robust security measures and compliance features to mitigate risks

Operational Analytics Market Scope

The market is segmented on the basis of type, business function, application, deployment model, and industry vertical

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Business Function |

|

|

By Application |

|

|

By Deployment Model |

|

|

By Industry Vertical |

|

In 2025, the network management is projected to dominate the market with a largest share in application segment

The network management segment is expected to dominate the operational analytics market with the largest share of 75% due to its critical role in optimizing IT infrastructure and ensuring seamless connectivity. As organizations increasingly rely on complex, hybrid, and cloud-based environments, the need for real-time monitoring and proactive management of network performance has intensified. Network management solutions provide actionable insights that help in identifying bottlenecks, predicting potential failures, and enhancing overall network efficiency

The hosted/ on-cloud is expected to account for the largest share during the forecast period in deployment model segment

In 2025, the hosted/ on-cloud segment is expected to dominate the market with the largest market share of approximately 37%, due to the increasing adoption of cloud-based solutions, which offer scalability, cost-efficiency, and flexibility for businesses seeking to analyze vast amounts of data in real-time. Cloud platforms enable organizations to access advanced analytics tools without the need for significant upfront investments in infrastructure, making them particularly attractive to small and medium-sized enterprises (SMEs)

Operational Analytics Market Regional Analysis

“North America Holds the Largest Share in the Operational Analytics Market”

- North America dominates the global operational analytics market with largest market share of 38.7%, driven by the widespread adoption of advanced analytics technologies and a strong digital infrastructure across industries such as manufacturing, healthcare, and finance

- The United States contributes significantly to this dominance with a largest market share of 51%, due to the early adoption of big data, cloud computing, and AI-powered analytics tools aimed at enhancing operational efficiency and business decision-making

- The region benefits from a high concentration of key technology providers and a robust enterprise environment that prioritizes data-driven strategies

- Increased investments in R&D and strong regulatory frameworks supporting data utilization further solidify North America’s leadership in the market

“Asia-Pacific is Projected to Register the Highest CAGR in the Operational Analytics Market”

- The Asia-Pacific region is expected to witness the fastest growth in the operational analytics market, fueled by digital transformation initiatives, rising internet penetration, and rapid industrialization across emerging economies

- Countries like China, India, and Japan are at the forefront due to growing investments in IT infrastructure and increasing demand for data-driven solutions to optimize operations in sectors such as manufacturing, logistics, and retail

- Japan remains a technologically advanced market, with businesses embracing AI and automation to enhance operational outcomes

- Meanwhile, China and India are experiencing strong growth due to government-backed digital initiatives and the increasing adoption of analytics solutions among small and medium-sized enterprises (SMEs), contributing to the region’s high growth trajectory

Operational Analytics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- IBM Corporation (U.S.)

- Oracle (U.S.)

- Microsoft (U.S.)

- SAP SE (Germany)

- Hexagon AB (Sweden)

- IMS Software, Inc. (U.S.)

- Autodesk Inc. (U.S.)

- Bentley Systems, Incorporated (U.S.)

- Alteryx, Inc. (U.S.)

- SAS Institute Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Cisco Systems, Inc. (U.S.)

- VMware, Inc. (U.S.)

- Continuity Software Ltd. (Israel)

- ExtraHop Networks, Inc. (U.S.)

- BMC Software, Inc. (U.S.)

- Apptio, Inc. (U.S.)

- Appnomic (U.S.)

- Evolven Software (U.S.)

- Splunk Inc. (U.S.)

Latest Developments in Global Operational Analytics Market

- In June 2023, Jaguar Land Rover (JLR) announced a strategic collaboration with Everstream Analytics, a leading supply chain intelligence provider. This partnership focuses on integrating advanced artificial intelligence into JLR’s global supply chain operations, allowing for real-time visibility, risk prediction, and proactive mitigation of supply disruptions. This collaboration highlights the growing adoption of operational analytics in the automotive industry, emphasizing the importance of real-time data insights and AI integration in optimizing complex global operations

- In March 2023, Insight Software, a prominent provider of reporting, analytics, and performance management solutions, announced the expansion of its Angles Professional product line for Oracle. This development includes the integration of Logi Analytics, significantly enhancing the platform's capabilities to deliver customizable, department-wide insights and more intuitive data visualizations. This expansion reflects the growing demand for integrated, user-friendly analytics tools that cater to cross-functional business needs

- In February 2023, IBM introduced its advanced Watson AIOps platform, designed to revolutionize IT operations through the power of artificial intelligence and machine learning. IBM’s launch of Watson AIOps underscores the accelerating adoption of AI-driven operational analytics in IT operations. It reflects a broader market trend where businesses are investing in intelligent automation to improve resilience, reduce operational costs, and support digital transformation efforts—key drivers of growth in the global operational analytics market

- In July 2024, IBM Consulting announced a strategic partnership with Microsoft aimed at strengthening security operations for enterprise clients, with a specific focus on managing cloud identity threats. The collaboration combines IBM’s expertise in cybersecurity services with Microsoft’s advanced security technologies, including Microsoft Sentinel and Microsoft Defender, to deliver modernized security operations and real-time threat detection capabilities. This partnership highlights the expanding role of operational analytics in cybersecurity, where real-time data processing and analytics are critical for threat detection and incident management

- In November 2023, Hewlett Packard Enterprise (HPE) announced a strategic partnership with NVIDIA to introduce a comprehensive enterprise-grade solution for generative AI (GenAI). This integrated full-stack offering combines HPE’s high-performance computing infrastructure and AI software with NVIDIA’s cutting-edge AI technologies, enabling businesses to efficiently tailor and deploy AI models using their own data. This collaboration reflects the increasing convergence of AI and operational analytics, as enterprises seek to leverage GenAI for real-time insights and decision automation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.