Global Open Iot Platform Market

Market Size in USD Billion

CAGR :

%

USD

25.65 Billion

USD

117.87 Billion

2024

2032

USD

25.65 Billion

USD

117.87 Billion

2024

2032

| 2025 –2032 | |

| USD 25.65 Billion | |

| USD 117.87 Billion | |

|

|

|

|

Open IoT Platform Market Size

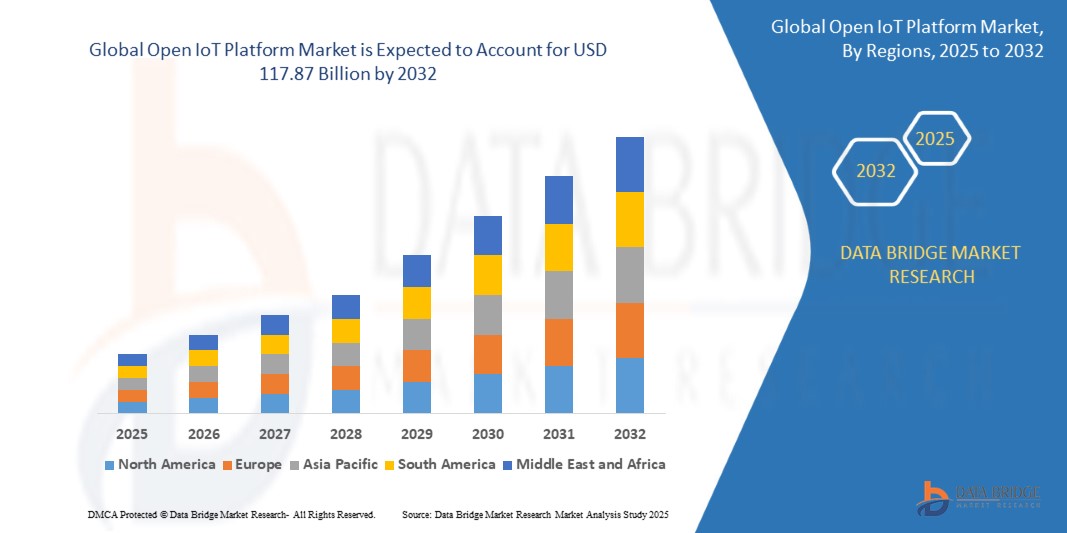

- The global open IoT platform market size was valued at USD 25.65 billion in 2024 and is expected to reach USD 117.87 billion by 2032, at a CAGR of 21.00% during the forecast period

- The market growth is largely fuelled by the increasing demand for interoperability across diverse IoT devices and systems, which is pushing enterprises to adopt open-source and vendor-neutral platforms that offer flexibility, scalability, and reduced total cost of ownership

- The expansion of smart infrastructure projects, especially in manufacturing, healthcare, energy, and smart cities, is also contributing significantly to the rising adoption of open IoT platforms globally

Open IoT Platform Market Analysis

- The market is being shaped by rising enterprise-level digital transformation initiatives that emphasize real-time data processing, predictive analytics, and seamless integration of edge and cloud computing through open frameworks

- Strategic collaborations among software vendors, device manufacturers, and cloud service providers are further accelerating the development of modular, standards-based IoT platforms that cater to a broader set of industries and use cases

- North America dominated the open IoT platform market with the largest revenue share of 38.27% in 2024, driven by early technology adoption, strong presence of leading cloud service providers, and widespread deployment of industrial and consumer IoT solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global open IoT platform market, driven by expanding smart city projects, growing penetration of the internet and smartphones, and rising demand for scalable, interoperable solutions in emerging economies such as China, India, and Southeast Asian countries. Regional investments in 5G and industrial automation are also playing a key role

- The software segment dominated the market with the largest revenue share of 52.4% in 2024, driven by the growing demand for scalable and interoperable solutions that enable real-time device management and data analytics. Open-source software platforms are increasingly being adopted due to their flexibility, cost efficiency, and support for diverse protocols and devices. In addition, the rise of edge computing and AI integration is amplifying the need for intelligent software platforms to process data locally

Report Scope and Open IoT Platform Market Segmentation

|

Attributes |

Open IoT Platform Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Open IoT Platform Market Trends

“Integration of Artificial Intelligence into Open IoT Platforms”

- The convergence of AI and open IoT platforms is enabling intelligent automation by analyzing vast data from connected devices in real time, helping organizations make quicker and more accurate decisions while optimizing system responses without human intervention

- AI algorithms embedded into open platforms empower predictive analytics, allowing systems to anticipate equipment failures, detect anomalies, and suggest corrective actions, thus reducing maintenance costs and operational risks

- The adoption of open-source AI frameworks such as TensorFlow and PyTorch within IoT platforms simplifies the development and deployment of machine learning models across industrial applications, supporting flexibility and rapid innovation

- Edge computing is further accelerating this trend as AI models are being executed at the edge of the network through open platforms, ensuring low-latency responses, enhancing security, and minimizing cloud dependency

- For instance, in 2023, IBM upgraded its Watson IoT platform with embedded AI services, allowing manufacturers to detect equipment inefficiencies in real-time and boost production efficiency through predictive insights across facilities

Open IoT Platform Market Dynamics

Driver

“Proliferation Of Connected Devices Across Industry Verticals”

- The rapid growth of Internet of Things (IoT) devices across sectors such as automotive, manufacturing, and healthcare is significantly increasing the demand for scalable, interoperable platforms that can manage these diverse assets in real time; open IoT platforms enable seamless integration of various hardware and software components from multiple vendors

- Businesses increasingly favor open-source platforms to avoid vendor lock-in and maintain the flexibility to adapt infrastructure to evolving needs, which is vital in industries experiencing fast digital transformation such as smart agriculture and industrial automation

- Open IoT platforms foster innovation by giving developers access to open standards and shared libraries, which accelerates product development cycles while lowering overall deployment and maintenance costs

- These platforms support custom analytics and visualizations, helping enterprises extract actionable insights from large volumes of device-generated data without being tied to proprietary tools or frameworks

- For instance, Eclipse IoT and ThingsBoard have gained traction among developers and enterprises due to their modular architecture, community-driven updates, and compatibility with leading cloud ecosystems, thus playing a key role in meeting the rising integration demands of connected devices

Restraint/Challenge

“Concerns Around Data Security and Privacy in Open Architectures”

- Open-source IoT platforms often lack centralized control, which can result in inconsistent implementation of security protocols, making them more susceptible to vulnerabilities and unauthorized access across the device network

- Organizations handling sensitive information, especially in healthcare and financial services, may find open platforms risky due to insufficient built-in compliance features and limited real-time threat detection mechanisms

- Community-maintained platforms may face delayed patch management, making it harder for enterprises to mitigate newly discovered threats quickly, thereby raising concerns among cybersecurity teams and IT managers

- Regulatory challenges such as GDPR, HIPAA, and CCPA demand strong encryption, secure storage, and transparent data handling—all of which can be difficult to implement uniformly in decentralized open environments

- For instance, researchers identified several vulnerabilities in an open-source smart home IoT platform in 2023, which lacked secure authentication protocols, raising alarms about the need for stricter security frameworks and best practices in the open IoT ecosystem

Open IoT Platform Market Scope

The market is segmented on the basis of component, deployment, organization size, and industry vertical.

• By Component

On the basis of component, the open IoT platform market is segmented into hardware, software, and service. The software segment dominated the market with the largest revenue share of 52.4% in 2024, driven by the growing demand for scalable and interoperable solutions that enable real-time device management and data analytics. Open-source software platforms are increasingly being adopted due to their flexibility, cost efficiency, and support for diverse protocols and devices. In addition, the rise of edge computing and AI integration is amplifying the need for intelligent software platforms to process data locally.

The service segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing demand for managed services, consulting, and technical support. As more enterprises adopt open IoT frameworks, they require expert services to ensure secure deployment, system integration, and maintenance. The growing complexity of IoT ecosystems further accelerates the reliance on third-party service providers for seamless operations.

• By Deployment

On the basis of deployment, the open IoT platform market is segmented into cloud and on-premise. The cloud segment accounted for the largest revenue share in 2024, attributed to the rising popularity of Software-as-a-Service (SaaS) models and the need for scalable, cost-effective, and remotely accessible solutions. Cloud-based platforms allow real-time analytics, data visualization, and system monitoring with reduced infrastructure overheads.

The on-premise segment is expected to witness the fastest growth rate from 2025 to 2032, due to its adoption by organizations with stringent data privacy requirements and regulatory compliance needs. Industries such as defense, finance, and healthcare often favor on-premise deployment to maintain full control over their data environments and avoid external dependencies.

• By Organization Size

On the basis of organization size, the open IoT platform market is segmented into SMEs and large enterprises. The large enterprise segment held the majority revenue share in 2024, owing to high budgets, complex IoT infrastructures, and increasing digital transformation initiatives. These organizations are investing in comprehensive platforms to support automation, predictive maintenance, and AI-driven insights.

The SMEs segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising availability of low-cost, modular open IoT platforms. Startups and mid-sized businesses are embracing open solutions for their flexibility, rapid deployment, and ability to scale with minimal investment, enabling innovation across diverse industries.

• By Industry Vertical

On the basis of industry vertical, the open IoT platform market is segmented into government, healthcare, education, manufacturing, retail, power and utilities, automotive, and IT and telecom. The manufacturing segment led the market in 2024, driven by the Industrial Internet of Things (IIoT) adoption for process automation, asset tracking, and real-time monitoring. Open platforms support interoperability across legacy systems, making them ideal for industrial use.

The healthcare segment is expected to witness the fastest growth rate from 2025 to 2032 due to the expanding use of IoT in patient monitoring, remote diagnostics, and medical device integration. Open platforms offer healthcare providers customizable solutions with enhanced data security, facilitating compliance and improving operational efficiency.

Open IoT Platform Market Regional Analysis

- North America dominated the open IoT platform market with the largest revenue share of 38.27% in 2024, driven by early technology adoption, strong presence of leading cloud service providers, and widespread deployment of industrial and consumer IoT solutions

- The region benefits from a robust digital infrastructure, significant investment in smart manufacturing, and government support for Industry 4.0 initiatives

- Growing demand for interoperability, real-time data analytics, and open-source frameworks among enterprises is further strengthening the market position of open IoT platforms across North America

U.S. Open IoT Platform Market Insight

The U.S. open IoT platform market held the largest share in 2024 within North America, supported by extensive deployment across smart cities, manufacturing, logistics, and agriculture sectors. The market is further driven by collaboration between leading tech companies and government agencies, promoting open standards and edge computing frameworks. Increasing adoption of open-source technologies to manage large-scale IoT ecosystems is fostering innovation, scalability, and cost-effective integration of devices.

Europe Open IoT Platform Market Insight

The Europe open IoT platform market is expected to witness the fastest growth rate from 2025 to 2032, driven by strong emphasis on data protection, interoperability, and cross-border IoT collaboration. The European Union’s Digital Strategy and support for open data initiatives are enhancing market prospects. The region is witnessing increasing implementation of open IoT platforms in smart mobility, energy efficiency, and healthcare solutions, aligning with sustainability goals and digital transformation roadmaps.

U.K. Open IoT Platform Market Insight

The U.K. open IoT platform market is expected to witness the fastest growth rate from 2025 to 2032, propelled by advancements in 5G connectivity and investments in smart city infrastructure. Public and private sectors are increasingly embracing open-source IoT platforms to support transparent, scalable, and secure deployment of applications. The nation’s robust startup ecosystem and strong tech talent pool are further facilitating rapid innovation and integration of open IoT technologies across various industry verticals.

Germany Open IoT Platform Market Insight

Germany's open IoT platform market is expected to witness the fastest growth rate from 2025 to 2032, due to the country's leadership in industrial automation and the ongoing implementation of Industrie 4.0 standards. Manufacturers are deploying open platforms to enable machine-to-machine communication, predictive maintenance, and real-time monitoring. The country’s focus on open architecture, secure data exchange, and smart factory adoption is accelerating the use of flexible, customizable IoT platforms in both large enterprises and SMEs.

Asia-Pacific Open IoT Platform Market Insight

The Asia-Pacific open IoT platform market is expected to witness the fastest growth rate from 2025 to 2032, driven by digital transformation across manufacturing, utilities, and smart governance in economies such as China, India, South Korea, and Japan. Government-led initiatives for smart cities and digital infrastructure development are fueling demand for open IoT platforms. In addition, regional tech companies and startups are contributing to innovation in lightweight, open-source IoT frameworks that support localized deployment and low-cost scalability.

Japan Open IoT Platform Market Insight

Japan’s open IoT platform market is expected to witness the fastest growth rate from 2025 to 2032 due to high adoption of automation in healthcare, manufacturing, and mobility sectors. The government’s Society 5.0 vision and strong investment in IoT research are promoting open standards and cross-platform integration. Japanese enterprises are embracing open IoT platforms to improve operational transparency, enable device interoperability, and deploy AI-powered analytics across smart devices and services.

China Open IoT Platform Market Insight

China accounted for the largest revenue share in the Asia-Pacific open IoT platform market in 2024, supported by its expanding smart city initiatives and leadership in industrial IoT deployment. The country’s strategic emphasis on open innovation ecosystems and collaborative platforms is driving market growth. Domestic tech giants and emerging startups are investing heavily in open-source IoT technologies, enabling real-time connectivity, cost-effective deployments, and seamless integration across diverse application scenarios.

Open IoT Platform Market Share

The open IoT Platform industry is primarily led by well-established companies, including:

- SAMSUNG (South Korea)

- Robert Bosch GmbH (Germany)

- Ayla Networks Inc. (U.S.)

- GENERAL ELECTRIC (U.S.)

- KaaIoT Technologies, LLC (U.S.)

- SiteWhere, LLC. (U.S.)

- Siemens (Germany)

- Italtel S.p.A. (Italy)

- Thinger.io (Spain)

- IBM (U.S.)

- SAP SE (Germany)

- Apple Inc. (U.S.)

- Vodafone Group Plc. (U.K.)

- Accenture (Ireland)

- Hewlett Packard Enterprise Development LP (U.S.)

- Intel Corporation (U.S.)

- Microsoft (U.S.)

- Oracle (U.S.)

- PTC (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Happiest Minds (India)

- HARMAN International (U.S.)

Latest Developments in Global Open IoT Platform Market

- In April 2024, Qualcomm Technologies introduced its next-generation industrial and embedded AI platforms, including the QCC730 Wi-Fi SoC and RB3 Gen 2 Platform, during the Embedded World Exhibition in Nuremberg, Germany. This launch is aimed at enhancing edge AI performance and energy-efficient wireless connectivity across robotics, manufacturing, and automotive applications. The move is expected to accelerate the deployment of intelligent IoT systems, improving operational efficiency and expanding Qualcomm’s presence in industrial IoT markets

- In July 2023, Soracom, Inc. formed a strategic partnership with Skylo Technologies to integrate direct-to-device 3GPP Non-Terrestrial Network (NTN) connectivity into Soracom’s virtualized cellular platform. This collaboration is designed to deliver seamless, reliable IoT communication in remote and underserved regions. The initiative broadens connectivity coverage for IoT and M2M devices, enabling more resilient and globally scalable solutions

- In April 2023, Advantech partnered with Altizon to jointly launch a unified industrial IoT solution combining Advantech’s automation hardware with Altizon’s Datonis Digital Factory platform. The integration aims to simplify the transition to smart factories by offering a cost-effective and scalable digital transformation path. This collaboration supports manufacturers in enhancing productivity and adopting Industry 4.0 capabilities with minimal capital expenditure

- In March 2023, Qualcomm Technologies unveiled two new robotics platforms and announced global integration of 5G IoT processors compatible with all major operating systems. The company also introduced an accelerator program to strengthen collaboration within the IoT ecosystem. These advancements aim to drive innovation across the connected edge, supporting faster adoption of intelligent, networked devices in industrial and commercial environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.