Global Online Testing Software Market

Market Size in USD Billion

CAGR :

%

USD

7.27 Billion

USD

24.18 Billion

2024

2032

USD

7.27 Billion

USD

24.18 Billion

2024

2032

| 2025 –2032 | |

| USD 7.27 Billion | |

| USD 24.18 Billion | |

|

|

|

|

Online Testing Software Market Size

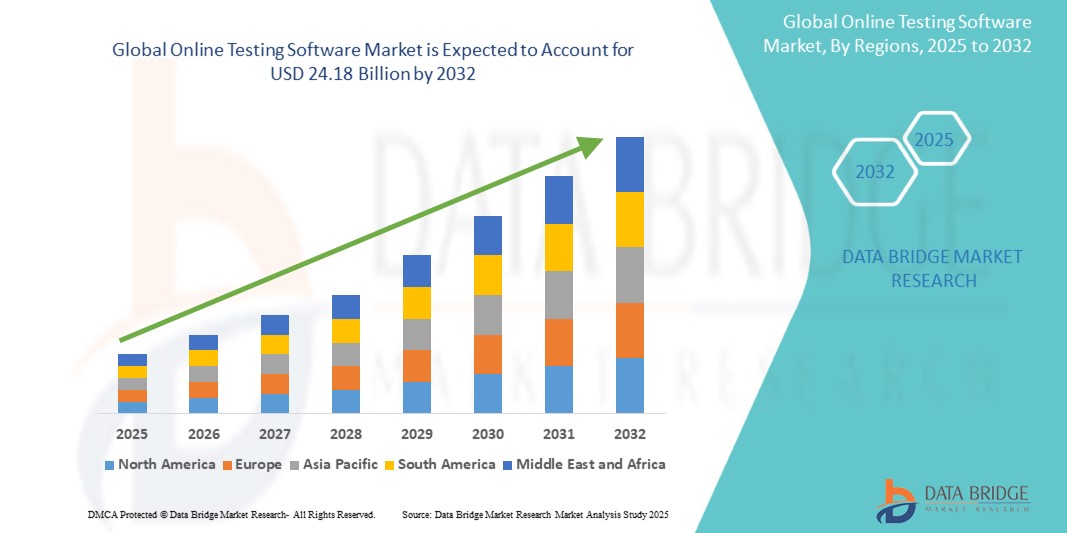

- The global online testing software market was valued at USD 7.27 billion in 2024 and is expected to reach USD 24.18 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 16.20%, primarily driven by factors such as the rising demand for remote learning, cost-effective assessment solutions, and technological advancements in online testing platforms

- Growing emphasis on certification programs, corporate skill development, and AI-driven proctoring solutions are further contributing to the market expansion

Online Testing Software Market Analysis

- Online testing software plays a crucial role in modern education and workforce assessment, offering scalable, flexible, and secure testing environments. These platforms are essential for academic institutions, certification bodies, and corporations conducting high-stakes assessments, recruitment tests, and continuous learning evaluations

- The demand for online testing solutions is significantly driven by the global shift toward remote learning, hybrid education models, and the increased need for skills verification in professional environments. The education sector, in particular, contributes a substantial share, with universities and schools rapidly digitizing their examination systems

- The North America regions stand out as dominant markets, fueled by their large student populations, rapid digital adoption, and strong investments in EdTech infrastructure

- For instance, in October 2024, Coursera reported a 35% year-over-year increase in enrollments from North American users, attributing the growth to partnerships with over 200 universities and colleges across the U.S. and Canada. The surge was largely driven by rising demand for flexible, online learning options among students and professionals, highlighting the region’s strong digital adoption and investment in EdTech solutions. Globally, online testing software ranks among the top digital tools adopted in both academic and enterprise learning ecosystems, second only to learning management systems (LMS), and plays a critical role in enhancing accessibility, standardization, and data-driven evaluation across diverse user bases

Report Scope and Online Testing Software Market Segmentation

|

Attributes |

Online Testing Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Online Testing Software Market Trends

“Increasing Adoption of AI and Automation in Online Assessments”

- One prominent trend in the global online testing software market is the growing adoption of AI and automation in online assessments

- These advanced technologies enhance the efficiency and accuracy of online testing by automating test creation, grading, and proctoring processes, leading to faster, more reliable results

- For instance, AI-driven proctoring systems use facial recognition, behavior analysis, and machine learning to monitor test-takers in real-time, reducing the risk of cheating and ensuring a secure testing environment

- Automation allows for the seamless creation of personalized tests that adapt to the skill level of the test-taker, offering a more tailored experience

- This trend is revolutionizing how assessments are conducted, improving test security, increasing the scalability of online testing platforms, and driving the demand for more innovative solutions in the market

Online Testing Software Market Dynamics

Driver

“Growing Demand for Remote Learning and Certification Programs”

- The increasing adoption of remote learning and online certification programs is significantly driving the demand for online testing software

- As educational institutions, businesses, and certification bodies embrace digital transformation, the need for secure, scalable, and efficient online assessment tools has surged

- The shift towards online learning platforms, accelerated by the COVID-19 pandemic, has led to a higher reliance on online testing to assess knowledge, skills, and competencies, particularly for students, professionals, and job seekers

- With more individuals seeking certifications and skills-based training, the demand for online testing solutions that support large-scale assessments, including AI-driven proctoring and automated grading, has risen

- This trend is fostering a dynamic growth environment for online testing software, as it ensures more accessible, equitable, and flexible assessment opportunities for a global audience

For instance,

- In 2022, according to a report from the World Economic Forum, the demand for online certifications surged by 20%, reflecting the shift towards remote skill-building and online examinations. This growth significantly contributes to the increasing adoption of advanced online testing platforms

- As the trend of remote learning and certification programs continues to rise globally, the demand for sophisticated online testing software is expected to increase, offering enhanced opportunities for market expansion

Opportunity

“Expansion of Mobile-Based and Remote-Friendly Testing Solutions”

- The rising need for accessibility and flexibility in education and corporate training is driving the development of mobile-first and remote-compatible online testing platforms

- With the widespread use of smartphones and tablets, especially in emerging markets, mobile-based testing offers a scalable way to reach users in both urban and rural areas, making assessments more inclusive and convenient

Remote-friendly features such as offline test-taking, mobile-optimized interfaces, and low-bandwidth compatibility are key to expanding market reach and improving user experience across diverse demographics

For instance,

- In February 2025, Pearson announced the launch of a mobile-first testing solution targeting developing regions in Southeast Asia and Africa, enabling test-takers to complete assessments on smartphones with offline functionality and automatic sync when reconnected

- In August 2024, TalentLMS integrated a mobile assessment suite designed for corporate teams, reporting a 28% increase in training completion rates among remote employees due to improved accessibility and device flexibility

As hybrid learning and remote work models become standard, mobile and remote-compatible testing solutions offer a powerful growth avenue for providers to broaden their user base, increase engagement, and support education and training anywhere, anytime

Restraint/Challenge

“Data Privacy and Security Concerns Hindering Market Growth”

- Data privacy and security concerns are a significant challenge for the global online testing software market, particularly when dealing with sensitive student or employee information, such as test results, personal details, and academic records

- With the increasing number of online assessments and remote testing, ensuring the protection of personal data and compliance with data privacy regulations, such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act), becomes more complex

- Many institutions and organizations are reluctant to fully adopt online testing solutions due to fears about potential data breaches or unauthorized access to confidential information, limiting the market's adoption

For instance,

- In October 2024, a report by the Cybersecurity and Infrastructure Security Agency (CISA) highlighted concerns over the security of online testing platforms, citing multiple instances of unauthorized data access in remote proctoring systems. This has prompted calls for tighter security protocols and better encryption methods.

- In March 2023, an article from EdTech Digest reported that educational institutions are increasingly hesitant to adopt new testing software without assurance of robust data protection features, slowing the growth of the online testing market in sectors that handle large volumes of sensitive student data

- As a result, the challenge of safeguarding personal information and maintaining trust in the security of online testing systems can hinder broader adoption, especially in highly regulated industries and academic institutions

Online Testing Software Market Scope

The market is segmented on the basis of type, application, end user, and question type

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By End User |

|

|

By Question Type |

|

Online Testing Software Market Regional Analysis

“North America is the Dominant Region in the Online Testing Software Market”

- North America dominates the online testing software market, driven by the rapid adoption of digital education solutions, robust infrastructure, and high demand for secure and scalable online assessments

- The U.S. holds a significant share due to the increasing reliance on remote learning, corporate training, and online certification programs, alongside the presence of leading technology and software companies

- The availability of well-established cloud platforms and cybersecurity standards further strengthens the market

- Additionally, the increasing demand for AI-driven proctoring solutions and the growing popularity of e-learning platforms in higher education and corporate training sectors are contributing to market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the online testing software market, driven by the rapid digital transformation of education and the increasing adoption of online exams in various sectors

- Countries such as India, China, and Japan are emerging as key markets due to the rising demand for remote learning and vocational training, as well as government initiatives to improve digital literacy and online education infrastructure

- India, with its expanding student population and a growing number of online learning platforms, is experiencing a surge in demand for affordable and scalable online testing solutions

- China continues to invest heavily in EdTech and online education tools, with increasing adoption of AI-driven assessment systems in both academic and corporate settings

- Japan, with its advanced technology sector, remains a crucial market for highly sophisticated and secure online testing platforms for universities, professional certifications, and corporate training

Online Testing Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Parasoft (U.S.)

- RadView Software (U.S.)

- SmartBear Software (U.S.)

- Tricentis (U.S.)

- Katalon (U.S.)

- BrowserStack (Ireland)

- Sauce Labs (U.S.)

- CrossBrowserTesting (U.S.)

- Ranorex (U.S.)

- TestComplete (U.S.)

- Selenium (Global)

- Applitools (Israel

- LambdaTest (U.S.)

- Perfecto (U.S.)

- QMetry (U.S.)

- Micro Focus (U.K.)

- IBM Rational (U.S.)

- HP LoadRunner (U.S.)

- Neotys (France)

- LoadRunner (U.S.)

Latest Developments in Global Online Testing Software Market

- In November 2, 2023 Tata Consultancy Services (TCS) introduced its new Cyber Insights Platform, which utilizes Artificial Intelligence (AI) and Amazon Security Lake to enhance cybersecurity measures and ensure compliance for its clients. This innovative platform aims to provide advanced threat detection, real-time security monitoring, and actionable insights to strengthen the security posture of businesses across various sectors. In the context of the growing online testing software market, this platform's focus on cybersecurity and compliance is highly relevant. As educational institutions, corporations, and certification bodies increasingly adopt digital assessments, safeguarding sensitive data and ensuring compliance with privacy regulations (such as GDPR and CCPA) become critical

- In November 11, 2023 Keysight Technologies, Inc. unveiled the Keysight i3070 Series 7i In-Line Test System, an advanced automated in-circuit test system (ICT) designed to increase capacity and throughput. This new system empowers manufacturers to efficiently meet the complex testing demands associated with larger node count printed circuit board assemblies (PCBs), offering enhanced performance at an economical cost. The introduction of the Keysight i3070 Series 7i highlights the growing need for automation and scalability in testing systems an aspect equally significant in the global online testing software market

- In May 2021 Mercer|Mettl introduced advanced digital solutions aimed at enhancing the integrity and efficiency of online exams. The company integrated features such as Automated Audio Proctoring, Super Proctor, and One-Click LMS Integration into its online testing platform. These innovations significantly improve the platform’s cheating prevention capabilities, addressing the growing demand from educational institutions for fair, secure, and credible exam processes. The advancements made by Mercer|Mettl are highly relevant to the evolving global online testing software market, as security and integrity remain paramount concerns in the digital assessment landscape

- In November 2022 SmartBear, a leading provider of software development and visibility solutions, conducted the fifth annual State of Software Quality Testing study earlier this year. The study, which spanned five weeks, involved more than 1,500 industry professionals from across the development, testing, and software delivery lifecycle. Participants contributed to a comprehensive 61-question online survey aimed at establishing key industry benchmarks in software quality and testing practices. The findings of SmartBear's State of Software Quality Testing study provide valuable insights that are directly applicable to the global online testing software market

- In March 2021 TESTD Inc., a blockchain-based company specializing in healthcare software and analytics, announced the launch of its innovative platform, TESTD. This platform allows businesses and individuals to efficiently schedule COVID-19 tests and vaccine appointments, streamline the testing process, and deliver results directly to both a business dashboard and an individual’s smartphone. The launch of TESTD is highly relevant to the growing global online testing software market, particularly in the context of healthcare and medical testing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.