Global Online Entertainment Market

Market Size in USD Billion

CAGR :

%

USD

316.80 Billion

USD

982.66 Billion

2024

2032

USD

316.80 Billion

USD

982.66 Billion

2024

2032

| 2025 –2032 | |

| USD 316.80 Billion | |

| USD 982.66 Billion | |

|

|

|

|

Online Entertainment Market Size

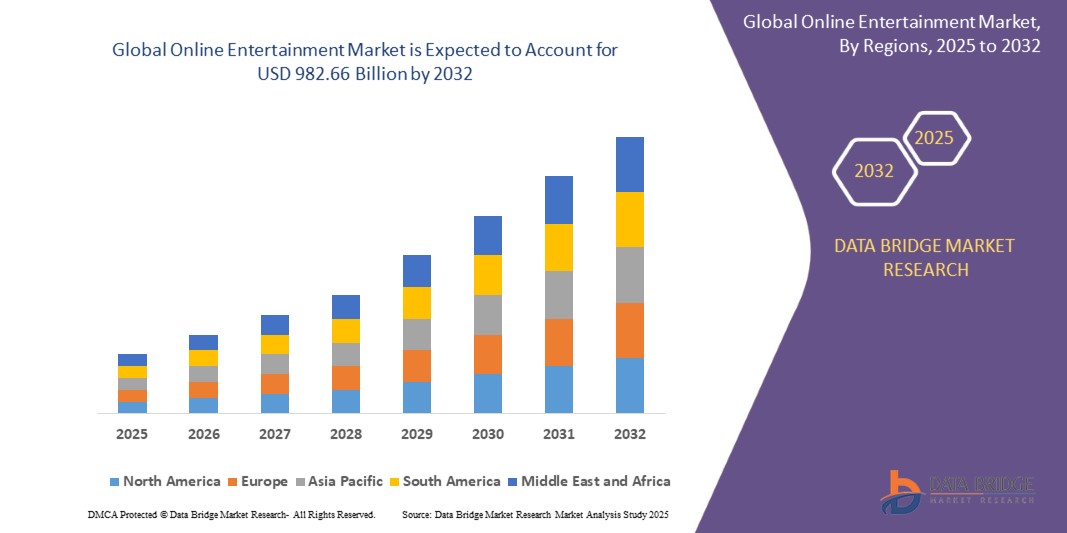

- The global online entertainment market was valued at USD 316.80 billion in 2024 and is expected to reach USD 982.66 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 15.20%, primarily driven by factors such as rising internet penetration, increased smartphone usage, and expansion of OTT platforms

- The market is also benefiting from technological advancements such as virtual reality (VR), augmented reality (AR), and interactive streaming features that enhance user engagement

Online Entertainment Market Analysis

- Online entertainment platforms are vital for providing digital content across various formats, including video streaming, music streaming, online gaming, and live events. These platforms enable users to access entertainment content on-demand, anytime, anywhere

- The demand for online entertainment is significantly driven by increasing internet penetration, rising smartphone usage, and the growing popularity of OTT platforms. Over half of the global demand is driven by the need for video streaming services, with regions such as North America and Asia-Pacific experiencing the highest growth due to increased content consumption

- The North America dominates the global online entertainment market , driven by its large digital population, the rise of local OTT platforms, and increasing disposable incomes, particularly in countries such as U.S. and Canada

- For instance, the number of paid subscribers for streaming services in countries such as U.S. and Canada has surged, reflecting a shift toward digital-first consumption habits, with a growing preference for localized content and entertainment

- Globally, online entertainment platforms rank as the most prominent source of content consumption, overtaking traditional media formats such as television and radio, and continue to play a pivotal role in shaping the future of entertainment delivery across various demographics

Report Scope and Online Entertainment Market Segmentation

|

Attributes |

Online Entertainment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Online Entertainment Market Trends

“Growing Integration of Interactive & Immersive Technologies”

- One prominent trend in the global online entertainment market is the growing integration of interactive and immersive technologies such as Virtual Reality (VR), Augmented Reality (AR), and 360-degree video content

- These technologies are enhancing user engagement by providing more immersive and interactive experiences across entertainment platforms such as gaming, live streaming, and virtual concerts

- For instance, VR gaming has revolutionized how users experience entertainment by offering full immersion, while AR is transforming mobile apps, allowing users to interact with virtual objects within their real-world environment, creating new ways of storytelling and content consumption

- Live streaming events are also incorporating these immersive technologies to offer fans a unique and participatory experience, such as AR-enhanced concerts or interactive sports events

- This trend is shaping the future of online entertainment by driving user engagement and attracting younger, tech-savvy audiences who demand more dynamic, experience-based content

Online Entertainment Market Dynamics

Driver

“Increasing Demand for On-Demand Content and Streaming Services”

- The rising demand for on-demand content and streaming services is significantly driving the growth of the global online entertainment market

- As consumers increasingly shift away from traditional television, the demand for digital content that can be accessed anytime, anywhere continues to rise, particularly among younger demographics who prefer flexibility and convenience

- OTT (Over-the-Top) platforms such as Netflix, Disney+, and Amazon Prime Video have gained massive popularity by offering a wide variety of movies, TV shows, and original programming to global audiences

- The growing adoption of smart TVs, streaming devices, and high-speed internet connections has enabled more households to access streaming services, further driving market growth

- With content consumption becoming more personalized, platforms are expanding their offerings to cater to diverse audiences, providing tailored recommendations and localized content to attract a broader viewer base

- This shift towards streaming services and on-demand content is reshaping the entertainment landscape, providing new growth opportunities for online entertainment providers and content creators

For instance,

- In 2023, it was reported that global subscriptions for streaming services had surpassed 1.1 billion. This continued increase in the number of subscribers highlights the growing market demand for on-demand entertainment content

- In 2022, a report by PwC highlighted that the global OTT market was projected to grow at a CAGR of 17.5% through 2026, fueled by increased consumer preferences for digital content consumption over traditional media

- As a result, the growing demand for on-demand content and streaming services is significantly driving the global online entertainment market. Consumers are increasingly shifting away from traditional television in favor of flexible, anytime access to digital content, particularly among younger demographics who value convenience

Opportunity

“AI-Driven Personalization and Content Creation”

- The integration of artificial intelligence (AI) in entertainment platforms is revolutionizing content discovery, curation, and creation by delivering hyper-personalized user experiences based on viewing habits, preferences, and engagement patterns

- AI is enabling real-time content customization—from adaptive storylines in streaming services to intelligent music playlists—enhancing user satisfaction and retention across entertainment platforms

Further, AI-generated content (AIGC), including music, art, and even scriptwriting, is opening new creative avenues and reducing production costs, empowering smaller creators and studios to compete on a global scale

- For instance, In 2023, Spotify enhanced its AI DJ feature, allowing users to experience personalized commentary and music curation, resulting in a 20% increase in session time among Gen Z users

- In 2024, Netflix introduced AI-powered dynamic trailers that adapt in real-time based on user behavior, significantly improving engagement rates and click-through on promoted content

As AI technologies continue to evolve, online entertainment platforms have the potential to deliver more dynamic, tailored, and cost-effective content, driving deeper user engagement and expanding monetization strategies in the digital entertainment ecosystem

Restraint/Challenge

“Rising Content Licensing Costs and Copyright Issues”

- The increasing costs of content licensing and copyright issues present a significant challenge for the global online entertainment market, particularly affecting streaming platforms and content producers

- Securing the rights to high-quality content, such as movies, TV shows, and live events, can often involve multi-million-dollar deals, increasing operational costs for OTT platforms and affecting profitability

- Additionally, copyright infringement and piracy remain persistent issues, with illegal distribution of content negatively impacting revenue generation and complicating content protection efforts

For instance,

- In 2023, according to a report by PwC, global piracy cost the entertainment industry more than USD 50 billion annually, affecting both content creators and distributors and complicating the landscape for legitimate content distribution

- As licensing costs rise and intellectual property issues become more prevalent, online entertainment platforms face increased financial pressure, which may hinder their ability to expand or sustain their content libraries, ultimately limiting market growth

Online Entertainment Market Scope

The market is segmented on the basis of form, revenue model, devices, end user, and application

|

Segmentation |

Sub-Segmentation |

|

By Form |

|

|

By Revenue Model |

|

|

By Devices |

|

|

By End User |

|

|

By Application |

|

Online Entertainment Market Regional Analysis

“North America is the Dominant Region in the Online Entertainment Market”

- North America dominates the global online entertainment market, driven by high internet penetration, advanced digital infrastructure, and the strong presence of key market players such as Netflix, Amazon, and Disney+

- The U.S. holds a significant share due to the widespread adoption of streaming services, high disposable incomes, and a strong culture of digital content consumption across various demographic groups

- The availability of well-established payment systems, strong OTT platforms, and the expansion of smart devices further strengthen the market in the region

- In addition, the increasing demand for original content and localized programming along with the rapid growth of mobile streaming is fueling market expansion across North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global online entertainment market, driven by rapid expansion in internet access, smartphone adoption, and increased mobile data consumption

- Countries such as China, India, and Japan are emerging as key markets due to their large, youthful populations and the growing shift towards digital-first content consumption

- China, with its booming OTT market and local streaming platforms such as iQIYI and Tencent Video, remains a major player. The country’s growing interest in interactive entertainment and localized content is also driving growth

- India, with its expanding middle class, rising smartphone penetration, and increased demand for low-cost subscription models, is one of the fastest-growing markets for streaming services in the region

- Japan, known for its high-tech industry and strong consumer culture around entertainment, continues to lead in the adoption of anime and niche content on digital platforms, contributing to its position as a key market for online entertainment

Online Entertainment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Netflix (U.S.)

- Amazon Prime Video (U.S.)

- Disney+ (U.S.)

- Hulu (U.S.)

- YouTube (U.S.)

- Tencent Video (China)

- Alibaba Group (China)

- Spotify (Sweden)

- Apple TV+ (U.S.)

- WarnerMedia (U.S.)

- ViacomCBS (U.S.)

- Bilibili (China)

- iQIYI (China)

- Youku (China)

- Pandora (U.S.)

- SoundCloud (Germany)

- TikTok (China)

- Roku (U.S.)

- Sling TV (U.S.)

- Starz (U.S.)

Latest Developments in Global Online Entertainment Market

- In August 2023, MIXI, a Japan-based mobile entertainment company, established a corporate venture capital (CVC) fund valued at USD 50 million in India. The fund aims to allocate between Yen 30-50 billion (USD 200-350 million) for acquisitions, mergers, and strategic partnerships from FY23 to FY25. This move underscores MIXI's commitment to expanding its footprint in the rapidly growing Indian market, which is a key region for the global online entertainment sector

- In August 2023, Penn Entertainment, a U.S.-based gambling company, entered into a strategic partnership with Disney’s ESPN to rebrand and relaunch its sportsbook under the name ESPN Bet. This collaboration signifies a significant step in the evolving landscape of online sports betting and entertainment. By leveraging ESPN's established brand and audience, the move aims to enhance Penn Entertainment’s market presence and expand its reach in the growing sports betting sector

- In January 2022, Microsoft revealed its intention to acquire Activision Blizzard, a U.S.-based video game company, with the goal of expanding its gaming offerings and enhancing the accessibility of gaming experiences across all devices. This acquisition reflects Microsoft's strategic efforts to strengthen its position in the growing digital entertainment and gaming sectors. By incorporating Activision Blizzard’s extensive portfolio of iconic gaming franchises, Microsoft aims to diversify and enrich its online entertainment services

- In February 2022, Sony Music Entertainment and Sony Pictures Entertainment launched Sony Entertainment Talent Ventures India (SETVI), a joint venture designed to tap into India's rapidly expanding entertainment industry. The venture spans multiple sectors, including film, music, TV, digital media, and gaming, with a focus on leveraging India's vast talent pool to foster strategic investments and partnerships. This initiative aligns with the growing demand for diverse, locally produced content in the global online entertainment market

- In February 2021, Disney+ expanded its global presence by introducing the Star brand in Australia, New Zealand, Western Europe, and Canada. This strategic move enhances Disney's footprint in the competitive online entertainment market by offering a broad range of general entertainment content, including movies, television series, and documentaries. Through the Star brand, Disney aims to strengthen its geographical reach and better serve the evolving content preferences of consumers in these key regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.