Global Omega 3 Market

Market Size in USD Billion

CAGR :

%

USD

3.04 Billion

USD

6.24 Billion

2024

2032

USD

3.04 Billion

USD

6.24 Billion

2024

2032

| 2025 –2032 | |

| USD 3.04 Billion | |

| USD 6.24 Billion | |

|

|

|

Omega 3 Market Size

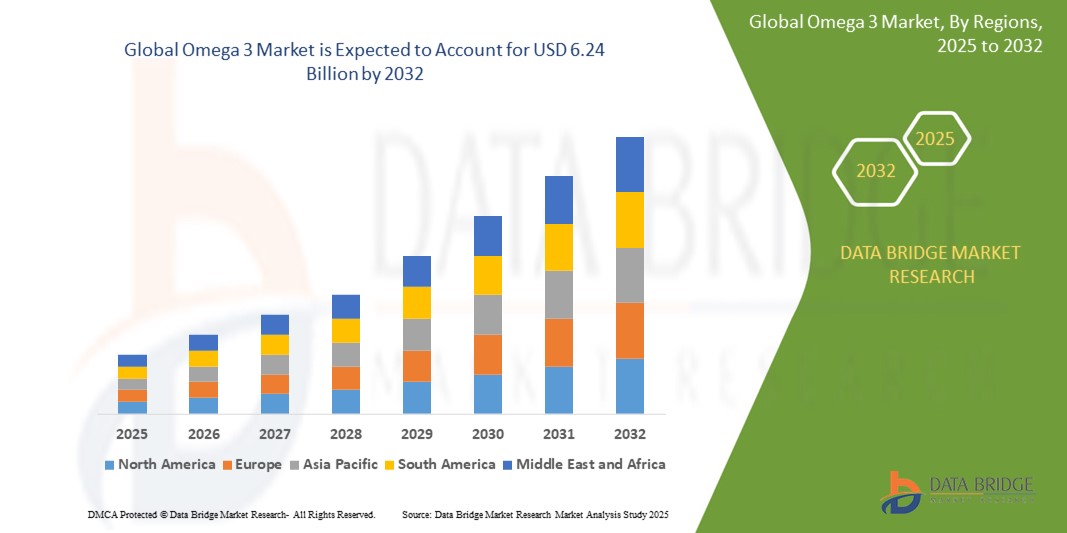

- The global omega 3 market was valued at USD 3.04 billion in 2024 and is expected to reach USD 6.24 billion by 2032

- During the forecast period of 2025 to 2032 the market is such as to grow at a CAGR of 9.40%, primarily driven by the rising consumer demand for health and wellness products

- This growth is driven by factors such as increasing awareness of the health benefits of omega 3 fatty acids

Omega 3 Market Analysis

- The global omega-3 market is experiencing significant growth, with projections indicating substantial increases in market size over the coming years

- Technological advancements in extraction and production methods are enhancing the quality and sustainability of omega-3 products. For instance, innovations such as supercritical CO₂ extraction and molecular distillation are improving purity and potency, meeting the rising consumer demand for clean and effective supplements

- The market is diversifying beyond traditional fish oil sources, with plant-based alternatives such as algae oil gaining popularity. Algae-derived omega-3s appeal to vegan and environmentally conscious consumers, offering sustainable options without compromising on health benefits

- Omega-3 fatty acids are being incorporated into a wide range of products, including dairy items, bakery goods, and beverages, broadening their consumer base. This trend reflects the versatility of omega-3s in enhancing various food categories

- North America currently leads the omega-3 market, driven by high consumer awareness and widespread use of dietary supplements. The presence of major manufacturers and a strong emphasis on health and wellness contribute to the region's dominant position

Report Scope and Omega 3 Market Segmentation

|

Attributes |

Omega 3 Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Omega 3 Market Trends

“Shift Toward Plant-Based Omega-3 Sources”

- The omega-3 market is shifting towards plant-based sources as consumer demand for vegan and sustainable alternatives grows

- Plant-based omega-3 supplements from algae, flaxseed, and chia seeds are becoming popular due to their alignment with ethical and environmental concerns

- Algae oil, a key plant-based source of omega-3 fatty acids, is emerging as a sustainable, vegan-friendly alternative to fish-derived omega-3 oils

- This shift reflects the broader trend of increasing plant-based diets and awareness of the environmental impact of marine-based omega-3 sourcing

- Innovations in product formulations and delivery methods are being developed to cater to health-conscious and environmentally aware consumers

- In conclusion, as the plant-based omega-3 segment expands, it creates new opportunities for brands to cater to evolving consumer demands and align with sustainability trends

Omega 3 Market Dynamics

Driver

“Health Awareness Boosting Omega-3 Demand”

- Rising global awareness about nutrition and wellness is boosting the demand for omega-3 fatty acids as consumers seek preventive healthcare solutions for long-term well-being

- Increasing cases of cardiovascular issues and lifestyle-related disorders such as obesity are pushing more people toward dietary supplements containing omega-3s for daily use

- Health professionals and institutions such as the American Heart Association recommend regular intake of omega-3s for heart and brain health, adding credibility and encouraging wider consumer adoption

- Companies such as Nestlé and Unilever are introducing omega-3 enriched products such as health drinks, dairy items, and fortified snacks to tap into the growing health-conscious market

- For instance, brands such as Nordic Naturals and Nature Made are offering high-purity omega-3 supplements in easy-to-consume forms such as gummies and soft gels, making them accessible to various age groups

- In conclusion, this growing alignment between health trends and product innovation positions omega-3s as a long-term essential in consumer health

Opportunity

“Rising Demand for Plant-Based Alternatives”

- There is a growing demand for plant-based omega-3 sources as more consumers adopt vegan and sustainable diets

- Plant-based omega-3 alternatives, such as algae, flaxseed, and chia seeds, are gaining traction due to their environmental benefits

- Algae oil, in particular, is becoming a prominent player as a sustainable and vegan-friendly alternative to fish-derived omega-3s

- This demand is fueled by consumers’ increasing awareness of the environmental impact of marine-sourced omega-3 fatty acids

- Companies are innovating with plant-based omega-3 supplements, fortified foods, and beverages to cater to health-conscious and eco-aware consumers

- In conclusion, the rise in plant-based diets and sustainable consumer values presents a significant growth opportunity for omega-3 brands

Restraint/Challenge

“Price-Sensitive Consumers in Various Income Groups”

- High-quality omega-3 supplements from sustainable sources such as algae tend to be expensive, making them less affordable for price-sensitive consumers in various income groups

- The advanced processes used for purity and safety, such as cold-press extraction and molecular distillation, increase manufacturing costs significantly

- For instance, algae-based omega-3 capsules by brands such as Ovega-3 are priced higher than traditional fish oil options due to eco-friendly sourcing and rigorous testing

- Regulatory compliance and third-party certifications add further to production costs, often resulting in a higher retail price that limits regular consumption

- The presence of cheaper, lower-quality alternatives in the market may lead some consumers to opt for less effective or unverified products, affecting the reputation of omega-3 supplements overall

- In conclusion, balancing premium quality with affordability is crucial to overcome this barrier and expand consumer reach

Omega 3 Market Scope

The market is segmented on the basis of type, source, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Source |

|

|

By Application |

|

Omega 3 Market Regional Analysis

“North America is the Dominant Region in the Omega 3 Market”

- North America holds the largest share of the global omega-3 market, driven by high consumer awareness regarding the health benefits of omega-3 fatty acids

- The region's strong presence of key manufacturers, distributors, and suppliers ensures continuous growth and market dominance

- The rising demand for dietary supplements and functional foods, particularly omega-3 enriched products, is prominent across the U.S. and Canada

- The growing focus on preventive healthcare and chronic disease management has contributed significantly to the adoption of omega-3s in daily diets

- Consumers are increasingly willing to invest in premium-quality supplements, particularly those that provide heart, brain, and joint health benefits

- The prevalence of lifestyle-related diseases, such as cardiovascular conditions, has further encouraged omega-3 adoption in the region

- In conclusion, North America maintains its dominance in the omega-3 market due to high consumer demand and awareness of health benefits.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia Pacific is experiencing the fastest market growth for omega-3 products, with a high compound annual growth rate expected over the coming years

- The rising middle class in countries such as China and India, along with improved disposable incomes, is driving the adoption of nutritional supplements, including omega-3s

- Increasing health awareness and the rising prevalence of chronic diseases such as diabetes, obesity, and cardiovascular diseases are pushing consumers towards omega-3 supplementation

- The market is benefiting from a growing shift towards healthier lifestyles and the adoption of Western diets, which have spurred interest in omega-3 enriched foods

- Algae-based omega-3 products are gaining popularity as a plant-based alternative to fish oil, appealing to environmentally conscious consumers

- Government initiatives and campaigns promoting nutrition and healthy living are contributing to the growth of the omega-3 market in the region

- In countries such as Japan, omega-3 supplements are being increasingly integrated into daily diets, both in supplement form and through fortified food products

- In conclusion, Asia Pacific is the fastest-growing region, driven by increasing health consciousness and rising disposable incomes

Omega 3 Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- DSM (Netherlands)

- BASF SE (Germany)

- Lonza Group (Switzerland)

- Glanbia Plc (Ireland)

- ADM (US)

- Farbest Brands (U.S)

- SternVitamin GmbH & Co. KG (Germany)

- Adisseo (France)

- BTSA Biotechnologias Aplicadas S.L. (Spain)

- Rabar Pty Ltd (Australia)

- Golden Omega (Chile)

- Kinomega Biopharm Inc. (China)

- Sinomega Biotech Engineering Co. Ltd. (China)

- Polaris (US), Pharma Marine AS (Norway)

- Huatai Biopharm (China)

- ALGISYS LLC (US)

- Biosearch Life (Spain)

Latest Developments in Global Omega 3 Market

- In February, 2025 GC Rieber VivoMega has introduced two new technologies, VivoTech and VivoSure, aimed at improving the quality, purity, and stability of omega-3 products. These innovations ensure a longer shelf life and enhanced sensory profiles by refining omega-3 concentrates with real-time evaluations

- In December 2024, Coromega launched Max Gold, the highest single-dose omega-3 fish oil supplement, designed for maximum wellness. This new product offers an easy and effective way to incorporate omega-3s into daily routines, just in time for consumers' 2025 New Year’s health resolutions. The Max Gold supplement aims to provide enhanced health benefits with a powerful, concentrated dose of omega-3s

- In December 2024, Nature's Bounty introduced a plant-based omega-3 supplement derived from algae, offering a vegetarian alternative to traditional fish oil. Each softgel provides 520 mg of omega-3 fatty acids, including 510 mg of EPA and DHA, to support heart, joint, and skin health. The supplement is available at major retailers such as Amazon, CVS, Walgreens, Publix, and Kroger

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL OMEGA 3 MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL OMEGA 3 MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL OMEGA 3 MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OUTLOOK

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL OMEGA 3 MARKET, BY TYPE, 2018-2032 (USD MILLION) (TONS)

11.1 OVERVIEW

11.2 EICOSAPENTAENOIC ACID (EPA)

11.2.1 MARINE-BASED EPA

11.2.1.1. FISH OIL

11.2.1.2. KRILL OIL

11.2.2 PLANT-BASED EPA

11.2.2.1. ALGAE-BASED

11.2.2.2. SEED OIL-DERIVED

11.2.3 SYNTHETIC/BIOTECHNOLOGICALLY PRODUCED EPA

11.3 DOCOSAHEXAENOIC ACID (DHA)

11.3.1 MARINE-BASED DHA

11.3.1.1. FISH OIL

11.3.1.2. COD LIVER OIL

11.3.2 ALGAE-BASED DHA

11.3.2.1. PURE DHA

11.3.2.2. BLENDS (DHA + EPA)

11.3.3 SYNTHETIC/FERMENTED DHA

11.4 ARACHIDONIC ACID (ARA)

11.4.1 MICROBIAL FERMENTATION-DERIVED ARA

11.4.1.1. NATURAL ARA

11.4.1.2. MEAT-BASED

11.4.1.3. EGG-BASED

11.4.2 SYNTHETIC ARA

11.5 COMBINED EPA/DHA BLENDS

11.5.1 STANDARDIZED EPA/DHA BLENDS

11.5.2 CUSTOM BLENDS FOR SPECIFIC APPLICATIONS

11.6 ALPHA-LINOLENIC ACID (ALA)

11.7 STEARIDONIC ACID (SDA)

12 GLOBAL OMEGA 3 MARKET, BY SOURCE, 2018-2032 (USD MILLION)

12.1 OVERVIEW

12.2 PLANTS

12.2.1 ALGAE OIL

12.2.2 SEED-BASED OMEGA-3

12.2.2.1. FLAXSEED

12.2.2.2. CHIA SEED

12.2.2.3. CAMELINA SEED

12.2.3 NUT-BASED OMEGA-3

12.2.3.1. WALNUTS

12.2.3.2. PECANS

12.2.3.3. OTHERS

12.2.4 LEAFY GREENS

12.2.5 OTHERS

12.3 SEAFOODS

12.3.1 FISH OIL

12.3.1.1. ANCHOVY OIL

12.3.1.2. SALMON OIL

12.3.1.3. COD LIVER OIL

12.3.2 KRILL OIL

12.3.2.1. ANTARCTIC KRILL

12.3.2.2. SUPERCRITICAL EXTRACTION KRILL OIL

12.3.3 MARINE MICRO-ORGANISMS

12.3.3.1. SCHIZOCHYTRIUM

12.3.3.2. CRYPTHECODINIUM

12.3.3.3. OTHERS

12.3.4 OTHERS

12.4 BIOTECHNOLOGICALLY SYNTHESIZED OMEGA-3

12.4.1 FERMENTATION-BASED OMEGA-3

12.4.2 GENETICALLY ENGINEERED PLANTS OR ALGAE

12.5 ANIMAL-BASED OMEGA-3

12.5.1 DAIRY

12.5.2 EGGS

12.5.3 OTHERS

12.6 OTHERS

13 GLOBAL OMEGA 3 MARKET, BY FORM, 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 OIL

13.3 POWDER

13.3.1 MICROCAPSULE POWDER

13.3.2 BIOMASS POWDER

13.4 OTHERS

14 GLOBAL OMEGA 3 MARKET, BY PRODUCTION METHOD, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 CULTIVATION OF MARINE MICROALGAE OR BACTERIA

14.3 PLANT MOLECULAR FARMING

14.4 PRECISION FERMENTATION

14.5 OTHERS

15 GLOBAL OMEGA 3 MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 DIETARY SUPPLEMENTS

15.2.1 DIETARY SUPPLEMENTS, BY TYPE

15.2.1.1. EICOSAPENTAENOIC ACID (EPA)

15.2.1.2. DOCOSAHEXAENOIC ACID (DHA)

15.2.1.3. ARACHIDONIC ACID (ARA)

15.2.1.4. COMBINED EPA/DHA BLENDS

15.2.1.5. ALPHA-LINOLENIC ACID (ALA)

15.2.1.6. STEARIDONIC ACID (SDA)

15.2.2 DIETARY SUPPLEMENTS, BY CATEGORY

15.2.2.1. CHEWABLES & GUMMIES

15.2.2.2. CAPSULES

15.2.2.3. POWDERS

15.2.2.4. TABLETS & SOFTGELS

15.2.2.5. OTHERS

15.2.3 DIETARY SUPPLEMENTS, BY TARGET CONSUMER

15.2.3.1. SPORTS FITNESS

15.2.3.2. ENERGY & WEIGHT MANAGEMENT

15.2.3.3. GENERAL HEALTH

15.2.3.4. BONE & JOINT HEALTH

15.2.3.5. GASTROINTESTINAL HEALTH

15.2.3.6. IMMUNITY

15.2.3.7. CARDIAC HEALTH

15.2.3.8. DIABETES

15.2.3.9. ANTI-CANCER

15.2.3.10. SKIN/HAIR/NAILS

15.2.3.11. BRAIN/MENTAL HEALTH

15.2.3.12. OTHERS

15.3 FUNCTIONAL FOODS AND BEVERAGES

15.3.1 FUNCTIONAL FOODS AND BEVERAGES, BY TYPE

15.3.1.1. EICOSAPENTAENOIC ACID (EPA)

15.3.1.2. DOCOSAHEXAENOIC ACID (DHA)

15.3.1.3. ARACHIDONIC ACID (ARA)

15.3.1.4. COMBINED EPA/DHA BLENDS

15.3.1.5. ALPHA-LINOLENIC ACID (ALA)

15.3.1.6. STEARIDONIC ACID (SDA)

15.3.2 FUNCTIONAL FOODS AND BEVERAGES, BY PRODUCT TYPE

15.3.2.1. OMEGA-3 ENRICHED DAIRY

15.3.2.1.1. MILK AND YOGURT

15.3.2.1.2. BUTTER AND CHEESE SPREADS

15.3.2.1.3. OTHERS

15.3.2.2. FORTIFIED BEVERAGES

15.3.2.2.1. JUICES

15.3.2.2.2. SMOOTHIES AND SHAKES

15.3.2.2.3. OTHERS

15.3.2.3. OMEGA-3 INFUSED SNACKS

15.3.2.3.1. PROTEIN BARS

15.3.2.3.2. CHIPS

15.3.2.3.3. OTHERS

15.3.2.4. OMEGA-3 FORTIFIED CEREALS AND GRAINS

15.4 SKINCARE AND PERSONAL CARE

15.4.1 SKINCARE AND PERSONAL CARE, BY TYPE

15.4.1.1. EICOSAPENTAENOIC ACID (EPA)

15.4.1.2. DOCOSAHEXAENOIC ACID (DHA)

15.4.1.3. ARACHIDONIC ACID (ARA)

15.4.1.4. COMBINED EPA/DHA BLENDS

15.4.1.5. ALPHA-LINOLENIC ACID (ALA)

15.4.1.6. STEARIDONIC ACID (SDA)

15.4.2 SKINCARE AND PERSONAL CARE, BY PRODUCT TYPE

15.4.2.1. SKIN CARE

15.4.2.1.1. SUN SCREEN LOTION

15.4.2.1.2. SERUM

15.4.2.1.3. MOISTURIZER

15.4.2.1.4. SCRUB

15.4.2.1.5. LIP CARE CREAM

15.4.2.1.6. OTHERS

15.4.2.2. HAIR CARE

15.4.2.2.1. SHAMPOO

15.4.2.2.2. CONDITIONER

15.4.2.2.3. HAIR OIL AND SERUM

15.4.2.2.4. OTHERS

15.4.2.3. OTHERS

15.5 PHARMACEUTICALS

15.5.1 PHARMACEUTICALS, BY TYPE

15.5.1.1. EICOSAPENTAENOIC ACID (EPA)

15.5.1.2. DOCOSAHEXAENOIC ACID (DHA)

15.5.1.3. ARACHIDONIC ACID (ARA)

15.5.1.4. COMBINED EPA/DHA BLENDS

15.5.1.5. ALPHA-LINOLENIC ACID (ALA)

15.5.1.6. STEARIDONIC ACID (SDA)

15.5.2 PHARMACEUTICALS, BY PRODUCT TYPE

15.5.2.1. PRESCRIPTION OMEGA-3 DRUGS

15.5.2.2. CARDIOVASCULAR HEALTH SUPPLEMENTS

15.5.2.3. NEUROLOGICAL AND COGNITIVE HEALTH TREATMENTS

15.5.2.4. ANTI-INFLAMMATORY FORMULATIONS

15.5.2.5. OTHERS

15.6 INFANT FORMULAS

15.6.1 INFABT FORMULAS, BY TYPE

15.6.1.1. EICOSAPENTAENOIC ACID (EPA)

15.6.1.2. DOCOSAHEXAENOIC ACID (DHA)

15.6.1.3. ARACHIDONIC ACID (ARA)

15.6.1.4. COMBINED EPA/DHA BLENDS

15.6.1.5. ALPHA-LINOLENIC ACID (ALA)

15.6.1.6. STEARIDONIC ACID (SDA)

15.6.2 INFANT FORMULAS, BY STAGE

15.6.2.1. SATGE 1

15.6.2.2. STAGE 2

15.6.2.3. STAGE 3

15.6.2.4. STAGE 4

15.6.3 INFANT FORMAULAS, BY FORMULA TYPE

15.6.3.1. STANDARD DHA/ARA FORTIFIED FORMULAS

15.6.3.2. HYPOALLERGENIC OR SPECIALIZED MEDICAL FORMULAS

15.6.4 OTHERS

15.7 ANIMAL NUTRITION

15.7.1 ANIMAL NUTRITION, BY TYPE

15.7.1.1. EICOSAPENTAENOIC ACID (EPA)

15.7.1.2. DOCOSAHEXAENOIC ACID (DHA)

15.7.1.3. ARACHIDONIC ACID (ARA)

15.7.1.4. COMBINED EPA/DHA BLENDS

15.7.1.5. ALPHA-LINOLENIC ACID (ALA)

15.7.1.6. STEARIDONIC ACID (SDA)

15.7.2 ANIMAL NUTRITION, BY END-USE

15.7.2.1. RUMINANTS

15.7.2.1.1. CALVES

15.7.2.1.2. DAIRY CATTLE

15.7.2.1.3. BEEF CATTLE

15.7.2.2. POULTRY

15.7.2.2.1. BROILER

15.7.2.2.2. LAYERS

15.7.2.2.3. BREEDER

15.7.2.3. SWINE

15.7.2.3.1. STARTERS

15.7.2.3.2. GROWERS

15.7.2.3.3. OTHERS

15.7.2.4. PET

15.7.2.4.1. CAT

15.7.2.4.2. DOG

15.7.2.4.3. RABBIT

15.7.2.4.4. MICE

15.7.2.4.5. OTHERS

15.7.2.5. AQUATIC ANIMAL

15.7.2.5.1. FISH FEED

15.7.2.5.2. MOLLUSK FEED

15.7.2.5.3. CRUSTACEANS

15.7.2.5.4. OTHERS

15.8 MEDICAL FOODS

15.8.1 MEDCIAL FOODS, BY TYPE

15.8.1.1. EICOSAPENTAENOIC ACID (EPA)

15.8.1.2. DOCOSAHEXAENOIC ACID (DHA)

15.8.1.3. ARACHIDONIC ACID (ARA)

15.8.1.4. COMBINED EPA/DHA BLENDS

15.8.1.5. ALPHA-LINOLENIC ACID (ALA)

15.8.1.6. STEARIDONIC ACID (SDA)

15.8.2 MEDICAL FOODS, BY END-USE

15.8.2.1. THERAPEUTIC NUTRITION FOR CHRONIC DISEASES

15.8.2.2. OMEGA-3 FOR MALNOURISHMENT RECOVERY

15.8.3 OTHERS

15.9 OTHERS

16 GLOBAL OMEGA 3 MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIAP-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT & APPROVALS

16.7 EXPANSIONS & PARTNERSHIP

16.8 REGULATORY CHANGES

17 GLOBAL OMEGA 3 MARKET, BY GEOGRAPHY, 2018-2032 (USD MILLION) (TONS)

17.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

17.2 NORTH AMERICA

17.2.1 U.S.

17.2.2 CANADA

17.2.3 MEXICO

17.3 EUROPE

17.3.1 GERMANY

17.3.2 U.K.

17.3.3 ITALY

17.3.4 FRANCE

17.3.5 SPAIN

17.3.6 RUSSIA

17.3.7 SWITZERLAND

17.3.8 TURKEY

17.3.9 BELGIUM

17.3.10 POLAND

17.3.11 DENMARK

17.3.12 NORWAY

17.3.13 SWEDEN

17.3.14 NETHERLANDS

17.3.15 REST OF EUROPE

17.4 ASIA-PACIFIC

17.4.1 JAPAN

17.4.2 CHINA

17.4.3 SOUTH KOREA

17.4.4 INDIA

17.4.5 SINGAPORE

17.4.6 THAILAND

17.4.7 INDONESIA

17.4.8 MALAYSIA

17.4.9 PHILIPPINES

17.4.10 AUSTRALIA

17.4.11 NEW ZEALAND

17.4.12 REST OF ASIA-PACIFIC

17.5 SOUTH AMERICA

17.5.1 BRAZIL

17.5.2 ARGENTINA

17.5.3 REST OF SOUTH AMERICA

17.6 MIDDLE EAST AND AFRICA

17.6.1 SOUTH AFRICA

17.6.2 EGYPT

17.6.3 SAUDI ARABIA

17.6.4 UNITED ARAB EMIRATES

17.6.5 ISRAEL

17.6.6 REST OF MIDDLE EAST AND AFRICA

18 GLOBAL OMEGA 3 MARKET, SWOT & DBMR ANALYSIS

19 GLOBAL OMEGA 3 MARKET, COMPANY PROFILE

19.1 BASF

19.1.1 COMPANY OVERVIEW

19.1.2 REVENUE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENTS

19.2 DSM-FIRMENICH

19.2.1 COMPANY OVERVIEW

19.2.2 REVENUE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT DEVELOPMENTS

19.3 CRODA INTERNATIONAL PLC

19.3.1 COMPANY OVERVIEW

19.3.2 REVENUE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENTS

19.4 CORBION

19.4.1 COMPANY OVERVIEW

19.4.2 REVENUE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT DEVELOPMENTS

19.5 ARISTA INDUSTRIES, INC.

19.5.1 COMPANY OVERVIEW

19.5.2 REVENUE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENTS

19.6 NU-MEGA INGREDIENTS

19.6.1 COMPANY OVERVIEW

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 OMEGA PROTEIN CORPORATION

19.7.1 COMPANY OVERVIEW

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENTS

19.8 COPEINCA SAC

19.8.1 COMPANY OVERVIEW

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENTS

19.9 EPAX

19.9.1 COMPANY OVERVIEW

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT DEVELOPMENTS

19.1 SOLUTEX

19.10.1 COMPANY OVERVIEW

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENTS

19.11 OLVEA OMEGA SOLUTIONS

19.11.1 COMPANY OVERVIEW

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 GOLDEN OMEGA

19.12.1 COMPANY OVERVIEW

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 KINOMEGA BIOPHARM INC

19.13.1 COMPANY OVERVIEW

19.13.2 REVENUE ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENTS

19.14 GC RIEBER VIVOMEGA AS

19.14.1 COMPANY OVERVIEW

19.14.2 REVENUE ANALYSIS

19.14.3 PRODUCT PORTFOLIO

19.14.4 RECENT DEVELOPMENTS

19.15 EVONIK INDUSTRIES AG

19.15.1 COMPANY OVERVIEW

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENTS

19.16 IMPERIAL-OEL-IMPORT HANDELSGESELLSCHAFT MBH

19.16.1 COMPANY OVERVIEW

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENTS

19.17 ALPSPURE LIFESCIENCES PVT. LTD.

19.17.1 COMPANY OVERVIEW

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENTS

19.18 PHYTOLOGIX LIFE SCIENCES

19.18.1 COMPANY OVERVIEW

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENTS

19.19 ELEMENTA

19.19.1 COMPANY OVERVIEW

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENTS

19.2 KD PHARMA GROUP SA

19.20.1 COMPANY OVERVIEW

19.20.2 REVENUE ANALYSIS

19.20.3 PRODUCT PORTFOLIO

19.20.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

20 RELATED REPORTS

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Global Omega 3 Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Omega 3 Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Omega 3 Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.