Global Oily Waste Can Market

Market Size in USD Million

CAGR :

%

USD

262.26 Million

USD

342.69 Million

2024

2032

USD

262.26 Million

USD

342.69 Million

2024

2032

| 2025 –2032 | |

| USD 262.26 Million | |

| USD 342.69 Million | |

|

|

|

|

Oily Waste Can Market Size

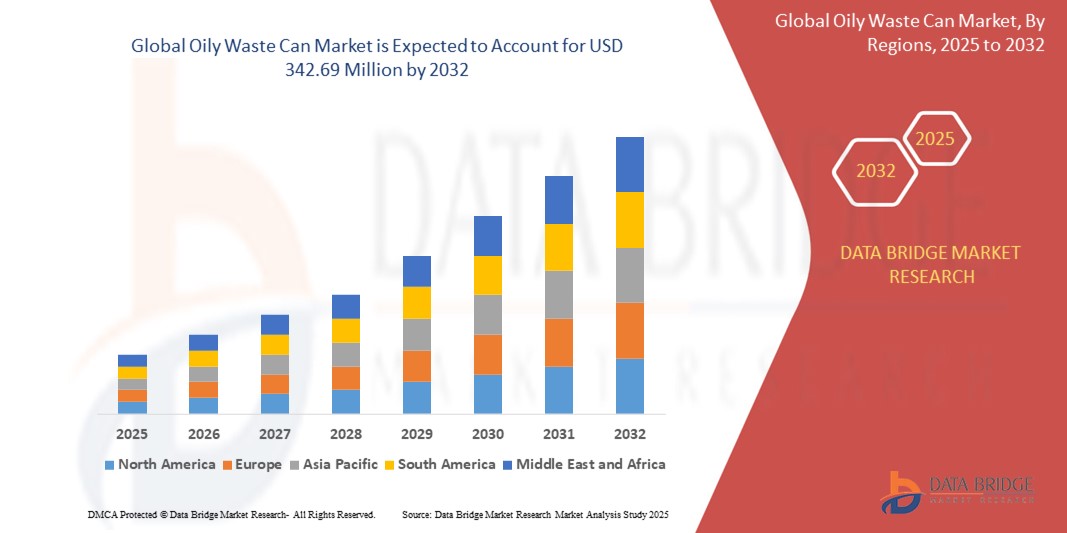

- The global oily waste can market size was valued at USD 262.26 million in 2024 and is expected to reach USD 342.69 million by 2032, at a CAGR of 3.40% during the forecast period

- The market growth is largely fueled by increasing industrial safety regulations and growing emphasis on proper disposal of oil-soaked materials, prompting widespread adoption of oily waste cans across manufacturing and maintenance sectors

- Furthermore, rising awareness regarding workplace fire hazards and environmental compliance is encouraging facilities to invest in certified, self-closing oily waste cans, thereby significantly boosting demand and driving market expansion

Oily Waste Can Market Analysis

- An oily waste can is a specialized container designed for safely collecting and storing waste contaminated with oil or other petroleum-based substances. It prevents leaks and spills, minimizing environmental contamination and ensuring safe disposal. Commonly used in industries such as automotive and manufacturing, it helps manage and dispose of hazardous waste in compliance with environmental regulations

- The escalating demand for oily waste cans is primarily fueled by rising industrial safety standards, growing awareness of fire hazards, and the need for reliable containment solutions that support regulatory compliance and workplace safety initiatives

- Europe dominated the oily waste can market with a share of 44.8% in 2024, due to stringent workplace safety regulations and a well-established industrial sector prioritizing hazardous waste management

- North America is expected to be the fastest growing region in the oily waste can market during the forecast period due to stricter enforcement of OSHA fire safety standards and expanding industrial activities.

- Steel segment dominated the market with a market share of 69% in 2024, due to its superior fire resistance, strength, and durability. Steel oily waste cans are extensively preferred in industrial and commercial environments where the safe disposal of flammable materials is critical. Their rigid construction meets strict safety regulations and offers long-term cost benefits through minimal maintenance. The resistance of steel to impact and high temperatures further supports its widespread use across heavy-duty applications

Report Scope and Oily Waste Can Market Segmentation

|

Attributes |

Oily Waste Can Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oily Waste Can Market Trends

“Growing Adoption of Sustainable Waste Management Solutions”

- A significant and accelerating trend in the global oily waste can market is the rising emphasis on sustainable waste management practices across industrial and commercial sectors. This trend is being driven by stringent environmental regulations and increasing awareness about the risks associated with improper disposal of oil-soaked materials

- For instance, organizations such as OSHA and EPA mandate strict compliance for the storage and disposal of flammable waste, leading companies to invest in certified oily waste cans that reduce the risk of spontaneous combustion

- Oily waste cans are increasingly being integrated into broader facility safety programs, with features such as self-closing lids and fire-safe construction ensuring compliance with international safety codes. Manufacturers such as Justrite and Eagle Manufacturing are offering eco-conscious models made of recyclable materials, aligning with global sustainability goals

- Furthermore, the adoption of these containers is growing in environmentally sensitive industries such as marine operations and construction, where contamination risks are high and safety standards are tightening

- This trend is also being driven by corporate ESG (Environmental, Social, and Governance) goals that prioritize reducing workplace hazards and ensuring proper waste segregation. Companies are recognizing the long-term cost benefits and liability reduction associated with safer waste disposal systems

- The demand for certified, durable, and environmentally responsible oily waste cans is rising across regions, especially in North America and Europe, as sustainability becomes an operational imperative for compliance-driven industries

Oily Waste Can Market Dynamics

Driver

“Rise in Oil and Gas Exploration”

- The growing expansion of oil and gas exploration and related industrial activities is a significant driver of demand for oily waste cans across global markets

- For instance, the resurgence of drilling activities in regions such as North America and the Middle East is generating high volumes of oil-contaminated rags and absorbents that require safe disposal. This has made compliant oily waste containment systems essential in upstream and downstream facilities

- The need to maintain regulatory compliance and prevent workplace incidents due to improperly stored flammable materials has led to widespread adoption of these cans at field sites and processing units

- Furthermore, companies operating in offshore and onshore exploration increasingly prioritize safe waste handling to meet internal safety protocols and minimize environmental liabilities

- The integration of oily waste cans into day-to-day operations within these sectors is driving market growth, especially as companies seek to standardize waste management procedures across multiple locations

Restraint/Challenge

“High Costs of Recycling Technologies”

- The high costs associated with the treatment and recycling of oil-contaminated waste materials pose a significant challenge to broader adoption of oily waste cans, particularly in developing economies and smaller facilities

- For instance, advanced recycling methods for hazardous waste often require specialized infrastructure, trained personnel, and ongoing maintenance, which may be financially unviable for small- and medium-sized enterprises

- Although oily waste cans provide safe interim storage, the burden of downstream processing discourages some facilities from adopting comprehensive waste containment practices

- To address this, market players are exploring cost-efficient designs and partnerships with third-party recycling firms, but the high overall lifecycle cost remains a key restraint for widespread deployment

- Increasing regulatory pressure may force more organizations to adopt compliant solutions despite cost concerns, but without scalable and affordable waste treatment ecosystems, adoption may remain uneven across markets

Oily Waste Can Market Scope

The market is segmented on the basis of material type, lid type, capacity, and end-user.

• By Material Type

On the basis of material type, the oily waste can market is segmented into steel and plastic. The steel segment accounted for the largest market revenue share of 69% in 2024, primarily due to its superior fire resistance, strength, and durability. Steel oily waste cans are extensively preferred in industrial and commercial environments where the safe disposal of flammable materials is critical. Their rigid construction meets strict safety regulations and offers long-term cost benefits through minimal maintenance. The resistance of steel to impact and high temperatures further supports its widespread use across heavy-duty applications.

The plastic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand in environments where corrosion resistance, lighter weight, and cost-effectiveness are essential. Plastic oily waste cans are especially gaining traction in less hazardous settings or for temporary use, where ease of handling and transportation is a priority. Advances in flame-retardant polymer technologies have also improved the safety standards of plastic cans, expanding their adoption across mid-scale facilities.

• By Lid Type

On the basis of lid type, the oily waste can market is segmented into foot operated self closing and hand operated self closing. The foot operated self closing segment held the largest market share in 2024, owing to its hands-free functionality that minimizes contamination risks and enhances user safety. Industrial and commercial facilities favor foot-operated cans as they offer a hygienic, efficient, and fire-safe way to dispose of oily rags without direct hand contact. Their robust mechanisms also ensure reliable, consistent closure, reducing oxygen exposure that could trigger combustion.

The hand operated self closing segment is anticipated to experience the fastest growth from 2025 to 2032, supported by its simple design, cost efficiency, and widespread use in space-constrained or lower-volume environments. Smaller workshops and facilities with less frequent waste disposal requirements often choose hand-operated cans due to their compact form and affordability. These lids still meet fire-safety standards while offering users more control in specialized applications.

• By Capacity

On the basis of capacity, the oily waste can market is segmented into up to 10 gallon, 11 to 15 gallon, 16 to 20 gallon, and above 20 gallon. The 11 to 15 gallon segment dominated the market in 2024, attributed to its ideal balance between capacity and portability, making it suitable for medium-sized operations. These cans are large enough to hold a substantial volume of waste without frequent emptying, yet compact enough to fit efficiently into a wide range of workspaces. They are particularly favored in facilities requiring daily or moderate disposal of oily materials.

The above 20 gallon segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the growing waste output from large-scale industrial and manufacturing operations. High-capacity oily waste cans are becoming essential in centralized waste management strategies, where minimizing handling frequency and maximizing containment are key to operational efficiency and workplace safety. These large units also cater to regulatory demands for safe and compliant storage of hazardous waste.

• By End-user

On the basis of end-user, the oily waste can market is segmented into auto repair shops, warehouse facilities, construction sites, marinas, machine shops, printing operations, furniture refinishers, and manufacturing plants. The manufacturing plants segment held the largest revenue share in 2024, as these facilities generate substantial quantities of oily rags, solvents, and flammable by-products during regular operations. Manufacturers prioritize fire-resistant oily waste cans to prevent workplace accidents, meet OSHA regulations, and ensure safe housekeeping in high-output environments.

The construction site segment is expected to grow at the fastest rate from 2025 to 2032, driven by increasing safety regulations and a rise in construction activities worldwide. Construction crews increasingly require mobile, rugged, and compliant containers to safely collect flammable waste materials at decentralized project sites. The portability, spill containment, and fire mitigation benefits of oily waste cans are propelling their adoption across temporary and dynamic work zones.

Oily Waste Can Market Regional Analysis

- Europe dominated the oily waste can market with the largest revenue share of 44.8% in 2024, driven by stringent workplace safety regulations and a well-established industrial sector prioritizing hazardous waste management

- Industrial and manufacturing facilities across Europe emphasize compliance with fire safety standards, creating strong demand for certified oily waste cans, particularly in sectors dealing with flammable materials

- The region’s focus on sustainability, risk mitigation, and occupational safety continues to fuel widespread adoption, with consistent demand across automotive, marine, printing, and machinery-related industries

Germany Oily Waste Can Market Insight

Germany oily waste can market captured the largest revenue share in 2024 within Europe, supported by the country’s robust manufacturing base and strict adherence to environmental and safety regulations. German industries prioritize high-quality, durable waste containment solutions that meet EN safety standards, driving demand for fire-resistant oily waste cans. The country’s focus on engineering precision and workplace safety ensures continued adoption across industrial segments, especially in automotive and mechanical workshops.

U.K. Oily Waste Can Market Insight

U.K. oily waste can market is anticipated to grow steadily, driven by increasing safety awareness in construction and marine sectors and the growing focus on fire hazard prevention. With an increasing number of regulatory guidelines addressing the safe disposal of flammable materials, the U.K. is witnessing heightened demand for compliant waste storage solutions. This growth is also supported by rising infrastructure investments and the need for mobile, durable containers on job sites.

North America Oily Waste Can Market Insight

North America oily waste can market is expected to grow at the fastest CAGR from 2025 to 2032, fueled by stricter enforcement of OSHA fire safety standards and expanding industrial activities. The rising number of auto repair shops, warehouses, and small-scale manufacturers, particularly in the U.S., is increasing the need for compliant containment solutions for oil-soaked waste. High workplace safety consciousness and demand for robust, fire-resistant containers are contributing to market growth, especially across decentralized facilities and mobile worksites.

U.S. Oily Waste Can Market Insight

U.S. oily waste can market is expected to witness significant growth rate in North America during forecast period, driven by widespread adoption across automotive garages, manufacturing plants, and construction zones. OSHA-mandated fire prevention measures play a significant role in boosting demand for oily waste cans with self-closing lids and fire-safe materials. The growing emphasis on regulatory compliance and increased investment in infrastructure development are expected to propel continued growth in the coming years.

Asia-Pacific Oily Waste Can Market Insight

Asia-Pacific oily waste can market is witnessing steady growth, supported by expanding industrial bases in countries such as China, India, and Southeast Asian nations. Rapid industrialization, rising safety awareness, and adoption of international fire safety norms are gradually increasing the deployment of certified oily waste cans in manufacturing and repair facilities. However, cost sensitivity and lack of widespread enforcement in some areas may moderate adoption compared to mature markets.

China Oily Waste Can Market Insight

China oily waste can market accounted for the largest share in Asia-Pacific in 2024, propelled by a rapidly growing manufacturing sector and stricter fire safety compliance across industrial parks and facilities. Domestic production capabilities and increasing local awareness of workplace safety are enabling broader accessibility of these products, particularly among small to mid-sized enterprises involved in metalwork, painting, and machinery maintenance.

Oily Waste Can Market Share

The oily waste can industry is primarily led by well-established companies, including:

- Eagle Manufacturing (U.S.)

- Hazero (New Zealand)

- TENAQUIP Limited (Canada)

- Shanghai SYSBEL Industry & Technology Co., Ltd. (China)

- VWR International, LLC (U.S.)

- Genex Container Pvt. Ltd. (India)

- DENIOS Inc. (U.S.)

- New Pig Corporation (U.S.)

- Brady Corporation (U.S.)

- SpillTech (U.S.)

- Fisher Scientific (U.S.)

- Wurth Canada Limited (Canada)

- Terra Universal Inc. (U.S.)

- Seton (U.K.)

Latest Developments in Global Oily Waste Can Market

- In April 2024, Eagle Materials Inc. announced plans to launch a new slag cement facility in Houston, Texas, with an annual production capacity of 500,000 tons, supplementing output from Texas Lehigh's Buda plant. This expansion is set to significantly strengthen regional supply and address the growing demand for low-carbon construction materials, thereby supporting the market's shift toward sustainable cement alternatives

- In January 2024, the Tenaquip Foundation, affiliated with TENAQUIP Limited, committed USD 5 million to develop an 18-unit housing project in Montreal for Old Brewery Mission, addressing the surge in homelessness post-pandemic. This initiative contributes to social welfare and also increases demand for building materials and safety equipment, indirectly influencing the growth of markets related to construction and facility maintenance

- In March 2023, Terramac opened a new assembly facility in St. Louis, Missouri, enhancing its capacity to serve both North American and international markets. With two production lines and more than 275 tons of crane lift capacity, this move is expected to boost the supply of specialized construction equipment, meeting rising infrastructure and industrial demands while creating over 100 new jobs to support local economic development

- In January 2021, Justrite Safety Group acquired National Marker Company (NMC), a Rhode Island-based leader in safety identification products. NMC specializes in signs, tags, labels, lockout-tagout devices, and 5S/lean products. This acquisition expands justrite oily waste can portfolio, enhancing their ability to deliver comprehensive safety solutions while upholding their commitment to safety and environmental protection

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oily Waste Can Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oily Waste Can Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oily Waste Can Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.