Global Oil And Gas Security And Service Market

Market Size in USD Million

CAGR :

%

USD

453.48 Million

USD

680.27 Million

2024

2032

USD

453.48 Million

USD

680.27 Million

2024

2032

| 2025 –2032 | |

| USD 453.48 Million | |

| USD 680.27 Million | |

|

|

|

|

Oil and Gas Security and Service Market Analysis

The global oil and gas security and service market is a rapidly growing sector driven by the increasing need for security and risk management across the oil and gas industry. This market includes a range of services such as cyber security, surveillance, access control, and physical security, all designed to safeguard critical infrastructure from threats such as cyber-attacks, terrorism, and physical sabotage. The rise in global energy demand, along with the growing sophistication of security threats, has spurred investments in advanced security solutions. Recent developments include the integration of IoT and AI in security systems, providing real-time monitoring and predictive threat analysis. Companies are also focusing on enhancing cyber resilience to protect against attacks targeting operational technology in oil and gas operations. In addition, governments and industry players are strengthening security policies to ensure safe exploration, drilling, transportation, and distribution of oil and gas. This evolving landscape presents significant growth opportunities for security service providers.

Oil and Gas Security and Service Market Size

The global oil and gas security and service market size was valued at USD 453.48 million in 2024 and is projected to reach USD 680.27 million by 2032, with a CAGR of 5.20% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Oil and Gas Security and Service Market Trends

“Demand for Advanced Security Solutions”

The global oil and gas security and service market is experiencing significant growth due to increasing security concerns in the industry. With rising threats such as cyber-attacks, terrorism, and environmental hazards, the demand for advanced security solutions is growing. Innovations such as the integration of artificial intelligence (AI) and Internet of Things (IoT) in security systems are transforming how risks are managed, allowing for real-time monitoring and predictive threat analysis. A key trend in the market is the increasing adoption of cyber security solutions to protect critical infrastructure and operational technology from digital threats. As oil and gas operations become more complex, the need for robust security services to ensure the safety of assets, personnel, and data is driving market expansion. These advancements are shaping the future of security in the oil and gas sector.

Report Scope and Oil and Gas Security and Service Market Segmentation

|

Attributes |

Oil and Gas Security and Service Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Microsoft (U.S.), Schneider Electric (France), ABB (Switzerland), Honeywell International Inc. (U.S.), Cisco Systems, Inc. (U.S.), Siemens (Germany), NortonLifeLock Inc. (U.S.), Black Mountain Solutions Ltd. (U.K.), Athos (U.S.), cpsgrup (India), GENERAL ELECTRIC COMPANY (U.S.), Allied Guard Services Inc (U.S.), Tyco Security Products (U.S.), Johnson Controls (U.S.), Carrier (U.S.), Pro-Vigil (U.S.), Intel Corporation (U.S.), Thales (France), Broadcom (U.S.), Lockheed Martin Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Oil and Gas Security and Service Market Definition

The global oil and gas security and service market refers to the range of security solutions and services designed to protect the oil and gas industry’s critical infrastructure, assets, personnel, and data from a variety of threats. This includes physical security measures such as surveillance, access control, and perimeter protection, as well as digital security services such as cyber security, risk management, and threat detection. The goal of these services is to safeguard oil and gas operations, including exploration, drilling, transportation, and distribution, from risks such as terrorism, natural disasters, theft, cyber-attacks, and operational disruptions.

Oil and Gas Security and Service Market Dynamics

Drivers

- Rising Threats to Infrastructure

The increasing prevalence of security threats, such as cyber-attacks, terrorism, and physical sabotage, has significantly heightened the need for robust security measures in the oil and gas sector. Critical infrastructure, including drilling rigs, pipelines, refineries, and storage facilities, is increasingly vulnerable to these risks, which can disrupt operations, cause financial losses, and endanger public safety. As a result, oil and gas companies are prioritizing advanced security solutions, including surveillance, access control, and cybersecurity measures, to protect these assets. This growing threat landscape acts as a key driver for the expansion of the oil and gas security and service market, prompting greater investment in comprehensive security systems.

- Rising Global Energy Demand

The growing global demand for oil and gas has led to increased exploration, production, and transportation activities, which in turn raises the need to protect critical assets such as oil rigs, pipelines, and refineries. As the industry expands to meet energy demands, these facilities are exposed to greater security risks, including theft, vandalism, and potential terrorist attacks. Consequently, oil and gas companies are investing more in advanced security solutions to safeguard their operations and ensure continuous supply. This heightened need for security infrastructure to protect valuable assets and maintain operational integrity serves as a significant driver for the growth of the oil and gas security and service market.

Opportunities

- Adoption of Advanced Technologies

The integration of Artificial Intelligence (AI), Internet of Things (IoT), and machine learning in security systems is revolutionizing the oil and gas sector by enabling more efficient and proactive security measures. These technologies allow for real-time monitoring of critical infrastructure, such as pipelines, refineries, and offshore rigs, providing immediate alerts in case of security breaches. Predictive analytics help anticipate potential threats, while automated threat response systems ensure swift action to mitigate risks. This technological advancement creates significant market opportunities for security service providers, who can offer innovative, cutting-edge solutions that enhance the safety and reliability of oil and gas operations.

- Increased Investments in Infrastructure Protection

As the frequency of security threats continues to rise, oil and gas companies are increasingly prioritizing the protection of their critical infrastructure, including pipelines, refineries, and offshore rigs. These assets are vulnerable to various risks, such as theft, sabotage, and cyber-attacks, prompting companies to invest heavily in advanced security infrastructure. This growing focus on securing operations has created a significant market opportunity for security service providers to offer innovative solutions, such as surveillance systems, access control, and cybersecurity measures. With ongoing investments in security, the demand for comprehensive security services is expected to rise, driving the growth of the oil and gas security services market.

Restraints/Challenges

- Complex Security Threats

The oil and gas sector faces a growing range of security threats, including cyber-attacks, terrorism, and physical sabotage, each presenting unique risks to critical infrastructure. As these threats evolve, they demand sophisticated, multi-layered security solutions to safeguard assets such as pipelines, refineries, and offshore platforms. Implementing such comprehensive security measures can be costly, requiring advanced technologies such as cybersecurity protocols, surveillance systems, and risk management tools. The complexity of integrating these solutions into existing infrastructure adds an additional layer of challenge. This need for high-level security systems, combined with the high costs, acts as a significant challenge for companies in the oil and gas security services market.

- High Costs of Security Solutions

Implementing advanced security measures, including surveillance systems, cybersecurity protocols, and physical infrastructure, can be prohibitively expensive, especially for smaller oil and gas companies or operations in remote areas. These companies may struggle to afford the costs of state-of-the-art security technology and skilled personnel required to manage these systems effectively. In addition, operations in remote regions often face logistical challenges in deploying and maintaining security infrastructure, further increasing costs. This financial burden limits the ability of smaller operators to adopt comprehensive security services, creating a restraint on the overall market growth. Consequently, cost remains a significant barrier to achieving optimal security in the sector.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Oil and Gas Security and Service Market Scope

The market is segmented on the basis of component, operation, security type, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Solution

- Services

Operation

- Upstream

- Midstream

- Downstream

Security Type

- Cyber Security

- Security Services

- Command and Control

- Screening and Detection

- Surveillance

- Access Control and Perimeter Security

Application

- Exploring and Drilling

- Transportation

- Pipelines

- Distribution and Retail Services

- Others

Oil and Gas Security and Service Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, component, operation, security type, and application as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

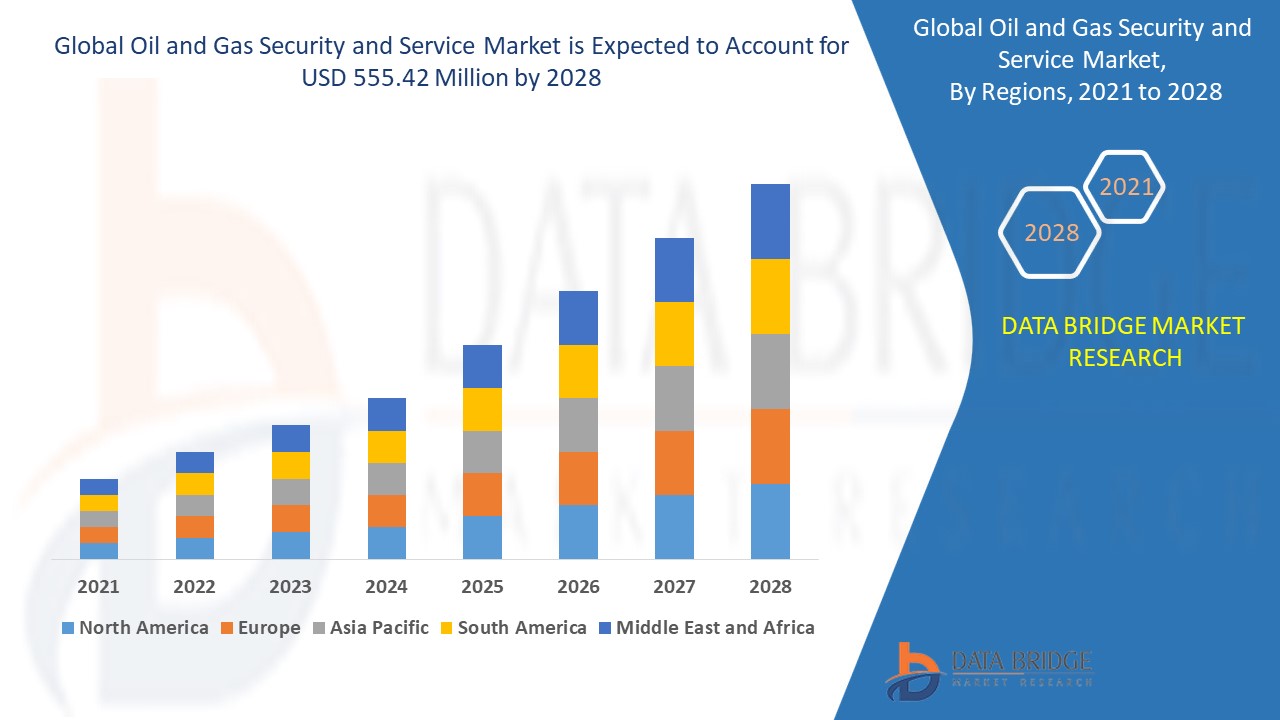

North America dominates the oil and gas security and service market due to the high demand for advanced security solutions in the region. The adoption of cutting-edge security technologies by key industry players is driving market growth. In addition, the region’s well-established infrastructure and focus on safeguarding critical assets contribute to its dominance in the market.

Middle East and Africa are expected to witness the highest compound annual growth rate (CAGR) during the forecast period, driven by the rising threat of militant activities and increasing terrorism in the region. These security challenges are prompting a greater need for advanced oil and gas security solutions. As a result, demand for security services is rapidly growing in these areas to protect critical infrastructure and personnel.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Oil and Gas Security and Service Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Oil and Gas Security and Service Market Leaders Operating in the Market Are:

- Microsoft (U.S.)

- Schneider Electric (France)

- ABB (Switzerland)

- Honeywell International Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Siemens (Germany)

- NortonLifeLock Inc. (U.S.)

- Black Mountain Solutions Ltd. (U.K.)

- Athos (U.S.)

- cpsgrup (India)

- GENERAL ELECTRIC COMPANY (U.S.)

- Allied Guard Services Inc (U.S.)

- Tyco Security Products (U.S.)

- Johnson Controls (U.S.)

- Carrier (U.S.)

- Pro-Vigil (U.S.)

- Intel Corporation (U.S.)

- Thales (France)

- Broadcom (U.S.)

- Lockheed Martin Corporation (U.S.)

Latest Developments in Oil and Gas Security and Service Market

- In April 2024, Siemens launched Siemens Xcelerator, a tool designed to automatically identify vulnerabilities in production assets, emphasizing the importance of detecting and addressing security gaps in industrial systems

- In September 2023, Huawei Technologies Co., Ltd. unveiled its intelligent architecture and E&P solutions for the oil and gas sector, featuring six key components, including AI models and connectivity, which integrate seamlessly with third-party platforms

- In January 2023, Waterfall Security Solutions partnered with Yokogawa to enhance the security measures for Yokogawa's customers, focusing on better protecting critical industrial infrastructures. This collaboration aims to strengthen defenses against targeted ransomware and nation-state cyberattacks. By combining Waterfall's expertise with Yokogawa's technology, the partnership seeks to provide more robust security solutions for industrial operations

- In September 2022, ABB introduced ABB Ability Cyber Security Workplace (CSWP), a unified platform that consolidates security solutions from various providers, allowing quicker identification and resolution of cybersecurity issues to enhance the protection of critical infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.