Global Occupational Therapy Market

Market Size in USD Billion

CAGR :

%

USD

5.15 Billion

USD

7.85 Billion

2024

2032

USD

5.15 Billion

USD

7.85 Billion

2024

2032

| 2025 –2032 | |

| USD 5.15 Billion | |

| USD 7.85 Billion | |

|

|

|

|

Occupational Therapy Market Size

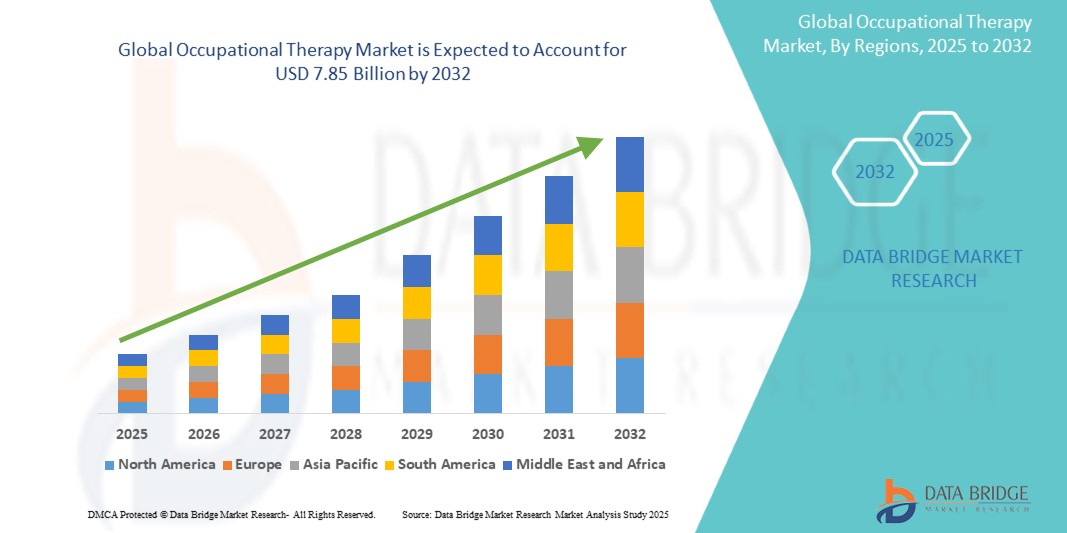

- The global occupational therapy market was valued at USD 5.15 billion in 2024 and is expected to reach USD 7.85 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.40%, primarily driven by the increasing prevalence of mental health disorders

- This growth is driven by factors such as the personalized and client-centered approaches, also focus on mental health in the workplace

Occupational Therapy Market Analysis

- There's a growing incorporation of digital solutions in occupational therapy, enhancing service delivery and patient engagement

- For Instance, the adoption of cloud-based therapy platforms facilitates remote patient monitoring and virtual therapy sessions

- Occupational therapy services are increasingly offered across various settings, including hospitals, rehabilitation centers, and private practices, broadening access to care.

- The market features a diverse array of providers, from specialized therapy service companies to technology firms offering supportive software solutions. Major players include WebPT, Premise Health, Net Health, CLINICIENT, and Optima Health Care

- There's a heightened focus on personalized therapy plans tailored to individual patient needs, aiming to improve outcomes and satisfaction.

- For instance, integrating artificial intelligence into therapy tools allows for customized treatment regimens

- These developments underscore a dynamic and evolving occupational therapy market, with technological advancements and a broadening scope of services driving its expansion

Report Scope and Occupational Therapy Market Segmentation

|

Attributes |

Occupational Therapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Occupational Therapy Market Trends

“Integration of Artificial Intelligence in Occupational Therapy”

- Artificial intelligence (AI) is being utilized to streamline patient evaluations by analyzing data to predict outcomes, identify patterns, and detect risk factors, leading to more precise and timely interventions

- AI algorithms assist therapists in developing customized treatment plans by analyzing individual patient data, ensuring interventions are tailored to each patient's specific needs

- The development of AI-driven rehabilitation devices, such as robotic exoskeletons, supports patients in regaining mobility and independence, adapting to their progress and providing real-time feedback

- AI-powered cognitive training tools offer patients personalized exercises aimed at improving memory, attention span, and executive function, enhancing cognitive rehabilitation outcomes

- Integration of AI in assistive technologies, such as voice-activated systems and adaptive equipment, aids patients with disabilities in performing daily activities more effectively, improving their quality of life

Occupational Therapy Market Dynamics

Driver

“Integration of Telehealth Services”

- The incorporation of telehealth into occupational therapy has significantly improved patient access to services, especially for those in remote or underserved regions. This digital approach allows patients to receive therapy from the comfort of their homes, reducing the need for travel and associated costs

- Telehealth ensures uninterrupted therapy sessions, particularly during situations such as public health emergencies, where in-person visits may be restricted. This continuity is crucial for maintaining therapeutic progress and patient engagement

- Providing therapy through telehealth platforms can lower operational costs for healthcare providers and reduce expenses for patients, making occupational therapy services more affordable and accessible

- The adoption of telehealth has been facilitated by advancements in technology, including improved internet connectivity and the development of user-friendly platforms, enhancing the overall effectiveness and reach of occupational therapy services

- For Instance, organizations such as the American Occupational Therapy Association (AOTA) and the World Federation of Occupational Therapists (WFOT) advocate for telehealth as a legitimate and effective means of delivering care, influencing policy changes that support its integration into standard practice

Opportunity

“Expansion of the Occupational Therapy Workforce”

- Investing in the expansion of the occupational therapy workforce is essential to meet the growing demand for services, particularly in low- and middle-income countries (LMICs) where the workforce is scarce or non-existent

- Establishing and enhancing occupational therapy education programs can increase the number of qualified professionals, ensuring that services are available to underserved populations and improving global health outcomes

- Advocating for policies that recognize the value of occupational therapy can lead to increased funding and support, facilitating workforce expansion and better integration of services into healthcare systems

- Collaborative efforts among countries can lead to shared resources and knowledge, strengthening the global occupational therapy workforce and addressing disparities in service provision

- Conducting economic analyses that demonstrate the cost-effectiveness and societal benefits of expanding the occupational therapy workforce can persuade stakeholders to invest in workforce development, leading to improved health outcomes and economic savings

Restraint/Challenge

“Limited Insurance Coverage”

- Limited insurance coverage for occupational therapy services can hinder patients' ability to afford necessary care, leading to reduced access and potentially poorer health outcomes

- The inconsistency in insurance policies regarding occupational therapy benefits creates confusion among patients and providers, complicating service delivery and planning

- Some insurance plans may cap the number of therapy sessions covered or exclude certain types of therapy, restricting the flexibility and comprehensiveness of care that patients can receive

- Healthcare providers may face challenges in receiving adequate reimbursement for occupational therapy services, affecting the sustainability of their practices and potentially limiting the availability of services

- Addressing these challenges requires concerted advocacy efforts to reform insurance policies, ensuring that occupational therapy services are adequately covered and accessible to all individuals who need them

Occupational Therapy Market Scope

The market is segmented on the basis product, disease, and application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Disease |

|

|

By Application |

|

Occupational Therapy Market Regional Analysis

“North America is the Dominant Region in the Occupational Therapy Market”

- North America is projected to hold a substantial share of the global pharmacogenetic testing market, with the U.S. leading due to its advanced healthcare infrastructure and significant investments in genomic technologies

- The U.S. government has been actively promoting personalized medicine through initiatives such as the Precision Medicine Initiative, which has bolstered the adoption of pharmacogenetic testing across healthcare settings

- Major companies such as Thermo Fisher Scientific Inc., Illumina Inc., and QIAGEN have established a strong presence in North America, contributing to the region's market dominance

- Favorable regulatory policies in the U.S. have facilitated the integration of pharmacogenetic testing into clinical practice, further solidifying North America's leading position in the market

- The region's robust investment in R&D has led to continuous advancements in pharmacogenetic testing technologies, maintaining its competitive edge globally

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Countries such as China and India are experiencing significant economic growth, leading to improved healthcare access and increased demand for advanced diagnostic tools, including pharmacogenetic testing

- The rising geriatric population in the Asia-Pacific region is contributing to a higher prevalence of chronic diseases, thereby driving the need for personalized medicine solutions

- Several Asia-Pacific governments have introduced favorable regulatory guidelines and reimbursement policies to encourage the adoption of pharmacogenetic testing, accelerating market growth

- Collaborations between local diagnostic players and global leaders are enhancing the availability and affordability of pharmacogenetic testing services in the region

- The Asia-Pacific pharmacogenetic testing market is expected to grow at a significant compound annual growth rate (CAGR) during the forecast period, reflecting its rapid expansion

Occupational Therapy Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- WebPT (US)

- Premise Health. (US)

- Net Health (US)

- CLINICIENT (US)

- Optima Health Care, Inc. (US)

- ClinicSource (US)

- Bio Med International Pvt. Ltd (India)

- Divine Physiotherapy Equipments (India)

- Ideal Surgical Company. (India)

- Alliance Therapy Services (US)

- Getinge AB (Sweden)

- Midmark Corporation (US)

- STERIS (US)

- Abbott (US)

- A-dec Inc. (US)

- Cantel Medical (US)

Latest Developments in Global Occupational Therapy Market

- In August 2024, SimplePractice launched specialized software for occupational therapy practices, which helps in scheduling, billing, and documentation

- In September 2023, NextGen Healthcare Inc. partnered with Athletico Physical Therapy (Athletico) to integrate its software solutions into Athletico’s therapy centers. Through this partnership, Athletico plans to optimize clinical and financial performance at its clinics in Colombia

- In October 2022, Anderson Orthopedic Clinic launched Anderson Clinic Physical Therapy, a high-quality treatment and training facility focused on helping each patient achieve personalized health goals. The physical therapy centers provide services ranging from joint replacement to neck and spine pain, as well as a multitude of sports injuries

- In January 2022, Rethink First, a behavioral health technology company, acquired Total Therapy, a company that offers practice management software solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL OCCUPATIONAL THERAPY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL OCCUPATIONAL THERAPY MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL OCCUPATIONAL THERAPY MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 PATENT ANALYSIS

6.1.1 PATENT LANDSCAPE

6.1.2 USPTO NUMBER

6.1.3 PATENT EXPIRY

6.1.4 EPIO NUMBER

6.1.5 PATENT STRENGTH AND QUALITY

6.1.6 PATENT CLAIMS

6.1.7 PATENT CITATIONS

6.1.8 PATENT LITIGATION AND LICENSING

6.1.9 FILE OF PATENT

6.1.10 PATENT RECEIVED CONTRIES

6.1.11 TECHNOLOGY BACKGROUND

6.2 DRUG TREATMENT RATE BY MATURED MARKETS

6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.4 PATIENT FLOW DIAGRAM

6.5 KEY PRICING STRATEGIES

6.6 KEY PATIENT ENROLLMENT STRATEGIES

6.7 INTERVIEWS WITH SPECIALIST

6.8 OTHER KOL SNAPSHOTS

7 EPIDEMIOLOGY

7.1 INCIDENCE OF ALL BY GENDER

7.2 TREATMENT RATE

7.3 MORTALITY RATE

7.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

7.5 PATIENT TREATMENT SUCCESS RATES

8 MERGERS AND ACQUISITION

8.1 LICENSING

8.2 COMMERCIALIZATION AGREEMENTS

9 REGULATORY FRAMEWORK

9.1 REGULATORY APPROVAL PROCESS

9.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

9.3 REGULATORY APPROVAL PATHWAYS

9.4 LICENSING AND REGISTRATION

9.5 POST-MARKETING SURVEILLANCE

9.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

10 PIPELINE ANALYSIS

10.1 CLINICAL TRIALS AND PHASE ANALYSIS

10.2 DRUG THERAPY PIPELINE

10.3 PHASE III CANDIDATES

10.4 PHASE II CANDIDATES

10.5 PHASE I CANDIDATES

10.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR XX

Company Name Therapeutic Area

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved But Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

11 MARKETED DRUG ANALYSIS

11.1 DRUG

11.1.1 BRAND NAME

11.1.2 GENERICS NAME

11.2 THERAPEUTIC INDICTION

11.3 PHARMACOLOGICAL CLASS OF THE DRUG

11.4 DRUG PRIMARY INDICATION

11.5 MARKET STATUS

11.6 MEDICATION TYPE

11.7 DRUG DOSAGES FORM

11.8 DOSAGES AVAILABILITY

11.9 DRUG ROUTE OF ADMINISTRATION

11.1 DOSING FREQUENCY

11.11 DRUG INSIGHT

11.12 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

11.12.1 FORECAST MARKET OUTLOOK

11.12.2 CROSS COMPETITION

11.12.3 THERAPEUTIC PORTFOLIO

11.12.4 CURRENT DEVELOPMENT SCENARIO

12 MARKET ACCESS

12.1 10-YEAR MARKET FORECAST

12.2 CLINICAL TRIAL RECENT UPDATES

12.3 ANNUAL NEW FDA APPROVED DRUGS

12.4 DRUGS MANUFACTURER AND DEALS

12.5 MAJOR DRUG UPTAKE

12.6 CURRENT TREATMENT PRACTICES

12.7 IMPACT OF UPCOMING THERAPY

13 R & D ANALYSIS

13.1 COMPARATIVE ANALYSIS

13.2 DRUG DEVELOPMENTAL LANDSCAPE

13.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

13.4 THERAPEUTIC ASSESSMENT

13.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

14 MARKET OVERVIEW

14.1 DRIVERS

14.2 RESTRAINTS

14.3 OPPORTUNITIES

14.4 CHALLENGES

15 GLOBAL OCCUPATIONAL THERAPY MARKET, BY TYPE

15.1 OVERVIEW

15.2 MANUAL THERAPIES

15.3 DIGITAL SOLUTIONS

16 GLOBAL OCCUPATIONAL THERAPY MARKET, BY PRODUCT

16.1 OVERVIEW

16.2 CLOUD-BASED

16.3 ON-PREMISES

17 GLOBAL OCCUPATIONAL THERAPY MARKET, BY SERVICES

17.1 OVERVIEW

17.2 ACQUIRED BRAIN INJURY

17.2.1 FINE MOTOR SKILLS

17.2.2 HAND –EYE COORDINATION

17.2.3 BASIC SELF CARE

17.2.4 BEHAVIOURAL COACHING

17.2.5 SPECIALZIED EQUIPMENT

17.2.5.1. WHEELCHAIRS

17.2.5.2. SPLINTS

17.2.5.3. BATHING QUIPMENT

17.2.5.4. DRESSING DEVICE

17.2.5.5. COMMUNICATION AID

17.2.5.6. OTHERS

17.3 PSYCHOLOGICAL DISABILITIES

17.3.1 FINE MOTOR SKILLS

17.3.2 HAND –EYE COORDINATION

17.3.3 BASIC SELF CARE

17.3.4 BEHAVIOURAL COACHING

17.3.5 SPECIALZIED EQUIPMENT

17.3.5.1. WHEELCHAIRS

17.3.5.2. SPLINTS

17.3.5.3. BATHING QUIPMENT

17.3.5.4. DRESSING DEVICE

17.3.5.5. COMMUNICATION AID

17.3.5.6. OTHERS

17.4 DEVELOPMENTAL DISABILITIES

17.4.1 FINE MOTOR SKILLS

17.4.2 HAND –EYE COORDINATION

17.4.3 BASIC SELF CARE

17.4.4 BEHAVIOURAL COACHING

17.4.5 SPECIALZIED EQUIPMENT

17.4.5.1. WHEELCHAIRS

17.4.5.2. SPLINTS

17.4.5.3. BATHING QUIPMENT

17.4.5.4. DRESSING DEVICE

17.4.5.5. COMMUNICATION AID

17.4.5.6. OTHERS

17.5 CHRONIC PAIN

17.5.1 FINE MOTOR SKILLS

17.5.2 HAND –EYE COORDINATION

17.5.3 BASIC SELF CARE

17.5.4 BEHAVIOURAL COACHING

17.5.5 SPECIALZIED EQUIPMENT

17.5.5.1. WHEELCHAIRS

17.5.5.2. SPLINTS

17.5.5.3. BATHING QUIPMENT

17.5.5.4. DRESSING DEVICE

17.5.5.5. COMMUNICATION AID

17.5.5.6. OTHERS

17.6 ORTHOPEDIC INJURY

17.6.1 FINE MOTOR SKILLS

17.6.2 HAND –EYE COORDINATION

17.6.3 BASIC SELF CARE

17.6.4 BEHAVIOURAL COACHING

17.6.5 SPECIALZIED EQUIPMENT

17.6.5.1. WHEELCHAIRS

17.6.5.2. SPLINTS

17.6.5.3. BATHING QUIPMENT

17.6.5.4. DRESSING DEVICE

17.6.5.5. COMMUNICATION AID

17.6.5.6. OTHERS

17.7 AUTISM

17.7.1 FINE MOTOR SKILLS

17.7.2 HAND –EYE COORDINATION

17.7.3 BASIC SELF CARE

17.7.4 BEHAVIOURAL COACHING

17.7.5 SPECIALZIED EQUIPMENT

17.7.5.1. WHEELCHAIRS

17.7.5.2. SPLINTS

17.7.5.3. BATHING QUIPMENT

17.7.5.4. DRESSING DEVICE

17.7.5.5. COMMUNICATION AID

17.7.5.6. OTHERS

17.8 VOCATIONAL INTERVENTIONS

17.8.1 FINE MOTOR SKILLS

17.8.2 HAND –EYE COORDINATION

17.8.3 BASIC SELF CARE

17.8.4 BEHAVIOURAL COACHING

17.8.5 SPECIALZIED EQUIPMENT

17.8.5.1. WHEELCHAIRS

17.8.5.2. SPLINTS

17.8.5.3. BATHING QUIPMENT

17.8.5.4. DRESSING DEVICE

17.8.5.5. COMMUNICATION AID

17.8.5.6. OTHERS

17.9 BEHAVIORAL IMPAIRMENTS

17.9.1 FINE MOTOR SKILLS

17.9.2 HAND –EYE COORDINATION

17.9.3 BASIC SELF CARE

17.9.4 BEHAVIOURAL COACHING

17.9.5 SPECIALZIED EQUIPMENT

17.9.5.1. WHEELCHAIRS

17.9.5.2. SPLINTS

17.9.5.3. BATHING QUIPMENT

17.9.5.4. DRESSING DEVICE

17.9.5.5. COMMUNICATION AID

17.9.5.6. OTHERS

17.1 COGNITIVE REHABILITATION

17.10.1 FINE MOTOR SKILLS

17.10.2 HAND –EYE COORDINATION

17.10.3 BASIC SELF CARE

17.10.4 BEHAVIOURAL COACHING

17.10.5 SPECIALZIED EQUIPMENT

17.10.5.1. WHEELCHAIRS

17.10.5.2. SPLINTS

17.10.5.3. BATHING QUIPMENT

17.10.5.4. DRESSING DEVICE

17.10.5.5. COMMUNICATION AID

17.10.5.6. OTHERS

17.11 CONCUSSON

17.11.1 FINE MOTOR SKILLS

17.11.2 HAND –EYE COORDINATION

17.11.3 BASIC SELF CARE

17.11.4 BEHAVIOURAL COACHING

17.11.5 SPECIALZIED EQUIPMENT

17.11.5.1. WHEELCHAIRS

17.11.5.2. SPLINTS

17.11.5.3. BATHING QUIPMENT

17.11.5.4. DRESSING DEVICE

17.11.5.5. COMMUNICATION AID

17.11.5.6. OTHERS

17.12 ADHD

17.13 OTHERS

18 GLOBAL OCCUPATIONAL THERAPY MARKET, BY AGE GROUP

18.1 OVERVIEW

18.2 PEDIATRIC

18.3 ADULT

18.4 GERIATRIC

19 GLOBAL OCCUPATIONAL THERAPY MARKET, BY END USER

19.1 OVERVIEW

19.2 HOSPITALS

19.2.1 PUBLIC

19.2.2 PRIVATE

19.3 SPECIALTY CLINICS

19.4 HOME HEALTHCARE

19.5 OTHERS

20 GLOBAL OCCUPATIONAL THERAPY MARKET, BY COUNTRY

GLOBAL OCCUPATIONAL THERAPY MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

20.1 NORTH AMERICA

20.1.1 U.S.

20.1.2 CANADA

20.1.3 MEXICO

20.2 EUROPE

20.2.1 GERMANY

20.2.2 FRANCE

20.2.3 U.K.

20.2.4 ITALY

20.2.5 SPAIN

20.2.6 RUSSIA

20.2.7 TURKEY

20.2.8 NETHERLANDS

20.2.9 SWITZERLAND

20.2.10 REST OF EUROPE

20.3 ASIA-PACIFIC

20.3.1 JAPAN

20.3.2 CHINA

20.3.3 SOUTH KOREA

20.3.4 INDIA

20.3.5 AUSTRALIA

20.3.6 SINGAPORE

20.3.7 THAILAND

20.3.8 MALAYSIA

20.3.9 INDONESIA

20.3.10 PHILIPPINES

20.3.11 REST OF ASIA-PACIFIC

20.4 SOUTH AMERICA

20.4.1 BRAZIL

20.4.2 ARGENTINA

20.4.3 REST OF SOUTH AMERICA

20.5 MIDDLE EAST AND AFRICA

20.5.1 SOUTH AFRICA

20.5.2 SAUDI ARABIA

20.5.3 UAE

20.5.4 EGYPT

20.5.5 ISRAEL

20.5.6 REST OF MIDDLE EAST AND AFRICA

20.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

21 GLOBAL OCCUPATIONAL THERAPY MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: GLOBAL

21.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

21.3 COMPANY SHARE ANALYSIS: EUROPE

21.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

21.5 MERGERS & ACQUISITIONS

21.6 NEW PRODUCT DEVELOPMENT & APPROVALS

21.7 EXPANSIONS

21.8 REGULATORY CHANGES

21.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

22 GLOBAL OCCUPATIONAL THERAPY MARKET, SWOT AND DBR ANALYSIS

23 GLOBAL OCCUPATIONAL THERAPY MARKET, COMPANY PROFILE

23.1 WEBPT

23.1.1 COMPANY OVERVIEW

23.1.2 REVENUE ANALYSIS

23.1.3 GEOGRAPHIC PRESENCE

23.1.4 PRODUCT PORTFOLIO

23.1.5 RECENT DEVELOPMENTS

23.2 PREMISE HEALTH

23.2.1 COMPANY OVERVIEW

23.2.2 REVENUE ANALYSIS

23.2.3 GEOGRAPHIC PRESENCE

23.2.4 PRODUCT PORTFOLIO

23.2.5 RECENT DEVELOPMENTS

23.3 NET HEALTH

23.3.1 COMPANY OVERVIEW

23.3.2 REVENUE ANALYSIS

23.3.3 GEOGRAPHIC PRESENCE

23.3.4 PRODUCT PORTFOLIO

23.3.5 RECENT DEVELOPMENTS

23.4 OT SERVICES GROUP

23.4.1 COMPANY OVERVIEW

23.4.2 REVENUE ANALYSIS

23.4.3 GEOGRAPHIC PRESENCE

23.4.4 PRODUCT PORTFOLIO

23.4.5 RECENT DEVELOPMENTS

23.5 OASIS OCCUPATIONAL THERAPY SERVICES

23.5.1 COMPANY OVERVIEW

23.5.2 REVENUE ANALYSIS

23.5.3 GEOGRAPHIC PRESENCE

23.5.4 PRODUCT PORTFOLIO

23.5.5 RECENT DEVELOPMENTS

23.6 ALLIANCE PHYSICAL THERAPY PARTNERS

23.6.1 COMPANY OVERVIEW

23.6.2 REVENUE ANALYSIS

23.6.3 GEOGRAPHIC PRESENCE

23.6.4 PRODUCT PORTFOLIO

23.6.5 RECENT DEVELOPMENTS

23.7 BLUESTONE THERAPY

23.7.1 COMPANY OVERVIEW

23.7.2 REVENUE ANALYSIS

23.7.3 GEOGRAPHIC PRESENCE

23.7.4 PRODUCT PORTFOLIO

23.7.5 RECENT DEVELOPMENTS

23.8 INNOVATIVE OCCUPATIONAL THERAPY SERVICES

23.8.1 COMPANY OVERVIEW

23.8.2 REVENUE ANALYSIS

23.8.3 GEOGRAPHIC PRESENCE

23.8.4 PRODUCT PORTFOLIO

23.8.5 RECENT DEVELOPMENTS

23.9 PROFESSIONAL THERAPY SERVICES

23.9.1 COMPANY OVERVIEW

23.9.2 REVENUE ANALYSIS

23.9.3 GEOGRAPHIC PRESENCE

23.9.4 PRODUCT PORTFOLIO

23.9.5 RECENT DEVELOPMENTS

EAGLE CREEK THERAPY SERVICES

23.9.6 COMPANY OVERVIEW

23.9.7 REVENUE ANALYSIS

23.9.8 GEOGRAPHIC PRESENCE

23.9.9 PRODUCT PORTFOLIO

23.9.10 RECENT DEVELOPMENTS

23.1 ENCOMPASS HEALTH

23.10.1 COMPANY OVERVIEW

23.10.2 REVENUE ANALYSIS

23.10.3 GEOGRAPHIC PRESENCE

23.10.4 PRODUCT PORTFOLIO

23.10.5 RECENT DEVELOPMENTS

23.11 CALIFORNIA THERAPY SERVICES

23.11.1 COMPANY OVERVIEW

23.11.2 REVENUE ANALYSIS

23.11.3 GEOGRAPHIC PRESENCE

23.11.4 PRODUCT PORTFOLIO

23.11.5 RECENT DEVELOPMENTS

23.12 OPTIMA HEALTH CARE, INC

23.12.1 COMPANY OVERVIEW

23.12.2 REVENUE ANALYSIS

23.12.3 GEOGRAPHIC PRESENCE

23.12.4 PRODUCT PORTFOLIO

23.12.5 RECENT DEVELOPMENTS

23.13 CLINICSOURCE

23.13.1 COMPANY OVERVIEW

23.13.2 REVENUE ANALYSIS

23.13.3 GEOGRAPHIC PRESENCE

23.13.4 PRODUCT PORTFOLIO

23.13.5 RECENT DEVELOPMENTS

23.14 BIO-MED INTERNATIONAL PVT LTD.

23.14.1 COMPANY OVERVIEW

23.14.2 REVENUE ANALYSIS

23.14.3 GEOGRAPHIC PRESENCE

23.14.4 PRODUCT PORTFOLIO

23.14.5 RECENT DEVELOPMENTS

23.15 DIVINE PHYSIOTHERAPY EQUIPMENTS

23.15.1 COMPANY OVERVIEW

23.15.2 REVENUE ANALYSIS

23.15.3 GEOGRAPHIC PRESENCE

23.15.4 PRODUCT PORTFOLIO

23.15.5 RECENT DEVELOPMENTS

23.16 POWERBACK REHABILITATION

23.16.1 COMPANY OVERVIEW

23.16.2 REVENUE ANALYSIS

23.16.3 GEOGRAPHIC PRESENCE

23.16.4 PRODUCT PORTFOLIO

23.16.5 RECENT DEVELOPMENTS

23.17 AEGIS THERAPEUTICS

23.17.1 COMPANY OVERVIEW

23.17.2 REVENUE ANALYSIS

23.17.3 GEOGRAPHIC PRESENCE

23.17.4 PRODUCT PORTFOLIO

23.17.5 RECENT DEVELOPMENTS

23.18 SAGE CARE THERAPY SERVICES

23.18.1 COMPANY OVERVIEW

23.18.2 REVENUE ANALYSIS

23.18.3 GEOGRAPHIC PRESENCE

23.18.4 PRODUCT PORTFOLIO

23.18.5 RECENT DEVELOPMENTS

23.19 FELICITY INC

23.19.1 COMPANY OVERVIEW

23.19.2 REVENUE ANALYSIS

23.19.3 GEOGRAPHIC PRESENCE

23.19.4 PRODUCT PORTFOLIO

23.19.5 RECENT DEVELOPMENTS

23.2 RKS OCCUPATIONAL THERAPY SERVICES

23.20.1 COMPANY OVERVIEW

23.20.2 REVENUE ANALYSIS

23.20.3 GEOGRAPHIC PRESENCE

23.20.4 PRODUCT PORTFOLIO

23.20.5 RECENT DEVELOPMENTS

23.21 ALLCARE THERAPY SERVICES

23.21.1 COMPANY OVERVIEW

23.21.2 REVENUE ANALYSIS

23.21.3 GEOGRAPHIC PRESENCE

23.21.4 PRODUCT PORTFOLIO

23.21.5 RECENT DEVELOPMENTS

23.22 DYNAMIC THERAPY FOR KIDS

23.22.1 COMPANY OVERVIEW

23.22.2 REVENUE ANALYSIS

23.22.3 GEOGRAPHIC PRESENCE

23.22.4 PRODUCT PORTFOLIO

23.22.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST RELATED REPORTS

24 CONCLUSION

25 QUESTIONNAIRE

26 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.