Global Non Chocolate Candy Market

Market Size in USD Billion

CAGR :

%

USD

87.59 Billion

USD

134.42 Billion

2021

2029

USD

87.59 Billion

USD

134.42 Billion

2021

2029

| 2022 –2029 | |

| USD 87.59 Billion | |

| USD 134.42 Billion | |

|

|

|

|

Non-Chocolate Candy Market Analysis and Size

Chocolates are popular among people of all ages, whether they are children, millennials, or the elderly. Non-chocolate candy has gained market traction in recent years, owing to increased health awareness and demand for low-sugar chocolates/confectionery products.

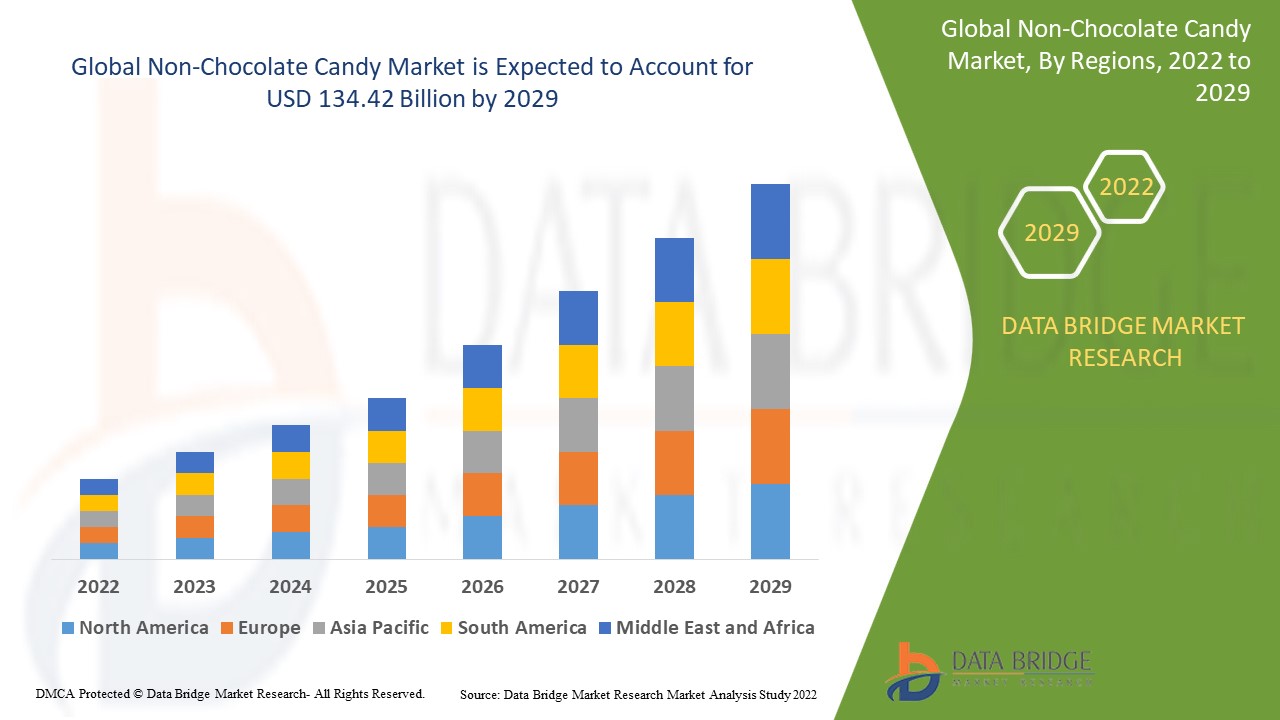

Data Bridge Market Research analyses that the non-chocolate candy market was valued at USD 87.59 billion in 2021 and is expected to reach the value of USD 134.42 billion by 2029, at a CAGR of 5.50% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and consumer behaviour.

Market Definition

Candy, also known as lollies, is a type of food that is typically made up of the main ingredient, sugar. These candies are available in small bite sizes and various shapes. Candies are also known as confectioneries, and some of the most common types of candies include gums, toffees, jellies, nougat, and caramel. During the holiday season, these candies are in high demand and are primarily consumed by children. Many candies contain fruits, nuts, and almonds, among other things, which help to enhance the flavour.

Non-Chocolate Candy Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Hard Type, Chewing Type, Scotch Type), Distribution Channel (Supermarkets/Hypermarkets, Specialist Stores, Convenience Stores, Online Stores, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Ghirardelli Chocolate Company (U.S.), Barry Callebaut (Switzerland), The Kraft Heinz Company (U.S.), Agostoni Chocolate (U.S.), The Hershey Company (U.S.), Blommer Chocolate Company (U.S.), Chocoladefabriken Lindt & Sprüngli AG (Switzerland), Ferrero (Italy), Mondelez International (U.S.), Nestle S.A (Switzerland), Cargill, Incorporated. (U.S.), LOTTE SHOPPING Co., Ltd. (South Korea), Mars, Incorporated (U.S.), Mondelez International Inc. (U.S.), Strauss Group (Israel), Favarger SA (Switzerland), Unilever (U.K.), Chocolat Bernrain AG (Switzerland) |

|

Opportunities |

|

Non-Chocolate Candy Market Dynamics

Drivers

- variations in product offerings tom provide more options to the consumers

Non-chocolate candy is driving perceptions of the offerings' healthfulness and also supporting accountable participation, rather than suffering from customer flight due to health concerns. Non-chocolate candy appeals to people of all ages, genders, and income levels. This adaptability opens up a wide range of opportunities for non-chocolate candy manufacturers to engage a larger number of consumers. Premium flavour profiles, such as mock tail-based flavours, are becoming more popular in the market to provide more options for the millennial population.

- Manufacturers focus on clean-labelled products

Non-chocolate candy is gaining popularity in the global market as a result of recent advancements in candy flavours and mouth-feel. The key manufacturers are focusing on the global launch and development of non-chocolate candy in keeping with natural chocolate tradition. Furthermore, the constant focus on clean-labelled products, stringent government rules on the sugar content in chocolates, and certifications such as vegan, organic, GMO-free, sugar-free, and kosher certified sweeteners, food colours, and other ingredients, are likely to create opportunities for non-chocolate candy manufacturers.

Opportunity

Manufacturers of non-chocolate candy are focusing on the Asian market because it has a larger population of young and children. The rising population in developing countries has increased demand for non-chocolate candies, fuelled by changing consumer purchasing habits. Developing countries, where per capita candy consumption is much lower than in the West, are gradually increasing. Many countries are endorsing campaigns and media advertisements for new candies, which are opening up new markets for non-chocolate candy manufacturers.

Restraints

Rising incidence of dental problems due to increased candy consumption, rising health consciousness among consumers, and increased obesity and diabetes due to high sugar content in candies are among the major factors acting as restraints and will further challenge the non-chocolate candy market during the forecast period.

This non-chocolate candy market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the non-chocolate candy market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Non-Chocolate Candy Market

The coronavirus has impacted every industry in the last year, including the confectionery and candy industries, albeit only temporarily. Early candy market sales data from around the world show a steep decline in the gums and mint category as a result of COVID-19, while chocolate candy and non-chocolate candy continue to grow strongly. COVID-19 also brought about significant changes in the candy industry's retail sector. More people started ordering groceries online, from click-and-collect to home delivery.

Recent Development

- Russell Stover Chocolates will introduce Joy Bites in 2021, a line of Fairtrade chocolate bars made with non-GMO and organic ingredients and no added sugar.

- Perfetti Van Melle USA Inc. launched its first soft gummy product in the United States under the Fruit-tella brand, which has deep roots in Europe, in 2020. Fruit-tella Soft Gummies are made with pectin rather than gelatin and contain real fruit puree. Each gummy has a playful fruit character shape and is available in Strawberry and Raspberry and Peach and Mango varieties.

- Following the success of M&M'S Block in the United States and Australia, Mars Wrigley United Kingdom announced plans in 2019 to introduce four new M&M'S block variants to the U.K. market: Chocolate, Crispy, Hazelnut, and Peanut.

Global Non-Chocolate Candy Market Scope

The non-chocolate candy market is segmented on the basis of type and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Hard type

- Chewing type

- Scotch type

Distribution channel

- Supermarkets/Hypermarkets

- Specialist Stores

- Convenience Stores

- Online Stores

- Others

Non-Chocolate Candy Market Regional Analysis/Insights

The non-chocolate candy market is analysed and market size insights and trends are provided by country, type and distribution channel as referenced above.

The countries covered in the non-chocolate candy market report are U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the non-chocolate candy market due to the presence of a large consumer base for candies as well as key players.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Non-Chocolate Candy Market Share Analysis

The non-chocolate candy market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to non-chocolate candy market.

Some of the major players operating in the non-chocolate candy market are:

- Ghirardelli Chocolate Company (U.S.)

- Barry Callebaut (Switzerland)

- The Kraft Heinz Company (U.S.)

- Agostoni Chocolate (U.S.)

- The Hershey Company (U.S.)

- Blommer Chocolate Company (U.S.)

- Chocoladefabriken Lindt & Sprüngli AG (Switzerland)

- Ferrero (Italy)

- Mondelez International (U.S.)

- Nestle S.A (Switzerland)

- Cargill, Incorporated. (U.S.)

- LOTTE SHOPPING Co., Ltd. (South Korea)

- Mars, Incorporated (U.S.)

- Mondelez International Inc. (U.S.)

- Strauss Group (Israel)

- Favarger SA (Switzerland)

- Unilever (U.K.)

- Chocolat Bernrain AG (Switzerland)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Non Chocolate Candy Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Non Chocolate Candy Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Non Chocolate Candy Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.