Global Next Generation Patient Monitoring Devices Market

Market Size in USD Billion

CAGR :

%

USD

6.23 Billion

USD

9.35 Billion

2024

2032

USD

6.23 Billion

USD

9.35 Billion

2024

2032

| 2025 –2032 | |

| USD 6.23 Billion | |

| USD 9.35 Billion | |

|

|

|

|

Next Generation Patient Monitoring Devices Market Size

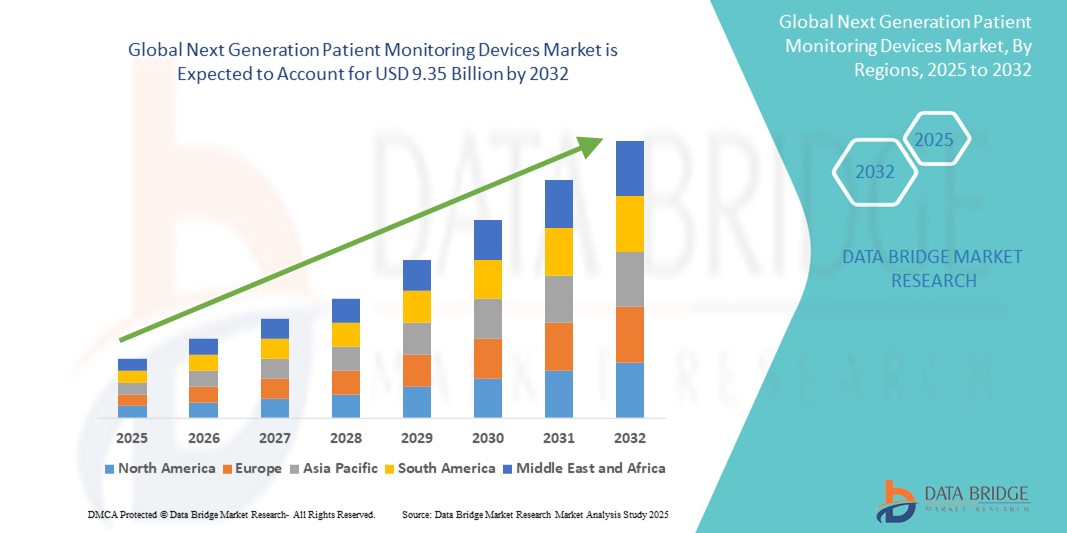

- The global next generation patient monitoring devices market size was valued at USD 6.23 billion in 2024 and is expected to reach USD 9.35 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely driven by advancements in wearable technologies, artificial intelligence integration, and remote healthcare solutions, which are enhancing real-time health tracking and patient engagement

- Furthermore, the rising prevalence of chronic diseases, coupled with increasing demand for home-based care and continuous monitoring, is positioning next generation devices as essential tools in modern healthcare. These converging trends are accelerating the adoption of advanced monitoring technologies, thereby significantly fueling market expansion

Next Generation Patient Monitoring Devices Market Analysis

- Next generation patient monitoring devices, encompassing advanced wearables, remote monitoring tools, and AI-driven analytics, are becoming crucial components in modern healthcare settings due to their ability to provide real-time, continuous health data and support proactive medical decision-making across hospital and homecare environments

- The growing demand for these devices is primarily fueled by the rising prevalence of chronic conditions, aging populations, increasing focus on personalized medicine, and the expanding adoption of telehealth and remote care models

- North America dominated the next generation patient monitoring devices market with the largest revenue share of 42.2% in 2024, driven by well-established healthcare infrastructure, rapid technology adoption, and favorable reimbursement frameworks, with the U.S. leading the market due to early deployment of remote patient monitoring programs and integration with electronic health records (EHRs)

- Asia-Pacific is expected to be the fastest growing region in the next generation patient monitoring devices market during the forecast period, attributed to growing investments in digital health, expanding geriatric population, and increasing government initiatives to improve healthcare accessibility

- Wearable component segment dominated the market with a market share of 45.8% in 2024, driven by their non-invasive nature, ease of use, and rising consumer interest in fitness and health tracking technologies integrated with mobile platforms

Report Scope and Next Generation Patient Monitoring Devices Market Segmentation

|

Attributes |

Next Generation Patient Monitoring Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Next Generation Patient Monitoring Devices Market Trends

“Integration of AI and Wearables for Predictive and Personalized Monitoring”

- A major trend shaping the global next generation patient monitoring devices market is the growing integration of artificial intelligence (AI) and wearable technologies, enabling predictive analytics, personalized health insights, and early intervention capabilities. These innovations are transforming traditional reactive healthcare into proactive, data-driven care delivery

- For instance, the BioIntelliSense BioButton provides continuous temperature, respiratory rate, and heart rate monitoring through a small wearable patch, offering clinicians AI-driven alerts for early deterioration. Similarly, Philips' wearable biosensors, integrated with AI algorithms, support early detection of patient deterioration in hospitals

- AI enables advanced functionalities such as anomaly detection, personalized baselines, and predictive modeling for chronic condition management. Devices can track subtle physiological changes and send alerts before symptoms manifest, significantly improving patient outcomes

- Integration with digital health ecosystems and EHRs allows centralized access to patient data, enhancing care coordination and reducing clinical workloads. Remote monitoring through AI-enhanced wearables enables healthcare providers to manage large patient populations with precision and efficiency

- This convergence of AI and wearable technology is revolutionizing patient monitoring by making healthcare more accessible, continuous, and tailored. Companies such as Masimo and Current Health are focusing on scalable, AI-enabled platforms with multi-parameter tracking and remote monitoring features for both inpatient and home settings

- The demand for intelligent, connected, and personalized monitoring solutions is rapidly increasing across hospitals, outpatient care, and home health sectors, driven by the need for efficient chronic disease management and the shift toward value-based care

Next Generation Patient Monitoring Devices Market Dynamics

Driver

“Rising Chronic Disease Burden and Shift Toward Remote Care”

- The global rise in chronic diseases, aging populations, and the growing shift toward decentralized and remote care models are primary drivers propelling the next generation patient monitoring devices market

- For instance, in May 2024, GE HealthCare expanded its wearable monitoring portfolio with AI-powered remote solutions designed to detect early signs of deterioration in cardiac and respiratory patients outside the hospital setting

- These devices empower continuous, real-time monitoring across various care environments, reducing hospital readmissions and enabling early interventions. With a growing focus on home-based care, patient-centric solutions that allow remote tracking of vital signs and physiological trends are in high demand

- In addition, government support for telehealth, favorable reimbursement policies in developed markets, and increasing healthcare digitalization are further accelerating the adoption of smart monitoring systems

- The convenience of non-invasive wearables, real-time analytics, and seamless data sharing with clinicians via mobile platforms make these devices attractive to both providers and patients. Their role in improving outcomes, reducing costs, and enhancing patient engagement makes them central to the future of healthcare delivery

Restraint/Challenge

“Data Privacy Concerns and Regulatory Compliance Hurdles”

- Data privacy, security concerns, and complex regulatory pathways present significant challenges to the widespread adoption of next generation patient monitoring devices. As these solutions collect, transmit, and store sensitive health data, they are subject to strict compliance standards and risk of cyberattacks

- For instance, the increasing use of cloud-based platforms and AI algorithms in patient monitoring raises compliance challenges under regulations such as HIPAA (U.S.) and GDPR (Europe). Any breach of health data could undermine trust and result in legal consequences.

- Companies such as Medtronic and Biobeat are addressing these challenges by adopting end-to-end encryption, multi-layered cybersecurity protocols, and transparency in data handling. However, navigating evolving regulations and securing regulatory approvals for AI-enabled devices remain time-consuming and costly

- Moreover, high costs associated with advanced monitoring platforms can limit access in low-resource settings. While prices are gradually declining, affordability and reimbursement challenges still impact the adoption curve, especially in emerging markets

- Overcoming these barriers will require not only robust cybersecurity frameworks and regulatory agility but also broader policy support, patient education, and cost-effective innovation to ensure equitable access and sustained market growth

Next Generation Patient Monitoring Devices Market Scope

The market is segmented on the basis of service type, component, application, and end user.

- By Service Type

On the basis of service type, the next generation patient monitoring devices market is segmented into MRI compatible devices and non-MRI compatible devices. The MRI compatible devices segment dominated the market with the largest revenue share in 2024, driven by increasing demand for safe and reliable monitoring solutions during MRI procedures. These devices are essential for critically ill patients who require continuous monitoring while undergoing MRI scans, making them a vital component in advanced diagnostic settings.

The non-MRI compatible devices segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by broader clinical applications, cost-effectiveness, and wider adoption in general hospital and home care environments. Their utility in routine patient monitoring, especially in non-MRI settings, contributes to their expanding market share.

- By Component

On the basis of component, the market is segmented into wearable and non-wearable components. The wearable component segment held the largest market revenue share of 45.8% in 2024, owing to the rising popularity of devices such as biosensors, patches, and smartwatches for continuous health tracking. Wearable devices enhance patient mobility, comfort, and adherence to long-term monitoring, especially for chronic disease management and post-acute care.

The non-wearable component segment is expected to grow steadily, supported by applications in hospital-based monitoring systems and bedside equipment used for real-time clinical assessments. While less mobile, these components play a critical role in high-acuity care.

- By Application

On the basis of application, the market is segmented into diagnosis and treatment monitoring. The treatment monitoring segment dominated the market in 2024, driven by the increased need for continuous assessment of therapeutic outcomes in chronic and post-surgical care. These devices allow clinicians to track patient progress in real-time, enabling personalized and timely medical interventions.

The diagnosis segment is projected to grow at a strong pace through 2032, bolstered by the integration of AI and real-time analytics that enhance early disease detection and clinical decision-making. The rise in proactive health screenings and preventive care is also contributing to this segment’s expansion.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, ambulatory surgical centers, diagnostic centers, and home care settings. The hospital segment led the market with the largest revenue share in 2024, supported by the availability of advanced infrastructure, high patient inflow, and the need for continuous monitoring in critical care units.

The home care settings segment is expected to witness the fastest growth from 2025 to 2032, fueled by the growing trend of remote monitoring, the rising elderly population, and increased healthcare cost-efficiency needs. Technological advancements in wireless and wearable monitoring solutions are making home-based care increasingly viable and effective for chronic condition management

Next Generation Patient Monitoring Devices Market Regional Analysis

- North America dominated the next generation patient monitoring devices market with the largest revenue share of 42.2% in 2024, driven by well-established healthcare infrastructure, rapid technology adoption, and favorable reimbursement frameworks

- Healthcare providers in the region prioritize real-time, remote monitoring solutions to improve patient outcomes and reduce hospital readmissions, leading to widespread deployment of wearable and AI-powered devices

- The region’s growth is further supported by favorable reimbursement policies, government initiatives promoting telehealth, and increasing consumer acceptance of home-based care. These factors collectively position North America as a leading hub for next generation patient monitoring technologies across both clinical and homecare settings

U.S. Next Generation Patient Monitoring Devices Market Insight

The U.S. next generation patient monitoring devices market captured the largest revenue share of 80.4% in 2024 within North America, driven by widespread adoption of digital healthcare, strong reimbursement frameworks, and growing demand for remote monitoring technologies. The country's advanced healthcare infrastructure supports the deployment of AI-powered and wearable monitoring devices for chronic disease management, telehealth, and post-acute care. In addition, increased investment in home-based care and strong regulatory support for digital health innovation continue to boost market penetration.

Europe Next Generation Patient Monitoring Devices Market Insight

The Europe next generation patient monitoring devices market is projected to expand at a substantial CAGR throughout the forecast period, supported by stringent healthcare regulations, increasing chronic disease burden, and rising demand for integrated care solutions. The shift toward value-based care models and early disease detection is propelling the adoption of intelligent monitoring technologies. Both public and private healthcare providers are investing in digital transformation, and the region's focus on patient-centric care is accelerating the uptake of wearable and remote monitoring systems.

U.K. Next Generation Patient Monitoring Devices Market Insight

The U.K. next generation patient monitoring devices market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by growing acceptance of remote care and digital health innovations. Government support for NHS digital transformation and patient self-monitoring initiatives is promoting the use of advanced monitoring devices across primary, secondary, and home-based care settings. The U.K.'s aging population and increased focus on proactive chronic care management are also driving demand for real-time, connected health solutions.

Germany Next Generation Patient Monitoring Devices Market Insight

The Germany next generation patient monitoring devices market is expected to expand at a considerable CAGR during the forecast period, owing to strong public healthcare funding, a highly digitized medical infrastructure, and a rising emphasis on preventive care. The country's preference for data privacy and clinically validated solutions supports the deployment of secure and effective patient monitoring technologies. Furthermore, Germany’s healthcare digitization roadmap, including eHealth initiatives, is boosting the adoption of smart wearables and remote monitoring systems across both inpatient and outpatient settings.

Asia-Pacific Next Generation Patient Monitoring Devices Market Insight

The Asia-Pacific next generation patient monitoring devices market is poised to grow at the fastest CAGR of 25.2% from 2025 to 2032, driven by rising healthcare expenditures, growing telemedicine platforms, and increased focus on managing chronic diseases in aging populations. Countries such as China, Japan, and India are leading this shift, with governments and private players investing heavily in digital health ecosystems. The region's expanding middle class, growing awareness about preventive care, and increasing access to affordable wearables are accelerating market growth.

Japan Next Generation Patient Monitoring Devices Market Insight

The Japan next generation patient monitoring devices market is gaining traction due to the nation’s advanced technological infrastructure, aging demographic, and high standards for healthcare innovation. Integration of AI-powered monitoring devices into hospital and home environments is increasing, with strong support from government health programs. Japan’s emphasis on non-invasive, remote care technologies aligns with the cultural preference for high-tech yet discreet health solutions, especially among elderly populations.

India Next Generation Patient Monitoring Devices Market Insight

The India next generation patient monitoring devices market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid digitalization, a large population base, and growing investment in healthcare infrastructure. Increasing prevalence of chronic diseases, demand for affordable remote monitoring tools, and the rise of digital health startups are driving market expansion. Government initiatives such as Ayushman Bharat and smart city missions are promoting healthcare innovation and access to real-time monitoring in both urban and rural areas, making India a key growth market.

Next Generation Patient Monitoring Devices Market Share

The next generation patient monitoring devices industry is primarily led by well-established companies, including:

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Medtronic (Ireland)

- Masimo Corporation (U.S.)

- Abbott (U.S.)

- Nihon Kohden Corporation (Japan)

- Biotronik SE & Co. KG (Germany)

- Schiller AG (Switzerland)

- Smiths Medical, Inc. (U.K.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Honeywell International Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- Vyaire Medical, Inc. (U.S.)

- VitalConnect, Inc. (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Bittium Corporation (Finland)

- iRhythm Technologies, Inc. (U.S.)

What are the Recent Developments in Global Next Generation Patient Monitoring Devices Market?

- In April 2023, GE HealthCare launched an expanded suite of wearable patient monitoring solutions that use artificial intelligence to provide early warnings of patient deterioration in both hospital and remote settings. These innovations aim to improve outcomes by enabling real-time, proactive care, reflecting GE HealthCare’s strategic commitment to intelligent, scalable monitoring technologies for diverse care environments

- In March 2023, Philips announced the deployment of its next-generation wearable biosensor system across several U.S. health systems. Designed for continuous monitoring of respiratory rate, heart rate, and mobility, the device aids in early detection of patient deterioration. This move demonstrates Philips' continued investment in digital transformation within healthcare and its emphasis on real-time, data-driven patient care

- In March 2023, Masimo Corporation unveiled Radius VSM, a versatile, wearable vital signs monitor featuring tetherless connectivity and customizable parameter tracking. Targeting hospitals and post-acute care, Radius VSM allows seamless patient mobility while maintaining continuous monitoring, reinforcing Masimo’s role in advancing wireless and modular monitoring platforms

- In February 2023, Current Health, a Best Buy Health company, expanded its remote care platform by integrating FDA-cleared biosensors and enhancing AI capabilities for predictive monitoring. This development supports healthcare systems in managing chronic conditions and post-discharge recovery, highlighting Current Health’s vision of combining clinical-grade monitoring with consumer-level usability

- In January 2023, Medtronic launched its next-generation Insertable Cardiac Monitor (ICM), LINQ II, in new global markets. With Bluetooth connectivity and AI-enhanced analytics, the device offers physicians long-term cardiac rhythm monitoring for atrial fibrillation and other cardiac issues. This expansion signifies Medtronic’s focus on minimally invasive, long-term diagnostic solutions that empower remote patient management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.