Global Next Generation Display Market

Market Size in USD Billion

CAGR :

%

USD

290.23 Billion

USD

595.51 Billion

2024

2032

USD

290.23 Billion

USD

595.51 Billion

2024

2032

| 2025 –2032 | |

| USD 290.23 Billion | |

| USD 595.51 Billion | |

|

|

|

|

Next Generation Display Market Size

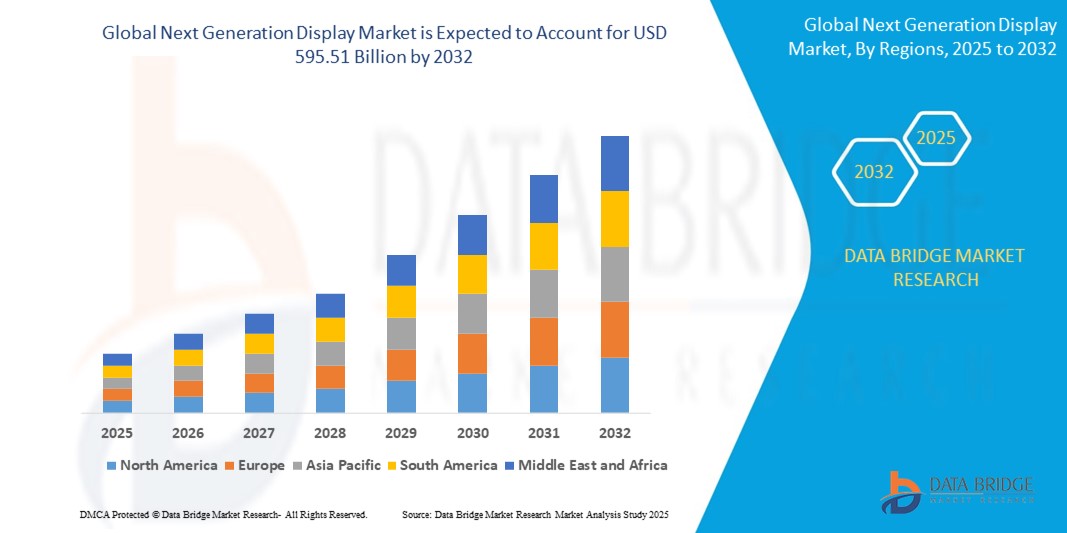

- The global next generation display market size was valued at USD 290.23 billion in 2024 and is expected to reach USD 595.51 billion by 2032, at a CAGR of 9.40% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-resolution display panels across consumer electronics, automotive, and healthcare sectors, driven by user preference for enhanced visual experiences and efficient energy usage

- Technological advancements such as OLED, micro-LED, and quantum dot displays are contributing to the shift from traditional LCD panels to next generation alternatives, supporting clearer images, thinner designs, and better durability

Next Generation Display Market Analysis

- Rising penetration of smart devices, coupled with surging investment in AR/VR headsets and foldable smartphones, is further accelerating the adoption of next generation displays

- Increasing demand for digital signage and advanced infotainment systems in automotive applications, particularly in electric and autonomous vehicles, is expected to create new growth avenues for the market

- Asia-Pacific dominated the next generation display market with the largest revenue share of 42.5% in 2024, fuelled by surging demand for advanced consumer electronics and increasing adoption of OLED and quantum dot technologies

- North America region is expected to witness the highest growth rate in the global next generation display market, driven by rapid adoption of advanced display technologies across consumer electronics, automotive displays, and commercial signage applications

- The quantum dots segment dominated the market with the largest revenue share in 2024, driven by its ability to offer enhanced brightness, color accuracy, and energy efficiency. Quantum dots are increasingly being integrated into display panels for televisions, smartphones, and monitors, owing to their superior color performance and longer lifespan compared to traditional technologies. For instance, several premium TV models launched in 2024 leveraged quantum dot-enhanced LCDs to achieve richer color gamuts and HDR quality

Report Scope and Next Generation Display Market Segmentation

|

Attributes |

Next Generation Display Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Next Generation Display Market Trends

“Growing Adoption of Micro-LED Displays in Consumer Electronics”

- Micro-LED technology offers higher brightness, energy efficiency, and longevity than OLED

- Consumer demand for better color contrast and thin displays fuels adoption

- Increasing R&D by tech giants is accelerating product innovation

- Applications are growing in smartwatches, TVs, smartphones, and AR/VR devices

- For instance, Samsung’s micro-LED “The Wall”, Apple’s R&D for Apple Watch micro-LED displays

Next Generation Display Market Dynamics

Driver

“Rising Demand for High-Performance Display Solutions Across Industries”

- Rising demand for sharper visuals, better resolution, and energy-efficient displays across consumer electronics, automotive, and healthcare sectors

- Next generation displays such as OLED, micro-LED, and quantum dot are replacing traditional LCDs for advanced performance

- Automakers are integrating digital dashboards, HUDs, and infotainment systems with next-gen displays to enhance driver experience

- Healthcare professionals increasingly rely on high-quality display systems for diagnostics, imaging, and surgical applications

- For instance, Audi’s use of OLED technology in its digital cockpit displays exemplifies the integration of high-performance panels in the automotive space

Restraint/Challenge

“High Manufacturing Costs and Technical Complexity”

- Production of OLED and micro-LED displays involves high-precision equipment and advanced materials, increasing overall cost

- Micro-LED manufacturing requires the precise placement of millions of microscopic LEDs, resulting in low yields and production delays

- Cost remains a major barrier for adoption in mid-range consumer products and emerging markets

- Small and mid-sized manufacturers face scalability challenges due to capital-intensive infrastructure

- For instance, Apple’s delay in mass-adopting micro-LED displays in iPhones underscores the ongoing technical and cost-related hurdles in production

Next Generation Display Market Scope

The next generation display market is segmented into four notable segments based on ingredients, display technology, resolution, and application.

• By Ingredients

On the basis of ingredients, the next generation display market is segmented into Carbon NanoTubes (CNT), Quantum Dots, and Other Nanomaterials. The Quantum Dots segment dominated the market with the largest revenue share in 2024, driven by its ability to offer enhanced brightness, color accuracy, and energy efficiency. Quantum dots are increasingly being integrated into display panels for televisions, smartphones, and monitors, owing to their superior color performance and longer lifespan compared to traditional technologies. For instance, several premium TV models launched in 2024 leveraged quantum dot-enhanced LCDs to achieve richer color gamuts and HDR quality.

The Carbon NanoTubes (CNT) segment is expected to witness the fastest growth rate from 2025 to 2032, supported by growing R&D and its potential in flexible and transparent display applications. CNT-based displays offer exceptional conductivity and mechanical strength, making them ideal for emerging foldable and wearable electronics.

• By Display Technology

On the basis of display technology, the market is segmented into OLED Display Technology, Electroluminescent Display Technology, Electro Wetting Display Technology, Field Emission Display Applications, Electrophoretic Display Technology, and LED Display Technology. OLED technology held the largest market share in 2024, driven by its wide adoption in smartphones, televisions, and wearables due to its deep black levels, high contrast, and energy efficiency. Major brands such as LG and Samsung continue to expand OLED-based product lines to cater to premium consumer demand.

The Electro Wetting Display Technology segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its application in low-power and reflective display solutions, particularly in e-readers and outdoor signage. Its low energy consumption and improved readability in sunlight make it a favorable choice for next-gen commercial applications.

• By Resolution

Based on resolution, the market is categorized into 3840x2160, 4096x2160, 3996x2160, 5120x3200, and 5120x2160. The 3840x2160 segment, also known as Ultra HD or 4K, dominated the market in 2024 due to the growing demand for high-resolution content across home entertainment systems, gaming monitors, and professional displays. Its affordability and broad compatibility have led to its rapid mainstream adoption.

The 5120x3200 segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its rising use in premium monitors designed for creative professionals and high-end computing. This resolution offers greater detail, making it ideal for content creators working in design, video editing, and CAD.

• By Application

On the basis of application, the market is segmented into Mobile Phones, Consumer Electronics, Industrial Applications, Movie/Entertainment, TV/Monitors, Automotive, Advertising, and E-Reader. The Mobile Phones segment accounted for the largest market share in 2024, supported by a massive user base and the rapid evolution of smartphone displays with innovations such as foldable screens and edge-to-edge OLED panels.

The Automotive segment is expected to witness the fastest growth rate from 2025 to 2032, due to the increasing implementation of advanced display systems in vehicles. These include instrument clusters, head-up displays (HUDs), and infotainment systems. For instance, next-gen electric vehicles from brands such as Tesla and BMW incorporate large, high-resolution screens powered by OLED and micro-LED technologies to enhance user interaction and driving experience.

Next Generation Display Market Regional Analysis

• Asia-Pacific dominated the next generation display market with the largest revenue share of 42.5% in 2024, fuelled by surging demand for advanced consumer electronics and increasing adoption of OLED and quantum dot technologies

• The region benefits from a strong manufacturing base, rapid urbanization, and growing investments in R&D across countries such as China, Japan, and South Korea

• Furthermore, rising disposable income and the expansion of local consumer electronics brands contribute to the mass-market availability of high-end display products including smartphones, TVs, and wearables

China Next Generation Display Market Insight

The China next generation display market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by the country’s dominant role in the global electronics manufacturing ecosystem. China is home to several major display panel manufacturers and benefits from large-scale government support promoting domestic innovation and production. The growing adoption of 4K and 8K televisions, coupled with surging demand for OLED smartphones and display-integrated wearables, continues to expand market prospects.

Japan Next Generation Display Market Insight

The Japan next generation display market is expected to witness the fastest growth rate from 2025 to 2032, owing to its technological innovation, focus on high-resolution applications, and advanced R&D infrastructure. Japan's strength in high-end niche segments, such as automotive displays, professional monitors, and industrial panels, continues to support market expansion. Moreover, collaborations between Japanese electronics giants and global tech leaders to develop microLED and OLED display technologies are boosting the nation’s presence in premium display segments.

North America Next Generation Display Market Insight

The North America next generation display market is expected to witness the fastest growth rate from 2025 to 2032, driven by increased demand for advanced display technologies in sectors such as entertainment, retail, automotive, and healthcare. The region also benefits from the presence of major tech companies and a strong emphasis on digital transformation. The widespread adoption of OLED and flexible displays in premium consumer electronics contributes to the region’s market expansion.

U.S. Next Generation Display Market Insight

The U.S. next generation display market dominated the North America region in 2024, propelled by early adoption of emerging technologies and high demand for premium consumer electronics. The growing penetration of augmented and virtual reality devices, along with robust investments in automotive and smart home displays, drives consistent innovation. Leading U.S.-based firms are also increasing investments in microLED and transparent display technologies to capitalize on future market opportunities.

Europe Next Generation Display Market Insight

The Europe next generation display market is expected to witness the fastest growth rate from 2025 to 2032, supported by the demand for energy-efficient and durable display solutions across sectors such as automotive, industrial, and healthcare. The region’s strong automotive sector is a key contributor to the adoption of advanced dashboard and infotainment displays. European consumers also exhibit a growing preference for sustainable and high-resolution products, fostering innovation in OLED and quantum dot displays.

U.K. Next Generation Display Market Insight

The U.K. next generation display market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for high-resolution consumer electronics, advanced automotive displays, and immersive entertainment technologies. The country’s strong media and broadcasting sector, combined with rising adoption of OLED and microLED technologies in smartphones and smart TVs, contributes to this expansion. In addition, growing investments in research and development and a robust retail electronics ecosystem support the integration of next-generation display panels across various applications, including education, digital signage, and medical imaging.

Germany Next Generation Display Market Insight

The Germany next generation display market is expected to witness the fastest growth rate from 2025 to 2032, bolstered by the nation’s leadership in automotive engineering and smart manufacturing. Advanced display solutions are increasingly being used in digital cockpits, human-machine interfaces, and industrial automation systems. In addition, Germany’s sustainability regulations and innovation in energy-efficient technologies are prompting the integration of next-generation displays in both commercial and residential applications.

Next Generation Display Market Share

The Next Generation Display industry is primarily led by well-established companies, including:

- Samsung (South Korea)

- LG Display Co Ltd (South Korea)

- Panasonic Corporation Co, Ltd (Japan)

- Japan Display Inc (Japan)

- AUO Corporation (Taiwan)

- BOE Technology Group Co., Ltd (China)

- Corning Incorporated (U.S.)

- FlexEnable Limited (U.K.)

- Kateeva (U.S.)

- Sony Corporation (Japan)

- Pioneer Corporation (Japan)

- WiseChip Semiconductor Inc. (Taiwan)

- WINSTAR Display Co., Ltd. (China)

- Visionox Company (China)

- SHARP CORPORATION (Japan)

- Innolux Corporation (Taiwan)

- RAYSTAR OPTRONICS, INC, (Taiwan)

- RITEK CORPORATION (Taiwan)

- OSRAM GmbH (Germany)

Latest Developments in Global Next Generation Display Market

- In May 2024, LG Display, a global leader in display innovation, announced the debut of numerous next-generation OLED and advanced display technologies at SID Display Week 2024, held in San Jose, California. Under the theme "A Better Future," LG Display is showcasing new OLED advancements, including OLEDoS technology for VR, large-sized OLED panels that push the boundaries of picture quality, and automotive display solutions designed for Software Defined Vehicles (SDV)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Next Generation Display Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Next Generation Display Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Next Generation Display Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.