Global Next-Generation Biomanufacturing Market Segmentation, By Workflow and Product (Continuous Upstream Biomanufacturing, Single-Use Upstream Biomanufacturing, and Downstream Biomanufacturing), Application (Monoclonal Antibodies, Hormones, Vaccines, Recombinant Proteins, and Others), End User (Commercial Stage, and Preclinical and Development Stage) – Industry Trends and Forecast to 2031

Next-Generation Biomanufacturing Market Analysis

The next-generation biomanufacturing market is poised for significant growth, driven by advancements in biotechnology and increasing demand for biologics. This innovative sector focuses on utilizing cutting-edge techniques, such as continuous upstream biomanufacturing and single-use technologies, to enhance the efficiency and scalability of bioprocesses. Recent developments highlight a shift towards more sustainable practices, with companies adopting environmentally friendly methods and reducing resource consumption. The market is witnessing heightened investments from both established firms and startups, fostering innovation in the production of monoclonal antibodies, vaccines, and recombinant proteins. Furthermore, the COVID-19 pandemic has accelerated the need for rapid response biomanufacturing capabilities, resulting in increased R&D activities. As the industry evolves, collaboration among key stakeholders, including academic institutions and regulatory bodies, is essential to navigate challenges and leverage opportunities, ensuring the delivery of high-quality biopharmaceuticals to meet global healthcare needs.

Next-Generation Biomanufacturing Market Size

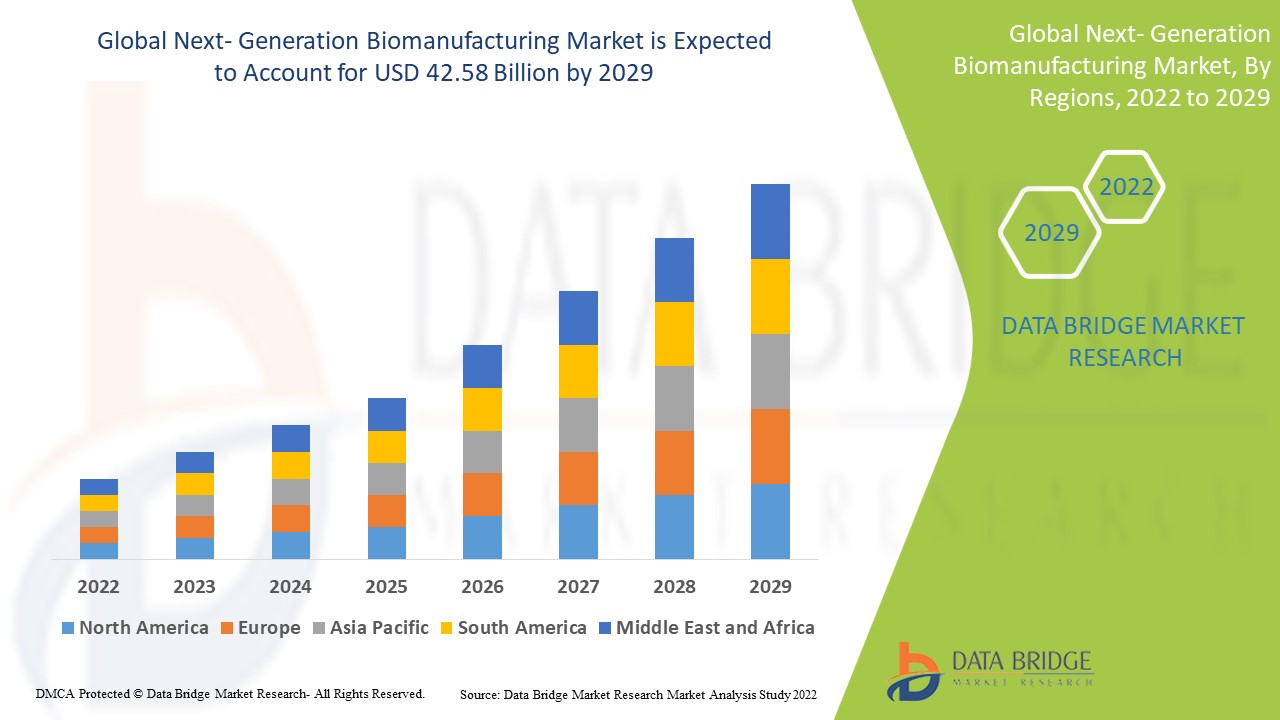

The global next-generation biomanufacturing market size was valued at USD 24.23 billion in 2023 and is projected to reach USD 51.37 billion by 2031, with a CAGR of 9.85% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Next-Generation Biomanufacturing Market Trends

“Technological Advancements in Biomanufacturing”

The next-generation biomanufacturing market is experiencing dynamic trends driven by technological advancements and the evolving landscape of biopharmaceutical production. A key trend is the shift towards continuous biomanufacturing processes, which offer enhanced efficiency and flexibility compared to traditional batch processing. Continuous systems enable real-time monitoring and control, resulting in higher product quality and reduced manufacturing costs. Recent innovations, such as the development of single-use technologies and integrated bioprocessing platforms, are further enhancing production capabilities and minimizing cross-contamination risks. In addition, the industry is witnessing an increased focus on sustainability, with companies adopting greener practices and reducing waste in biomanufacturing processes. Furthermore, the rise of personalized medicine is driving demand for tailored bioproducts, prompting manufacturers to invest in advanced analytics and automation solutions. As these trends continue to evolve, they will reshape the biomanufacturing landscape, ultimately leading to more efficient, sustainable, and patient-centered production methods.

Report Scope and Next-Generation Biomanufacturing Market Segmentation

|

Attributes

|

Next-Generation Biomanufacturing Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Key Market Players

|

Illumina Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Oxford Nanopore Technologies plc (U.K.), Agilent Technologies, Inc. (U.S.), BGI Group Guangdong (China), PerkinElmer (U.S.), QIAGEN (Germany), Eurofins Scientific (Luxembourg), F. Hoffmann-La Roche Ltd (Switzerland), Takara Bio Inc. (Japan), Azenta Life Sciences (U.S.), Hamilton Company (U.S.), Macrogen Inc. (South Korea), Zymo Research Corporation (U.S.), Tecan Trading AG (Switzerland)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Next-Generation Biomanufacturing Market Definition

Next-generation biomanufacturing refers to innovative techniques and processes that leverage biological systems for the production of high-value products, including pharmaceuticals, vaccines, and bioproducts. This approach utilizes advanced technologies such as synthetic biology, automated and continuous bioprocessing, and high-throughput screening to enhance efficiency, scalability, and sustainability in production. Unlike traditional biomanufacturing methods, which can be time-consuming and resource-intensive, next-generation biomanufacturing focuses on optimizing biological pathways and integrating digital tools for real-time monitoring and control. As a result, it reduces production costs and minimizes waste and environmental impact.

Next-Generation Biomanufacturing Market Dynamics

Drivers

- Increasing Global Demand for Biopharmaceuticals

The increasing global demand for biopharmaceuticals, such as monoclonal antibodies, gene therapies, and vaccines, is a significant catalyst for the growth of the next-generation biomanufacturing market. As healthcare providers and patients alike recognize the therapeutic potential of these advanced treatments, manufacturers are under pressure to scale production efficiently. This demand is driving innovation in biomanufacturing processes, prompting the adoption of cutting-edge technologies that enhance productivity, reduce costs, and improve product quality. Companies are investing in streamlined workflows and sophisticated bioreactors to meet the urgent need for these life-saving therapies. Thus, the quest for efficient biopharmaceutical production methods directly links to the burgeoning market growth, positioning it as a crucial driver in the evolution of the biomanufacturing landscape.

- Rising Demand in Complex Therapeutics

Innovations in synthetic biology, gene editing technologies like CRISPR, and automation are revolutionizing the field of biomanufacturing, significantly enhancing efficiency and scalability. Synthetic biology enables the design and construction of new biological parts, systems, and organisms, allowing for more precise and effective production methods. Meanwhile, CRISPR technology allows for targeted gene modifications, leading to improved yields and faster development times for biopharmaceuticals. In addition, automation streamlines processes, reduces human error, and accelerates production timelines. These advancements improve the overall efficiency of biomanufacturing and lower costs, making high-quality biopharmaceuticals more accessible. As a result, these technological innovations act as a pivotal driver for the growth of the next-generation biomanufacturing market, enabling companies to meet the rising demand for complex therapeutics.

Opportunities

- Personalized Medicine Development

The shift towards personalized medicine is creating significant growth opportunities in the next-generation biomanufacturing market. As healthcare increasingly emphasizes individualized treatment plans, biomanufacturers are focusing on developing targeted therapies that cater to the specific needs of patients. This approach involves utilizing advanced biomanufacturing techniques, such as high-throughput screening and gene editing, to create customized therapies that can improve treatment efficacy and minimize side effects. Moreover, the integration of data analytics and artificial intelligence in the production process enables biomanufacturers to optimize drug formulations and manufacturing efficiency. As a result, this trend enhances patient outcomes and fosters innovation within the industry. By capitalizing on the demand for personalized medicine, biomanufacturers can establish themselves as leaders in this evolving healthcare landscape, linking this trend as a significant market opportunity.

- Collaboration with Biomanufacturers and Tech Companies

Collaborations between biomanufacturers and technology firms present a valuable market opportunity by enhancing innovation and optimizing production processes. By integrating artificial intelligence (AI) and machine learning into biomanufacturing operations, companies can significantly improve efficiency and reduce costs. These advanced technologies allow for real-time data analysis, enabling manufacturers to monitor production in detail, predict potential issues, and optimize workflows. For instance, machine learning algorithms can identify patterns in production data that human operators might overlook, leading to more informed decision-making and faster response times. In addition, these partnerships foster the development of cutting-edge tools and solutions, such as predictive maintenance systems and automated quality control measures. As the demand for biopharmaceuticals continues to grow, leveraging technology through strategic collaborations can position biomanufacturers at the forefront of the industry, making this trend a critical market opportunity.

Restraints/Challenges

- Shortage of Skilled and Knowledgeable Professionals

The biomanufacturing sector is increasingly reliant on advanced technologies like synthetic biology and automation, which necessitates a workforce that is both skilled and knowledgeable in these areas. However, the industry is currently facing a significant shortage of qualified professionals capable of navigating the complexities of these innovative processes. This talent gap can severely limit innovation, as companies may struggle to develop new products or enhance existing manufacturing techniques without the right expertise. In addition, operational efficiency can be compromised when existing staff must take on additional responsibilities or when projects are delayed due to a lack of specialized skills. As a result, the inability to recruit and retain skilled professionals stands out as a critical challenge in the biomanufacturing market.

- High Cost of Advanced Technologies

The high costs associated with advanced technologies and equipment necessary for next-generation biomanufacturing serve as a significant restraint for the market. Cutting-edge tools and machinery, such as automated systems, bioreactors, and sophisticated analytics software, require substantial capital investment. This financial burden can be particularly daunting for smaller firms and startups, which may have limited funding and resources. Consequently, these high entry costs can discourage innovation and restrict the participation of new players in the market. Moreover, established companies with deeper pockets can leverage their resources to dominate the market, leaving little room for smaller entities to compete effectively. Thus, the economic barrier posed by expensive technologies is a critical factor limiting the growth and diversity of the next-generation biomanufacturing landscape.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Next-Generation Biomanufacturing Market Scope

The market is segmented on the basis of workflow and product, application, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Workflow and Product

- Continuous Upstream Biomanufacturing

- Single-Use Upstream Biomanufacturing

- Downstream Biomanufacturing

Application

- Monoclonal Antibodies

- Hormones

- Vaccines

- Recombinant Proteins

- Others

End User

- Commercial Stage

- Preclinical Stage

- Development Stage

Next-Generation Biomanufacturing Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, workflow and product, application, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America leads the next-generation biomanufacturing market, primarily driven by the widespread adoption of cutting-edge technologies. The region is home to a multitude of established manufacturing companies that are at the forefront of innovation in biomanufacturing processes. In addition, supportive government policies and a strong focus on research and development further bolster the industry's growth in this area. These factors collectively contribute to North America's prominent position in the global next-generation biomanufacturing landscape.

Asia-Pacific region is driving a significant increase in new capacity installations. This trend is aimed at meeting the growing consumer and healthcare needs for advanced treatments and therapies. As more facilities are established to enhance production capabilities, the next-generation biomanufacturing market is poised for substantial growth in these emerging economies. Consequently, this surge in capacity expansion is expected to play a crucial role in shaping the market dynamics in the Asia-Pacific region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Next-Generation Biomanufacturing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Next-Generation Biomanufacturing Market Leaders Operating in the Market Are:

- Illumina Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Oxford Nanopore Technologies plc (U.K.)

- Agilent Technologies, Inc. (U.S.)

- BGI Group Guangdong (China)

- PerkinElmer (U.S.)

- QIAGEN (Germany)

- Eurofins Scientific (Luxembourg)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Takara Bio Inc. (Japan)

- Azenta Life Sciences (U.S.)

- Hamilton Company (U.S.)

- Macrogen Inc. (South Korea)

- Zymo Research Corporation (U.S.)

- Tecan Trading AG (Switzerland)

Latest Developments in Next-Generation Biomanufacturing Market

- In June 2023, Samsung Biologics announced an accelerated timeline for its fifth plant, which is now set to become operational by April 2025. This facility will be located within the company's second Bio Campus and will boast the largest biomanufacturing capacity in the world at 784,000 liters. Equipped with cutting-edge automation and sustainable systems, the plant aims to provide seamless integration and optimization of manufacturing processes

- In February 2020, Honeywell International Inc. partnered with Bigfinite, Inc. to enhance process automation and control technologies within the pharmaceutical and biotech industries. This collaboration leverages Bigfinite's advanced AI, data analytics, and machine learning platform to optimize the pace of medicinal therapies. By integrating these innovative technologies, the partnership aims to improve efficiency and effectiveness in drug development and production processes

SKU-