Global Next Generation Biomanufacturing Market

Market Size in USD Billion

CAGR :

%

USD

26.61 Billion

USD

56.43 Billion

2024

2032

USD

26.61 Billion

USD

56.43 Billion

2024

2032

| 2025 –2032 | |

| USD 26.61 Billion | |

| USD 56.43 Billion | |

|

|

|

|

Next-Generation Biomanufacturing Market Size

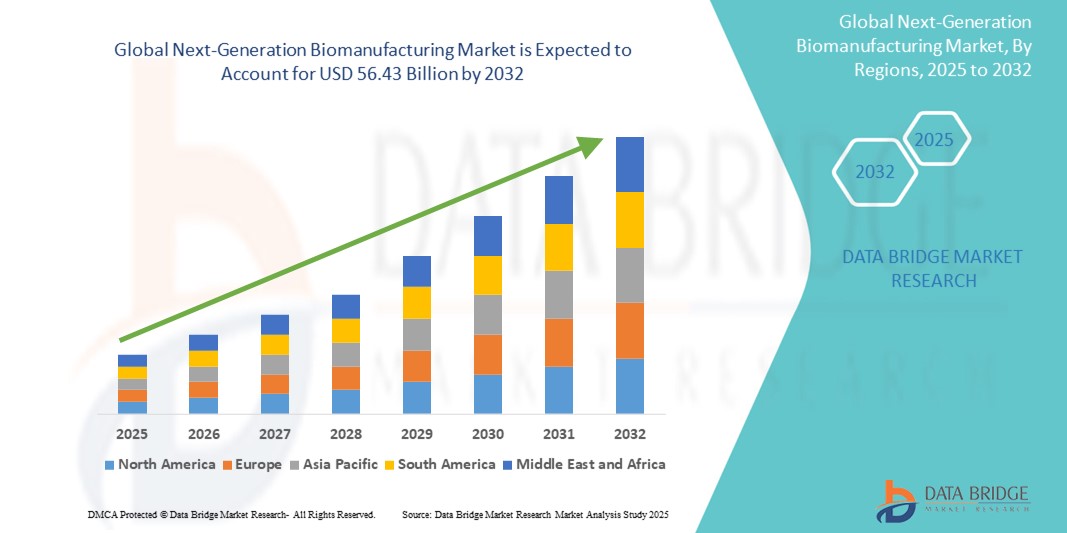

- The global next-generation biomanufacturing market size was valued at USD 26.61 billion in 2024 and is expected to reach USD 56.43 billion by 2032, at a CAGR of 9.85% during the forecast period

- The market growth is largely fueled by the increasing demand for more efficient, scalable, and cost-effective bioproduction processes, driven by advancements in synthetic biology, single-use technologies, and continuous manufacturing platforms. These innovations are enabling faster development and production of biologics, including monoclonal antibodies, vaccines, and cell and gene therapies

- Furthermore, the rising focus on personalized medicine, coupled with the surge in chronic diseases and pandemic preparedness, is establishing next-generation biomanufacturing as the preferred approach in modern bioprocessing. These converging factors are accelerating the transition from traditional batch production to integrated, modular, and flexible biomanufacturing solutions, thereby significantly boosting the industry's growth

Next-Generation Biomanufacturing Market Analysis

- Next-generation biomanufacturing, offering advanced modular, continuous, and single-use production solutions, is becoming a critical pillar in modern biologics development due to its ability to enhance efficiency, reduce contamination risk, and streamline scaling in both clinical and commercial production settings

- The escalating demand for next-generation biomanufacturing is primarily fueled by the rising global burden of chronic diseases, surging biologics pipeline, and the growing preference for flexible, cost-efficient, and accelerated production systems in the biopharmaceutical sector

- North America dominated the next-generation biomanufacturing market with the largest revenue share of 42.8% in 2024, characterized by early adoption of advanced bioprocess technologies, strong biotech R&D funding, and a concentration of key players. The U.S. has witnessed substantial growth in continuous manufacturing facilities, particularly in the production of cell and gene therapies, driven by strategic partnerships and FDA support for innovation

- Asia‑Pacific is expected to be the fastest-growing region, projecting a CAGR of 26.4% from 2025 to 2032 in the Next‑Generation Biomanufacturing market. This rapid growth is driven by government initiatives aimed at boosting biomanufacturing capacity, a surge in biotech startups, and rising investments in countries such as China, India, and South Korea

- The continuous upstream biomanufacturing segment dominated the next-generation biomanufacturing market with a market share of 45.3% in 2024, due to its advantages in operational efficiency, footprint reduction, and suitability for high-throughput biologics production, especially for monoclonal antibodies and personalized therapies

Report Scope and Next-Generation Biomanufacturing Market Segmentation

|

Attributes |

Next-Generation Biomanufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Next-Generation Biomanufacturing Market Trends

“Enhanced Efficiency Through Automation and Smart Analytics”

- A significant and accelerating trend in the global next generation biomanufacturing market is the integration of advanced automation and smart analytics platforms, which are streamlining production workflows and improving quality control across both clinical and commercial biologics manufacturing

- For instance, automated continuous bioreactors outfitted with IoT sensors and real-time monitoring systems allow manufacturers to collect live process data—such as pH, oxygen, and metabolite levels—and dynamically adjust parameters to maintain optimal cell culture conditions

- Such automation enables predictive maintenance and reduces batch variability. In-house platforms such as GE’s BioPharma Smart PLC systems and Siemens’ PharmaFAB solutions analyze performance trends and alert operators to anomalies before critical errors occur

- Moreover, smart data analytics tools are powering AI-driven process optimization—identifying bottlenecks, recommending scale-up strategies, and improving yield. For instance, Amgen reported yield improvements of up to 15% after deploying machine-learning models for upstream process control

- This shift toward more intelligent, data-driven, and fully automated biomanufacturing workflows is transforming traditional production paradigms. By reducing manual interventions and human error, facilities are achieving faster batch throughput and enhanced consistency

- Consequently, biopharma companies such as Pfizer and Novartis are investing heavily in “lights-out” manufacturing lines—with automated cell culture, filtration, and fill–finish—designed to run continuously and adaptively, meeting demand for complex therapeutics with greater reliability and at lower cost

Next-Generation Biomanufacturing Market Dynamics

Driver

“Growing Demand Driven by Supply Chain Resilience and Flexible Production”

- The increasing need for robust, decentralized, and adaptive biomanufacturing capabilities is a significant driver behind the heightened demand for next‑generation biomanufacturing platforms. These systems provide critical resilience during public health crises, supply chain disruptions, and fluctuating demand for biologics

- For instance, during the COVID‑19 pandemic, modular and mobile biomanufacturing units were rapidly deployed for urgent vaccine production—showcasing how advanced platforms can be mobilized quickly to address emergent public health needs. Such strategies by leading biopharma companies are expected to drive the next‑generation biomanufacturing industry forward in the coming years

- As regulators and healthcare providers prioritize fast response and surge capacity, continuous and single‑use systems offer real‑time flexibility, simplified validation processes, and the ability to pivot between different biologics without extensive downtime

- Furthermore, growing adoption by contract development and manufacturing organizations (CDMOs) and smaller biotech firms—driven by reduced capital requirements and the scalability of these platforms—is fueling market expansion in both established and emerging biopharma clusters

- The integration of digital twins, process analytics, and remote monitoring into these systems allows real‑time quality control and regulatory compliance across geographically dispersed manufacturing sites, enhancing visibility and control over production processes

- The convenience and reliability of plug‑and‑play biomanufacturing solutions, combined with cost‑effective deployment and rapid technology transfer, are key factors propelling adoption by both innovators and established manufacturers. The continued development of user-friendly, integrated next‑generation platforms further support sustainable market growth

Restraint/Challenge

“Technical Complexity and Regulatory Barriers”

- Despite their advantages, next‑generation biomanufacturing platforms often require sophisticated setup, specialized training, and integration of complex control systems, which can delay deployment in resource‑limited or decentralized settings

- For instance, some CDMOs have encountered delays in facility qualification and tech transfers due to the complexity of continuous bioprocessing documentation and scale‑down modelling

- Navigating evolving regulatory frameworks—particularly around continuous processing validation, multi-product facility licensing, and data integrity standards—is a major hurdle that manufacturers must overcome to gain approval and commercial viability

- Moreover, the upfront capital investment for modular cleanrooms and automated systems can be high, even if capex is lower over time. Smaller companies or emerging markets may find cost-prohibitive entry barriers, especially without revenue guarantees or public funding

- While economies of scale and standardization are gradually lowering costs, smaller manufacturers often lack the technical and financial bandwidth to transition away from traditional batch processes

- Addressing these challenges through harmonized regulatory guidance, workforce retraining programs, and financing incentives will be essential to unlocking the full potential of next‑generation biomanufacturing globally

Next-Generation Biomanufacturing Market Scope

The market is segmented on the basis of workflow and product, application and end user

• By Workflow and Product

On the basis of workflow and product, the next-generation biomanufacturing market is segmented into continuous upstream biomanufacturing, single-use upstream biomanufacturing, and downstream biomanufacturing. The continuous upstream biomanufacturing segment dominated the market with the largest revenue share of 45.3% in 2024, fueled by its real-time control, operational efficiency, and growing adoption in continuous processing lines for biologics

The single-use upstream biomanufacturing segment is expected to record the fastest CAGR from 2025 to 2032, driven by growing demand for flexible, cost-effective production systems. These systems minimize cleaning validation and contamination risk, offering faster batch turnaround.

• By Application

On the basis of application, the next-generation biomanufacturing market is segmented into monoclonal antibodies, hormones, vaccines, recombinant proteins, and others. The monoclonal antibodies segment held the largest market share of 42.6% in 2024, owing to the widespread application of monoclonal therapies across oncology, autoimmune, and infectious diseases. Their demand has accelerated the uptake of next-gen biomanufacturing platforms for scalable, high-yield production.

The vaccines segment is expected to record the fastest CAGR of 16.4% from 2025 to 2032, driven by rising global immunization efforts, advancements in mRNA technology, and government support for rapid-response manufacturing capabilities.

• By End User

On the basis of end user, the next-generation biomanufacturing market is segmented into commercial stage and preclinical and development stage. The commercial stage segment accounted for the largest revenue share of 61.3% in 2024, supported by expanded production capacities, increasing contract manufacturing outsourcing, and successful biologics entering the commercial phase.

The preclinical and development stage segment is anticipated to register the fastest CAGR of 15.9% from 2025 to 2032, as startups and research labs increasingly adopt modular, scalable platforms to streamline R&D and clinical trial manufacturing.

Next-Generation Biomanufacturing Market Regional Analysis

- North America dominated the next-generation biomanufacturing market with the largest revenue share of 42.8% in 2024, driven by the region's strong presence of leading biopharmaceutical companies, advanced healthcare infrastructure, and robust investments in biotechnology innovation

- The region's emphasis on accelerating biologics production, increasing demand for personalized medicine, and adoption of automation and digital technologies in bioprocessing have significantly contributed to market growth

- In addition, supportive government initiatives, high R&D expenditure, and a skilled workforce further reinforce North America's position as a global leader in next-generation biomanufacturing advancements

U.S. Next-Generation Biomanufacturing Market Insight

The U.S. next-generation biomanufacturing market captured the largest revenue share of 82.3% in 2024 within North America, fueled by strong investment in smart process automation and advanced modular facilities. Biopharma companies are prioritizing continuous manufacturing and single-use systems to enhance speed, efficiency, and flexibility. Early adoption of digital twins, real-time analytics, and scalable production platforms—particularly for mRNA vaccines, cell & gene therapies, and monoclonal antibodies—further propels U.S. market growth. Moreover, favorable FDA frameworks supporting novel biomanufacturing approaches such as “right-first-time” validation and real-time release testing are significantly contributing to the market’s expansion.

Europe Next-Generation Biomanufacturing Market Insight

The Europe next-generation biomanufacturing market is projected to expand at a substantial CAGR throughout the forecast period. This growth is primarily driven by robust R&D ecosystems in the U.K., Germany, and Switzerland, alongside progressive regulations encouraging continuous and modular bioprocessing. The region is witnessing significant adoption of decentralized production models, supported by strong government initiatives and investments in Bio-Networking hubs and Centers of Excellence.

U.K. Next-Generation Biomanufacturing Market Insight

The U.K. next-generation biomanufacturing market is anticipated to grow at a noteworthy CAGR of 12.3% during the forecast period. This growth is supported by strategic government funding (such as, UK BioIndustry Association partnerships), increasing investments in single-use facilities, and expansion of CDMO networks focused on personalized medicine and cell & gene therapies. Continued integration of continuous bioprocess techniques is further advancing production efficiency across both early- and late-stage pipelines.

Germany Next-Generation Biomanufacturing Market Insight

The Germany next-generation biomanufacturing market is expected to expand at a considerable CAGR throughout the forecast period. The country’s cutting-edge manufacturing infrastructure and emphasis on Industry 4.0 integration are driving the adoption of digitalized and eco-efficient production systems. Increasing use of continuous bioprocessing platforms in German CDMOs and pharmaceutical manufacturers is enhancing access to flexible and sustainable biomanufacturing.

Asia-Pacific Next-Generation Biomanufacturing Market Insight

The Asia-Pacific next-generation biomanufacturing market is poised to grow at the fastest CAGR of 26.4% during the forecast period (2025–2032), supported by government-led biotech initiatives and expanding public–private partnerships. The region held 31.2% of the global market in 2024, with countries such as China, India, and Japan accelerating investments in modular bioreactor systems and digital bioprocess infrastructure.

Japan Next-Generation Biomanufacturing Market Insight

The Japan next-generation biomanufacturing market is gaining momentum, accounting for 25.6% of the Asia-Pacific regional revenue in 2024. The country’s tech-forward pharmaceutical landscape and focus on regenerative medicine are driving the widespread adoption of single-use and continuous manufacturing technologies. Furthermore, Japan’s integration of smart factory principles and automation is boosting production resilience and productivity.

China Next-Generation Biomanufacturing Market Insight

The China next-generation biomanufacturing market accounted for the largest regional revenue share of 38.4% in Asia-Pacific in 2024. Rapid facility expansion in biotech hubs, aggressive licensing reforms, and support for local CDMOs have fueled capacity growth for biologics, vaccines, and gene therapies. In addition, government-backed technology transfer programs and supportive financing structures have increased access to advanced manufacturing platforms.

Next-Generation Biomanufacturing Market Share

The next-generation biomanufacturing industry is primarily led by well-established companies, including:

- Illumina Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Oxford Nanopore Technologies plc (U.K.)

- Agilent Technologies, Inc. (U.S.)

- BGI Group Guangdong ICP (China)

- PerkinElmer (U.S.)

- QIAGEN (Germany)

- Eurofins Scientific (Luxembourg)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Takara Bio Inc. (Japan)

- Azenta Life Sciences (U.S.)

- Hamilton Company (U.S.)

- Macrogen Inc. (South Korea)

- Zymo Research Corporation (U.S.)

- Tecan Trading AG (Switzerland)

Latest Developments in Global Next-Generation Biomanufacturing Market

- In April 2025, Amgen announced a USD 900 million expansion of its biomanufacturing facility in New Albany, Ohio, increasing its total investment in the region to over USD 1.4 billion and creating approximately 750 new jobs. This move underscores Amgen's commitment to bolstering U.S.-based biologics capabilities—especially for monoclonal antibodies and gene therapies—while reinforcing domestic supply chains amid global uncertainties

- In April 2025, Ferring Pharmaceuticals received FDA approval for a second U.S. manufacturing site dedicated to ADSTILADRIN (nadofaragene firadenovec‑vncg) in Parsippany, New Jersey. The facility features sustainable energy integration, marking a significant step in specialized gene therapy production capacity in the Next‑Generation Biomanufacturing space

- In December 2024, China’s Ministry of Industry and Information Technology announced a strategic initiative, directing USD 4.17 billion in investments toward emerging industries—including biomanufacturing—for 2025. This landmark funding drive reinforces China's ambition to become a global leader in future-focused manufacturing technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.