Global Newborn Screening Market

Market Size in USD Billion

CAGR :

%

USD

1.16 Billion

USD

2.27 Billion

2024

2032

USD

1.16 Billion

USD

2.27 Billion

2024

2032

| 2025 –2032 | |

| USD 1.16 Billion | |

| USD 2.27 Billion | |

|

|

|

|

Newborn Screening Market Size

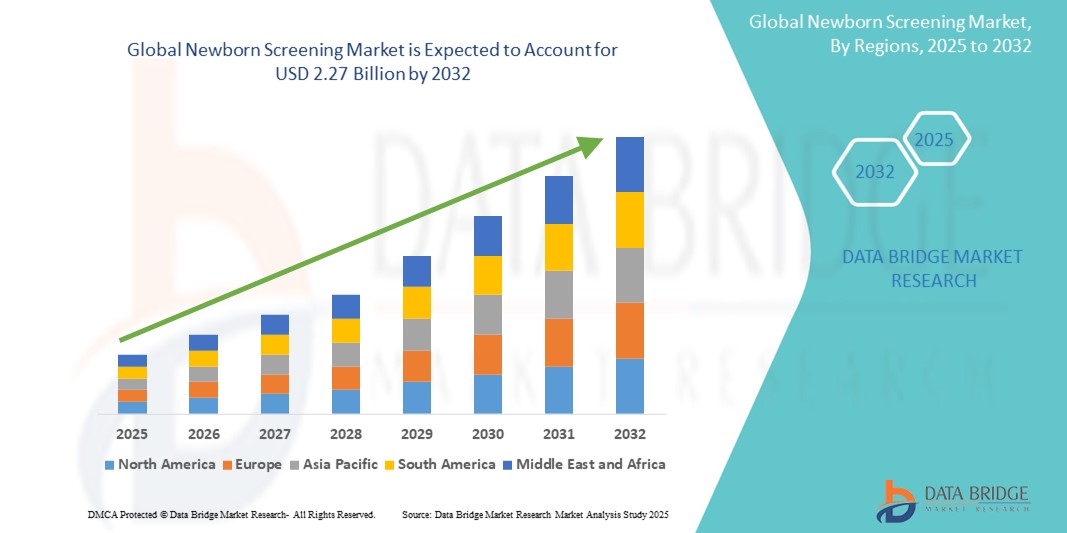

- The global newborn screening market size was valued at USD 1.16 billion in 2024 and is expected to reach USD 2.27 billion by 2032, at a CAGR of 8.80% during the forecast period

- This growth is driven by factors such as rising prevalence of congenital disorders, government mandates, and advancements in screening technologies.

Newborn Screening Market Analysis

- Newborn screening is a vital process that helps detect congenital disorders early, allowing for timely interventions that can significantly improve health outcomes for infants. It includes tests for metabolic, genetic, and hearing disorders, typically conducted shortly after birth

- The newborn screening market is experiencing steady growth, driven by rising awareness of the importance of early diagnosis, increased government mandates and healthcare initiatives, advancements in screening technologies, and the growing prevalence of congenital disorder

- North America is expected to dominate the newborn screening market with a share of 48.8%, due to the widespread implementation of universal screening programs, high healthcare spending, and a strong regulatory framework supporting early diagnosis of congenital disorders

- Asia-Pacific is expected to be the fastest growing region in the newborn screening market during the forecast period with a share of 33.40%, due to increasing awareness of early diagnosis, expansion of national screening programs, and government support in emerging economies

- Instruments segment is expected to dominate the market with a market share of 76.41% due to increasing adoption of advanced screening technologies such as tandem mass spectrometry (MS/MS), improved automation in laboratories, and the rising demand for high-throughput and accurate diagnostic tools that enable early detection of a wide range of congenital disorders

Report Scope and Newborn Screening Market Segmentation

|

Attributes |

Newborn Screening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Newborn Screening Market Trends

“Increasing Prevalence of Congenital Illnesses”

- One prominent trend in the global newborn screening market is the increasing prevalence of congenital illnesses

- This trend is driven by the growing recognition of the importance of early detection, advancements in screening technologies, and rising healthcare awareness among parents and healthcare providers

- For instance, as the awareness around conditions such as sickle cell disease, cystic fibrosis, and phenylketonuria (PKU) grows, more governments and healthcare organizations are implementing mandatory newborn screening programs. These efforts aim to identify such disorders early and provide timely intervention

- The demand for newborn screening is expanding in developed markets, such as North America and Europe, and also in emerging markets, where rising healthcare access and infrastructure are improving early diagnostic capabilities

- As the focus on preventive healthcare continues to increase and more diseases are included in screening programs, the prevalence of congenital illnesses will likely continue to shape the growth of the newborn screening market

Newborn Screening Market Dynamics

Driver

“Growing Awareness About Early Diagnosis”

- The rising awareness of the importance of early diagnosis is a significant driver for the newborn screening market, as healthcare providers focus on detecting conditions in infants at the earliest stages for better treatment outcome

- This awareness is gaining momentum worldwide, with increased support from governments, healthcare organizations, and advocacy groups aiming to enhance screening programs in both developed and developing regions.

- As healthcare systems evolve, there is a shift toward incorporating more comprehensive, cost-effective, and accurate newborn screening tests that can be seamlessly integrated into routine healthcare practices

- Companies are responding by developing advanced screening technologies that offer higher sensitivity, quicker results, and easier integration with existing healthcare infrastructures

- Furthermore, the rising focus on preventative healthcare and early interventions is propelling the adoption of newborn screening, with a particular emphasis on genetic and metabolic disorders

For instance,

- Gentle Bio offers innovative diagnostic tools for newborn screening, focusing on genetic disorders and metabolic conditions, to align with the global push for comprehensive early diagnosis

- PerkinElmer provides integrated newborn screening platforms designed to support a wide range of tests, from blood and hearing screenings to more advanced genomic analyses

- As awareness and initiatives for early diagnosis continue to grow, the newborn screening market is expected to see sustained demand, driven by both public health policies and technological advancements in diagnostic capabilities

Opportunity

“Advancements in Screening Techniques”

- Advancements in screening techniques present a significant opportunity for the newborn screening market, as innovative diagnostic tools and methods offer more accurate, faster, and cost-effective ways to detect a range of conditions in newborns

- Screening technology developers are capitalizing on this growth by creating cutting-edge, high-performance solutions tailored to the unique needs of newborns, expanding the scope of early detection in a variety of conditions

- This opportunity aligns with the broader trend of healthcare modernization, as hospitals, neonatal care units, and diagnostic centers upgrade their capabilities to integrate advanced screening technologies, including genomic and multiplex testing

For instance,

- Companies such as Bio-Rad Laboratories and Thermo Fisher Scientific are offering advanced multiplex testing platforms that allow for the detection of multiple disorders simultaneously, enhancing the scope of newborn screening

- PerkinElmer provides state-of-the-art newborn screening technologies with high-throughput capabilities, allowing for comprehensive metabolic and genetic testing, addressing the rising demand for early diagnostics

- As screening techniques continue to evolve, especially in emerging markets where healthcare infrastructure is improving, the newborn screening market is well-positioned to thrive by offering state-of-the-art solutions that meet the growing demand for precise, reliable, and comprehensive early diagnosis

Restraint/Challenge

“Variations in Screening Practices”

- Variations in screening practices pose a significant challenge for the newborn screening market, as inconsistent protocols and differing standards across regions complicate the implementation of universal screening program

- The need for standardized, reliable, and accessible newborn screening practices requires overcoming the disparities in healthcare infrastructure, training, and regulatory frameworks, leading to potential delays and gaps in screening coverage.

- Addressing these variations involves adapting screening technologies to meet the diverse needs of different regions, which can lead to higher costs and more complex implementation processes

For instance,

- In countries with limited resources, screening practices may vary significantly, requiring tailored approaches to integrate advanced testing methods that balance affordability and diagnostic accuracy

- Without addressing these challenges through harmonization of practices, improved training, and global cooperation, the variability in newborn screening practices may limit the market’s growth and the overall effectiveness of early detection programs

Newborn Screening Market Scope

The market is segmented on the basis of test type, product type, technology, disease type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Test Type |

|

|

By Product Type |

|

|

By Technology |

|

|

By Disease Type |

|

|

By End User

|

|

In 2025, the instruments is projected to dominate the market with a largest share in product type segment

The instruments segment is expected to dominate the newborn screening market with the largest share of 76.41% in 2025 due to the increasing adoption of advanced screening technologies such as tandem mass spectrometry (MS/MS), improved automation in laboratories, and the rising demand for high-throughput and accurate diagnostic tools that enable early detection of a wide range of congenital disorders.

The dried blood spot test is expected to account for the largest share during the forecast period in test type segment

In 2025, the dried blood spot test segment is expected to dominate the market with the largest market share of 24.9% due to its cost-effectiveness, ease of sample collection and transport, minimal invasiveness, and long-term sample stability, making it highly suitable for large-scale newborn screening programs, especially in low-resource settings.

Newborn Screening Market Regional Analysis

“North America Holds the Largest Share in the Newborn screening Market”

- North America dominates the newborn screening market with a share of 48.8%, driven by the widespread implementation of universal screening programs, high healthcare spending, and a strong regulatory framework supporting early diagnosis of congenital disorders

- U.S. holds a significant share due to presence of major industry players, advanced laboratory infrastructure, and favorable reimbursement policies that encourage early and routine screening for newborns

- Regional leadership is further supported by strong government mandates, continuous technological advancements in screening instruments, and robust public health initiatives focused on early detection and intervention

- With the ongoing integration of next-generation screening technologies and emphasis on improving infant health outcomes, North America is expected to maintain its dominant position in the global newborn screening market through 2032

“Asia-Pacific is Projected to Register the Highest CAGR in the Newborn screening Market”

- Asia-Pacific is expected to witness the highest growth rate in the newborn screening market driven by increasing awareness of early diagnosis, expansion of national screening programs, and government support in emerging economies

- India holds a significant share due to a rising birth rate, growing public health investments, and accelerated implementation of newborn screening in both urban and rural healthcare settings

- The region’s market growth is further supported by improved healthcare access, collaborations between public and private sectors, and rising adoption of dried blood spot tests as a cost-effective screening method

- With growing healthcare infrastructure, increasing focus on preventive pediatric care, and rising demand for affordable diagnostic technologies, Asia-Pacific is poised to lead global market growth for newborn screening through 2032

Newborn Screening Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- PerkinElmer Inc., (U.S.)

- Demant A/S (Denmark)

- Natus Medical Incorporated (U.S.)

- Bio-Rad Laboratories (U.S.)

- Luminex Corporation (U.S.)

- F. Hoffmann-La Roche Ltd., (Switzerland)

- Thermo Fisher Scientific Inc., (U.S.)

- Bruker (U.S.)

- Danaher Corporation (U.S.)

- Medtronic (Ireland)

- Chromsystems Instruments & Chemicals GmbH (Germany)

- Trivitron Healthcare (India)

- Baebies Inc., (U.S.)

Latest Developments in Global Newborn Screening Market

- In April 2024, Revvity introduced a next-generation sequencing-based panel and workflow for newborn screening, aiming to enhance current screening programs that predominantly rely on biochemical testing, thereby positioning itself to significantly impact the market by offering more comprehensive and accurate diagnostic capabilities

- In December, Revvity launched its EONIS Q system, a CE-IVD declared platform that allows laboratories in countries accepting the CE marking to integrate molecular testing for spinal muscular atrophy (SMA) and severe combined immunodeficiency (SCID) in newborns, potentially expanding the adoption of advanced molecular diagnostics and advancing the market for genetic newborn screening

- In September 2020, PerkinElmer, Inc., a worldwide company devoted to developing for a healthy society, has gained CE-IVD certification for their EONISTM newborn screening assay, which screens for SMA (spinal muscular atrophy), SCID (severe combined immunodeficiency), and XLA (X-linked agammaglobulinemia). This IVD RT-PCR assay is designed to interact with PerkinElmer's full newborn screening workflow, giving labs a complete, single-source solution that includes everything from sample to solution

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.