Global Network Service Market

Market Size in USD Billion

CAGR :

%

USD

2.80 Billion

USD

7.80 Billion

2024

2032

USD

2.80 Billion

USD

7.80 Billion

2024

2032

| 2025 –2032 | |

| USD 2.80 Billion | |

| USD 7.80 Billion | |

|

|

|

|

Network-as-a-Service (NaaS) Market Size

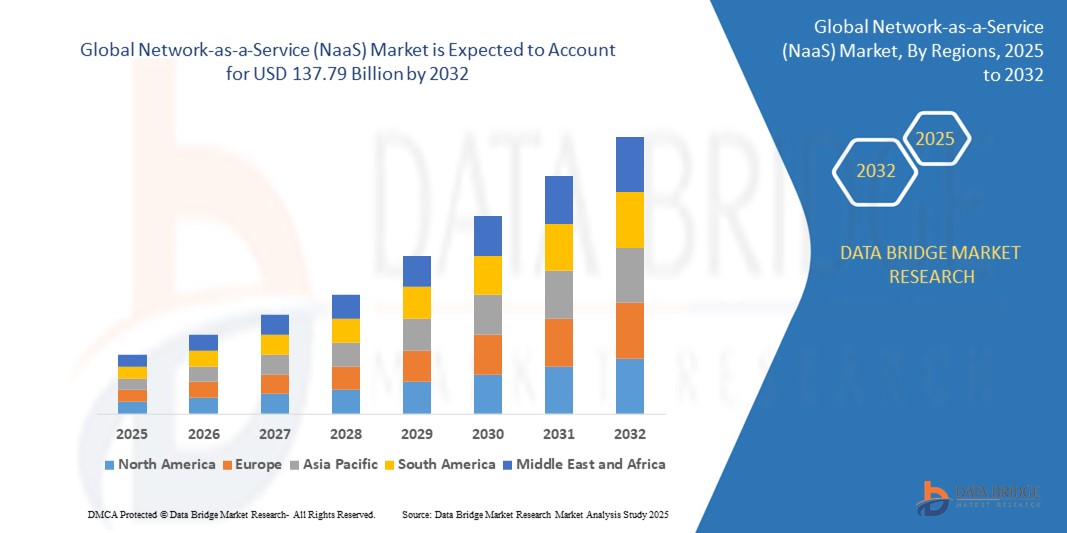

- The global Network-as-a-Service (NaaS) market size was valued at USD 15.22 billion in 2024 and is expected to reach USD 137.79 billion by 2032, at a CAGR of 31.70% during the forecast period

- This growth is driven by growing technological advancements and growing internet penetration

Network-as-a-Service (NaaS) Market Analysis

- Network-as-a-Service (NaaS) is transforming enterprise network delivery models by offering on-demand access to scalable, secure, and customizable network infrastructure, enabling businesses to shift from traditional CAPEX-heavy models to a subscription-based OPEX approach, thereby improving cost-efficiency and agility

- The rapid adoption of hybrid cloud environments, increasing use of virtualized network functions (VNFs), and rising demand for network automation are significantly contributing to the growth of NaaS, as enterprises seek to modernize their network architecture with flexible, policy-driven solutions

- North America is expected to dominate the network-as-a-service (NaaS) market, with the largest market share of 39.22%, driven by the strong investments in 5G, the presence of key providers such as Verizon, AT&T, and Lumen, and widespread adoption of cloud-first and remote work strategies across industries

- Asia-Pacific is expected to witness the fastest growth in the network-as-a-service (NaaS) market, due to extensive smart city initiatives and the region's active push toward industrial digitalization, especially in countries such as China, India, and Japan

- The wide area network segment is expected to dominate the network-as-a-service (NaaS) market with the largest market share of 66.25% in 2025 due to the increasing demand for high-speed, low-latency connectivity across multiple locations, enabling businesses to efficiently manage remote offices and branch networks

Report Scope and Network-as-a-Service (NaaS) Market Segmentation

|

Attributes |

Network-as-a-Service (NaaS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Network-as-a-Service (NaaS) Market Trends

“Emergence of Consumption-Based Pricing Models”

- A growing trend in the NaaS market is the shift toward pay-as-you-go or consumption-based pricing models, allowing enterprises to pay only for the network resources they use rather than investing in fixed infrastructure

- This model improves budget flexibility, helps reduce capital expenditures, and aligns better with the scalable nature of cloud services, especially for businesses with fluctuating network needs

- Service providers are increasingly offering subscription-based or metered billing options, enabling better cost management and forecasting for clients

- For instance, in February 2024, HPE Aruba Networking expanded its NaaS platform with new consumption-based pricing for campus and branch networks, helping organizations manage network expenses more efficiently

- This pricing shift is making NaaS more accessible to SMEs and attractive to large enterprises seeking agile, cost-aligned infrastructure models

Network-as-a-Service (NaaS) Market Dynamics

Driver

“Proliferation of IoT Devices and Smart Infrastructure”

- The exponential growth of IoT devices and connected systems across industries is significantly driving demand for reliable, high-bandwidth, and low-latency network infrastructure

- NaaS providers offer scalable and secure frameworks that support the seamless integration of IoT endpoints and real-time data exchange

- Smart city initiatives, industrial automation, and connected healthcare rely heavily on robust network infrastructure powered by managed network services

- For instance, in 2023, Cisco partnered with a major smart city project in Europe to provide IoT-ready managed NaaS infrastructure, enabling real-time data flow and intelligent traffic management

- The integration of NaaS with IoT ecosystems is enabling next-gen applications and driving innovation across verticals

Opportunity

“Expansion in Emerging Markets with Growing Digital Infrastructure”

- Emerging economies across Latin America, Africa, and Southeast Asia present significant growth opportunities for NaaS providers due to increasing investments in telecom infrastructure and digital inclusion programs

- These regions are experiencing a rapid surge in mobile connectivity, cloud adoption, and e-commerce growth, requiring agile network solutions that can be deployed quickly and scaled easily

- Local governments and enterprises are prioritizing digital transformation, creating a fertile landscape for NaaS deployment

- For instance, in 2024, Airtel Africa collaborated with a global cloud provider to launch a NaaS offering across Nigeria and Kenya, targeting SMEs and government sectors with scalable connectivity services

- The push for inclusive digital ecosystems in emerging markets is unlocking new customer bases for global NaaS providers

Restraint/Challenge

“Data Sovereignty and Compliance Complexities”

- A major challenge for NaaS providers is navigating data sovereignty regulations, especially in regions where data must be stored or processed locally.

- This often complicates the delivery of cloud-based or centralized services, requiring providers to establish localized infrastructure and ensure compliance with national standards

- The increasing focus on GDPR, HIPAA, and region-specific privacy laws adds layers of complexity to service deployment and management

- For instance, in 2023, a multinational tech firm faced regulatory delays when rolling out its NaaS platform in the Middle East due to data localization policies and cross-border data transfer restrictions

- To succeed globally, NaaS vendors must develop compliance-first architectures and build trust by aligning with regional legal frameworks

Network-as-a-Service (NaaS) Market Scope

The market is segmented on the basis of type, organization size, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Organization Size |

|

|

By Application |

|

|

By End User |

|

In 2025, the wide area network is projected to dominate the market with a largest share in Type segment

The wide area network segment is expected to dominate the network-as-a-service (NaaS) market with the largest market share of 66.25% in 2025 due to the increasing demand for high-speed, low-latency connectivity across multiple locations, enabling businesses to efficiently manage remote offices and branch networks.

The large enterprises is expected to account for the largest share during the forecast period in organization size segment

In 2025, the large enterprises segment is expected to dominate the market with the largest market share of 53.12% due to their significant investment in advanced network solutions, the need for scalable and secure infrastructures, and the growing demand for digital transformation.

Network-as-a-Service (NaaS) Market Regional Analysis

“North America Holds the Largest Share in the Network-as-a-Service (NaaS) Market”

- North America is expected to dominate the network-as-a-service (NaaS) market with the largest market share of 39.22%, driven by the rapid adoption of cloud-based technologies, advanced telecom infrastructure, and a strong push for IT outsourcing to improve operational efficiency

- The U.S. leads the regional growth due to its robust telecom ecosystem, early adoption of digital services, and the presence of key players such as Verizon, AT&T, and T-Mobile

- There is a growing demand across healthcare, financial services, and manufacturing sectors for scalable, secure, and flexible network solutions, driving up investment in network-as-a-service (NaaS)

“Asia-Pacific is projected to register the Highest CAGR in the Network-as-a-Service (NaaS) Market”

- Asia-Pacific is expected to witness the highest growth rate in the network-as-a-service (NaaS) market due to rapid digital transformation, increasing cloud adoption, and a strong emphasis on IT modernization in both private and public sectors

- Major contributors such as China, India, and Japan are benefiting from smart city initiatives, exponential growth in internet penetration, and widespread implementation of IoT and 5G

- Enterprises across the region are seeking to streamline operations, improve network performance, and boost cybersecurity, creating strong demand for managed network and security services

- With continued investment in digital infrastructure and support from government initiatives, Asia-Pacific is emerging as a strategic growth hub for global service providers in the network-as-a-service (NaaS) market

Network-as-a-Service (NaaS) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Oracle (U.S.)

- IBM (U.S.)

- Cisco Systems, Inc. (U.S.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Verizon (U.S.)

- Huawei Technologies Co., Ltd. (China)

- AT&T Intellectual Property. (U.S.)

- BT (U.K.)

- Telefónica S.A. (Spain)

- T-Systems International GmbH. (Germany)

- NEC Corporation (Japan)

- NTT Corporation (Japan)

- Orange Business Services (France)

- FUJITSU (Japan)

- Lumen Technologies. (U.S.)

- Masergy Communications, Inc. (U.S.)

- Colt Technology Services Group Limited (U.K.)

- Telstra (Australia)

- CommScope, Inc. (U.S.)

- Singtel (Singapore)

Latest Developments in Global Network-as-a-Service (NaaS) Market

- In May 2022, Tata Communications launched DIGO, a cloud communications platform designed to enhance customer engagement for digital-first enterprises. DIGO offers a comprehensive suite of device-independent communication capabilities that can be smoothly integrated into existing applications, enabling intelligent, 360-degree human-to-everything (H2X) conversations. This launch significantly strengthens Tata Communications' position in the cloud-based communication services space

- In April 2022, Lumen introduced Lumen Cloud Communications (LCC), a platform offering voice telephony, group chat, video calling, and mobile app integration. The LCC Basic version acts as a PBX replacement, featuring unlimited local and domestic calling, visual voicemail, paging, and support for IP endpoints, including Poly and Grandstream devices. This move marks Lumen’s strategic expansion into enterprise-grade unified communication services

- In January 2022, Orange Business Services unveiled Service Manage-Watch, a global supervision solution for managing network services and applications from both Orange and third-party vendors. It ensures optimal connectivity, security, and performance across apps, hardware, and customer experience, aligning with the evolving needs of enterprise clients. This release reinforces Orange’s commitment to performance management and customer satisfaction

- In October 2021, Telefónica, in collaboration with Fortinet, launched Secure SD-WAN, a service aimed at enhancing secure connectivity for hybrid work environments. The offering integrates networking and security features to allow remote and office-based employees to access enterprise applications with high productivity and security. This initiative underlines Telefónica’s focus on enabling secure digital transformation in the hybrid work era

- In June 2021, AT&T Business introduced Cisco Webex Calling with AT&T – Enterprise, linked with Cisco’s Unified Communications Manager – Cloud (UCMC). This platform was developed to streamline business processes and accelerate digital transformation while delivering improved reliability and operational efficiency. This collaboration enhances AT&T’s cloud communications offerings and strengthens enterprise connectivity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.