Global Network Security Market

Market Size in USD Billion

CAGR :

%

USD

22.90 Billion

USD

56.70 Billion

2024

2032

USD

22.90 Billion

USD

56.70 Billion

2024

2032

| 2025 –2032 | |

| USD 22.90 Billion | |

| USD 56.70 Billion | |

|

|

|

|

Network Security Market Size

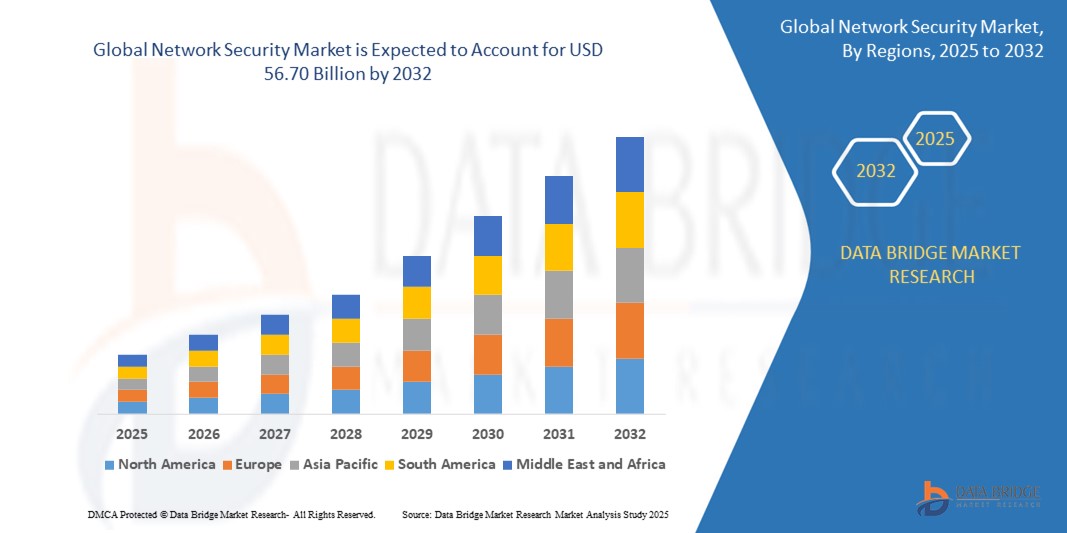

- The global Network Security market was valued at USD 22.90 billion in 2024 and is expected to reach USD 56.70 billion by 2032

- During the forecast period of 2025 to 2032 the market is such as to grow at a CAGR of 12%, primarily driven by the increasing frequency and sophistication of cyberattacks

- This growth is driven by factors such as the growing adoption of cloud-based security solutions and the need for businesses to protect sensitive data

Network Security Market Analysis

- The network security market is experiencing significant growth, with an increasing focus on protecting data privacy and integrity

- Technological advancements are driving the adoption of efficient security solutions, especially in industries such as banking, IT, and healthcare

- The rise in cyber-crimes and threats, alongside the expansion of small and medium-sized enterprises, contributes to this market’s growth

- With the growing use of IoT and BYOD policies, organizations are seeking advanced network security technologies to prevent data theft and unauthorized access

- For instance, advancements in firewall and antivirus technologies have played a vital role in bolstering data protection measures across industries

- In conclusion, the network security market is expanding due to rising cyber threats and the adoption of advanced security solutions across various industries

Report Scope and Network Security Market Segmentation

|

Attributes |

Network Security Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Network Security Market Trends

"Advancements in Network Security"

- The network security market is evolving rapidly as organizations prioritize stronger protection measures against cyber threats and data breaches

- There is a growing adoption of artificial intelligence and machine learning technologies in network security solutions, allowing for more effective detection and response to emerging threats

- The shift towards cloud-based security solutions is gaining momentum, as businesses move their operations and data to cloud environments, increasing the need for scalable and flexible security measures

- As the number of connected devices rises, organizations are implementing more advanced security protocols to safeguard against the vulnerabilities introduced by the Internet of Things and Bring Your Own Device policies

- For instance, the rise of cloud computing has amplified the need for advanced network security solutions, driving the adoption of AI and next-gen firewalls. This shift underscores the critical role of proactive security measures in today’s evolving digital landscape

- In conclusion, the network security market is rapidly evolving with the adoption of AI, machine learning, and cloud-based solutions to address emerging threats and secure growing connected environments

Network Security Market Dynamics

Driver

“Rising Cybersecurity Threats”

- The rising frequency and sophistication of cyberattacks are driving the network security market, as businesses and individuals depend more on digital infrastructure for operations and services

- Hackers, cybercriminals, and state-sponsored entities are continuously evolving their tactics to breach defenses, leading to significant financial, operational, and reputational losses, especially in industries such as finance, healthcare, and government

- With the proliferation of Internet of Things devices, new vulnerabilities are created, expanding the surface area for potential attacks and making network security even more crucial to safeguard sensitive data

- Regulatory pressures, such as the General Data Protection Regulation (GDPR), are forcing companies to adopt stronger security measures, ensuring compliance with global data protection standards and driving demand for advanced network security solutions

- Businesses are increasingly investing in advanced security technologies, including firewalls, encryption, intrusion detection systems, and secure access controls, to address these growing threats and maintain a secure network environment

- For instance, companies in the finance sector are investing heavily in multi-layered security solutions to prevent data breaches, which can result in hefty fines and loss of consumer trust, ensuring long-term growth and sustainability in the digital age

- In conclusion the network security market is expanding as rising cyberattacks, IoT vulnerabilities, and regulatory pressures drive businesses to invest in advanced security technologies to protect sensitive data and ensure compliance

Opportunity

“Adoption of Cloud-Based Security Solutions”

- As more organizations shift to cloud platforms such as Amazon Web Services and Microsoft Azure, the demand for strong network security measures in cloud environments is rapidly increasing

- Businesses are adopting cloud-based services due to their scalability and flexibility, but they also face growing concerns about protecting sensitive data and ensuring regulatory compliance

- This trend is driving the rise of services such as identity and access management, secure web gateways, and encryption tools tailored specifically for cloud infrastructures

- Cloud security-as-a-service is emerging as a cost-effective solution for companies to outsource protection while maintaining focus on core operations

- Vendors are integrating artificial intelligence and machine learning into cloud security offerings to predict and counter threats before they cause damage

- For instance, major enterprises in the banking sector are partnering with cloud security providers to deploy AI-powered monitoring tools that ensure compliance with international data protection laws, as cloud adoption accelerates across industries, the need for integrated and intelligent security systems will continue to offer long-term market growth potential for network security providers

- In conclusion, The increasing shift to cloud platforms is driving demand for robust cloud security measures, with businesses adopting AI-powered tools to protect sensitive data, ensure compliance, and mitigate emerging threats.

Restraint/Challenge

“Lack of Skilled Workforce”

- The growing complexity of cyber threats demands skilled professionals who can detect, analyze, and respond effectively, but there is a significant shortage of such talent

- Many organizations are unable to find qualified experts in areas such as threat intelligence, incident response, and security architecture, leading to gaps in their cybersecurity posture

- Small and medium-sized enterprises are especially vulnerable due to limited budgets for hiring or training specialized cybersecurity staff

- The fast-paced evolution of threat vectors requires ongoing education and upskilling, which many companies struggle to provide internally

- This workforce shortage increases the risk of cyberattacks, slows down incident response times, and impacts the overall effectiveness of network security solutions

- For instance, a 2024 report by the International Information System Security Certification Consortium found that over 3 million cybersecurity roles remained unfilled globally, putting immense pressure on existing teams and which address the talent gap through investment in training and education is essential for sustaining long-term security and supporting market growth

- In conclusipon, The shortage of skilled cybersecurity professionals is hindering effective threat response and increasing vulnerability to cyberattacks

Network Security Market Scope

The market is segmented on the basis of component, deployment mode, organization size, and vertical

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment Mode |

|

|

By Organization Size |

|

|

By Vertical |

|

Network Security Market Regional Analysis

“North America is the Dominant Region in the Network Security Market”

- North America holds the largest share of the network security market due to the presence of established technology giants and cybersecurity firms

- The region has a strong regulatory framework, including data protection laws such as the California Consumer Privacy Act and federal initiatives, which compel businesses to implement robust network security

- High awareness about cyber threats among enterprises and consumers leads to greater investment in advanced security technologies

- The increasing number of cyberattacks on sectors such as finance, healthcare, and government drives constant innovation and demand for network security solutions

- For instance, the U.S. Department of Homeland Security frequently partners with private cybersecurity firms to strengthen national cyber defenses, reflecting the region’s proactive stance on network security

- In conclusion, North America leads the network security market due to strong regulatory frameworks, high cybersecurity awareness, and ongoing innovation in response to increasing cyber threats.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is the fastest growing region in the network security market due to rapid digital transformation and increasing internet penetration

- Emerging economies such as India and Southeast Asian countries are investing heavily in IT infrastructure and cybersecurity to protect expanding digital ecosystems

- Regulatory push in countries such as China and South Korea is encouraging businesses to adopt strong network security frameworks

- The rise in remote working, e-commerce, and financial digitalization in this region has amplified the need for secure networks

- For instance, India’s national cybersecurity strategy and investments in data protection by major banks and telecoms are accelerating the adoption of network security solutions across sectors

- In conclusion, Asia-Pacific is the fastest-growing region in the network security market due to digital transformation, increased internet penetration, and regulatory support, driving higher demand for robust network security solutions.

Network Security Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- IBM (U.S.)

- Check Point Software Technologies Ltd. (Israel)

- Cisco Systems, Inc. (U.S.)

- FireEye, Inc. (U.S.)

- Fortinet, Inc. (U.S.)

- Qualys, Inc. (U.S.)

- Broadcom (U.S.)

- Dell Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- FUJITSU (Japan)

- McAfee, LLC (U.S.)

- Micro Focus (U.K.)

- Proofpoint, Inc. (U.S.)

- Tripwire, Inc. (U.S.)

- Symantec Corporation (U.S.)

- Skybox Security, Inc. (U.S.)

- AT&T Intellectual Property (U.S.)

- ALIENVAULT, INC. (U.S.)

- VERACODE (U.S.)

- Tenable, Inc. (U.S.)

- Rapid7 (U.S.)

- NetSPI LLC. (U.S.)

- Trustwave Holdings, Inc. (U.S.)

- Intel Corporation (U.S.)

- F-Secure (Finland)

Latest Developments in Global Network Security Market

- In April 2024, CRN unveiled its list of the "20 Coolest Cybersecurity Products" featured at the RSA Conference. This selection includes groundbreaking tools and technologies that offer advanced protection against cyber threats. The products highlight the latest innovations in network security, from enhanced threat detection to streamlined security management, catering to the growing needs of modern enterprises

- In April 2024, Palo Alto Networks announced the launch of new security solutions integrated with precision AI to combat advanced cyber threats and enhance the security of AI adoption. The solutions are designed to offer improved threat detection, faster response times, and fortified defenses against evolving cyberattacks. These innovations aim to support businesses in securing their infrastructures while embracing AI technologies, aligning with the growing demand for robust, intelligent security measures

- In April 2024, Fortinet unveiled a range of new security products aimed at enhancing network security across various industries. These products integrate advanced technologies such as artificial intelligence and machine learning to provide real-time threat detection, improve network resilience, and streamline security operations. With an emphasis on scalability and performance, Fortinet's latest offerings are designed to address the growing complexity of cyber threats in today's digital landscape

- In April 2024, SourceSecurity.com highlighted several new product releases in the security industry. These releases include advanced security technologies designed to improve surveillance, access control, and threat detection across various sectors. With innovations from leading companies, the new products aim to address the evolving challenges in cybersecurity and physical security, enhancing protection for both enterprises and individuals

- In April 2024, Atlas Systems launched ComplyScore, a cybersecurity product designed for mid to large-sized companies. This product aims to streamline compliance processes and enhance security measures by providing businesses with real-time insights into their cybersecurity posture. By focusing on risk management and compliance, ComplyScore helps companies improve their overall security frameworks while ensuring adherence to regulatory requirements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.