Global Network Packet Broker Market

Market Size in USD Million

CAGR :

%

USD

814.27 Million

USD

1,575.46 Million

2024

2032

USD

814.27 Million

USD

1,575.46 Million

2024

2032

| 2025 –2032 | |

| USD 814.27 Million | |

| USD 1,575.46 Million | |

|

|

|

|

Network Packet Broker Market Size

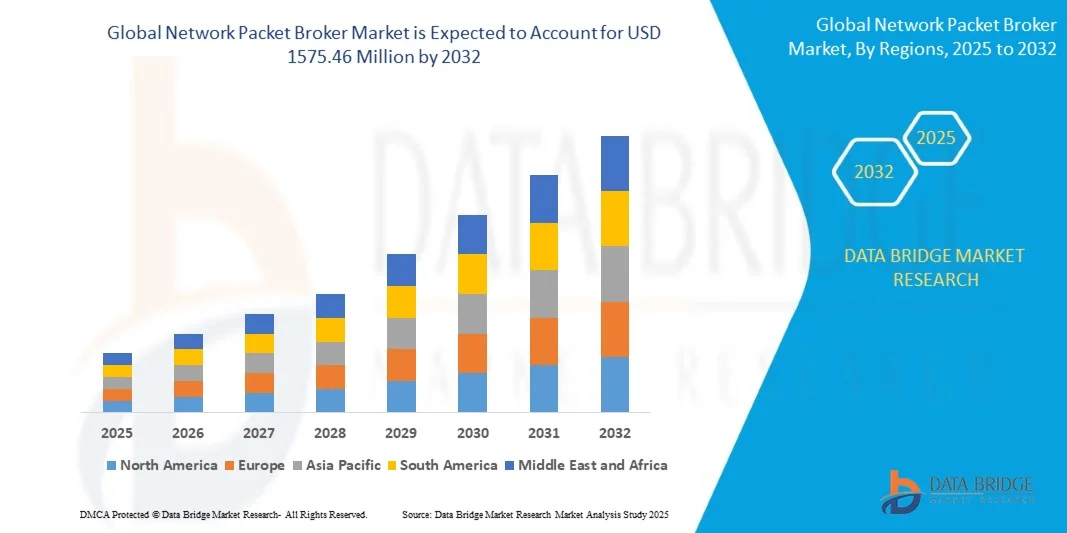

- The global network packet broker market size was valued at USD 814.27 million in 2024 and is expected to reach USD 1575.46 million by 2032, at a CAGR of 8.60% during the forecast period

- The market growth is largely fuelled by the increasing demand for efficient data traffic management and enhanced network security solutions

- Growing adoption of cloud computing and virtualization technologies is also driving the need for advanced packet broker systems to optimize network performance and monitoring

Network Packet Broker Market Analysis

- The network packet broker market is expanding as organizations seek to improve network visibility and streamline traffic management for better performance and security

- Increasing complexity of network infrastructures is driving demand for scalable and flexible packet broker solutions that support diverse monitoring and analytics needs

- North America dominates the network packet broker market with the largest revenue share, anticipated to be around 32-40% in 2025. This dominance is primarily driven by the region's robust enterprise adoption of advanced networking technologies, the widespread use of cloud-based network infrastructure, and stringent regulatory demands that promote enhanced security and efficient traffic management. The presence of a mature IT system and continuous investments in data centres also contribute significantly.

- Asia-Pacific is expected to be the fastest growing region in the network packet broker market during the forecast period due to rapid digital transformation initiatives, expanding IT infrastructure, increasing investments in network security solutions, and the booming telecommunications industry in countries such as China, Japan, and India. The widespread adoption of cloud computing, the proliferation of IoT devices, and the continuous expansion of data centres are key factors driving the significant demand for network packet broker solutions in this region

- The 1 GBPS and 10 GBPS segment dominates the largest market revenue share, primarily due to its widespread adoption in small to medium-sized enterprises (SMEs) and smaller network environments where cost-effectiveness and efficient traffic management are crucial. The versatility of these bandwidths also makes them suitable for a wide range of monitoring and security applications

Report Scope and Network Packet Broker Market Segmentation

|

Attributes |

Network Packet Broker Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Network Packet Broker Market Trends

“Integration of Network Packet Brokers with Cloud and Virtual Environments”

- Businesses are increasingly adopting virtual network packet brokers to manage traffic efficiently across hybrid and multi-cloud environments, supporting flexible and scalable infrastructure needs

- The transition from hardware to software-driven packet brokers is gaining momentum due to the rising use of cloud-native applications and decentralized networks

- Integration with software-defined networking enables enhanced visibility, real-time traffic filtering, and proactive threat detection across various network layers

- For instance, top vendors now provide packet broker solutions compatible with Amazon Web Services and Microsoft Azure to ensure seamless cloud integration

- For instance, the implementation of virtual brokers in Kubernetes environments, offering consistent traffic management and policy enforcement for containerized workloads

- For instance, top vendors now provide packet broker solutions compatible with Amazon Web Services and Microsoft Azure to ensure seamless cloud integration

Network Packet Broker Market Dynamics

Driver

“Exponential Increase in Data Traffic Across Enterprise Networks”

- The surge in data traffic from digitization, cloud computing, and Internet of Things integration is driving demand for network packet brokers that provide real-time visibility into network activity

- Packet brokers act as intermediaries that aggregate, filter, and distribute traffic to appropriate monitoring and security tools, supporting efficient data analysis and rapid threat detection

- With the increasing complexity of hybrid cloud infrastructures and distributed networks, traditional monitoring systems are falling short, pushing enterprises toward centralized packet broker solutions

- For instance, financial institutions use packet brokers to maintain visibility and compliance, while healthcare providers rely on them to protect sensitive patient data across digital systems

- Innovations in cloud-native and virtual packet brokers are expanding accessibility, especially for small and medium enterprises seeking scalable, secure, and cost-efficient network management options

Restraint/Challenge

“High Cost of Deployment and Maintenance”

- High deployment and maintenance costs of traditional hardware-based network packet brokers pose a significant barrier, especially for small and mid-sized organizations with limited IT budgets

- The need for specialized hardware, licensing fees, and skilled personnel adds to the total cost of ownership, making it difficult for many enterprises to adopt these solutions

- Integration challenges with existing legacy systems can complicate deployment, particularly as networks evolve toward cloud-native and virtualized environments

- For instance, configuring packet brokers to manage encrypted traffic in software-defined networks or ensuring visibility in containerized systems often requires complex, time-consuming customization

- The shortage of professionals skilled in advanced packet broker technologies further limits optimal usage, leading to underperformance and delayed implementation across various sectors

Network Packet Broker Market Scope

The market is segmented on the basis of bandwidth, network set-up, security tools, and end user.

- By Bandwidth

On the basis of bandwidth, the network packet broker market is segmented into 1 GBPS and 10 GBPS, 40 GBPS, and 100 GBPS. The 1 GBPS and 10 GBPS segment dominates the largest market revenue share, primarily due to its widespread adoption in small to medium-sized enterprises (SMEs) and smaller network environments where cost-effectiveness and efficient traffic management are crucial. The versatility of these bandwidths also makes them suitable for a wide range of monitoring and security applications.

The 100 GBPS segment is anticipated to witness the fastest growth rate, fuelled by the escalating demand for higher data throughput and network performance in large enterprises and data centres. The proliferation of connected devices, 5G networks, and cloud computing requires robust solutions capable of handling massive volumes of data traffic, driving the rapid adoption of higher bandwidth network packet brokers.

- By Network Set-Up

On the basis of network set-up, the network packet broker market is segmented into on-premise, cloud, and virtual. The On-Premise segment holds the largest market revenue share, driven by organizations prioritizing data security, control, and compliance for sensitive data. On-premise deployments offer direct management and a higher degree of customization, which is crucial for enterprises with specific security and operational requirements.

The cloud segment is expected to witness the fastest CAGR, fuelled by the increasing adoption of cloud computing and the demand for flexible, scalable, and cost-effective network visibility solutions. Cloud-based network packet brokers offer ease of deployment, reduced infrastructure costs, and the ability to monitor distributed cloud environments, making them attractive to businesses embracing digital transformation.

- By Security Tools

On the basis of security tools, the network packet broker market is segmented into passive and active. The passive segment holds the largest market revenue share, primarily due to its non-intrusive nature, allowing for continuous network monitoring and threat detection without affecting network performance. Passive security tools, which include intrusion detection systems (IDS) and data loss prevention (DLP), rely on duplicated traffic from network packet brokers for analysis.

The Active segment is expected to witness the fastest CAGR, driven by the increasing need for real-time threat prevention and mitigation. Active security tools, such as intrusion prevention systems (IPS) and firewalls, require inline deployment with network packet brokers to inspect and take action on traffic in real-time, offering a more proactive approach to cybersecurity.

- By End User

On the basis of end user, the network packet broker market is segmented into enterprise, service providers, and government organizations. The Enterprise segment accounted for the largest market revenue share, driven by the growing complexity of IT infrastructures, increasing cybersecurity concerns, and the need for enhanced network visibility and optimization across various industries. Enterprises utilize NPBs to manage vast volumes of data traffic, bolster cybersecurity, and ensure compliance.

The service providers segment is expected to witness the fastest CAGR, fuelled by the rapid expansion of telecommunications, internet, and cloud services. Service providers require sophisticated network packet brokers to manage increasing data traffic, ensure quality of service (QoS), and maintain robust security postures across their vast and evolving networks.

Network Packet Broker Market Regional Analysis

- North America dominates the global network packet broker market with a significant revenue share of 37.28%

- This is primarily driven by the rapid adoption of advanced networking technologies, increasing data traffic, and the strong presence of major technology companies in the region

- The emphasis on network security and data management further fuels the demand for network packet brokers across various industries

U.S. Network Packet Broker Market Insight

The U.S. network packet broker market holds a substantial revenue share within North America, fuelled by extensive investments in data centres, increasing cloud adoption, and a strong focus on cybersecurity. The growing complexity of network infrastructures and the need for comprehensive network visibility to manage and secure data traffic are key drivers in the country.

Europe Network Packet Broker Market Insight

The Europe network packet broker market is expected to grow at a substantial growth rate throughout the forecast period, driven by the consistent expansion of data centres, the surge in cloud adoption, and the implementation of stringent data privacy regulations. The region's well-established IT infrastructure and focus on digitalization contribute to the uptake of network packet broker solutions across various sectors.

U.K. Network Packet Broker Market Insight

The U.K. network packet broker market is expected to grow at a substantial growth rate during the forecast period, driven by increasing cybersecurity concerns and the widespread adoption of cloud-based services. The need for enhanced network visibility and performance optimization in response to growing data traffic and evolving digital transformation initiatives further supports market growth in the UK.

Germany Network Packet Broker Market Insight

The German network packet broker market is expected to grow at a substantial growth rate during the forecast period, fuelled by its robust industrial sector, strong emphasis on data privacy, and significant investments in digital infrastructure. The increasing demand for efficient network monitoring and security solutions across enterprises and government organizations drives market expansion.

Asia-Pacific Network Packet Broker Market Insight

The Asia-Pacific network packet broker market is expected to grow at a substantial growth rate over the forecast period, driven by rapid digitalization, increasing internet penetration, and the booming telecommunications industry in countries such as China, Japan, and India. The growing adoption of cloud computing, IoT technologies, and the expansion of data canters are significantly contributing to the rising demand for NPB solutions in the region.

Japan Network Packet Broker Market Insight

The Japan network packet broker market is expected to grow at a substantial growth rate due to the country's advanced technological landscape and increasing demand for robust cybersecurity solutions. The widespread adoption of cloud services, the emphasis on high-performance networks, and the need for efficient traffic management are key factors fuelling growth in Japan.

China Network Packet Broker Market Insight

The China network packet broker market is expected to grow at a substantial growth rate in Asia Pacific, attributed to its massive digital economy, rapid expansion of 5G infrastructure, and substantial investments in data centres. The country's strong focus on network security and surveillance, coupled with a large number of enterprises and service providers, drives the high demand for NPB solutions.

Network Packet Broker Market Share

The network packet broker industry is primarily led by well-established companies, including:

- NETSCOUT (U.S.)

- VIAVI Solutions Inc. (U.S.)

- Keysight Technologies (U.S.)

- Gigamon (U.S.)

- APCON (Switzerland)

- Garland Technology (India)

- Big Switch Networks, Inc. (U.S.)

- Network Critical (U.K.)

- Corvil (Ireland)

- Microtel Innovation S.r.l (Italy)

- Juniper Networks, Inc. (U.S.)

- Arista Networks, Inc. (U.S.)

- CPACKET NETWORKS (U.S.)

- Niagara Networks (U.S.)

- Profitap HQ B.V. (Netherlands)

- CGS Tower Networks (Israel)

- Datacom Systems INC (U.S.)

- 5FeetNetworks Oy (Finland)

- Cisco (U.S.)

- ECI Telecom (Israel)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL NETWORK PACKET BROKER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL NETWORK PACKET BROKER MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL NETWORK PACKET BROKER MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 PRICING ANALYSIS

6 GLOBAL NETWORK PACKET BROKER MARKET, BY TYPE

6.1 OVERVIEW

6.2 TRAFFIC AGGREGATORS

6.3 ADVANCED AGGREGATORS

7 GLOBAL NETWORK PACKET BROKER MARKET, BY BANDWIDTH

7.1 OVERVIEW

7.2 1 GBPS & 10 GBPS

7.3 40 GBPS

7.4 100 GBPS

8 GLOBAL NETWORK PACKET BROKER MARKET, BY SECURITY TOOLS

8.1 OVERVIEW

8.2 ACTIVE (INLINE)

8.3 PASSIVE

9 GLOBAL NETWORK PACKET BROKER MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 SINGLE SITE OUT-OF-BAND

9.3 MULTI-SITE OUT-OF-BAND

9.4 INTEGRATED MODE

10 GLOBAL NETWORK PACKET BROKER MARKET, BY NETWORK SETUP

10.1 OVERVIEW

10.2 ON-PREMISES

10.3 CLOUD

10.4 VIRTUAL

11 GLOBAL NETWORK PACKET BROKER MARKET, BY FUNCTION

11.1 OVERVIEW

11.2 AGGREGATION

11.3 REPLICATION

11.4 STACKING

11.5 TIME STAMPING

11.6 FILTERING & LOAD BALANCING

11.7 TRAFFIC SLICING & MASKING

11.8 OTHERS

12 GLOBAL NETWORK PACKET BROKER MARKET, BY END USER

12.1 OVERVIEW

12.2 ENTERPRISES

12.2.1 ENTERPRISES, BY SIZE

12.2.1.1. SMALL & MEDIUM SIZE ENTERPRISES

12.2.1.2. LARGE SIZE ENTERPRISES

12.2.2 BY BANDWIDTH

12.2.2.1. 1 GBPS & 10 GBPS

12.2.2.2. 40 GBPS

12.2.2.3. 100 GBPS

12.3 SERVICE PROVIDERS

12.3.1 BY BANDWIDTH

12.3.1.1. 1 GBPS & 10 GBPS

12.3.1.2. 40 GBPS

12.3.1.3. 100 GBPS

12.4 GOVERNMENT ORGANIZATIONS

12.4.1 BY BANDWIDTH

12.4.1.1. 1 GBPS & 10 GBPS

12.4.1.2. 40 GBPS

12.4.1.3. 100 GBPS

12.5 OTHERS

13 GLOBAL NETWORK PACKET BROKER MARKET, BY GEOGRAPHY, (USD MILLION)

GLOBAL NETWORK PACKET BROKER MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

13.2 EUROPE

13.2.1 GERMANY

13.2.2 FRANCE

13.2.3 U.K.

13.2.4 ITALY

13.2.5 SPAIN

13.2.6 RUSSIA

13.2.7 TURKEY

13.2.8 BELGIUM

13.2.9 NETHERLANDS

13.2.10 SWITZERLAND

13.2.11 SWEDEN

13.2.12 POLAND

13.2.13 NORWAY

13.2.14 FINLAND

13.2.15 DENMARK

13.2.16 REST OF EUROPE

13.3 ASIA PACIFIC

13.3.1 JAPAN

13.3.2 CHINA

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 AUSTRALIA

13.3.6 SINGAPORE

13.3.7 THAILAND

13.3.8 MALAYSIA

13.3.9 INDONESIA

13.3.10 PHILIPPINES

13.3.11 TAIWAN

13.3.12 NEW ZEALAND

13.3.13 VIETNAM

13.3.14 REST OF ASIA PACIFIC

13.4 SOUTH AMERICA

13.4.1 BRAZIL

13.4.2 ARGENTINA

13.4.3 REST OF SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 EGYPT

13.5.3 SAUDI ARABIA

13.5.4 U.A.E

13.5.5 ISRAEL

13.5.6 OMAN

13.5.7 KUWAIT

13.5.8 QATAR

13.5.9 BAHRAIN

13.5.10 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL NETWORK PACKET BROKER MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

16 GLOBAL NETWORK PACKET BROKER MARKET - COMPANY PROFILE

16.1 CISCO SYSTEMS, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT UPDATES

16.2 FS.COM GMBH

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT UPDATES

16.3 EXTREME NETWORKS

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATES

16.4 KEYSIGHT TECHNOLOGIES

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 NOVIFLOW INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT UPDATES

16.6 INTEL CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 ARISTA NETWORKS, INC

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT UPDATES

16.8 PALO ALTO NETWORKS

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT UPDATES

16.9 NETSCOUT

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATES

16.1 MOBILEUM

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT UPDATES

16.11 PROFITAP HQ B.V

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT UPDATES

16.12 DATACOM SYSTEMS INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT UPDATES

16.13 CUBRO NETWORK VISIBILITY

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATES

16.14 NIAGARA NETWORKS (INTERFACE MASTERS TECHNOLOGIES, INC.)

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 CGS TOWER NETWORKS LTD

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT UPDATES

16.16 LARCH NETWORKS

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT UPDATES

16.17 GARLAND TECHNOLOGY

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT UPDATES

16.18 MICROTEL INNOVATION S.R.L (A PART OF CINETIX GROUP COMPANY)

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT UPDATES

16.19 GIGAMON (A PART OF ELLIOTT MANAGEMENT)

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 RELATED REPORTS

18 QUESTIONNAIRE

19 CONCLUSION

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Network Packet Broker Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Network Packet Broker Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Network Packet Broker Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.