Global Network Encryption Market

Market Size in

CAGR :

%

5.10

10.81

2024

2032

5.10

10.81

2024

2032

| 2025 –2032 | |

| USD 5.10 | |

| USD 10.81 | |

|

|

|

Network Encryption Market Size

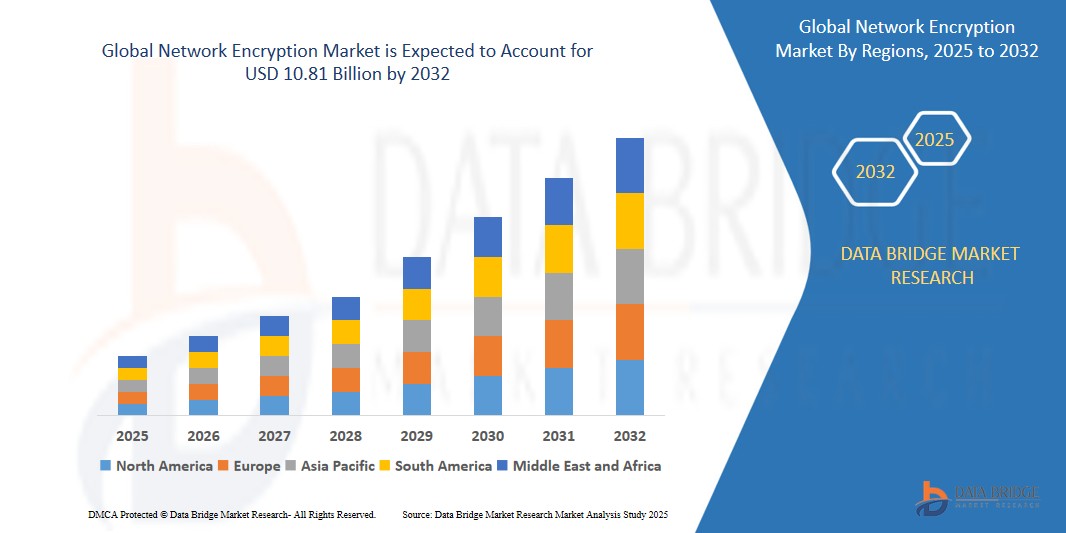

- The Global Network Encryption Market size was valued at USD 5.1 billion in 2024 and is expected to reach USD 10.81 billion by 2032, at a CAGR of 11.3% during the forecast period

- This growth is driven by factors such as the increasing demand for data security and privacy, along with the rise in cyber threats and regulatory compliance requirements.

Network Encryption Market Analysis

- Network encryption serves as the security boundary between multi-network communications. A collection of open IETF (Internet Engineering Task Force) standards, which are used in combination, are implemented through internet protocol security (IPSec) through various algorithms to create a framework for private communication over IP networks. IPSec works within the structure of the network, which ensures that end-users and applications do not need to be altered in any way.

- North America will dominate the network encryption market due to the increasing number of technological advancement along with various industries are focusing on deploying network encryption on their platform such as telecom and IT, media and entertainment, BFSI, and others

- Asia-Pacific region will expect to grow in the forecast period of 2025-2032 due to the increasing adoption of cloud technology among various organizations in the region.

- Optical Transmission segment is expected to dominate the market with a market share of 54.12% due to its ability to provide high-speed, secure, and scalable data transmission solutions.

Report Scope and Network Encryption Market Segmentation

|

Attributes |

Network Encryption Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Network Encryption Market Trends

“Integration of Post-Quantum Cryptography (PQC) Standards”

- As quantum computing advances, traditional encryption methods face potential obsolescence. In response, the U.S. National Institute of Standards and Technology (NIST) has formalized post-quantum cryptography (PQC) standards, including algorithms for key encapsulation and digital signatures, to secure systems against future quantum threats .

- Organizations like LGT Financial Services and NXP Semiconductors are already testing these new algorithms to replace current encryption methods . This proactive approach aims to safeguard data against the anticipated capabilities of quantum computers, ensuring long-term data security.

- For instance, In August 2024, IBM announced its Quantum Safe roadmap, integrating post-quantum cryptography (PQC) into its products, including IBM z16 and IBM Cloud. This initiative aims to secure data in transit and at rest, addressing the vulnerabilities introduced by quantum computing advancements. IBM's proactive approach underscores the growing need for robust network encryption solutions amidst the increasing adoption of cloud services and remote work

Network Encryption Market Dynamics

Driver

“Increasing Cybersecurity Threats and the Need for Robust Network Encryption”

- As digital transformation accelerates, organizations are increasingly vulnerable to cyber threats like data breaches, hacking, and identity theft. Cybercrime is becoming more sophisticated, and it is no longer just large corporations but also small and medium-sized enterprises (SMEs) that are under threat. The rise in cyber-attacks has made network encryption more critical than ever.

- Encrypting data transmitted across networks ensures that even if hackers intercept the information, they cannot read or misuse it. With the growing dependence on digital communication and cloud technologies, encryption has become a foundational element of any security strategy. Businesses and governments worldwide are heavily investing in network encryption solutions to protect sensitive data and maintain privacy in the face of evolving cyber threats.

For instance,

- In November 2024, Cisco Systems announced a significant upgrade to its encryption protocols across its networking solutions, specifically targeting the growing threat of cyberattacks. With the increase in data breaches globally, Cisco has integrated stronger encryption technologies into its cloud services to offer businesses enhanced security. This investment reflects the rising concern about cybersecurity, which is pushing companies to adopt stronger encryption measures. Cisco's move positions it as a leader in addressing the global demand for secure data transmission and protecting clients against emerging cyber threats.

Opportunity

“Surge in Cloud Adoption and Remote Work”

- The rapid shift towards cloud computing and the increase in remote work have significantly expanded the attack surface for organizations. With over 90% of organizations utilizing cloud services as of 2024, the need for robust network encryption has never been more critical. Cloud environments, by their nature, involve data transmission over public networks, making them susceptible to cyber threats.

- Network encryption solutions are essential in safeguarding data in transit and at rest, ensuring compliance with stringent data protection regulations like GDPR and HIPAA. Furthermore, the rise in remote work has led to a decentralized workforce, necessitating secure communication channels to protect sensitive information. This trend presents a substantial opportunity for network encryption providers to offer scalable and flexible solutions tailored to the evolving needs of businesses.

For instance,

- In August 2024, IBM announced its Quantum Safe roadmap, integrating post-quantum cryptography (PQC) into its products, including IBM z16 and IBM Cloud. This initiative aims to secure data in transit and at rest, addressing the vulnerabilities introduced by quantum computing advancements. IBM's proactive approach underscores the growing need for robust network encryption solutions amidst the increasing adoption of cloud services and remote work. By embedding PQC standards into their offerings, IBM is positioning itself as a leader in providing secure cloud environments, catering to businesses seeking to safeguard sensitive information against future quantum threats.

Restraint/Challenge

“High Implementation Costs”

- One of the key restraints affecting the global network encryption market is the high cost of implementation. Network encryption solutions often require significant investment in both hardware and software, which can be a financial burden, especially for small to medium-sized enterprises (SMEs). The process of upgrading existing infrastructure to support these encryption solutions can also incur additional costs, including training staff, hiring experts, and maintaining the systems.

- For many companies, this high initial investment can deter them from adopting advanced encryption technologies, despite the growing need for data protection and security. As a result, the reluctance to allocate significant resources for encryption solutions may limit the market's potential growth, especially in regions where businesses are more cost-sensitive.

For instance,

- In March 2024, XYZ Corp., a medium-sized enterprise in the financial sector, was exploring the adoption of network encryption to secure sensitive customer data. However, the company found the cost of implementing the necessary infrastructure and encryption solutions to be too high for its budget. The estimated expenses for both hardware and software upgrades were over $500,000, which included purchasing encryption software, upgrading servers, and training staff.

Network Encryption Market Scope

The market is segmented on the basis transmission type, component, deployment type, data range, organization size, and vertical.

|

Segmentation |

Sub-Segmentation |

|

Transmission type |

|

|

Component |

|

|

Deployment type |

|

|

Data range |

|

|

Organization size |

|

|

Vertical |

|

In 2025, the Optical Transmission is projected to dominate the market with a largest share in segment

In 2025, the optical transmission segment is projected to dominate the market with the largest share of 54.12%, driven by the increasing demand for high-speed, high-capacity data transmission across global networks. This growth is attributed to the advantages of optical transmission technologies, including faster data transfer rates, enhanced bandwidth capabilities, and lower latency, which are crucial to supporting the expanding requirements of cloud computing, data centers, and telecom networks. Additionally, optical transmission technologies are more efficient in handling the large volume of data generated by modern applications, further boosting their adoption and market share.

The Traditional Transmission is expected to account for the largest share during the forecast period in market

The traditional transmission segment is expected to account for the largest share of 49.83% during the forecast period in the market, primarily due to the widespread and established use of copper-based systems and other legacy technologies across various industries. Many businesses and telecom operators continue to rely on traditional transmission methods for their cost-effectiveness and existing infrastructure, especially in regions where upgrading to newer technologies like optical transmission is not yet fully feasible. The robustness, familiarity, and reliability of traditional transmission systems contribute to their continued dominance, even as newer solutions emerge

Network Encryption Market Regional Analysis

“North America Holds the Largest Share in the Network Encryption Market”

- North America holds the largest share in the network encryption market, driven by factors such as advanced technological infrastructure, increasing cyber threats, and stringent data protection regulations. The region's businesses, particularly in industries like finance, healthcare, and government, are highly focused on safeguarding sensitive data from escalating cyberattacks.

- Additionally, the growing adoption of cloud services and the need for secure data transmission contribute significantly to the demand for network encryption solutions. The presence of key players in the cybersecurity industry and strong government support for cybersecurity initiatives further solidifies North America's position as the market leader.

- This combination of factors ensures that North America remains the largest and most rapidly growing market for network encryption technologies.

“Asia-Pacific is Projected to Register the Highest CAGR in the Network Encryption Market”

- Asia-Pacific is projected to register the highest CAGR in the network encryption market, fueled by rapid digital transformation, increasing internet penetration, and a growing reliance on cloud-based services across the region. As more businesses in countries like China, India, Japan, and Southeast Asia adopt digital technologies, the demand for robust cybersecurity measures, including network encryption, has surged.

- Additionally, the rise in cyber threats, coupled with tightening data protection regulations, is pushing enterprises to invest in stronger encryption solutions to safeguard sensitive information. The region's rapid industrialization, coupled with expanding e-commerce and financial sectors, further drives the need for secure and reliable data transmission. These factors combined with relatively low adoption rates in some markets make Asia-Pacific a key growth driver for the network encryption market in the coming years.

Network Encryption Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cisco;

- Juniper Networks, Inc.;

- NOKIA.;

- Thales.;

- Atos SE;

- Ciena Corporation.;

- Rohde & Schwarz;

- ADVA Optical Networking;

- Colt Technology Services Group Limited;

- Huawei Technologies Co., Ltd.;

- Hewlett Packard Enterprise Development LP;

- F5, Inc.;

- ECI Telecom;

- Senetas Corporation Limited.;

- Viasat, Inc.;

- Raytheon Technologies.;

- Quantum Xchange.;

- Technical Communications Corporation;

- ARRIS Group, Inc.;

- atmedia GmbH;

- Securosys SA.;

- PacketLight Networks;

- CERTES NETWORKS, INC

Latest Developments in Global Network Encryption Market

- In January 2025, Cisco announced the launch of its new network encryption platform designed to strengthen data security across cloud and enterprise networks. This platform integrates advanced encryption capabilities with real-time monitoring and analytics tools, providing businesses with enhanced protection against cyber threats while ensuring seamless performance. Cisco aims to meet the increasing demand for robust security measures in both traditional and hybrid cloud environments. The new platform also supports high-bandwidth data transmission, which is crucial for industries like finance, healthcare, and telecommunications, where data integrity is paramount.

- In February 2025, Juniper Networks introduced its "QuantumShield" encryption technology, a next-gen solution for securing high-speed networks in enterprise and carrier environments. This solution is built to handle the growing demand for encrypted traffic in large-scale deployments, offering both data confidentiality and network performance optimization. The QuantumShield technology incorporates advanced key management and offers seamless integration with existing network infrastructures. Juniper's innovation aims to address the increasing concerns about cyber threats, ensuring that customers can securely transmit data without compromising network speed.

- In March 2025, Nokia unveiled its enhanced optical encryption solution, designed to secure the transmission of sensitive data across global telecom networks. The solution leverages the latest advancements in optical technology to provide high-capacity encryption without affecting network performance. By incorporating AI-driven threat detection and prevention, Nokia aims to help telecom operators meet stringent regulatory requirements for data protection, while enhancing their ability to manage and scale their network infrastructures. This innovation positions Nokia as a key player in the evolving network encryption market.

- In April 2025, Thales launched its "SecureNet" platform, a comprehensive solution aimed at securing critical network infrastructures for government and enterprise clients. SecureNet integrates multi-layer encryption techniques and advanced cryptographic algorithms to provide end-to-end security for sensitive communications. This solution is designed to protect against evolving cyber threats, such as man-in-the-middle attacks, which are increasingly common in today's interconnected world. With growing concerns over data breaches and regulatory compliance, Thales' new platform offers a reliable way to secure data in transit.

- In May 2025, Atos announced its partnership with leading cloud service providers to offer end-to-end network encryption solutions for hybrid cloud environments. The collaboration focuses on delivering encrypted data services across public and private clouds, ensuring that businesses can maintain secure data storage and transmission in multi-cloud setups. Atos' solution includes advanced key management protocols and automated compliance reporting tools to meet international data protection standards. This development is expected to support businesses in various sectors, including finance, healthcare, and retail, which are increasingly adopting hybrid cloud strategies.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.