Global Natural Sweetener Candies Market

Market Size in USD Billion

CAGR :

%

USD

19.25 Billion

USD

45.02 Billion

2024

2032

USD

19.25 Billion

USD

45.02 Billion

2024

2032

| 2025 –2032 | |

| USD 19.25 Billion | |

| USD 45.02 Billion | |

|

|

|

|

Natural Sweetener Candies Market Size

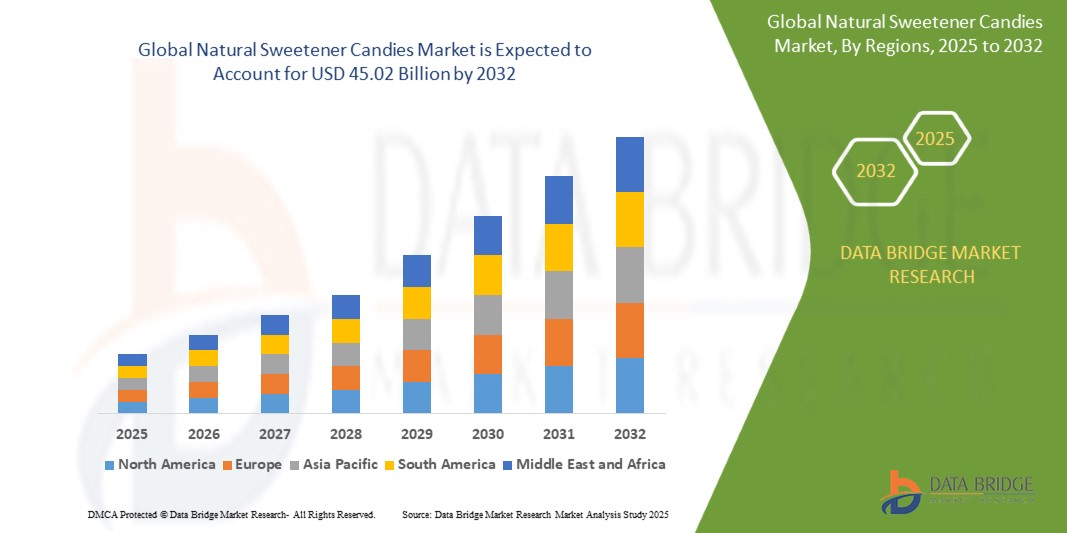

- The global natural sweetener candies market size was valued at USD 19.25 billion in 2024 and is expected to reach USD 45.02 billion by 2032, at a CAGR of 11.20% during the forecast period

- The market growth is largely fuelled by the increasing consumer preference for healthier alternatives to traditional sugar-based products, rising awareness about lifestyle-related diseases such as diabetes and obesity, and the expanding availability of naturally sweetened confectionery options across retail and online platforms

- In addition, the surge in demand for plant-based, vegan, and allergen-free candies is further encouraging manufacturers to incorporate natural sweeteners, catering to a broader demographic focused on clean-label, transparent ingredient offerings

Natural Sweetener Candies Market Analysis

- The demand for natural sweetener candies is witnessing strong momentum as consumers shift toward clean-label products and scrutinize ingredients in packaged foods. Plant-based sweeteners such as stevia, monk fruit, and erythritol are gaining popularity due to their low glycemic index and perceived health benefits

- Market players are focusing on reformulating traditional candy products using natural alternatives to attract health-conscious consumers without compromising taste or texture. The growing trend of sugar reduction across the food industry is also pushing innovation in the natural candy segment

- North America dominated the natural sweetener candies market with the largest revenue share in 2024, driven by rising health consciousness and increased demand for low-sugar and sugar-free confectionery options

- Asia-Pacific region is expected to witness the highest growth rate in the global natural sweetener candies market, driven by government-led sugar reduction initiatives, expanding middle-class population, and increasing consumer inclination toward functional, low-calorie snacks incorporating natural sweeteners such as monk fruit and stevia

- The non-chocolate candy segment held the largest market revenue share in 2024, driven by the widespread availability of fruit-based chews, mints, and hard candies formulated with natural sweeteners. Consumers are increasingly drawn to non-chocolate options due to their perceived lighter profiles, sugar-free positioning, and broader flavor variety. These products often utilize stevia, monk fruit, or erythritol to cater to diabetic and calorie-conscious individuals seeking healthier indulgence

Report Scope and Natural Sweetener Candies Market Segmentation

|

Attributes |

Natural Sweetener Candies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Natural Sweetener Candies Market Trends

“Growing Preference for Plant-Based Sweeteners in Confectionery”

- Consumers are increasingly moving toward natural, plant-derived sweeteners such as stevia, monk fruit, and erythritol due to growing health concerns over artificial ingredients

- Clean-label awareness is driving demand for simpler ingredient lists, pushing manufacturers to switch to recognizable, naturally sourced sweeteners

- The rise in vegan, keto, and diabetic-friendly diets is reinforcing the appeal of plant-based sweetened candies among health-conscious populations

- Innovation in extraction and blending techniques is helping reduce the bitter aftertaste associated with plant-based sweeteners, improving product acceptance

- For instance, Brands such as SmartSweets have seen success in North America with their stevia-sweetened gummy candies, targeting both calorie-conscious and diabetic consumers

Natural Sweetener Candies Market Dynamics

Driver

“Rising Health Consciousness and Sugar Reduction Efforts”

- Increasing awareness of health issues such as obesity, diabetes, and cardiovascular disease is encouraging consumers to reduce sugar intake

- Governments are implementing sugar taxes and front-of-pack labeling systems that incentivize manufacturers to reformulate with healthier alternatives

- Natural sweeteners help retain sweetness while significantly lowering calorie and carbohydrate content, appealing to a wide demographic

- Fitness and wellness trends are pushing demand for "better-for-you" indulgence, including candies with natural, low-glycemic sweeteners

- For instance, In the U.K., the introduction of a sugar tax has led to a reformulation of popular confections, with companies incorporating stevia and monk fruit to maintain market competitiveness

Restraint/Challenge

“Taste and Texture Limitations of Natural Sweeteners”

- Natural sweeteners such as stevia and monk fruit can leave bitter or metallic aftertastes, which may not align with mainstream flavor expectations

- Unlike sugar, these alternatives often lack the bulk, mouthfeel, and caramelization properties needed in various candy types

- Reformulating for taste and texture using natural sweeteners demands extensive R&D, driving up production costs for manufacturers

- Consumer skepticism still lingers around some natural sweeteners, with misperceptions that they are less enjoyable or still "processed"

- For instance, Some early stevia-sweetened candies received criticism on online retail platforms for their aftertaste, prompting companies such as Hershey to invest in improved stevia formulations and masking techniques

Natural Sweetener Candies Market Scope

The market is segmented on the basis of product type, distribution channel, and end-user.

• By Product Type

On the basis of product type, the natural sweetener candies market is segmented into chocolate candy and non-chocolate candy. The non-chocolate candy segment held the largest market revenue share in 2024, driven by the widespread availability of fruit-based chews, mints, and hard candies formulated with natural sweeteners. Consumers are increasingly drawn to non-chocolate options due to their perceived lighter profiles, sugar-free positioning, and broader flavor variety. These products often utilize stevia, monk fruit, or erythritol to cater to diabetic and calorie-conscious individuals seeking healthier indulgence.

The chocolate candy segment is expected to witness at the fastest growth rate from 2025 to 2032, fueled by innovation in sugar-free and plant-based chocolate formulations. As consumers demand clean-label confections, manufacturers are increasingly introducing chocolates made with natural sweeteners that offer both taste and wellness benefits. The growing popularity of vegan and keto-friendly chocolates is also supporting this segment’s rapid growth.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into supermarkets and hypermarkets, convenience stores, retailers, online retail, and others. Supermarkets and hypermarkets accounted for the largest market revenue share in 2024, owing to their wide product assortment, in-store promotions, and consumer trust in branded outlets. These channels continue to be a primary source for health-oriented shoppers exploring natural candy alternatives.

Online retail is expected to witness at the fastest growth rate from 2025 to 2032, driven by the rise of e-commerce platforms, subscription models, and direct-to-consumer (DTC) strategies. Digital platforms provide consumers with convenient access to niche and specialty brands that offer naturally sweetened candies, particularly in regions with limited in-store availability.

• By End-User

On the basis of end-user, the natural sweetener candies market is segmented into food and beverages, direct sales, and others. The food and beverages segment dominated the market in 2024, supported by strong demand from retailers and private labels seeking to enhance their natural snack and treat portfolios. These candies are increasingly featured in wellness-oriented product lines and used as ingredients or accompaniments in health-focused food products.

The direct sales segment is expected to witness at the fastest growth rate from 2025 to 2032, boosted by increasing consumer demand for customizable, functional confectionery. Health and wellness companies are leveraging direct sales models to promote naturally sweetened candies as part of sugar-reduction programs or personalized nutrition kits, aligning with individual dietary needs and preferences.

Natural Sweetener Candies Market Regional Analysis

- North America dominated the natural sweetener candies market with the largest revenue share in 2024, driven by rising health consciousness and increased demand for low-sugar and sugar-free confectionery options

- Consumers in the region are showing a growing preference for clean-label products made with stevia, monk fruit, and other natural sweeteners, as they aim to reduce sugar intake without sacrificing taste

- The expanding vegan, keto, and diabetic population across the region is further propelling the adoption of naturally sweetened candies across both specialty and mainstream retail outlets

U.S. Natural Sweetener Candies Market Insight

The U.S. natural sweetener candies market accounted for the largest revenue share within North America in 2024, supported by the increasing adoption of plant-based and reduced-sugar snacks. Rising rates of obesity and diabetes have encouraged consumers to turn toward healthier indulgence options. Additionally, the robust presence of natural and organic candy brands, growing popularity of e-commerce, and increased availability of such products in health-focused supermarket chains have further contributed to the market’s expansion.

Europe Natural Sweetener Candies Market Insight

The Europe natural sweetener candies market is expected to witness at the fastest growth rate from 2025 to 2032, driven by supportive regulatory initiatives limiting sugar content in food products. Consumer preferences across countries such as Germany, France, and the U.K. are increasingly shifting toward low-calorie, natural sweetener-based alternatives. The market is also benefiting from a rising number of confectionery manufacturers investing in reformulating classic treats using natural ingredients.

U.K. Natural Sweetener Candies Market Insight

The U.K. natural sweetener candies market is expected to witness at the fastest growth rate from 2025 to 2032, influenced by increasing public health campaigns against excessive sugar consumption and a growing demand for functional confections. Health-conscious consumers are opting for candies made with stevia and erythritol, especially in urban areas. The expansion of health-focused retail formats and greater label transparency requirements are further encouraging the adoption of naturally sweetened candy products.

Germany Natural Sweetener Candies Market Insight

The Germany natural sweetener candies market is expected to witness at the fastest growth rate from 2025 to 2032, fueled by the country’s strong demand for organic, sustainable, and reduced-sugar products. German consumers are highly responsive to ingredient transparency and product origin, driving the success of brands that offer clean-label, naturally sweetened confections. Additionally, an increase in diabetic-friendly product lines and environmentally conscious packaging is reinforcing market penetration.

Asia-Pacific Natural Sweetener Candies Market Insight

The Asia-Pacific natural sweetener candies market is expected to witness at the fastest growth rate from 2025 to 2032, supported by rising disposable incomes, urbanization, and increasing awareness of diet-related health issues. Countries such as China, India, and Japan are experiencing a significant shift in consumer behavior toward low-sugar, functional, and plant-based food products. Government initiatives to reduce sugar consumption and local production of natural sweeteners are making naturally sweetened candies more accessible across price ranges.

Japan Natural Sweetener Candies Market Insight

The Japan natural sweetener candies market is expected to witness at the fastest growth rate from 2025 to 2032 due to increasing demand for health-oriented snacks and innovations in sugar alternatives. With a rapidly aging population, Japanese consumers are actively seeking confections that are both tasty and low in sugar, often favoring those sweetened with monk fruit or rare sugars. The country’s leading food manufacturers are launching functional candy products targeting digestive health, energy support, and weight management.

China Natural Sweetener Candies Market Insight

The China natural sweetener candies market captured the largest revenue share in the Asia-Pacific region in 2024, driven by a growing middle class, strong domestic production of natural sweeteners, and changing dietary preferences. Chinese consumers are increasingly favoring sugar-free candies, especially in urban areas where health and wellness trends are gaining momentum. The market is also supported by the presence of both global and local confectionery players launching naturally sweetened product lines to tap into this rising demand.

Natural Sweetener Candies Market Share

The Natural Sweetener Candies industry is primarily led by well-established companies, including:

- Nana's Cookie Company (U.S.)

- YummyEarth, Inc. (U.S.)

- JJ's Sweets (U.S.)

- HailMerry (U.S.)

- Ice Chips Candy LLC (U.S.)

- Wholesome Sweeteners Inc. (U.S.)

- Amore Di Mona (U.S.)

- Orkla (Norway)

- Nutiva Inc. (U.S.)

- Dr. John's Healthy Sweets LLC (U.S.)

Latest Developments in Global Natural Sweetener Candies Market

- In July 2024, During IFT First 2024, NutraEx unveiled L-arabinose, a pioneering "sugar blocker" that helps inhibit sugar absorption in the body. This innovative product comes in response to the rising incidence of chronic conditions such as diabetes and obesity, highlighting the increasing consumer demand for sugar-free alternatives. NutraEx's emphasis on L-arabinose positions it as a vital solution for those seeking healthier lifestyle choices without sacrificing flavor

- In March 2022, Cargill's leading stevia sweetener, EverSweet, achieved significant commercial success thanks to its ClearFlo technology platform. This innovative integration allows EverSweet to blend effortlessly with various natural flavors, providing several enhancements, such as flavor modification, improved solubility, and greater stability in food formulations. As a result, EverSweet has become a go-to choice for manufacturers seeking versatile, high-quality sweetening solutions that meet consumer preferences

- In January 2022. Sweet Harvest Foods, a leading honey packer in North America, strategically expanded its U.S. market presence by acquiring Nature Nate’s Honey Co. This acquisition not only enhances Sweet Harvest's product offerings but also solidifies its position in the natural sweetener segment. The merger aims to deliver a wider range of high-quality honey products, responding to the increasing consumer demand for authentic and pure honey

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Natural Sweetener Candies Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Natural Sweetener Candies Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Natural Sweetener Candies Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.