Global Natural Rubber Market

Market Size in USD Billion

CAGR :

%

USD

18.30 Billion

USD

26.12 Billion

2024

2032

USD

18.30 Billion

USD

26.12 Billion

2024

2032

| 2025 –2032 | |

| USD 18.30 Billion | |

| USD 26.12 Billion | |

|

|

|

|

Natural Rubber Market Analysis

The global natural rubber market is experiencing steady growth, driven by increasing demand from key industries such as automotive, healthcare, and manufacturing. The Asia-Pacific region dominates the market, with Thailand, Indonesia, and Malaysia being the largest producers and suppliers of natural rubber. Meanwhile, North America is projected to witness the fastest growth due to rising demand from the automotive sector and advancements in rubber processing technologies. Innovations such as bio-based rubber production, improved tapping techniques, and the development of high-performance rubber composites are enhancing efficiency and sustainability in the industry. In addition, the healthcare sector's growing reliance on natural rubber-based medical gloves and latex products is further fueling demand. Rising environmental concerns are prompting manufacturers to adopt eco-friendly processing methods and explore alternatives such as genetically modified rubber trees for higher yield. However, challenges such as fluctuating raw material prices, climate change effects on rubber plantations, and synthetic rubber competition remain key restraints. Despite these hurdles, continuous research, technological advancements, and expanding applications in industrial and consumer goods sectors are expected to sustain market growth in the coming years.

Natural Rubber Market Size

The global natural rubber market size was valued at USD 18.30 billion in 2024 and is projected to reach USD 26.12 billion by 2032, with a CAGR of 4.55 % during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Natural Rubber Market Trends

“Increasing Shift toward Sustainable and Bio-Based Rubber Production”

One significant trend in the natural rubber market is the shift toward sustainable and bio-based rubber production to reduce environmental impact and meet growing eco-conscious consumer demands. With increasing concerns over deforestation and carbon emissions, companies are investing in sustainable rubber plantations and adopting environment-friendly processing techniques. For instance, major industry players such as Michelin have initiated the "Zero Deforestation" policy, ensuring ethical sourcing and responsible cultivation. In addition, advancements in genetically modified (GM) rubber trees are improving yield and disease resistance, reducing dependency on traditional plantations. The rise of recycled and reclaimed rubber is also gaining momentum, particularly in the automotive and footwear industries, as brands seek circular economy solutions. These sustainable innovations are enhancing natural rubber market growth and helping industries comply with stringent environmental regulations, making eco-friendly rubber a key driver for the future of rubber manufacturing and industrial applications.

Report Scope and Natural Rubber Market Segmentation

|

Attributes |

Natural Rubber Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Sri Trang Agro-Industry Plc (Thailand), Ceyenar (India), CHINA HAINAN RUBBER INDUSTRY GROUP CO., LTD. (China), Southland Rubber (Thailand), KA-Glove (Malaysia), Thai Hua (2511) Co., Ltd. (Thailand), Von Bundit Co., Ltd. (Thailand), THAI RUBBER LATEX GROUP PUBLIC COMPANY LIMITED (Thailand), Goodyear Rubber Company of Southern California (U.S.), Duratuf Products Pvt. Ltd. (India), Rolex Reclaim Pvt. Ltd. (India), Kent Elastomer Products (U.S.), PT. Bakrie Sumatera Plantations tbk (Indonesia), Unitex Rubber Co., Ltd. (Thailand), HALCYON AGRI (Singapore), Bridgestone Corporation (Japan), SINOCHEM GROUP CO., LTD. (China), Firestone Liberia, LLC (Liberia), and PT. Indolatex Jaya Abadi (Indonesia) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Natural Rubber Market Definition

Natural rubber is an elastic, polymeric material obtained from the latex of rubber trees, primarily Hevea brasiliensis. It is composed mainly of polyisoprene, a natural hydrocarbon polymer, and is valued for its high elasticity, durability, and resistance to wear and tear.

Natural Rubber Market Dynamics

Drivers

- Growing Automotive Industry

The automotive industry is one of the largest consumers of natural rubber, with tires, seals, and gaskets being essential components in vehicle manufacturing. The increasing global demand for automobiles, particularly in emerging economies such as India, China, and Brazil, is driving the growth of the natural rubber market. In addition, the rise of electric vehicles (EVs) has further intensified the need for high-performance rubber tires that offer better durability and efficiency. Companies such as Bridgestone and Michelin are investing in advanced rubber compounds to enhance tire performance, fuel efficiency, and environmental sustainability. With governments worldwide pushing for EV adoption and setting strict emission regulations, the demand for lightweight, high-durability rubber components is expected to grow significantly. This increasing reliance on natural rubber in automotive applications positions the sector as a key driver for market expansion.

- Increasing Demand in Healthcare

The healthcare industry heavily depends on natural rubber for the production of medical gloves, catheters, surgical instruments, and tubing, owing to its flexibility, biocompatibility, and high tensile strength. The COVID-19 pandemic significantly amplified the demand for latex-based gloves and PPE kits, and the emphasis on hygiene and infection control continues to drive long-term market growth. Countries such as the U.S., Germany, and Japan have expanded their production capacities for medical-grade rubber products to meet the increasing need in hospitals and laboratories. In addition, companies such as Sri Trang Agro-Industry and Top Glove are focusing on sustainable and biodegradable latex alternatives to address environmental concerns. As healthcare regulations tighten and the global population ages, the demand for natural rubber-based medical products is expected to surge, reinforcing the healthcare industry as a critical growth driver for the natural rubber market.

Opportunities

- Rising Eco-Friendly and Sustainable Practices

The increasing emphasis on sustainability and environmental responsibility is creating significant opportunities in the natural rubber market. With rising concerns over deforestation, carbon emissions, and unsustainable rubber plantations, many companies are shifting toward eco-friendly rubber production. Initiatives such as Michelin’s "Zero Deforestation" policy and the Global Platform for Sustainable Natural Rubber (GPSNR) are promoting responsible rubber sourcing. In addition, advancements in biodegradable and recycled rubber are opening new avenues for growth, particularly in industries such as automotive and footwear, where sustainability is becoming a key purchasing factor. For instance, companies such as Continental and Pirelli are investing in bio-based rubber and recycled tire technology, reducing dependency on virgin rubber while minimizing environmental impact. As regulatory frameworks tighten and consumers demand green alternatives, the adoption of sustainable natural rubber is expected to rise, positioning eco-friendly practices as a major market opportunity for manufacturers.

- Increasing Advancements in Rubber Processing Technologies

Technological advancements in rubber processing are revolutionizing the natural rubber industry, enhancing efficiency, durability, and sustainability. Innovations such as genetically modified (GM) rubber trees are improving latex yield and disease resistance, addressing supply chain challenges in major rubber-producing regions such as Thailand, Indonesia, and Malaysia. In addition, advancements in liquid-phase processing, eco-friendly vulcanization, and nanotechnology are enhancing the quality and performance of natural rubber. For instance, Bridgestone and Goodyear are exploring silica-infused rubber compounds to improve tire grip and longevity while reducing rolling resistance for better fuel efficiency. The development of synthetic bio-rubber alternatives, such as rubber derived from dandelions (Taraxacum kok-saghyz), is also gaining traction as a sustainable substitute. These innovations present lucrative opportunities for manufacturers to improve production efficiency, reduce waste, and develop high-performance rubber products, making technological progress a key growth driver in the natural rubber market.

Restraints/Challenges

- Competition from Synthetic Rubber

One of the biggest challenges in the natural rubber market is the growing competition from synthetic rubber. Synthetic rubber, primarily derived from petroleum-based materials such as styrene-butadiene rubber (SBR) and polybutadiene rubber (BR), offers consistent quality, better resistance to wear and tear, and lower production costs. Industries such as automotive, aerospace, and manufacturing often prefer synthetic rubber due to its stability in extreme temperatures and ability to be customized for specific applications. For instance, major tire manufacturers, including Michelin and Bridgestone, have increasingly incorporated synthetic rubber into their products to maintain cost efficiency and durability. In addition, fluctuations in natural rubber supply, driven by weather conditions or diseases affecting rubber trees, make synthetic alternatives more attractive. If technological advancements continue improving the performance of synthetic rubber while reducing environmental concerns, it could significantly impact the demand for natural rubber, creating a long-term market challenge.

- Government Regulations and Trade Policies

Strict government regulations and shifting trade policies present a significant challenge to the natural rubber market. Many countries impose environmental restrictions on rubber plantations due to concerns about deforestation, water consumption, and biodiversity loss. For instance, the European Union has introduced stringent sustainability regulations that require natural rubber suppliers to meet specific environmental and social compliance standards before exporting. In addition, trade policies, such as export restrictions imposed by major rubber-producing countries such as Thailand and Indonesia, can disrupt global supply chains and cause price fluctuations. For instance, in 2019, Thailand, Indonesia, and Malaysia collectively reduced rubber exports under the International Tripartite Rubber Council (ITRC) agreement to stabilize global rubber prices. Such policies can create uncertainties for manufacturers relying on natural rubber, making long-term planning and investment more challenging.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Natural Rubber Market Scope

The market is segmented on the basis of type and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- RSS Grade

- Latex Concentrate

- Solid Block Rubber

- Others

Application

- Auto-Tire Sector

- Gloves

- Footwear

- Latex Products

- Others

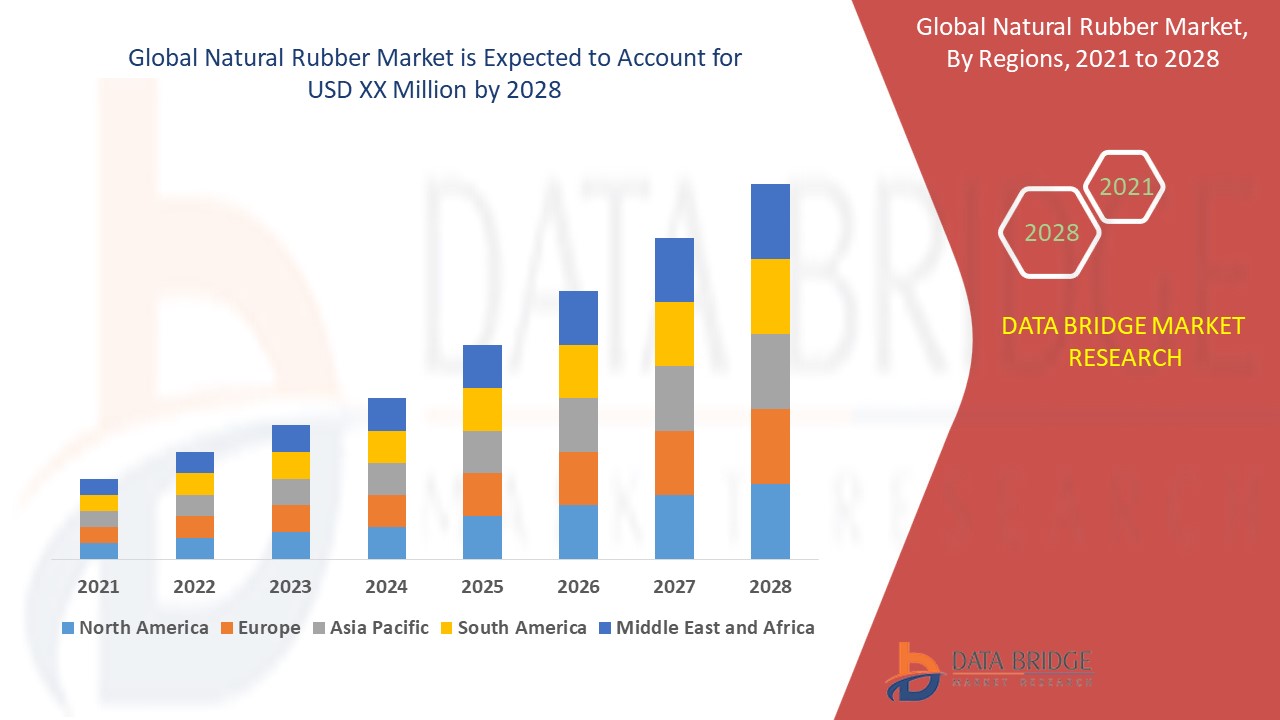

Natural Rubber Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the natural rubber market and is expected to maintain its dominance throughout the forecast period. Thailand, Indonesia, and Malaysia will be the key contributors, as they are the primary global suppliers of natural rubber. The growing use of natural rubber-based products, such as medical gloves in the healthcare sector, will further drive market growth. In addition, the rising demand from the automotive industry will contribute to the increasing market value of natural rubber.

North America is projected to experience the fastest growth in the natural rubber market during the forecast period. This surge can be attributed to the rising demand from the automotive sector, increasing usage in medical and industrial applications, and advancements in rubber processing technologies. In addition, the region's focus on sustainable and eco-friendly materials is driving interest in natural rubber alternatives. Strong investments in research and development, along with expanding manufacturing capabilities, will further support market growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Natural Rubber Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Natural Rubber Market Leaders Operating in the Market Are:

- Sri Trang Agro-Industry Plc (Thailand)

- Ceyenar (India)

- CHINA HAINAN RUBBER INDUSTRY GROUP CO., LTD. (China)

- Southland Rubber (Thailand)

- KA-Glove (Malaysia)

- Thai Hua (2511) Co., Ltd. (Thailand)

- Von Bundit Co., Ltd. (Thailand)

- THAI RUBBER LATEX GROUP PUBLIC COMPANY LIMITED (Thailand)

- Goodyear Rubber Company of Southern California (U.S.)

- Duratuf Products Pvt. Ltd. (India)

- Rolex Reclaim Pvt. Ltd. (India)

- Kent Elastomer Products (U.S.)

- PT. Bakrie Sumatera Plantations tbk (Indonesia)

- Unitex Rubber Co., Ltd. (Thailand)

- HALCYON AGRI (Singapore)

- Bridgestone Corporation (Japan)

- SINOCHEM GROUP CO., LTD. (China)

- Firestone Liberia, LLC (Liberia)

- PT. Indolatex Jaya Abadi (Indonesia)

Latest Developments in Natural Rubber Market

- In July 2023, Sumitomo Rubber Group introduced a risk assessment tool in Singapore to promote sustainable natural rubber procurement. This tool covers ten natural rubber-producing countries, including key procurement regions

- In November 2022, the Rubber Industries Smallholders Development Authority (RISDA) allocated USD 111 million for rubber replanting in Malaysia. The funding also aims to enhance productivity, marketing, new product initiatives, and entrepreneurship programs to boost rubber production

- In October 2022, Bridgestone Corporation expanded its rubber plantations in Southeast Asia with an investment of USD 26.7 million. This investment ensures a sustainable supply of natural rubber for tire production

- In April 2022, The Goodyear Tire & Rubber Company announced a multi-year, multi-million-dollar initiative in collaboration with the U.S. Department of Defense (DoD), the Air Force Research Lab (AFRL), and BioMADE. This program supports Ohio-based Farmed Materials in developing a domestic source of natural rubber from a specific species of dandelion

- In May 2021, The BMW Group India announced its plan to equip vehicles with tires made from certified sustainable natural rubber. This initiative promotes the wider adoption of natural rubber in tire manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Natural Rubber Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Natural Rubber Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Natural Rubber Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.