Global Natural Gas Engine Market

Market Size in USD Billion

CAGR :

%

USD

5.56 Billion

USD

8.28 Billion

2024

2032

USD

5.56 Billion

USD

8.28 Billion

2024

2032

| 2025 –2032 | |

| USD 5.56 Billion | |

| USD 8.28 Billion | |

|

|

|

|

Natural Gas Engine Market Size

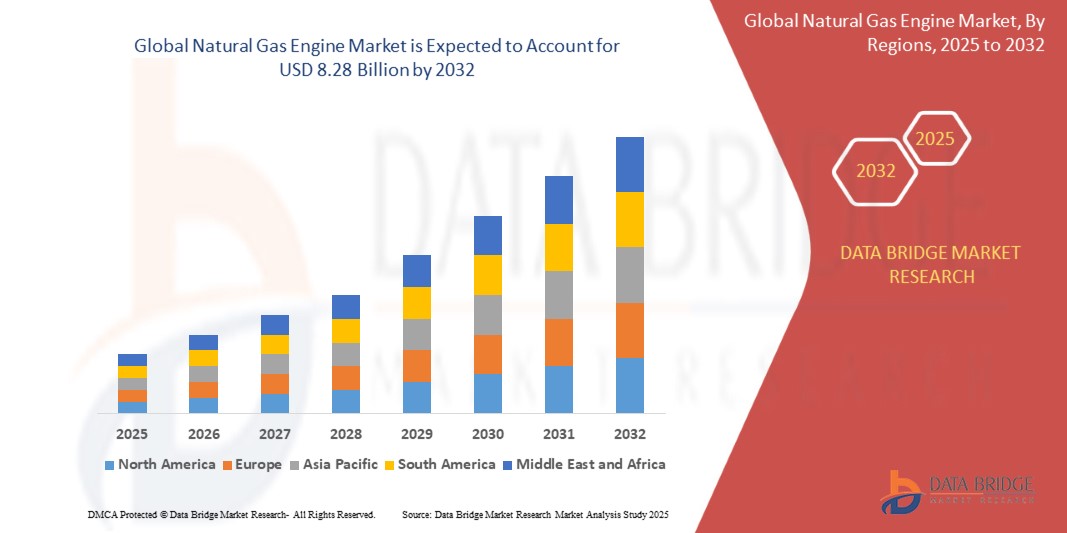

- The global natural gas engine market was valued at USD 5.56 billion in 2024 and is expected to reach USD 8.28 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.10%, primarily driven by the increasing adoption of natural gas engines in various applications, including power generation, transportation, and industrial machinery

- This growth is driven by factors such as the aging population, increasing prevalence of eye diseases, and advancements in ophthalmic technology

Natural Gas Engine Market Analysis

- Continuous improvements in natural gas engine technology have enhanced efficiency and performance, attracting increased adoption across various sectors

- Natural gas engines emit fewer pollutants compared to traditional fossil fuels, aligning with global efforts to reduce greenhouse gas emissions These engines are utilized in multiple sectors, including power generation, transportation, and industrial processes, demonstrating their versatility and broad market appeal

- The market features a competitive landscape with key players such as Caterpillar, Wärtsilä, Rolls-Royce, and Siemens, all striving to innovate and capture market share

- For Instance, In March 2023, Mitsubishi Heavy Industries Engine & Turbocharger introduced the SGP M2000 natural gas engine cogeneration system, offering a 2000 kW output and an electrical efficiency of 44.3%. This innovation exemplifies the industry's commitment to reducing CO2 emissions and enhancing energy efficiency

Report Scope and Natural Gas Engine Market Segmentation

|

Attributes |

Natural Gas Engine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Natural Gas Engine Market Trends

“Technological Advancements in Engine Efficiency:”

- One of the key technological advancements in natural gas engines is the integration of turbocharging systems, which enhance the overall efficiency and performance of the engine by forcing more air into the combustion chamber. This results in better fuel utilization and improved power output, making natural gas engines more cost-effective and efficient

- For instance, companies such as Cummins are focusing on turbocharging systems to improve engine performance while reducing emissions

- The implementation of advanced electronic control systems allows for precise monitoring and regulation of the engine’s performance. These systems optimize fuel consumption and emissions, making natural gas engines more efficient

- For Instance, companies such as General Electric are incorporating these systems to help their natural gas engines achieve higher efficiency levels while ensuring reduced operational costs

- The demand for cleaner engines has led to innovations such as selective catalytic reduction (SCR) and exhaust gas recirculation (EGR) systems, which reduce nitrogen oxide (NOx) emissions. These systems are being integrated into natural gas engines to meet stringent emission regulations

- Hybrid and dual-fuel technologies are enhancing the fuel efficiency of natural gas engines. These systems allow engines to switch between different fuels (such as natural gas and diesel) based on availability and cost, improving operational flexibility and efficiency. MAN Energy Solutions has developed dual-fuel engines that help optimize fuel consumption and reduce operational costs for power plants and transportation

- Manufacturers are investing heavily in improving the fuel efficiency of natural gas engines while focusing on reducing their carbon footprint. Advanced combustion technologies, including low-load optimization and high-efficiency turbochargers, are enabling engines to consume less fuel while producing more power

Natural Gas Engine Market Dynamics

Driver

“Increasing Demand for Cleaner Energy Solutions”

- Governments worldwide are implementing stringent environmental regulations to reduce greenhouse gas emissions. Natural gas engines produce fewer pollutants compared to traditional fossil fuels, making them an attractive option for industries aiming to comply with these regulations

- The global shift towards cleaner energy sources is driving the adoption of natural gas engines. Natural gas serves as a lower-carbon alternative to coal and oil, providing a bridge towards more sustainable energy solutions

- As industries expand, the demand for reliable and efficient power generation increases. Natural gas engines offer a viable solution, providing consistent energy for manufacturing and other industrial processes

- The transportation industry is transitioning towards natural gas-powered vehicles to reduce emissions and fuel costs. This shift is evident in regions such as China, where LNG-powered trucks have gained significant market share

Opportunity

“Integration with Renewable Energy Sources”

- Integrating natural gas engines with renewable energy sources, such as solar and wind, offers a promising opportunity. This hybrid approach ensures a stable power supply, balancing the intermittency of renewable energy

- Natural gas engines are well-suited for distributed power generation, providing localized energy solutions that enhance grid resilience and reduce transmission losses

- The adoption of microgrids and combined heat and power systems powered by natural gas engines is increasing, offering efficient and reliable energy solutions for both urban and remote areas

- Combining natural gas engines with energy storage technologies, such as batteries, creates flexible and resilient power systems, optimizing energy use and supporting grid stability

Restraint/Challenge

“High Initial Investment Costs”

- Establishing the necessary infrastructure for natural gas engines, including refueling stations and distribution networks, requires significant initial investments, which can be a barrier for widespread adoption

- The procurement and installation of natural gas engines involve substantial upfront expenses, which may deter businesses, especially small and medium-sized enterprises, from transitioning to natural gas solutions

- The high initial costs associated with natural gas engines can pose challenges for businesses in financial planning and budgeting, potentially delaying investment decisions

- Businesses may question the economic benefits of transitioning to natural gas engines due to the significant initial investments required, especially if the return on investment is uncertain or slow to materialize

Natural Gas Engine Market Scope

The market is segmented on the basis engine family, power output, horsepower, application, and end-use.

|

Segmentation |

Sub-Segmentation |

|

By Engine Family |

|

|

By Power Output |

|

|

By Horsepower |

|

|

By Application |

|

|

By End-Use |

|

Natural Gas Engine Market Regional Analysis

“Europe is the Dominant Region in the Natural Gas Engine Market”

- Europe leads the global natural gas engine market, propelled by a combination of business expansions and heightened consumer awareness regarding sustainable energy solutions

- European nations are deeply committed to environmental sustainability, actively promoting the adoption of natural gas engines as part of their strategies to reduce carbon emissions and enhance energy efficiency

- Government Initiatives: Supportive policies and incentives across Europe have significantly accelerated the adoption of natural gas engines, reinforcing the region's dominant position in the market

- Industries in Europe are increasingly integrating natural gas engines into their operations, recognizing both economic and environmental benefits, which further solidifies the region's market leadership

- For Instance, Germany's transition towards cleaner energy sources has led to substantial investments in natural gas technologies, exemplifying Europe's role in driving market growth

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is experiencing swift industrialization and urbanization, leading to a heightened demand for efficient and cleaner power solutions, thereby accelerating the adoption of natural gas engines

- Countries such as China and India are implementing supportive policies and investing heavily in natural gas infrastructure, fostering the growth of natural gas engine applications

- A strong governmental focus on reducing air pollution and enhancing energy efficiency in the Asia-Pacific region has led to increased adoption of natural gas engines, contributing to market growth

- The increasing adoption of natural gas engines in power generation and industrial sectors across Asia-Pacific is a testament to the region's rapid market expansion

- For Instance, China's substantial investments in natural gas infrastructure and technology have significantly boosted the adoption of natural gas engines, illustrating the region's rapid market growth

Natural Gas Engine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Caterpillar (U.S.)

- Wärtsilä (Finland)

- Rolls-Royce plc (U.K.)

- Volkswagen (Germany)

- Siemens (Germany)

- INNIO (Austria)

- Cummins Inc., (U.S.)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Ningbo C.S.I Power & Machinery Group Co., Ltd. (China)

- IHI Power Systems Co.,Ltd. (Japan)

- JFE Engineering Corporation (Japan)

- Liebherr (Germany)

- Hyundai Heavy Industries Co., Ltd. (South Korea)

- ENF Ltd., (China)

- R Schmitt Enertec GMBH (Germany)

- China National Petroleum Corporation (China)

- Fairbanks Morse Defense (U.S.)

- Baudouin (France)

Latest Developments in Global Natural Gas Engine Market

- In September 2023, GE Gas Power has announced the debut of their latest gas turbine engine, the 9HA.02, which promises increased efficiency and lower emissions. This approach is intended to provide flexible, dependable power generation, hence promoting grid stability and the integration of renewable energy sources

- In July 2023, Wärtsilä launched its next-generation 50DF dual-fuel engine series, which is designed for use in both marine and power generation applications. The 50DF engine series is optimized for lower fuel consumption and reduced emissions. The launch is part of Wärtsilä’s broader strategy to support the transition to low-carbon energy sources and offer efficient solutions to meet global energy demands

- In July 2023, MAN Energy Solutions introduced its new dual-fuel gas engine, which enables operators to effortlessly transition between natural gas and diesel. This flexibility allows users to adjust to fuel availability and market conditions, making it an attractive option for marine and power generation applications

- In March 2023, Mitsubishi Heavy Industries Engine & Turbocharger is set to revolutionize power generation with its new SGP M2000 natural gas engine cogeneration system. Boasting an impressive 2000 kW output and an unparalleled electrical efficiency of 44.3%, this innovation not only reduces CO2 emissions but also offers remarkable compactness

- In January 2023, GE Gas Power launched its upgraded LM6000 aeroderivative gas turbine, which is designed to run on both natural gas and hydrogen blends. The turbine offers higher efficiency and lower emissions, making it an ideal solution for power plants seeking to reduce their carbon footprint. This development reflects GE’s ongoing commitment to providing cleaner energy solutions for global power generation needs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Natural Gas Engine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Natural Gas Engine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Natural Gas Engine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.