Global Nanosatellite And Microsatellite Market

Market Size in USD Billion

CAGR :

%

USD

3.98 Billion

USD

16.88 Billion

2024

2032

USD

3.98 Billion

USD

16.88 Billion

2024

2032

| 2025 –2032 | |

| USD 3.98 Billion | |

| USD 16.88 Billion | |

|

|

|

|

Nanosatellite and Microsatellite Market Analysis

The nanosatellite and microsatellite market is experiencing rapid growth, driven by advancements in miniaturization, cost-effective launch solutions, and increasing demand for Earth observation, communication, and scientific research applications. These small satellites, typically ranging from 1 kg to 100 kg, offer significant advantages such as lower manufacturing costs, shorter development cycles, and the ability to operate in constellations for enhanced coverage. Governments, space agencies, and private companies are actively investing in nanosatellite and microsatellite technologies to improve global connectivity, monitor climate change, and enhance defense and reconnaissance capabilities. Advancements in artificial intelligence (AI), machine learning, and data analytics are further enhancing satellite performance, enabling autonomous operations and real-time data processing. The integration of electric propulsion systems and high-efficiency solar panels is also improving mission longevity. Companies such as GomSpace, Planet Labs, and Surrey Satellite Technology Ltd. are continuously innovating to expand the capabilities of small satellites. In addition, the growing number of public-private partnerships and cost-effective launch services, such as SpaceX’s rideshare programs, are making space more accessible, fueling the market's expansion and positioning nanosatellites and microsatellites as key players in the future of space exploration and connectivity.

Nanosatellite and Microsatellite Market Size

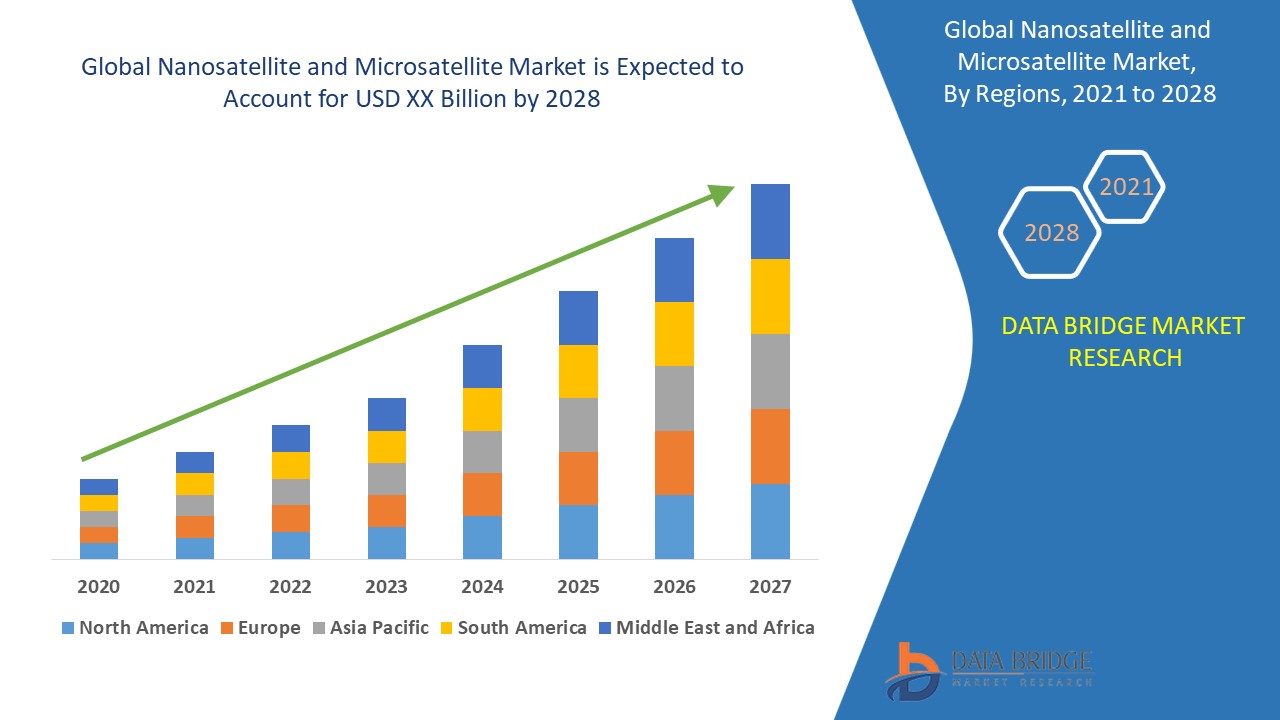

The global nanosatellite and microsatellite market size was valued at USD 3.98 billion in 2024 and is projected to reach USD 16.88 billion by 2032, with a CAGR of 19.80% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Nanosatellite and Microsatellite Market Trends

“Rise of Satellite Mega-Constellations for Global Connectivity”

One significant trend in the nanosatellite and microsatellite market is the rise of satellite mega-constellations for global connectivity. Companies such as SpaceX, OneWeb, and Amazon’s Project Kuiper are deploying large constellations of nanosatellites and microsatellites to provide high-speed broadband services worldwide, particularly in remote and underserved regions. These constellations leverage advanced satellite networking, AI-driven automation, and inter-satellite links to enhance coverage and data transfer efficiency. For instance, SpaceX’s Starlink has already launched thousands of small satellites, enabling seamless global internet access. This trend is further supported by advancements in miniaturization, low-cost launch services such as SpaceX’s rideshare program, and increasing demand for high-speed internet for industries such as defense, maritime, and aviation. As satellite constellations continue to grow, they are driving significant investments in nanosatellite and microsatellite technologies, improving data transmission capabilities, and reshaping the landscape of global communications while also presenting challenges related to orbital congestion and space debris management.

Report Scope and Nanosatellite and Microsatellite Market Segmentation

|

Attributes |

Nanosatellite and Microsatellite Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

GomSpace (Denmark), Lockheed Martin Corporation (U.S.), L3Harris Technologies, Inc. (U.S.), Sierra Nevada Corporation (U.S.), AAC Clyde Space (Sweden), Planet Labs PBC (U.S.), NanoAvionics (Lithuania), Tyvak International (Italy), Isispace Group (Netherlands), RTX (U.S.), RUAG Group (Switzerland), Surrey Satellite Technology Ltd (U.K.), Axelspace (Japan), Sky and Space Company Limited (Australia), Berlin Space Technologies (Germany), Spire Global (U.S.), Northrop Grumman (U.S.), and Leidos (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Nanosatellite and Microsatellite Market Definition

Nanosatellites and microsatellites are small-sized artificial satellites, typically weighing between 1 kg and 100 kg, designed for various applications such as Earth observation, communication, scientific research, and defense. Nanosatellites generally weigh between 1 kg and 10 kg, while microsatellites range from 11 kg to 100 kg.

Nanosatellite and Microsatellite Market Dynamics

Drivers

- Growing Demand for Earth Observation and Remote Sensing

The increasing reliance on real-time Earth observation and remote sensing is a key driver of the nanosatellite and microsatellite market. These small satellites play a crucial role in monitoring environmental changes, managing natural resources, and supporting disaster response efforts. Governments, research institutions, and private organizations are deploying them to enhance climate tracking, deforestation analysis, and weather forecasting. For instance, NASA and the European Space Agency (ESA) use small satellite constellations to monitor greenhouse gas emissions and ice cap melting. In addition, precision agriculture benefits from these satellites as they provide high-resolution imaging for soil analysis, crop health monitoring, and irrigation management. Companies such as Planet Labs operate a vast constellation of nanosatellites, delivering daily imagery that aids businesses and governments in making data-driven decisions. With increasing environmental concerns and the need for real-time geospatial intelligence, the demand for Earth observation satellites continues to grow, driving market expansion.

- Expanding Commercial Space Industry

The commercialization of space activities has significantly fueled the nanosatellite and microsatellite market, as private enterprises increasingly invest in space-based solutions for communication, navigation, and data analytics. Small satellites are being deployed for applications such as global broadband coverage, IoT connectivity, and asset tracking, making space more accessible to industries beyond government agencies. For instance, SpaceX’s Starlink and OneWeb are building extensive satellite constellations to provide high-speed internet connectivity to remote and underserved regions worldwide. Similarly, companies such as Swarm Technologies offer low-cost IoT connectivity using nanosatellite networks, helping industries such as logistics, agriculture, and maritime operations enhance efficiency. The reduction in launch costs due to advancements in reusable rocket technology, such as SpaceX’s Falcon 9, further accelerates the adoption of small satellites. As commercial players continue to innovate and integrate nanosatellites into their business models, the market is expected to witness rapid growth in the coming years.

Opportunities

- Rising Adoption in Defense and Security Applications

Nanosatellites and microsatellites are becoming essential assets in military and defense operations, driving their adoption across global defense agencies. These small satellites provide critical support for intelligence gathering, surveillance, reconnaissance (ISR), and secure military communications. Unlike traditional large satellites, nanosatellites offer a cost-effective and rapidly deployable alternative, allowing defense forces to enhance real-time situational awareness. For instance, the U.S. Department of Defense (DoD) has launched microsatellite constellations to monitor potential threats, improve battlefield intelligence, and strengthen communications in remote locations. Similarly, the European Defence Agency (EDA) is investing in small satellite networks to enhance border security and maritime surveillance. The increasing need for persistent monitoring and rapid data transmission in modern warfare makes nanosatellites a valuable tool for military applications. As governments continue prioritizing defense modernization, the demand for small satellite solutions is expected to grow, creating lucrative market opportunities for satellite manufacturers and defense contractors.

- Increasing Technological Advancements in Miniaturization and Cost Reduction

The continuous evolution of satellite miniaturization and cost-effective launch services is significantly expanding market opportunities for nanosatellites and microsatellites. Advances in microelectronics, lightweight materials, and compact propulsion systems have enabled the development of highly functional small satellites at a fraction of the cost of traditional spacecraft. In addition, the growing adoption of reusable launch vehicles, such as SpaceX’s Falcon 9, has drastically reduced launch expenses, making it easier for startups, research institutions, and commercial players to enter the space industry. For instance, companies such as Rocket Lab and Astra offer dedicated small satellite launch services at lower costs, enabling universities and space startups to deploy their own satellite missions. Furthermore, CubeSat platforms standardized miniature satellites are now being used for research, Earth observation, and communication applications, further lowering barriers to entry. As the industry continues to focus on cost reduction and improved satellite capabilities, the market for nanosatellites and microsatellites is poised for significant expansion.

Restraints/Challenges

- High Development and Launch Costs

Despite their small size, nanosatellites and microsatellites still require significant investment in RandD, manufacturing, and launch services. The cost of building advanced payloads, integrating miniaturized components, and ensuring mission success can be high. Moreover, launching these satellites depends on shared launch services, which can lead to delays and scheduling conflicts. For instance, rideshare launches with SpaceX or Rocket Lab often require waiting for optimal launch windows, impacting deployment timelines.

- Limited Power and Payload Capacity

Due to their small form factor, nanosatellites and microsatellites face challenges related to power generation, battery life, and payload limitations. Their reduced capacity affects the quality of onboard sensors, data transmission rates, and operational lifespan. For instance, Earth observation satellites require high-resolution imaging sensors, but compact designs limit the integration of advanced optics and communication systems.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Nanosatellite and Microsatellite Market Scope

The market is segmented on the basis of component, mass, application, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Hardware

- Software and Data Processing

- Launch Services

Mass

- 1 Kg – 10 Kg (Nanosatellites)

- 11 Kg – 100 Kg (Microsatellites)

Application

- Communications

- Reconnaissance

- Scientific Research

- Earth Observation

- Remote Sensing

- Climate

- Mapping and Navigation

Vertical

- Media and Entertainment Sector

- BFSI

- Healthcare Sector

- Transportation

- Public Sector

- Manufacturing Sector

- Retail Sector

- IT and Telecom Sector

- Energy and Utilities

- Others

Nanosatellite and Microsatellite Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, component, mass, application, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates the nanosatellite and microsatellite market, driven by the strong presence of well-established space research agencies, academic institutions, and private space technology firms. The region, particularly the U.S., is at the forefront of advancements in satellite miniaturization, propulsion systems, and data processing technologies. Increasing government and commercial investments in space exploration, defense, and telecommunication applications further strengthen market growth. In addition, collaborations between universities and industry players fuel innovation, making North America a key hub for satellite development and deployment.

Asia-Pacific is experiencing the fastest growth in the global nanosatellite and microsatellite market, driven by increasing government investments in space technology and rising demand for satellite-based communication and Earth observation services. Countries such as China, India, and Japan are leading advancements in small satellite launches, supported by initiatives from agencies such as ISRO, CNSA, and JAXA. The rapid expansion of private space startups and commercial satellite operators in the region is further accelerating market growth. In addition, the adoption of low-cost satellite deployment solutions and miniaturized satellite technologies is making nanosatellites and microsatellites more accessible for scientific and commercial applications.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Nanosatellite and Microsatellite Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Nanosatellite and Microsatellite Market Leaders Operating in the Market Are:

- GomSpace (Denmark)

- Lockheed Martin Corporation (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Sierra Nevada Corporation (U.S.)

- AAC Clyde Space (Sweden)

- Planet Labs PBC (U.S.)

- NanoAvionics (Lithuania)

- Tyvak International (Italy)

- Isispace Group (Netherlands)

- RTX (U.S.)

- RUAG Group (Switzerland)

- Surrey Satellite Technology Ltd (U.K.)

- Axelspace (Japan)

- Sky and Space Company Limited (Australia)

- Berlin Space Technologies (Germany)

- Spire Global (U.S.)

- Northrop Grumman (U.S.)

- Leidos (U.S.)

Latest Developments in Nanosatellite and Microsatellite Market

- In November 2024, the U.K. Ministry of Defense (MOD) signed a contract with Surrey Satellite Technology Limited (SSTL) for the Juno satellite program, aiming to enhance the U.K.'s Earth observation and satellite communication capabilities. The Juno satellites will provide critical intelligence, surveillance, and reconnaissance data for military operations

- In August 2024, Sierra Nevada Corporation (SNC) announced advancements in its Vindler commercial radio frequency (RF) satellite constellation through a new partnership with Muon Space, focusing on developing and deploying three additional satellites to enhance the detection and geo-location of targeted RF emissions

- In August 2024, Surrey Satellite Technology Limited (SSTL) participated in the Small Satellite Conference 2024, showcasing its advancements in small satellite technology and contributions to space missions, including Earth observation and communication capabilities

- In June 2020, NanoAvionics collaborated with Exolaunch and signed an agreement for SpaceX’s rideshare mission, planning to launch a 6U nanosatellite on the Falcon 9 smallsat-dedicated board, with the mission scheduled for December 2020

- In June 2020, Kepler Communication, in partnership with Space Flight Laboratory, announced an operational nanosatellite constellation, leveraging SFL’s expertise in satellite design and in-house manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MULTIVARIATE MODELLING

2.2.4 TOP TO BOTTOM ANALYSIS

2.2.5 STANDARDS OF MEASUREMENT

2.2.6 VENDOR SHARE ANALYSIS

2.2.7 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.8 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES MODEL

5.2 CASE STUDY

5.3 IMPACT OF DISRUPTIVE TECHNOLOGIES

6 GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 HARDWARE

6.3 SOFTWARE & DATA PROCESSING

6.4 SERVICES

6.4.1 SPACE SERVICES

6.4.2 LAUNCH SERVICES

7 GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE

7.1 OVERVIEW

7.2 NANOSATELLITE

7.3 MICROSATELLITE

8 GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET, BY BAND

8.1 OVERVIEW

8.2 X-BAND

8.3 K-BAND

8.4 KA-BAND

9 GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 COMMUNICATION

9.3 EARTH OBSERVATION AND REMOTE SENSING

9.4 SCIENTIFIC RESEARCH

9.5 BIOLOGICAL EXPERIMENTS

9.6 TECHNOLOGY DEMONSTRATION AND VERIFICATION

9.7 ACADEMIC TRAINING

9.8 MAPPING AND NAVIGATION

9.9 RECONNAISSANCE

10 GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL

10.1 OVERVIEW

10.2 GOVERNMENT

10.2.1 BY TYPE

10.2.1.1. NANOSATELLITE

10.2.1.2. MICROSATELLITE

10.3 CIVIL

10.3.1 BY TYPE

10.3.1.1. NANOSATELLITE

10.3.1.2. MICROSATELLITE

10.4 COMMERCIAL

10.4.1 BY TYPE

10.4.1.1. NANOSATELLITE

10.4.1.2. MICROSATELLITE

10.5 MILITARY & DEFENSE

10.5.1 BY TYPE

10.5.1.1. NANOSATELLITE

10.5.1.2. MICROSATELLITE

10.6 ENERGY AND INFRASTRUCTURE

10.6.1 BY TYPE

10.6.1.1. NANOSATELLITE

10.6.1.2. MICROSATELLITE

10.7 MARITIME AND TRANSPORTATION

10.7.1 BY TYPE

10.7.1.1. NANOSATELLITE

10.7.1.2. MICROSATELLITE

11 GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET, BY ORBIT

11.1 OVERVIEW

11.2 NON-POLAR INCLINED ORBIT

11.3 SUN-SYNCHRONOUS ORBIT

11.4 POLAR ORBIT

12 GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION

12.1 GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1.1 NORTH AMERICA

12.1.1.1. U.S.

12.1.1.2. CANADA

12.1.1.3. MEXICO

12.1.2 EUROPE

12.1.2.1. GERMANY

12.1.2.2. FRANCE

12.1.2.3. U.K.

12.1.2.4. ITALY

12.1.2.5. SPAIN

12.1.2.6. RUSSIA

12.1.2.7. TURKEY

12.1.2.8. BELGIUM

12.1.2.9. NETHERLANDS

12.1.2.10. SWITZERLAND

12.1.2.11. REST OF EUROPE

12.1.3 ASIA-PACIFIC

12.1.3.1. JAPAN

12.1.3.2. CHINA

12.1.3.3. SOUTH KOREA

12.1.3.4. INDIA

12.1.3.5. AUSTRALIA

12.1.3.6. SINGAPORE

12.1.3.7. THAILAND

12.1.3.8. MALAYSIA

12.1.3.9. INDONESIA

12.1.3.10. PHILIPPINES

12.1.3.11. REST OF ASIA-PACIFIC

12.1.4 SOUTH AMERICA

12.1.4.1. BRAZIL

12.1.4.2. ARGENTINA

12.1.4.3. REST OF SOUTH AMERICA

12.1.5 MIDDLE EAST AND AFRICA

12.1.5.1. SOUTH AFRICA

12.1.5.2. EGYPT

12.1.5.3. ISRAEL

12.1.5.4. UAE

12.1.5.5. SAUDI ARABIA

12.1.5.6. REST OF MIDDLE EAST AND AFRICA

12.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT & APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET, COMPANY PROFILE

14.1 GOMSPACE

14.1.1 COMPANY OVERVIEW

14.1.2 COMPANY SNAPSHOT

14.1.3 REVENUE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 LOCKHEED MARTIN

14.2.1 COMPANY OVERVIEW

14.2.2 COMPANY SNAPSHOT

14.2.3 REVENUE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 L3HARRIS

14.3.1 COMPANY OVERVIEW

14.3.2 COMPANY SNAPSHOT

14.3.3 REVENUE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 SIERRA NEVADA CORPORATION

14.4.1 COMPANY OVERVIEW

14.4.2 COMPANY SNAPSHOT

14.4.3 REVENUE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 AAC CLYDE SPACE

14.5.1 COMPANY OVERVIEW

14.5.2 COMPANY SNAPSHOT

14.5.3 REVENUE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 PLANET LABS

14.6.1 COMPANY OVERVIEW

14.6.2 COMPANY SNAPSHOT

14.6.3 REVENUE ANALYSIS

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT DEVELOPMENTS

14.7 SURREY SATELLITE TECHNOLOGY

14.7.1 COMPANY OVERVIEW

14.7.2 COMPANY SNAPSHOT

14.7.3 REVENUE ANALYSIS

14.7.4 PRODUCT PORTFOLIO

14.7.5 RECENT DEVELOPMENTS

14.8 PUMPKIN

14.8.1 COMPANY OVERVIEW

14.8.2 COMPANY SNAPSHOT

14.8.3 REVENUE ANALYSIS

14.8.4 PRODUCT PORTFOLIO

14.8.5 RECENT DEVELOPMENTS

14.9 OHB SE

14.9.1 COMPANY OVERVIEW

14.9.2 COMPANY SNAPSHOT

14.9.3 REVENUE ANALYSIS

14.9.4 PRODUCT PORTFOLIO

14.9.5 RECENT DEVELOPMENTS

14.1 TYVAK

14.10.1 COMPANY OVERVIEW

14.10.2 COMPANY SNAPSHOT

14.10.3 REVENUE ANALYSIS

14.10.4 PRODUCT PORTFOLIO

14.10.5 RECENT DEVELOPMENTS

14.11 NORTHROP GRUMMAN

14.11.1 COMPANY OVERVIEW

14.11.2 COMPANY SNAPSHOT

14.11.3 REVENUE ANALYSIS

14.11.4 PRODUCT PORTFOLIO

14.11.5 RECENT DEVELOPMENTS

14.12 SPACEQUEST

14.12.1 COMPANY OVERVIEW

14.12.2 COMPANY SNAPSHOT

14.12.3 REVENUE ANALYSIS

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENTS

14.13 RUAG SPACE

14.13.1 COMPANY OVERVIEW

14.13.2 COMPANY SNAPSHOT

14.13.3 REVENUE ANALYSIS

14.13.4 PRODUCT PORTFOLIO

14.13.5 RECENT DEVELOPMENTS

14.14 RAYTHEON

14.14.1 COMPANY OVERVIEW

14.14.2 COMPANY SNAPSHOT

14.14.3 REVENUE ANALYSIS

14.14.4 PRODUCT PORTFOLIO

14.14.5 RECENT DEVELOPMENTS

14.15 MILLENNIUM SPACE SYSTEMS

14.15.1 COMPANY OVERVIEW

14.15.2 COMPANY SNAPSHOT

14.15.3 REVENUE ANALYSIS

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENTS

14.16 EXOLAUNCH

14.16.1 COMPANY OVERVIEW

14.16.2 COMPANY SNAPSHOT

14.16.3 REVENUE ANALYSIS

14.16.4 PRODUCT PORTFOLIO

14.16.5 RECENT DEVELOPMENTS

14.17 ALEXSPACE

14.17.1 COMPANY OVERVIEW

14.17.2 COMPANY SNAPSHOT

14.17.3 REVENUE ANALYSIS

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENTS

14.18 NANOAVIONICS

14.18.1 COMPANY OVERVIEW

14.18.2 COMPANY SNAPSHOT

14.18.3 REVENUE ANALYSIS

14.18.4 PRODUCT PORTFOLIO

14.18.5 RECENT DEVELOPMENTS

14.19 GAUSS

14.19.1 COMPANY OVERVIEW

14.19.2 COMPANY SNAPSHOT

14.19.3 REVENUE ANALYSIS

14.19.4 PRODUCT PORTFOLIO

14.19.5 RECENT DEVELOPMENTS

14.2 SPIRE GLOBAL

14.20.1 COMPANY OVERVIEW

14.20.2 COMPANY SNAPSHOT

14.20.3 REVENUE ANALYSIS

14.20.4 PRODUCT PORTFOLIO

14.20.5 RECENT DEVELOPMENTS

14.21 DAURIA AEROSPACE

14.21.1 COMPANY OVERVIEW

14.21.2 COMPANY SNAPSHOT

14.21.3 REVENUE ANALYSIS

14.21.4 PRODUCT PORTFOLIO

14.21.5 RECENT DEVELOPMENTS

14.22 SWARM

14.22.1 COMPANY OVERVIEW

14.22.2 COMPANY SNAPSHOT

14.22.3 REVENUE ANALYSIS

14.22.4 PRODUCT PORTFOLIO

14.22.5 RECENT DEVELOPMENTS

14.23 ALEN SPACE

14.23.1 COMPANY OVERVIEW

14.23.2 COMPANY SNAPSHOT

14.23.3 REVENUE ANALYSIS

14.23.4 PRODUCT PORTFOLIO

14.23.5 RECENT DEVELOPMENTS

14.24 ENDUROSAT

14.24.1 COMPANY OVERVIEW

14.24.2 COMPANY SNAPSHOT

14.24.3 REVENUE ANALYSIS

14.24.4 PRODUCT PORTFOLIO

14.24.5 RECENT DEVELOPMENTS

14.25 ASTROCAST

14.25.1 COMPANY OVERVIEW

14.25.2 COMPANY SNAPSHOT

14.25.3 REVENUE ANALYSIS

14.25.4 PRODUCT PORTFOLIO

14.25.5 RECENT DEVELOPMENTS

14.26 BERLIN SPACE TECHNOLOGIES

14.26.1 COMPANY OVERVIEW

14.26.2 COMPANY SNAPSHOT

14.26.3 REVENUE ANALYSIS

14.26.4 PRODUCT PORTFOLIO

14.26.5 RECENT DEVELOPMENTS

14.27 ISIS

14.27.1 COMPANY OVERVIEW

14.27.2 COMPANY SNAPSHOT

14.27.3 REVENUE ANALYSIS

14.27.4 PRODUCT PORTFOLIO

14.27.5 RECENT DEVELOPMENTS

14.28 HELIOS WIRE

14.28.1 COMPANY OVERVIEW

14.28.2 COMPANY SNAPSHOT

14.28.3 REVENUE ANALYSIS

14.28.4 PRODUCT PORTFOLIO

14.28.5 RECENT DEVELOPMENTS

14.29 PLANETARY RESOURCES, INC.

14.29.1 COMPANY OVERVIEW

14.29.2 COMPANY SNAPSHOT

14.29.3 REVENUE ANALYSIS

14.29.4 PRODUCT PORTFOLIO

14.29.5 RECENT DEVELOPMENTS

14.3 KEPLER COMMUNICATIONS

14.30.1 COMPANY OVERVIEW

14.30.2 COMPANY SNAPSHOT

14.30.3 REVENUE ANALYSIS

14.30.4 PRODUCT PORTFOLIO

14.30.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

15 RELATED REPORTS

16 QUESTIONNAIRE

17 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.