Global Music Market

Market Size in

CAGR :

%

54.84

198.60

2025

2032

54.84

198.60

2025

2032

| 2026 –2032 | |

| USD 54.84 | |

| USD 198.60 | |

|

|

|

|

Music Market and Streaming Services Market Size

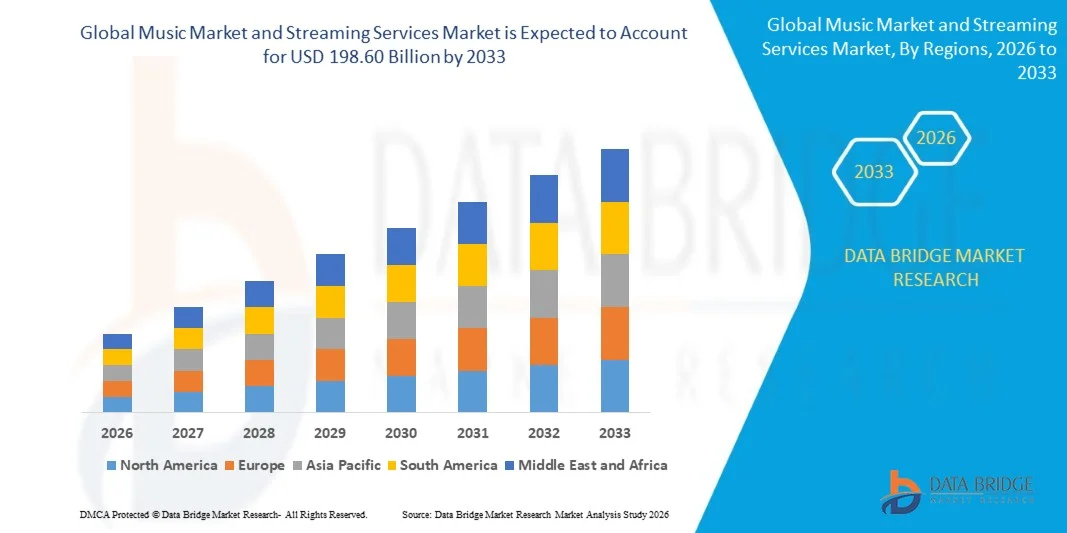

- The global music market and streaming services market size was valued at USD 54.84 billion in 2025 and is expected to reach USD 198.60 billion by 2033, at a CAGR of 17.45% during the forecast period

- The market growth is largely driven by the rapid shift from physical media to digital consumption, supported by widespread internet access and increasing smartphone and connected device adoption across global markets

- Furthermore, rising consumer preference for on-demand, personalized, and subscription-based entertainment experiences is establishing music streaming and digital platforms as the primary mode of content consumption. These combined factors are accelerating user adoption and monetization, thereby significantly boosting overall market growth

Music Market and Streaming Services Market Analysis

- Music and streaming services are digital platforms that enable users to access, stream, and download audio and video content through internet-connected devices, offering personalized recommendations, curated playlists, and multi-device compatibility for residential and commercial use

- The growing demand for these services is mainly fueled by increasing digitalization of entertainment, rising consumption of mobile-first content, and strong user interest in flexible, ad-free, and customized listening and viewing experiences

- North America dominated the music market and streaming services market with a share of around 40% in 2025, due to high subscription penetration, strong digital infrastructure, and early adoption of paid streaming platforms

- Asia-Pacific is expected to be the fastest growing region in the music market and streaming services market during the forecast period due to rapid urbanization, expanding middle-class populations, and increasing smartphone adoption

- On-Demand streaming segment dominated the market with a market share of 65.5% in 2025, due to strong consumer preference for flexibility, personalized playlists, and anytime access to music and video libraries. Users increasingly favor platforms that allow content selection, downloads, and algorithm-driven recommendations, supporting higher engagement and subscription retention. The widespread adoption of smartphones, smart TVs, and connected devices has further strengthened demand for on-demand streaming services across global markets

Report Scope and Music Market and Streaming Services Market Segmentation

|

Attributes |

Music Market and Streaming Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Music Market and Streaming Services Market Trends

“Rising Adoption of On-Demand and Personalized Streaming Platforms”

- A major trend shaping the music market and streaming services market is the growing consumer shift toward on-demand and highly personalized content consumption, supported by advanced recommendation algorithms and data-driven user insights. Streaming platforms are increasingly focusing on tailoring playlists, music discovery, and content suggestions to individual listening behavior, improving engagement and time spent on platforms

- For instance, Spotify leverages its proprietary recommendation engine and curated playlists such as Discover Weekly and Release Radar to enhance music discovery and user retention. These features have strengthened platform stickiness and positioned personalization as a core differentiator in the competitive streaming landscape

- On-demand streaming is also gaining traction due to consumer preference for flexible, anytime access to vast music libraries without reliance on physical ownership. Platforms are continuously expanding their catalogs to include diverse genres, regional music, and exclusive releases to address evolving user preferences

- Video and audio streaming services are integrating personalized experiences across multiple devices, including smartphones, smart speakers, and connected cars. This multi-platform accessibility is reinforcing consistent usage patterns and broadening the overall consumer base

- The increasing use of artificial intelligence and machine learning in content curation is enabling platforms to predict listening trends and adapt offerings in real time. This is improving content relevance and supporting higher subscription conversion rates

- As personalization becomes central to user experience strategies, streaming platforms are strengthening their competitive positioning and accelerating overall market growth through differentiated, user-centric service models

Music Market and Streaming Services Market Dynamics

Driver

“Increasing Smartphone Penetration and Affordable High-Speed Internet Access”

- The rapid growth in smartphone adoption and the availability of affordable high-speed internet are key drivers supporting expansion of the music market and streaming services market. Easy access to mobile devices has enabled users to stream music and video content seamlessly across urban and emerging markets

- For instance, Apple Music and YouTube Music have expanded mobile-first streaming experiences optimized for smartphones, contributing to rising user adoption in both developed and developing regions. These platforms benefit from widespread mobile connectivity and app-based consumption patterns

- The rollout of 4G and 5G networks has significantly improved streaming quality, reduced buffering, and enabled uninterrupted access to high-definition audio and video content. This infrastructure development is encouraging higher daily usage and longer listening sessions

- Affordable data plans offered by telecom operators are further accelerating streaming adoption, particularly in price-sensitive markets. This has supported growth in subscription-based and ad-supported streaming models

- The sustained improvement in mobile connectivity continues to reinforce streaming services as a dominant form of digital entertainment, driving consistent market expansion

Restraint/Challenge

“Content Licensing Costs and Intensifying Competition Among Platforms”

- The music market and streaming services market faces challenges related to high content licensing costs and intense competition among global and regional platforms. Licensing agreements with music labels and artists require significant financial commitments, impacting profitability margins for streaming providers

- For instance, Spotify and Apple Music incur substantial royalty payments to major music labels such as Universal Music Group and Sony Music Entertainment, increasing operational costs and limiting pricing flexibility. These expenses place pressure on platforms to continuously scale subscriber bases

- The competitive landscape is becoming increasingly crowded, with global players and regional platforms vying for exclusive content and user attention. This competition drives higher marketing spending and investment in original and localized content

- Smaller streaming platforms often struggle to secure comprehensive licensing agreements, limiting catalog depth and affecting user acquisition. This creates barriers to entry and reinforces market consolidation

- These combined challenges are compelling streaming companies to balance content acquisition costs with sustainable monetization strategies, shaping competitive dynamics within the market

Music Market and Streaming Services Market Scope

The market is segmented on the basis of type of streaming, end-user, and content type.

• By Type of Streaming

On the basis of type of streaming, the Music and Streaming Services market is segmented into live streaming and on-demand streaming. The on-demand streaming segment dominated the largest market revenue share of 65.5% in 2025, driven by strong consumer preference for flexibility, personalized playlists, and anytime access to music and video libraries. Users increasingly favor platforms that allow content selection, downloads, and algorithm-driven recommendations, supporting higher engagement and subscription retention. The widespread adoption of smartphones, smart TVs, and connected devices has further strengthened demand for on-demand streaming services across global markets.

The live streaming segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising popularity of virtual concerts, live events, and real-time audience interaction. Artists and platforms are leveraging live streaming to enhance fan engagement and generate alternative revenue streams through ticketing and exclusive access. The integration of interactive features, chat functions, and social media sharing is accelerating adoption of live streaming formats.

• By End-User

On the basis of end-user, the Music and Streaming Services market is segmented into residential and commercial. The residential segment dominated the market revenue share in 2025, supported by increasing household adoption of subscription-based streaming platforms and growing consumption of digital entertainment. Rising internet penetration, affordable data plans, and the shift toward home-based entertainment have significantly contributed to sustained residential demand. Consumers continue to value personalized content experiences, multi-device access, and ad-free listening or viewing options.

The commercial segment is expected to register the fastest growth during the forecast period, driven by increasing use of streaming services in retail, hospitality, fitness centers, and public venues. Businesses are adopting licensed streaming solutions to enhance customer experience, brand ambience, and engagement. The growing focus on curated background music, digital signage, and in-store entertainment is supporting rapid adoption across commercial establishments.

• By Content Type

On the basis of content type, the market is segmented into audio streaming and video streaming. The video streaming segment held the largest market revenue share in 2025, driven by high demand for movies, TV shows, music videos, and exclusive original content. Increased investment by streaming platforms in premium and regional video content has boosted subscriber growth and viewing hours. The expansion of high-speed broadband and smart display devices has further reinforced video streaming dominance.

The audio streaming segment is projected to witness the fastest growth rate from 2026 to 2033, supported by rising consumption of music, podcasts, and audiobooks. Audio streaming benefits from lower data usage, ease of multitasking, and growing popularity of podcast content across diverse age groups. Integration with smart speakers, connected cars, and wearable devices is further accelerating adoption of audio streaming services.

Music Market and Streaming Services Market Regional Analysis

- North America dominated the music market and streaming services market with the largest revenue share of around 40% in 2025, driven by high subscription penetration, strong digital infrastructure, and early adoption of paid streaming platforms

- Consumers in the region strongly value personalized content discovery, exclusive releases, and seamless cross-device streaming experiences across music and video platforms

- This dominance is further supported by high disposable incomes, widespread smartphone and smart TV usage, and the strong presence of global streaming service providers, positioning North America as a mature and innovation-driven market

U.S. Music Market and Streaming Services Market Insight

The U.S. music market and streaming services market captured the largest revenue share in 2025 within North America, supported by a well-established digital entertainment ecosystem and high willingness to pay for premium subscriptions. Consumers increasingly favor ad-free streaming, offline access, and bundled entertainment services. The strong integration of streaming platforms with connected devices, voice assistants, and in-car entertainment systems continues to propel market growth. Moreover, the dominance of major global streaming companies headquartered in the U.S. significantly strengthens the country’s leadership position.

Europe Music Market and Streaming Services Market Insight

The Europe music market and streaming services market is projected to grow at a steady CAGR during the forecast period, driven by increasing digital consumption of music and video content across both Western and Eastern Europe. Strong regulatory frameworks supporting digital content distribution and rising adoption of subscription-based models are accelerating market expansion. European consumers show growing interest in localized and regional-language content, supporting platform diversification. Growth is observed across residential and commercial applications, including hospitality and retail environments.

U.K. Music Market and Streaming Services Market Insight

The U.K. music market and streaming services market is expected to register notable growth over the forecast period, driven by high streaming penetration and strong consumer engagement with digital music platforms. The country’s vibrant music industry and culture of early technology adoption support sustained demand for streaming services. Increasing consumption of podcasts, live-streamed events, and exclusive artist content is further enhancing platform usage. The U.K.’s strong broadband infrastructure and widespread mobile access continue to reinforce market growth.

Germany Music Market and Streaming Services Market Insight

The Germany music market and streaming services market is anticipated to expand at a considerable CAGR, supported by rising adoption of paid subscriptions and a strong focus on data privacy and content quality. German consumers demonstrate a preference for high-fidelity audio streaming and premium video content. The country’s advanced digital infrastructure and growing acceptance of cloud-based entertainment services contribute to market expansion. Increasing use of streaming platforms across residential and commercial environments further supports growth.

Asia-Pacific Music Market and Streaming Services Market Insight

The Asia-Pacific music market and streaming services market is expected to grow at the fastest CAGR from 2026 to 2033, driven by rapid urbanization, expanding middle-class populations, and increasing smartphone adoption. Rising internet penetration and affordable data plans are accelerating streaming consumption across emerging economies. The strong demand for regional-language content and mobile-first streaming platforms is reshaping market dynamics. Government-led digitalization initiatives further support widespread adoption across the region.

Japan Music Market and Streaming Services Market Insight

The Japan music market and streaming services market is witnessing steady growth, supported by high digital literacy and strong demand for high-quality audio and video content. Japanese consumers show consistent engagement with both music streaming and video-on-demand services. The integration of streaming platforms with gaming consoles, smart TVs, and connected vehicles is contributing to increased usage. The market also benefits from strong domestic content production and a growing podcast listener base.

China Music Market and Streaming Services Market Insight

The China music market and streaming services market accounted for the largest revenue share in Asia-Pacific in 2025, driven by a massive user base and widespread adoption of mobile streaming platforms. The popularity of short-form video, live streaming, and social music platforms is significantly shaping consumption patterns. Strong domestic streaming providers and deep integration with social media ecosystems support high user engagement. Continuous investment in original content and interactive streaming formats remains a key factor driving market expansion in China.

Music Market and Streaming Services Market Share

The music market and streaming services industry is primarily led by well-established companies, including:

- Rhapsody International Inc. (U.S.)

- iHeartMedia, Inc. (U.S.)

- JOOX (China)

- Spotify AB (Sweden)

- Apple, Inc. (U.S.)

- Amazon (U.S.)

- SoundCloud Limited (Germany)

- JioSaavn (India)

- Tidal (U.S.)

- Deezer (France)

- Pandora (U.S.)

- LiveOne (U.S.)

- Jamendo (Luxembourg)

- KukuFM (India)

Latest Developments in Global Music Market and Streaming Services Market

- In October 2025, SoundCloud launched its music bot for the Discord platform, strengthening its presence in community-driven digital spaces and expanding music discovery among younger, highly engaged users. This development enhances user interaction by enabling real-time music exploration based on mood, tags, and genres, supporting higher engagement and brand visibility. The integration positions SoundCloud closer to social-first consumption trends, reinforcing its competitive standing in the streaming ecosystem

- In July 2025, Spotify acquired Heardle, an interactive music-guessing game, to deepen user engagement and extend time spent within its ecosystem. By allowing players to listen to full tracks on Spotify after gameplay, the acquisition supports music discovery and drives traffic to the core streaming platform. This move strengthens Spotify’s gamification strategy, encouraging daily user interaction and reinforcing subscriber retention

- In October 2023, Spotify reported growth in its global subscriber base, supported by new strategic partnerships across Asia, highlighting the region’s growing contribution to streaming revenues. During the same period, Apple Music expanded its platform with exclusive content from emerging artists, improving user engagement and differentiation. Meanwhile, regional players such as JioSaavn and Anghami intensified their focus on localized content, strengthening their competitive positioning and accelerating adoption in regional markets

- In September 2023, Amazon Music acquired a smaller independent music label, enhancing its content ownership and diversifying its music catalog. This acquisition supports greater control over exclusive releases and improves platform differentiation in an increasingly competitive streaming landscape. The move also reflects a broader industry trend toward vertical integration to strengthen long-term content strategies

- In 2023, Tencent Music entered into a strategic partnership with global music labels to improve licensing access and expand its content portfolio across Asian markets. This partnership enhances platform credibility and supports sustained user growth through broader music availability. Alongside this, rising investments in music technology and user interface improvements across the industry underline a strong focus on seamless listening experiences and long-term subscriber engagement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Music Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Music Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Music Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.