Global Multivendor ATM Software Market, By Function (Card Payment, Bill Payment, Cash/ Cheque Dispenser, Passbook Printer, Cash/Cheque Deposit, Others), Component (Service, Software), End User (Independent ATM Deployer, Bank and Financial Institutions), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028.

Market Analysis and Insights : Global Multivendor ATM Software Market

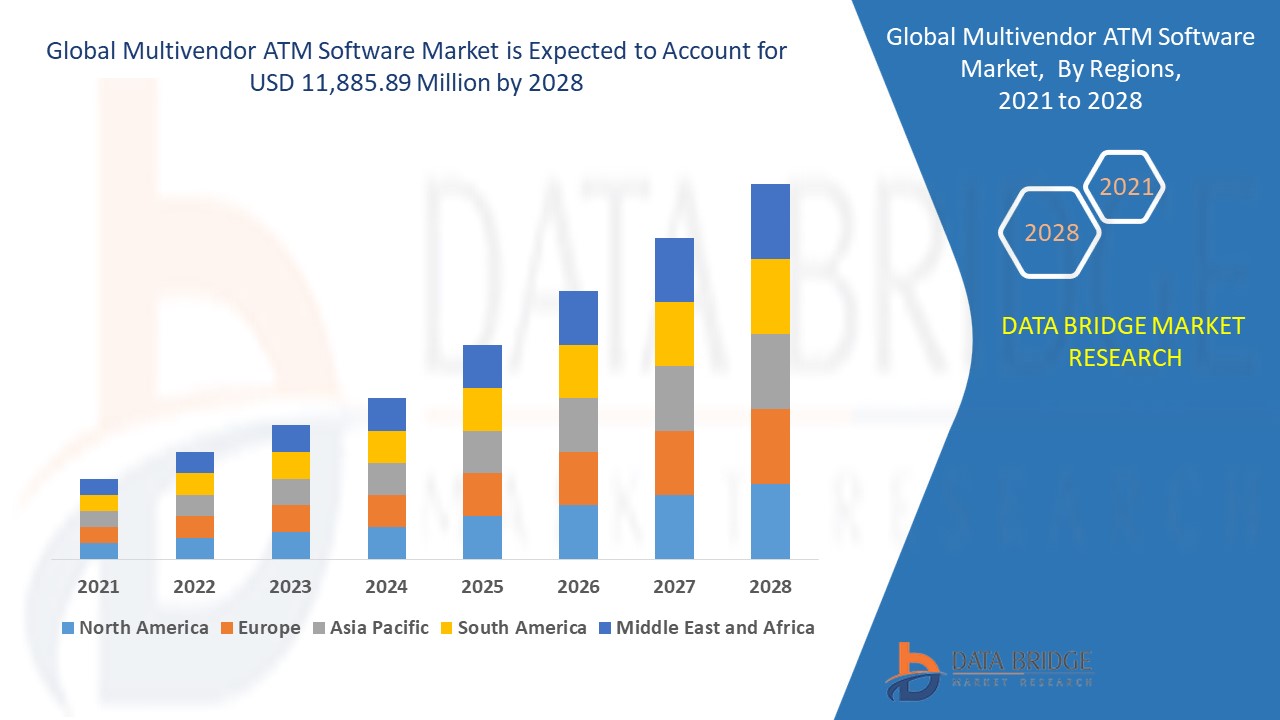

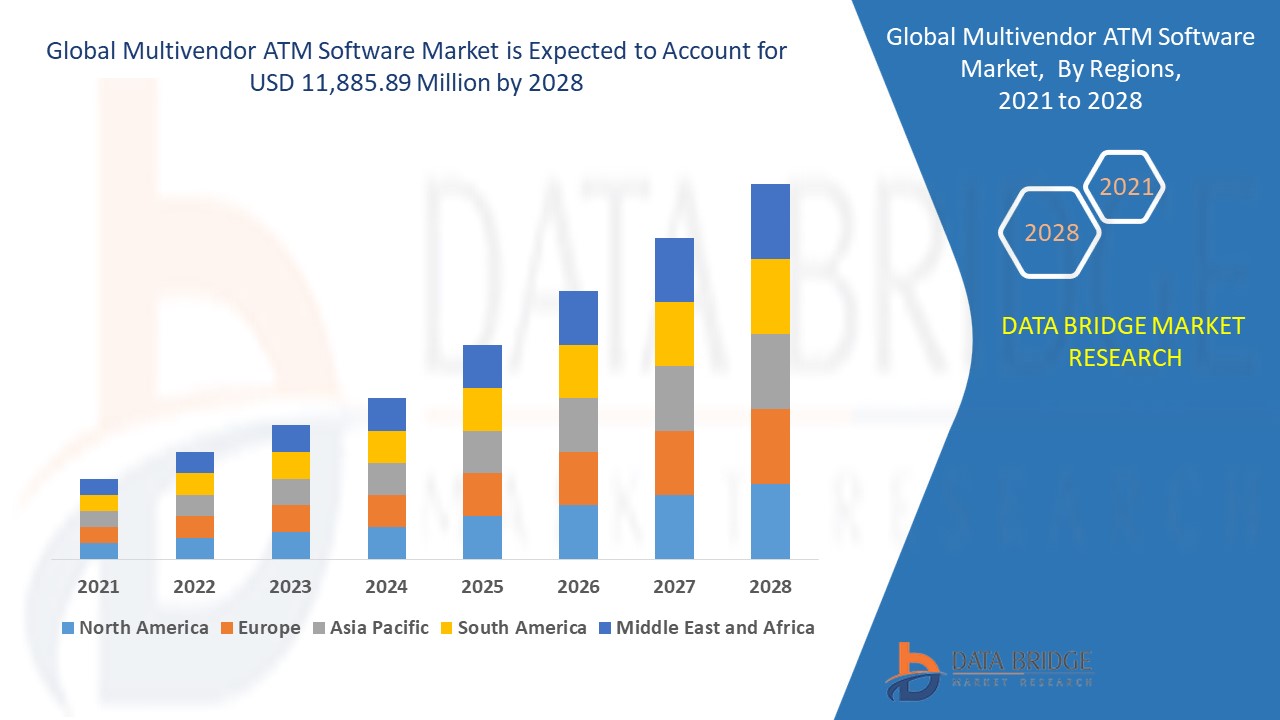

The multivendor ATM software market is expected to witness market growth at a rate of 24.0% in the forecast period of 2021 to 2028, and is estimated to reach the value of USD 11,885.89 million by 2028. Data Bridge Market Research report on multivendor ATM software market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market’s growth. The rise in the demand from various industry verticals is escalating the growth of multivendor ATM software market.

Multivendor ATM software refers to the type of software that allows banks and financial institutions in taking control of their ATM networks to decline costs, improve competitiveness and increase functionality. The need to acquire innovative financial self-service equipment from different manufacturers has been discovered by many financial institutions.

The rise in awareness regarding benefits of ATM software acts as one of the major factors driving the growth of multivendor ATM software market. The emergence of new technologies such as QR code, cashless payments, and touch screens, and rise in demand for self-service ATM software in various financial sectors accelerate the market growth. The increase in demand for modern ATM software and hardware, and high adoption of the technology because of the increase in use of advanced analytics for predictive maintenance in multivendor ATM support services further influence the market. Additionally, expansion of end use industries, increase in investments and expansion of finance sector positively affect the multivendor ATM software market. Furthermore, advancements in the software and integration of new technologies such as contactless payments extend profitable opportunities to the market players in the forecast period of 2021 to 2028.

On the other hand, limitations in terms of ATM management and issues in working with ATM suppliers are expected to obstruct the market growth. Improper telecom infrastructure is projected to challenge the multivendor ATM software market in the forecast period of 2021-2028.

This multivendor ATM software market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on multivendor ATM software market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Multivendor ATM Software Market Scope and Market Size

The multivendor ATM software market is segmented on the basis of function, component and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the multivendor ATM software market is segmented into card payment, bill payment, cash/ cheque dispenser, passbook printer, cash/cheque deposit and others.

- On the basis of component, the multivendor ATM software market is segmented into service and software.

- On the basis of end user, the multivendor ATM software market is segmented into independent ATM deployer, and bank and financial institutions.

Multivendor ATM Software Market Country Level Analysis

The multivendor ATM software market is segmented on the basis of function, component and end user.

The countries covered in the multivendor ATM software market report are the U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates the multivendor ATM software market due to the presence of largest banks and high purchasing power within the region. Asia-Pacific is expected to witness highest growth during the forecast period of 2021 to 2028 because of the inclination toward TCP/IP-based networks in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Multivendor ATM Software Market Share Analysis

The multivendor ATM software market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to multivendor ATM software market.

The major players covered in the multivendor ATM software market report are Vortex Engineering Pvt. Ltd., Incorporated, Diebold Nixdorf, Incorporated, NCR Corporation, Auriga, SpA, Renovite Inc., Clydestone (Ghana) Limited. Worldline, Euronet Worldwide, Inc., CashLink Global Systems Pvt. Ltd., Voicecom, KAL, GRGBanking, and Printec Group, among other domestic and global players. Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

SKU-